Investor Perception

Redstone Assets’ (ASX:RDS) strategic exploration of copper and different base metals in Western Australia’s West Musgrave area, coupled with its lithium acquisition in Canada, positions the corporate to probably capitalize on the rising international demand for battery metals, leveraging its one hundred pc possession of its West Musgrave challenge and proximity to important current deposits.

Overview

Australia is supporting this progress in demand via its mining-friendly, tier-1 jurisdictions. The nation is a world chief in producing and exporting a plethora of metals and minerals, together with iron, copper, lithium, nickel, bauxite and gold. Australia produces important quantities of 19 in- demand minerals from greater than 350 working mines. The Musgrave Province incorporates a Mesoproterozoic crystalline basement terrain that reaches throughout the shared borders of Western Australia, the Northern Territory and South Australia. The terrain has important deposits of a number of important metals, together with nickel, platinum group parts (PGEs), copper, gold, lead, zinc, chromite, and uncommon earth parts (REEs). But, a lot of Musgrave stays underexplored, particularly for the bottom metals the world now wants.

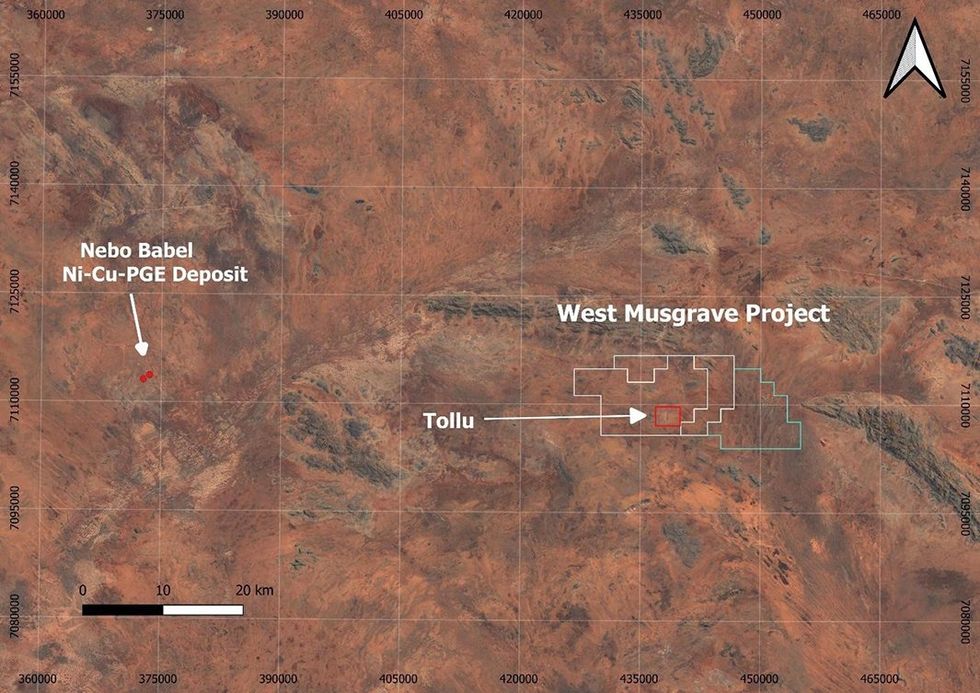

Redstone Assets (ASX:RDS) is a base and valuable metals exploration firm, exploring its 100-percent-owned, extremely potential West Musgrave Mission, which incorporates the Tollu Copper deposit, situated within the West Musgrave Province of Western Australia. The corporate’s West Musgrave Mission is situated proximal to BHP’s world-class Nebo-Babel nickel-copper- PGE sulphide deposit and Succoth copper (nickel, palladium) deposit, and Nico Assets’ Wingellina nickel-cobalt challenge.

Redstone additionally has different pending tenement purposes potential for base metals in the identical area. The corporate is led by a administration crew with experience in geology and mineral exploration, enterprise growth and company regulation, creating confidence within the crew’s potential to capitalize on its belongings.

