Investor Perception

Osisko Metals’ high-quality polymetallic property current a compelling funding alternative amid a quickly increasing crucial and base metals market, as North America continues to strengthen its home provide.

Overview

Osisko Metals (TSXV:OM) is an exploration and growth firm specializing in two base metallic property in Canada – Gaspé Copper and Pine Level – focusing on copper and zinc, each crucial minerals mandatory for the worldwide transition to clear vitality. These property are past-producing, brownfield initiatives of serious potential for future manufacturing.

The Gaspé Copper mission in Québec has a fast growth plan to start mining the indicated useful resource of 495 million tons (Mt) of ore grading 0.37 % copper equal. Because the hole between obtainable copper provide and rising demand widens, Osisko Metals is well-positioned to assist create and strengthen a home provide chain for the North American market.

The corporate’s Pine Level zinc-lead mission within the Northwest Territories incorporates an indicated mineral useful resource estimate of 49.5 million tons at 4.2 % zinc and 1.5 % lead, along with important inferred assets. Zinc is a mandatory mineral for the clear vitality transition and has vital functions all through the manufacturing business. This widespread use of this mineral has analysts cautioning a couple of looming provide scarcity.

A preliminary financial evaluation (PEA) accomplished in 2022 signifies the Pine Level mission has the potential to turn into a world-class, high-grade zinc asset, with an after-tax internet current worth (NPV) of C$602 million and inner charge of return (IRR) of 25 %.

In February 2023, Osisko Metals introduced a C$100-million funding settlement with Appian Pure Sources Fund III for a three way partnership on the Pine Level mission. The settlement consists of C$75.3 million of funding for the mission and as much as C$24.7 million in money funds to Osisko Metals.

Led by a administration crew with a variety of experience all through the pure assets business and expertise in geology, exploration, company finance and company administration, Osisko Metals is well-poised to turn into a world-class provider of base metals.

Firm Highlights

- Osisko Metals (OM) is concentrated on turning into a big base metals producer by bringing two past-producing Canadian brownfield property again into manufacturing: the Gaspé Copper mission and the Pine Level zinc and lead mission.

- The corporate’s initiatives goal crucial minerals to help within the international transition to scrub vitality and net-zero emissions.

- OM’s 100-percent-owned Gaspé Copper mission in Québec has a fast growth plan to capitalize on its NI 43-101 indicated useful resource of 495 million tons of ore grading 0.37 % copper equal to satisfy the wants of a rising provide hole.

- Copper Mountain hosts the biggest undeveloped copper asset in Jap North America with an in-pit indicated useful resource of three.25 billion kilos (1.47 million tonnes) of contained copper, not together with important molybdenum (180 million kilos) and silver (28 million ounces) assets.

- The Pine Level mission within the Northwest Territories has the potential to turn into a top-ten zinc producer with high-grade zinc concentrates.

- C$100 million funding settlement with Appian Pure Sources Fund III for a three way partnership on the Pine Level mission – together with C$75.3 million funding for the mission – underneath which Appian can earn an as much as 65 % possession in Pine Level.

- A accomplished preliminary financial evaluation for the Pine Level asset signifies an after-tax IRR of 25 % and an NPV (8 %) of C$602 million.

- The 2024 mineral useful resource estimate replace for the Pine Level mission consists of indicated mineral assets of 49.5 Mt grading 4.22 % zinc and 1.49 % lead and inferred mineral assets of 8.3 Mt grading 4.18 % zinc and 1.69 % lead.

- A administration crew with experience all through the mining business leads the corporate towards attaining its purpose of turning into the main base metallic developer in North America by supplying the bottom metals mandatory for the clear vitality transition.

