Do you need to retire a millionaire? Until you are one of many fortunate few who can construct a profitable enterprise or who’s born with wealthy family members, your greatest path towards that purpose is prone to contain a long time of investing, which can enable the facility of compound progress to construct your nest egg up for you. A diversified portfolio of high-quality shares can work wonders should you give it sufficient time.

And what higher place to seek out dominant corporations with decades-long progress alternatives than in healthcare? Healthcare is not going wherever, and it is already a multitrillion-dollar business in America. With that in thoughts, listed here are three of the most effective healthcare shares cash can purchase proper now.

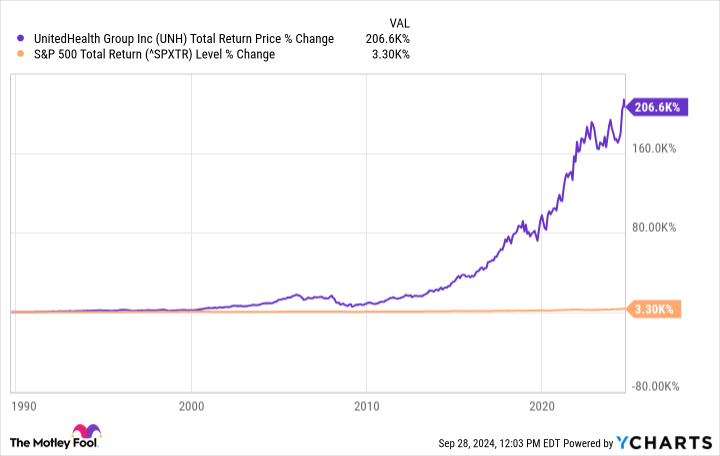

1. UnitedHealth Group

UnitedHealth Group (NYSE: UNH) is an enormous conglomerate with two major models. Its UnitedHealthcare section offers medical insurance and advantages to tens of thousands and thousands in america, and greater than 2 million in South America. Its Optum section offers healthcare and pharmacy providers to greater than 100 million individuals, and expertise providers to hospitals and different healthcare suppliers.

Over the previous 4 quarters, it generated over $380 billion in income. Its dimension is a aggressive benefit for UnitedHealth, as it might supply extra worth for much less cash, which in flip helps it proceed to take market share. UnitedHealth is a behemoth with a market cap of over $500 billion, but it retains rising. Analysts imagine UnitedHealth can develop earnings by a mean of 13% yearly over the long run. The corporate has additionally boosted its dividend payouts for 15 consecutive years. The inventory is poised to proceed delivering stellar returns, assuming the corporate stays out of antitrust hassle.

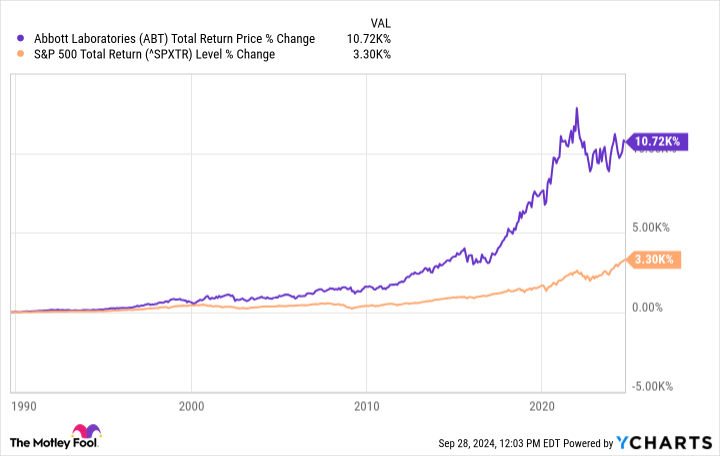

2. Abbott Labs

Healthcare merchandise firm Abbott Labs (NYSE: ABT) has developed over time. It spun off its major pharmaceutical enterprise over a decade in the past into AbbVie, however that hasn’t held the mum or dad firm’s inventory again from delivering market-beating returns. In the present day, Abbott Labs sells client well being merchandise, medical gadgets, testing gear, and generic prescription drugs to rising markets.

Abbott Labs can also be a Dividend King with a 53-year payout-hiking streak, which buyers in search of ever-increasing revenue from their portfolios ought to love. In the present day, it solely spends about half its earnings on the dividend, so it ought to have loads of room for future will increase.

Most significantly, Abbott has positioned itself properly for long-term progress. After spinning off AbbVie, the corporate aligned itself with progress traits in cardiovascular and diabetes care. Analysts masking the corporate on common imagine that it’s going to develop earnings by 8% to 9% yearly over the long run, and the dividend provides virtually 2% to buyers’ returns. Abbott most likely will not present explosive positive aspects, however years of regular returns within the 8% to 10% vary from progress and dividends can add as much as life-changing wealth.

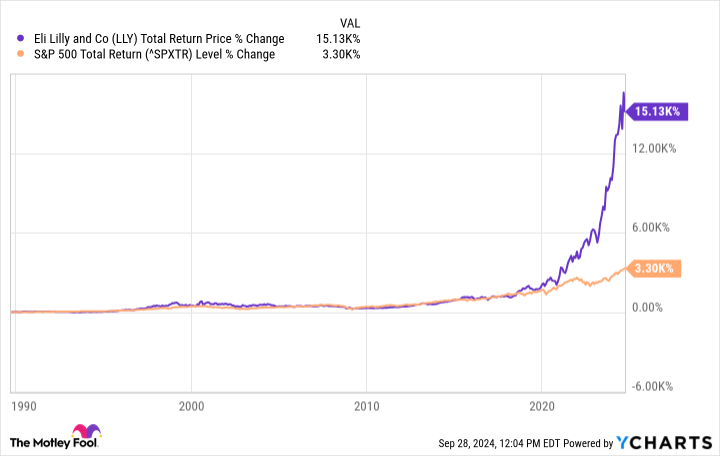

3. Eli Lilly

Pharmaceutical large Eli Lilly (NYSE: LLY) may be essentially the most explosive inventory of those three. The corporate struck it huge with its GLP-1 receptor agonist medication Wegovy and Zepbound, that are prescribed for diabetes and weight reduction, respectively. The mixed gross sales of all GLP-1 medication worldwide reached roughly $40 billion final 12 months, and a few forecasters count on that would almost quadruple to $150 billion yearly by 2032. Eli Lilly is considered one of a small variety of pharmaceutical corporations with FDA-approved GLP-1 merchandise. Nonetheless, Eli Lilly is way over that: It has a deep pipeline and a broad portfolio that features quite a few merchandise with rising gross sales.

Analysts imagine Eli Lilly will ship earnings progress that averages 20% yearly over the subsequent three to 5 years. Lengthy-term buyers should not sleep on Eli Lilly’s dividend potential, both. The corporate has raised its payouts for 10 consecutive years. Whereas it solely yields 0.6% right now, the payout ratio is simply 31% of this 12 months’s estimated earnings. Search for administration to ramp up that payout as Eli Lilly enjoys speedy progress over the approaching years. That makes the inventory a powerful candidate for additional market-beating complete returns.

Do you have to make investments $1,000 in UnitedHealth Group proper now?

Before you purchase inventory in UnitedHealth Group, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and UnitedHealth Group wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $752,838!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 30, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends AbbVie and Abbott Laboratories. The Motley Idiot recommends UnitedHealth Group. The Motley Idiot has a disclosure coverage.

Need $1 Million in Retirement? 3 Shares to Purchase Now and Maintain for A long time was initially printed by The Motley Idiot