The distinctive Musgrave terrain has already drawn the curiosity of notable miners, equivalent to BHP. BHP has progressed with the event of its Nebo-Babel nickel-copper-PGE sulphide deposit, following grant of closing regulatory approval to start development of the Nebo-Babel mine. The Nebo-Babel nickel-copper-PGE sulphide deposit has been estimated to have a useful resource of 390 million tonnes grading 0.33 p.c copper and 0.30 p.c nickel, for 1.2 million tonnes of contained nickel steel and 1.3 million tonnes of contained copper steel (Mea + Ind + Inf – 2012 JORC). Different discoveries and deposits within the space, such because the Wingellina nickel-cobalt deposit, point out the potential of the West Musgrave area to develop into a big base steel jurisdiction.

Redstone’s flagship, 100-percent-owned West Musgrave Mission is located between these two deposits — roughly 40 kilometres east of BHP’s Nebo Babel nickel-copper-PGE deposit and 50 kilometres west-southwest of Nico Assets’ Wingellina nickel-cobalt deposit.

Redstone’s West Musgrave Mission is extremely potential but largely underexplored. The asset has the suitable geological and structural setting for big magmatic nickel-copper sulphide deposits, volcanic-hosted huge sulphide (VHMS) deposits and different giant intrusive associated hydrothermal programs.

Location of Redstone’s West Musgrave Mission, which incorporates the Tollu copper deposit, in relation to the world-class Nebo-Babel Ni-Cu-PGE deposit.

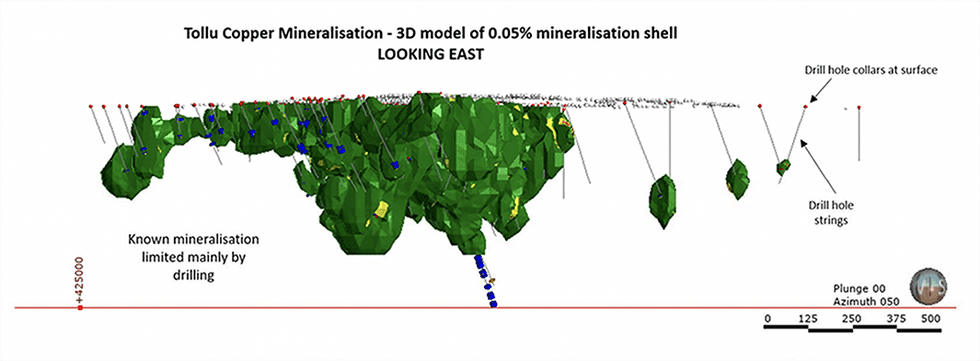

The 100-percent-owned Tollu copper vein deposit, situated inside the West Musgrave challenge, has a JORC-compliant indicated and inferred useful resource estimate of three.8 million tonnes grading 1 p.c copper, for 38,000 tonnes of contained copper with a cut-off of 0.2 p.c. There’s additionally a present estimated conceptual exploration goal*, suggesting a possible for as much as 627,000

tonnes of copper at Tollu. (*conceptual exploration goal ranges from 31 to 47 million tonnes of mineralization at 0.8 to 1.3 p.c copper, containing 259,000 to 627,000 tonnes copper.)

Exterior Australia, Redstone Assets is an rising battery metals explorer and has been constructing its portfolio of lithium and different essential mineral belongings in Canada.