Key Tasks

Gaspé Copper Challenge

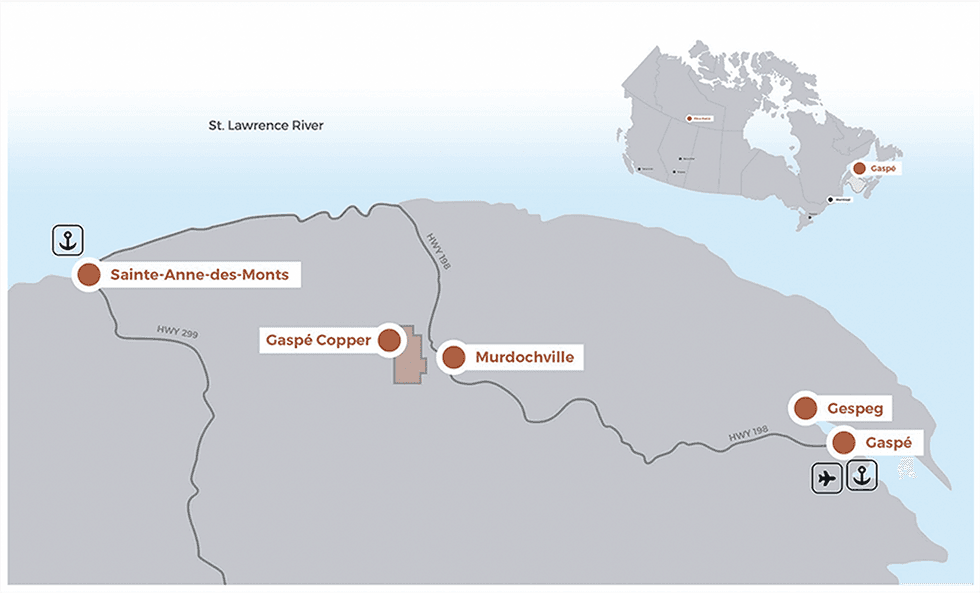

The Gaspé Copper mission in Québec is among the many most vital copper growth initiatives in jap North America. Osisko Metals accomplished the 100-percent acquisition of Gaspé Copper in July 2023 and has since commenced drilling on the property. Québec has a widely known status as one of the mining-friendly jurisdictions in North America, with a protracted historical past of copper manufacturing.

Challenge Highlights:

- Important Mineral Useful resource Estimate: The present NI 43-101 useful resource estimate for the asset demonstrates 3.25 billion kilos of contained copper at a 0.15 % sulfide copper cut-off. The useful resource additionally consists of important molybdenum at 180 million kilos and silver at 28 million ounces. Osisko Metals believes there’s room to develop recognized deposits with its upcoming drill marketing campaign.

- Promising Metallurgy: Preliminary testwork delivered common copper recoveries of 92 % and common molybdenum recoveries of 65 %, indicating that Gaspé Copper ought to produce copper and molybdenum concentrates with wonderful metallic grades and a payable silver credit score added to the copper focus.

- Prolific Previous Manufacturing: The previous Gaspé mines have been in manufacturing from 1955 to 1999 and produced greater than 100 million tonnes from a mix of open-pit and high-grade underground mines. The rising demand for copper makes reviving the mission economically compelling.

- Strong Infrastructure: The mission has infrastructure to quicken growth, together with paved highway entry, hydroelectric energy on-site, and port entry by way of the Saint Lawrence River and the city of Gaspé.

- 2023 Drill Program: Osisko Metals’ 2023 drill program at Gaspé Copper spanned 8,000 to 10,000 meters centered on continued infill drilling of the inferred mineral useful resource of the Mount Copper open pit deposit.

- Copper Mountain Up to date MRE: The up to date mineral useful resource estimate at Copper Mountain, as a part of the Gaspé copper mission, contains an open-pit indicated useful resource of 495 million tons grading 0.37 % copper equal, representing a 30 % enhance in copper-equivalent metallic content material, in addition to a better than 99 % conversion charge from inferred to indicated class.

- 2024 Drill Program: The 2024 drill program is underway at Needle and Copper mountains. Roughly 2,600 meters over 11 holes have been drilled at Needle Mountain aimed toward understanding the potential for figuring out extra mineral assets across the former Needle Mountain pit. Drilling is ongoing on the Copper Mountain pit, the place a 4,500-metre program is aimed toward higher defining assets within the enriched core of the deposit.

- Water characterization: Floor water characterization of the mine web site and surrounding space is continuous. Detailed sampling of the pit waters and experimental fishing downstream from the mine web site are deliberate to higher perceive the well being of fish populations and the potential impacts of pit dewatering.

- Preliminary financial evaluation: Scheduled for early 2025.

