Are you in search of funding revenue? Dividend shares are an apparent place to begin your search, however there are such a lot of! For most individuals, limiting your prospects to the 30 shares that make up the Dow Jones Industrial Common won’t solely make the hunt extra manageable, but additionally ensures you personal high-quality names.

Even so, which Dow shares? It is tempting to easily plow into the index’s three highest-yielding names and name it a day. However there’s one thing you may wish to find out about that technique earlier than utilizing it.

The Dow’s highest-yielding dividend shares proper now

In case you are questioning, the Dow names sporting the highest-dividend yields proper now are telecom behemoth Verizon Communications (NYSE: VZ), chemical firm Dow Inc. (NYSE: DOW), and oil large Chevron (NYSE: CVX), with trailing yields of 6.5%, 5.3%, and 4.5%, respectively. You can definitely do worse.

As veteran buyers can attest, nonetheless, each funding comes with a trade-off. Within the case of above-average dividend yields you are more likely to see below-average dividend progress and/or below-average capital appreciation. It is also potential that shares with robust dividend yields merely pose above-average danger to their homeowners.

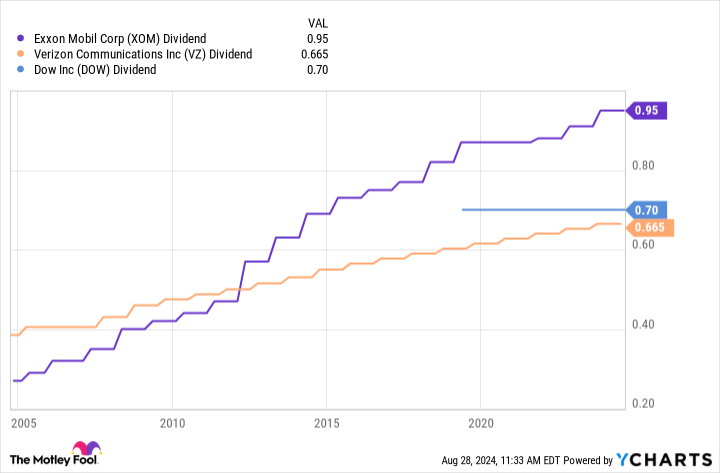

Within the case of Verizon, Dow, and Chevron, it is largely the primary two trade-offs. That’s, these are all stable corporations, however none of them are in progress industries that may help nice dividend progress or worth beneficial properties. Respectable progress? Positive. Nice progress? No.

In case your solely precedence is above-average yields and inflation-beating dividend progress although, these three tickers will do properly. Clearly, the necessity for wi-fi telecom companies isn’t going away, and neither is the necessity for industrial chemical substances. Even the old-school vitality enterprise is fairly effectively protected for the foreseeable future. Due to inhabitants progress and ever-expanding industrialization,

Goldman Sachs believes world consumption of crude oil will proceed rising by way of 2034, and can nonetheless be wanted for a lot of, a few years after that. Power large ExxonMobil equally predicts we’ll be utilizing as a lot oil in 2050 as we’re utilizing proper now.

Given this outlook, Chevron’s dividend goes to be high quality for an extended, lengthy whereas as effectively. And in not less than two of the three circumstances, future dividend progress will prolong spectacular dividend-growth histories. (Dow cut up from its guardian in 2019 — proper earlier than the COVID-19 pandemic — and as such hasn’t had a good probability to lift its dividend cost but.)

There’s good purpose to anticipate some stable capital appreciation from these three names, too, regardless of their unusually excessive dividend yields proper now.

Canine of the Dow

Ever heard of the Canine of the Dow stock-picking technique? If not, it isn’t difficult. The technique merely calls for getting the Dow’s 10 highest-yielding shares at of the top of any given calendar yr, and holding them for the whole lot of the next yr. The speculation is that these highest-yielding blue chips are unduly undervalued, and ripe for a worth rebound; the dividends they will be allotting within the meantime are only a good added bonus.

The factor is, the technique works! Though not profitable yearly, as a rule these high-yield tickers do find yourself outperforming the Dow itself in addition to the S&P 500. The tactic is much more productive with the so-called Small Canine of the Dow (typically known as the Puppies of the Dow), that are simply the 5 lowest-priced Canine of the Dow shares in any given yr. In each circumstances buyers are scooping mathematically undervalued blue chips after which reaping the reward for not overthinking their picks (versus speaking themselves out of what would have been a sensible commerce).

Clearly, this rules-based technique would not fairly apply right here and now. We’re not on the finish of the yr, and we’re solely excited about three shares — not 10, and even the 5 lowest-priced tickers of these 10. The underlying premise applies all the identical, although. That’s, you are shopping for confirmed, dividend-paying blue chip shares at a reduction. The calendar and amount aren’t elements for those who’re a real long-termer simply in search of some dependable revenue shares to personal.

Simply do it already

Admittedly, the thought appears too easy to be efficient. Selecting shares is (in principle) presupposed to be difficult, requiring numerous analysis that also in the end results in a judgment name. This strategy is something however a sophisticated judgment name. And to be truthful, there is definitely no assure this strategy will pan out for you.

At the least embrace the underlying thought, nonetheless. Buyers have a knack for making issues tougher than they must be, typically undermining their web returns in consequence by not getting into a place they arguably ought to have.

Or, stated in easier phrases, do not overthink issues when your universe of prospects is already restricted to the market’s prime blue chips. In case you’re in search of above-average dividend revenue proper now — with cheap hope for extra of the identical sooner or later — the Dow’s three highest-yielding names ought to do exactly high quality.

Must you make investments $1,000 in Verizon Communications proper now?

Before you purchase inventory in Verizon Communications, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Verizon Communications wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $731,449!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 26, 2024

James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chevron and Goldman Sachs Group. The Motley Idiot recommends Verizon Communications. The Motley Idiot has a disclosure coverage.

Ought to You Purchase the three Highest-Paying Dividend Shares within the Dow Jones? was initially printed by The Motley Idiot