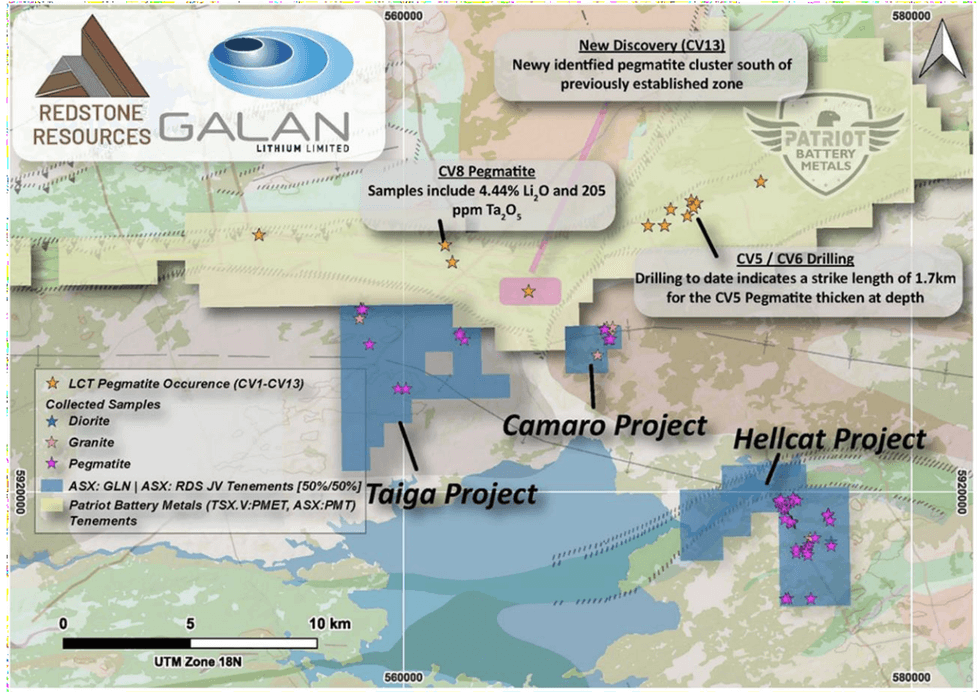

Redstone Assets additionally just lately entered right into a 50/50 three way partnership settlement with Galan Lithium (ASX:GLN), aqcuiring one hundred pc of the extremely potential suite of lithium initiatives that embody the Camaro, Taiga and Hellcat Initiatives situated within the prolific James Bay Lithium District in Quebec, host to a number of superior lithium initiatives and new lithium discoveries in Canada together with:

- Patriot Metals (ASX:PMT,TSXV:PMET) Corvette Mission

- Winsome Assets Ltd (ASX:WR1) Cancet Mission; and

- Q2 Metals Corp (TSXV:QTWO) Mia Lithium Mission.

Patriot’s CV8 pegmatite discovery is situated only one.4 km north of the Taiga Mission and the newly found CV13 pegmatite cluster is situated 1.5 km north of the Camaro Mission

Redstone would be the supervisor of the three way partnership which covers 5,187 hectares of tenure.

An skilled administration crew leads Redstone with many years of expertise within the mineral sources sector, with experience in mineral exploration, mining operations and company finance.

Firm Highlights

- Redstone Assets is an Australia-based mineral exploration firm exploring extremely potential properties for copper and different base metals within the West Musgrave area of Western Australia.

- The West Musgrave area has already drawn the curiosity of miners who’ve made important discoveries, together with the world-class Nebo-Babel nickel-copper-PGE sulphide deposit and the Wingellina nickel-cobalt deposit.

- Redstone’s flagship West Musgrave Mission is situated close to these current initiatives, solely 40 km west of BHP’s Nebo-Babel deposit, indicating the potential of the corporate’s tenure.

- The corporate owns one hundred pc of the West Musgrave Mission, which incorporates the Tollu Copper vein deposit.

- It has the suitable geological and structural setting for big magmatic nickel-copper sulphide deposits, VHMS deposits and different giant intrusive-related hydrothermal programs

- The Tollu Copper vein deposit is proof of a big hydrothermal system within the challenge space.

- Redstone Assets has additionally entered right into a 50/50 three way partnership settlement with Galan Lithium (ASX:GLN), buying a one hundred pc of a extremely potential suite of lithium initiatives in James Bay, Quebec.

- The Redstone and Galan Lithium three way partnership challenge acquisitions in James Bay complement the corporate’s West Musgrave and its technique to extend publicity to the rising international battery metals and probe for essential minerals in excessive demand.

- A robust administration crew leads the corporate with many years of expertise within the sources sector.

Key Initiatives

The West Musgrave Mission

The West Musgrave Missioncovers 237 sq. kilometres of extremely potential but underexplored terrain. The asset is 40 kilometres east of the world-class Nebo-Babel nickel- copper-PGE sulphide deposit owned by BHP, and incorporates appropriate geological construction and settings for nickel-copper deposits. Redstone plans to proceed the exploration of the asset to comply with up on latest drilling and exploration outcomes which recognized quite a few potential targets.

Considerably, latest drilling some 7.5 km northeast of the Tollu Copper Vein deposit has confirmed for the primary time the presence of mafic-ultramafic intrusions on the challenge, that are potential host and/or supply rocks for nickel-copper-PGE ± cobalt mineralisation. This affirmation is important for Redstone particularly contemplating the western boundary of the challenge space is barely 40 kms east of the BHP-owned world-class Nebo Babel nickel-copper-cobalt-PGE deposit and may be a possible rationalization for a supply of the excessive grade copper at Tollu.