Pine Level Zinc-Lead Challenge

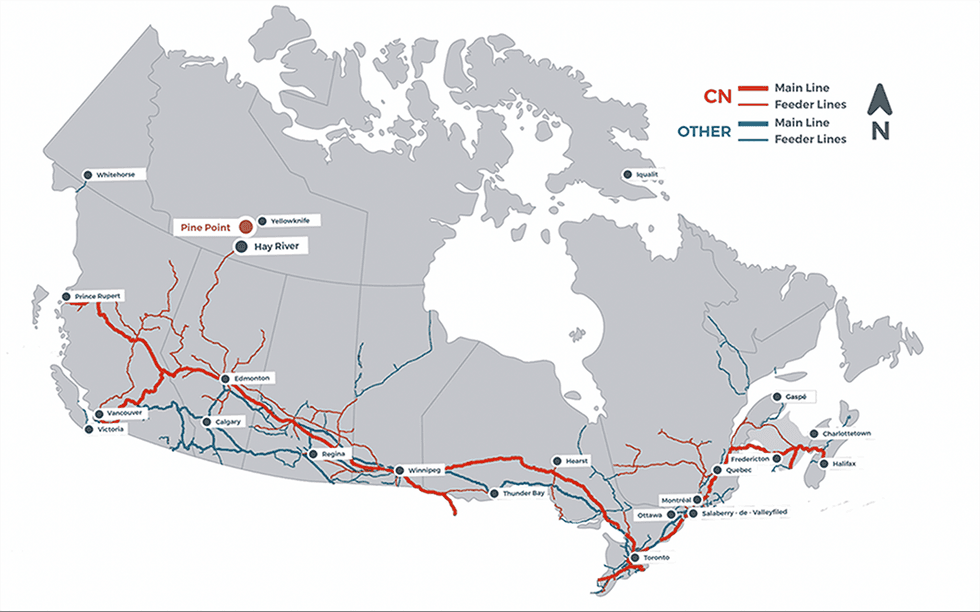

The Pine Level asset within the Northwest Territories has the infrastructure in place to assist the corporate transfer the mission towards growth. The mission has an current hydroelectric energy substation on web site, rail entry inside 60 kilometers, and paved entry roads to the positioning.

Challenge Highlights:

- Joint Enterprise: Pine Level Mining Restricted, which holds a 100% curiosity within the Pine Level mission, is operated underneath a joint-venture between Osisko Metals and Appian Pure Sources Fund III. This C$100-million funding settlement was finalized in April 2023 and yielded C$75.3 million of funding for the mission; in February 2024, Osisko Metals bought an extra 5 % possession curiosity in Pine Level Mining to a subsidiary of Appian Pure Sources Fund III LP for an anticipated fee of roughly C$8.33 million. In complete, Appian has the precise to earn as much as 65 % of Pine Level, with OM retaining 35 %.

- Excessive-grade Clear Concentrates: Pine Level has demonstrated the potential to provide one of many world’s cleanest concentrates for zinc and lead. A current metallurgical evaluation signifies excessive recoveries of 87 % for zinc, and 93 % for lead utilizing XRT sorting and traditional grinding and flotation processes. Moreover, research point out low ranges of deleterious components within the concentrates, making them interesting to smelters world wide that search to extend the general purity ranges of their focus inputs.

- Promising Preliminary Financial Evaluation: The 2022 PEA signifies a median annual life-of-mine manufacturing of 329 million kilos of zinc and 141 million kilos of lead. Moreover, the 2022 PEA signifies diminished estimated dewatering quantity by 30 % in comparison with the 2020 PEA.

- 2024 Up to date Mineral Useful resource Estimate: Up to date MRE for the Pine Level mission highlights the next:

- Indicated mineral assets of 49.5 Mt grading 4.22 % zinc and 1.49 % lead (5.52 % zinc equal) containing roughly 4.6 billion kilos of zinc and 1.6 billion kilos of lead in situ (undiluted).

- Inferred mineral assets of 8.3 Mt grading 4.18 % zinc and 1.69 % lead (5.64 % zinc equal containing roughly 0.7 billion kilos of zinc and 0.3 billion kilos of lead in situ (undiluted).

- Used variable cut-off grades between 1.41 % and 1.51 % zinc equal for open pit assets and between 4.10 % and 4.40 % zinc equal for underground assets.

