NASDAQ Elliott Wave Evaluation Buying and selling Lounge Day Chart.

NASDAQ Elliott Wave technical evaluation

Perform: Development.

Mode: Impulsive.

Construction: Grey wave 1.

Place: Orange wave 5.

Path subsequent decrease levels: Grey wave 2.

Particulars: Orange Wave 4 seems accomplished, and now grey wave 1 of Orange Wave 5 is in progress.

Wave cancel invalidation stage: 17245.9.

The NASDAQ day by day chart, in response to the Elliott Wave evaluation, exhibits that the market is at present in a trending section. The evaluation signifies that the market is in an impulsive mode, suggesting a continuation of the broader pattern. The first construction underneath statement is grey wave 1, marking the start of a brand new wave cycle.

The market is positioned in orange wave 5, the ultimate wave of the present sequence. This follows the completion of orange wave 4, suggesting that the corrective section has ended, and the market is now transferring upward within the last section of this cycle.

Relating to the course for the following decrease levels, the main focus shifts to grey wave 2. This means that after grey wave 1 completes, the market might enter a corrective section inside grey wave 2, earlier than probably resuming its upward motion.

At current, grey wave 1 of orange wave 5 is lively, indicating the early phases of the ultimate wave inside this sequence. This upward pattern is anticipated to proceed until the worth reaches the wave cancel invalidation stage of 17245.9, which might invalidate the present wave depend.

In abstract, the NASDAQ day by day chart stays in a trending section with the market positioned in orange wave 5. Following the completion of orange wave 4, the market is progressing inside grey wave 1 of orange wave 5. The evaluation suggests continued upward motion, with the following concentrate on grey wave 2. The evaluation holds so long as the worth stays above the wave cancel invalidation stage of 17245.9.

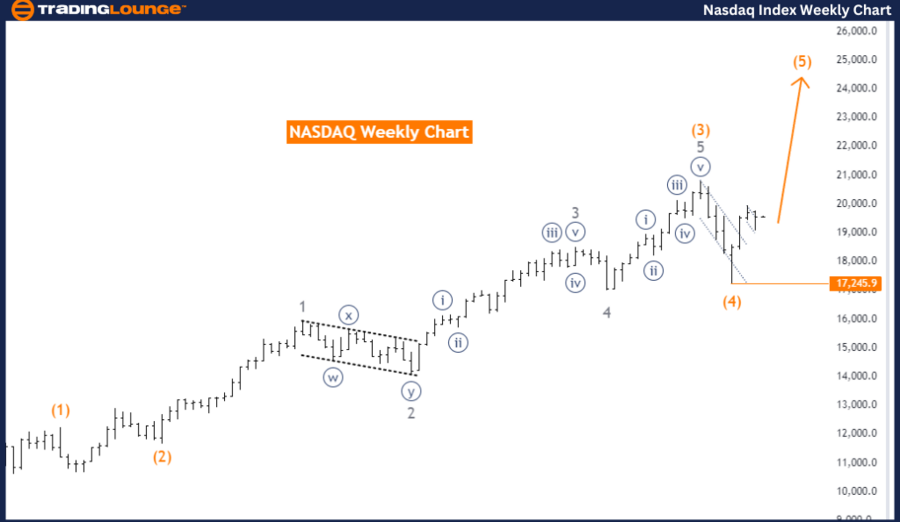

NASDAQ Elliott Wave Evaluation Buying and selling Lounge Weekly Chart.

NASDAQ Elliott Wave technical evaluation

-

Perform: Development.

-

Mode: Impulsive.

-

Construction: Orange wave 5.

-

Path subsequent decrease levels: Orange wave 5 (began).

-

Particulars: Orange wave 4 seems accomplished, and now orange wave 5 is in progress.

-

Wave cancel invalidation stage: 17245.9.

The NASDAQ weekly chart, primarily based on Elliott Wave evaluation, signifies that the market is at present in an impulsive pattern section, with a concentrate on the development of orange wave 5. This wave is an element of a bigger ongoing sequence and represents the ultimate upward motion following the completion of the earlier corrective section, recognized as orange wave 4.

The evaluation means that orange wave 4 has concluded, marking the tip of the market’s corrective section. The market has now transitioned into orange wave 5, signaling the beginning of a brand new upward pattern. This wave is anticipated to push the market greater because it unfolds. The pattern is taken into account robust, given its impulsive mode, which is often characterised by a transparent directional motion with minimal retracements.

Orange wave 5 is important because it often represents the final section of a bigger wave cycle. The development of this wave is essential in figuring out the continuation of the present pattern. The market is anticipated to proceed its upward motion until a big reversal happens.

A essential side of the evaluation is the wave cancel invalidation stage, set at 17245.9. This stage serves as a key threshold; if the market value falls beneath it, the present wave depend could be invalidated, probably signaling a shift available in the market’s course. Nonetheless, so long as the worth stays above this stage, the upward trajectory of orange wave 5 is anticipated to persist.

In conclusion, the NASDAQ weekly chart displays a robust bullish pattern, with orange wave 5 at present in progress after the completion of orange wave 4. The evaluation anticipates that this upward motion will proceed until the worth drops beneath the wave cancel invalidation stage of 17245.9.

Technical analyst: Malik Awais.

![NASDAQ Elliott Wave technical evaluation [Video] NASDAQ Elliott Wave technical evaluation [Video]](https://i3.wp.com/editorial.fxstreet.com/miscelaneous/p-638608649772152540.png?w=860&resize=860,0&ssl=1)