The Tollu Copper Vein Mission

Redstone’s Tollu Copper Vein deposit is situated inside the broader West Musgrave Mission and has already produced promising drilling outcomes. Tollu hosts an enormous swarm of hydrothermal copper-rich veins in a mineralized system protecting an space of not less than 5 sq. kilometres.

Copper mineralization is uncovered on the floor and kinds a part of a dilation system inside and between two main shears.

Redstone has outlined a JORC 2012 useful resource estimate for Tollu of 3.8 million tonnesgrading 1 p.c copper, for 38,000 tonnes of contained copper and 0.01 p.c cobalt, which equates to 535 tonnes of contained cobalt. Nevertheless, the corporate considers that this estimate could also be far larger with additional drilling.

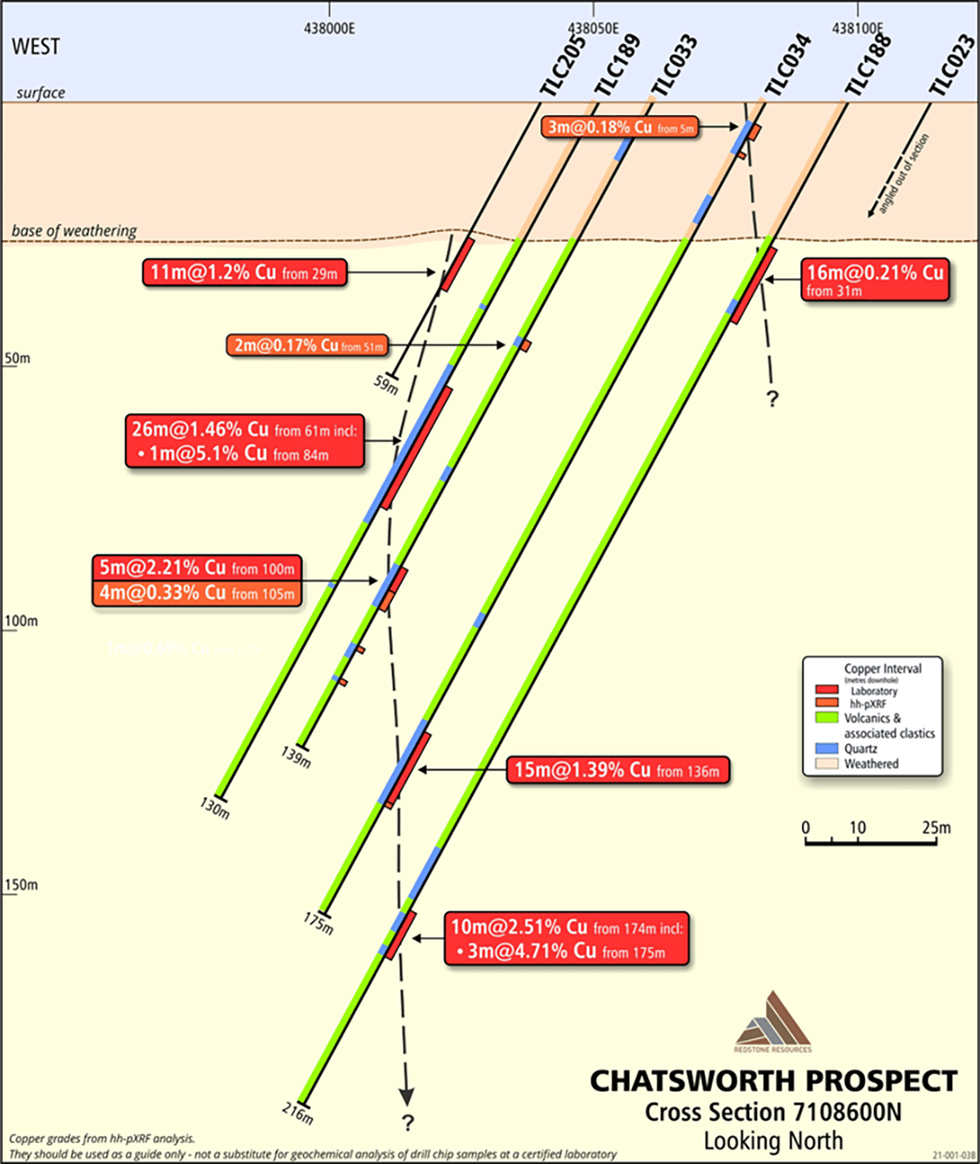

Drilling outcomes from Redstone Assets’ most up-to-date exploration program proceed to ship excellent copper outcomes for the Chatsworth and Forio prospects on the Tollu Copper Vein deposit.