- The mission’s East Mill, Central and North Zones now include roughly 36.2 Mt of indicated assets grading 5.22 % zinc equal, or 3.2 billion kilos of zinc and 1.1 billion kilos of lead in situ.

- Group Assist: Osisko Metals has labored exhausting to earn group assist within the close by cities of Hay River, Fort Smith and Fort Decision, and has additionally concluded two separate collaboration agreements with native Indigenous communities: Deninu Ok’ue First Nation and Northwest Territory Metis Nation. These agreements embrace training, coaching, employment, and enterprise alternatives. Moreover, a 2017 exploration settlement was signed with Ok’atl’odeeche First Nation.

Administration Staff

Robert Wares – CEO

Robert Wares is an expert geologist with greater than 35 years of expertise in mineral exploration and growth. He was liable for discovering the Canadian Malartic bulk tonnage gold mine, which Osisko Mining subsequently developed into one in every of Canada’s largest gold producers. Amongst different awards, Wares was a co-winner of the Prospectors and Builders Affiliation of Canada’s “Prospector of the Yr Award” for 2007 and was named, along with John Burzynski and Sean Roosen, as “Mining Males of the Yr” for 2009 by the Northern Miner. Wares sits on the board of administrators of Brunswick Exploration. Wares has a Bachelor of Science and an honorary doctorate in earth sciences from McGill College.

Jeff Hussey – Director and CEO of Pine Level Mining Restricted

Jeff Hussey has 32 years {of professional} expertise within the mining business. He has labored in each open-pit and underground mine operations at varied phases of mine life, from start-up to mine closure, and extra lately, working in mineral exploration and growth initiatives. He spent 19 years with Noranda/Falconbridge. His mine operation expertise consists of work on the Brunswick No. 12 mine, Gaspé Copper mines, the Antamina mine start-up in Peru, in addition to the Raglan mine in Northern Québec. As a senior scientist with the Mining Know-how Group on the Noranda Know-how Centre in 2002, he enhanced his community within the metallurgical analysis and mining innovation fields. As a guide since 2007, Jeff Hussey and Associates has helped junior mine growth firms by providing exploration, mining, and geo-metallurgical assist providers. These embrace Champion Iron Mines, Focus Graphite, Puma Exploration and Starcore Worldwide in Mexico. Whereas at Champion Iron Mines, he participated in constructing important high-quality iron ore assets, finishing feasibility research and collaborating in elevating greater than $70 million for company growth. Whereas working with Focus Graphite, growth obligations included a feasibility research and related work with group stakeholders and governments. Hussey has a Bachelor of Science in geology from the College of New Brunswick.

Anthony Glavac – Chief Monetary Officer

Anthony Glavac has greater than 17 years of expertise in monetary reporting, together with over 12 years within the mining business. Since August 2017, Glavac has served as vice-president, company controller for Falco Sources. He beforehand served as director of economic reporting and inner controls at Dynacor Gold Mines, and interim chief monetary officer at Alderon Iron Ore. Earlier than becoming a member of Alderon, Glavac spent 10 years at KPMG, working with each private and non-private firms, offering audit, taxation, strategic advisory and public providing providers. Glavac can be concerned with different public firms within the mining business.

Ann Lamontagne – Vice-president, Atmosphere and Sustainable Improvement

Ann Lamontagne is a civil engineer who obtained her doctoral diploma in mining atmosphere from Laval College in 2001. She has labored within the mining business for over 25 years as a guide for geotechnical, water administration, hydrogeology, and environmental initiatives. She has been concerned within the growth of a number of mining initiatives the place her experience has been invaluable in minimizing environmental dangers all through the mine planning course of, from preliminary design via to closure and reclamation. Lamontagne has additionally been concerned in lots of R&D initiatives with mining firms, together with Nouveau Monde Graphite, Troilus Gold, and Mason Graphite.

Killian Charles – Strategic Advisor

Killian Charles has been president and CEO of Brunswick Exploration since 2020. Previous to this, he was vice-president, company growth for Osisko Metals, the place he now stays as a particular advisor. Charles was a mining analyst at Laurentian Financial institution Securities and at Industrial Alliance Securities (Dealer) for six years. He additionally labored as a supervisor of company growth at Integra Gold, till its acquisition by Eldorado Gold in 2017. Charles acquired an undergraduate diploma in Earth and Planetary Sciences from McGill College.