At Chatsworth, latest RC drill gap TLC205 intersected 11 metres at 1.2 p.c copper from solely 29 metres downhole, extending the beforehand intersected excessive‐grade copper lens an extra 20 metres in the direction of the floor.

Along with earlier drilling, TLC205 has proven that the focused excessive grade copper lens at Chatsworth is as much as 26 metres thick (downhole), has a copper grade at all times over 1 p.c copper and extends over 140 metres vertical from TLC205 to its deepest intersection to this point in TLC188 at 174 metres-184 metres downhole. No drilling has been examined beneath the intersection in TLC188 and so this important, as much as 26 metre thick (downhole) vertically lengthy high-grade copper lens stays open at depth.

Earlier important intersections at Chatsworth additionally embody:

- TLC188 – 10m at 2.51 p.c Cu from 174m downhole together with:

- 3m at 4.71p.c Cu from 175m downhole;

- TLC189 – 26m at 1.46 p.c Cu from 61m downhole together with:

- 1m at 5.1p.c Cu from 84m downhole;

- TLC033 – 5m at 2.21p.c Cu from 100m downhole; and

- TLC034 – 15m at 1.39 p.c Cu from 136m downhole together with:

- 3m at 3.67 p.c Cu from 122m downhole.

E-W Cross-section of excessive grade copper lens at Chatsworth Prospect, Tollu Copper Deposit. Current intersection in RC drill gap TLC205 is proven together with intersections from 2021 drilling in TLC188 and TLC189 in addition to intersections in historic drilling, RC drill holes TLC033 and TLC034

Current drilling has additionally delivered additional high-grade intersections at Forio, together with the very best Cu grade ever intersected with 1 m at 18.5 p.c copper from 18 m downhole in RC drill gap TLC203.

Drilling accomplished at Forio in late 2022 RC drilling marketing campaign at Tollu had been aimed toward testing the continuity alongside strike of a zone of excessive grade copper lenses at Forio recognized in earlier drilling.

The excessive grade Cu intersections at Forio embody:

- 8 m at 4.1 p.c copper from 13 m downhole depth (TLC203) together with 1 m at 18.5 p.c copper from 18 m downhole.

- 4 m at 1.2 p.c copper from 45 m downhole (TLC203)

- 6m at 1.47 p.c copper from 80 m downhole (TLC201).

The numerous drilling intersections of excessive‐ grade copper mineralisation at each the Chatsworth and Forio Prospects (relationship again to 2017) at Tollu are but to be included within the current JORC 2012 Tollu useful resource estimate.

Redstone and Galan 50/50 Joint Enterprise

James Bay Lithium Initiatives – Taiga, Camaro and Hellcat

The Redstone and Galan 50/50 JV just lately acquired the James Bay Lithium Initiatives, particularly three top quality initiatives consisting of Taiga, Camaro and Hellcat Initiatives (TCH). The initiatives cowl 3,850 hectares and are adjoining to Patriot Battery Metals’ (TSXV:PMET) Corvette Lithium discovery in James Bay. PMET’s CV8 pegmatite is likely one of the best new exhausting rock lithium discoveries, with seize samples averaging 4.6 p.c lithium oxide Li2O, and is situated only one.4 kilometres north of the Taiga Mission. PMET’s newly-discovered CV13 pegmatite cluster is situated 1.5 kilometres north of the Camaro Mission.

James Bay Mission Highlights:

The Taiga and Camaro are located within the Meso-Archean to Paleoproterozoic La Grande Subprovince of the Superior Province underlain by the Poste Le Moyne and Langelier plutons, respectively. The Camaro challenge is hosted within the Semonville Pluton with native home windows of the Rouget Formation metabasalt. Properties are hosted in hornblende biotite diorite, quartz-rich diorite, biotite hornblende tonalite, granodiorite, granite, conglomerate, wacke, and amphibolite. The Hellcat Mission hosts Vieux Comptoir Granitic suite believed to be the supply of the spodumene-bearing pegmatite dykes discovered inside the area. The first greenstone inside the challenge is amphibolites of the rouget greenstone belt, an identical age to the Grupe de Guyer greenstone belt, situated inside Patriot Battery Metals Corvette discovery.

Earlier preliminary exploration on the James Bay Lithium Initiatives accomplished by Axiom Exploration recognized 28 potential pegmatite dykes.

Board and Administration

Richard Homsany – Non-executive Chairman

Richard Homsany is govt vice-president of Mega Uranium, a Toronto Inventory Change listed firm and govt chairman of Toro Power Restricted, an ASX-listed uranium firm. He’s additionally the non-executive chairman of Galan Lithium and the Well being Insurance coverage Fund of Australia Restricted.

Previous to this Homsany was a company and industrial advisory associate with considered one of Australia’s main regulation companies. He’s at the moment the principal of Cardinals Attorneys and Consultants and has been admitted as a solicitor for over 20 years. Homsany has in depth expertise in company regulation, together with advising public sources and vitality corporations on company governance, finance, capital raisings, takeovers, mergers, acquisitions, joint ventures and divestments.

He additionally has important board expertise with publicly listed useful resource corporations and within the sources {industry}. He has additionally labored for an ASX prime 50-listed internationally diversified sources firm in operations, danger administration and company.

Homsany is a licensed practising accountant and is a fellow of the Monetary Providers Institute of Australasia (FINSIA). He has a commerce diploma and honors diploma in regulation from the College of Western Australia and a graduate diploma in finance and funding from FINSIA.

Edward van Heemst – Non-executive Director

Edward van Heemst is a distinguished Perth businessman with over 40 years of expertise in managing a various vary of actions with giant non-public corporations.

He’s the managing director of Vanguard Press and was beforehand the long-time chairman of Perth Racing (1997 to 2016). He was additionally appointed as non-executive chairman of NTM Gold, an ASX-listed firm from July 2019 to March 2021.

Van Heemst holds a bachelor of commerce diploma from the College of Melbourne, an MBA from the College of Western Australia and is a member of the Institute of Chartered Accountants Australia.

He has in depth information of capital markets and established mining {industry} networks.

Brett Hodgins – Technical Director

Brett Hodgins has over 20 years {of professional} expertise within the sources sector primarily targeted on exploration and mining operations. He started his profession as a geologist with Gown River Mining and Rio Tinto Iron Ore. Throughout that point he was concerned with the commissioning and growth of the West Angelas and Hope Downs operations. Hodgins’ latest roles embody normal supervisor challenge growth for Iron Ore Holdings and he’s president/CEO of Central Iron Ore Ltd, a TSXV-listed firm gold and iron ore explorer. He brings a variety of expertise in exploration, feasibility research, operations, and has a broad information of the useful resource sector.

Hodgins has accomplished a bachelor of science diploma with honors in geology from Newcastle College, diploma of administration and a graduate diploma in finance and funding from FINSIA.

Dr. Greg Shirtliff – Geological Guide

Dr. Greg Shirtliff has over 20 years of expertise in industry-related geology and geochemistry, together with a PhD in mine-related geology from the Australian Nationwide College. Since his research, Shirtliff has spent over 17 years in numerous roles within the mining and exploration {industry} starting from environmental, mine geology, useful resource growth, exploration and administration roles, exploration and technical initiatives inclusive of engineering and metallurgical. His roles have included a number of years at ERA-Rio Tinto’s Ranger Uranium Mine, because the senior geoscientist for Cameco Australasia and extra just lately because the lead geologist and technical supervisor for Toro Power Ltd, an ASX-listed uranium growth firm in Australia the place he’s the exploration and technical lead chargeable for rising the viability of the corporate’s uranium and mineral sources, creating and directing the corporate’s uranium and non- uranium exploration technique, aiding the corporate technically via EPA approval for a uranium, and guiding the engineering and metallurgical via to scoping degree financial evaluation.

Shirtliff has had latest exploration success at Toro Power, discovering a number of zones of huge nickel sulphide mineralization alongside the Dusty Komatiite, arguably the primary huge nickel sulphide mineralization found within the Yandal Greenstone Belt in Western Australia. Shirtliff holds directorships on privately owned consultancy and prospecting corporations.

Shirtliff is a long-standing member of the Australian Institute of Mining and Metallurgy and the internationally acknowledged Society of Financial Geologists.