Investor Perception

Prospect Ridge Assets’ compelling funding worth proposition stems from the corporate’s strong development ambitions pushed by its extremely potential property close to the famend Golden Triangle area, and a administration workforce with substantial technical experience.

Overview

Prospect Ridge (CSE:PRR,OTC:PRRSF,FRA:OED) is a treasured metals exploration firm targeted on key initiatives in Northern British Columbia close to the prolific Golden Triangle. The Golden Triangle in northwest British Columbia has been a hub for mineral exploration and mining endeavors for over 150 years. The corporate owns one hundred pc of each the Knauss Creek property and the Holy Grail property.

The Knauss Creek property resembles the high-grade mineralization discovered within the historic Dorreen mine. Exploration at Knaus Creek has revealed high-grade mineralization comprising gold, silver, copper, lead and zinc. The Copper Ridge zone, which is within the southern a part of the Knauss Creek property, is especially fascinating. In 2023, a complete of 241 samples have been collected from this space which prolonged the Copper Ridge mineralized zones over an east-west strike size of 1,550 meters, a north-south strike of 850 meters, and a top distinction of 470 meters.

Prospect Ridge Assets has additionally accomplished an inaugural drilling program on the Copper Ridge zone to check high-priority targets within the western and central portion of this massive system.

The opposite property, Holy Grail, has additionally traditionally produced high-grade gold and silver from placer mining. Prospecting outcomes on the Holy Grail property confirmed distinctive promise, uncovering vital discoveries of gold, silver, copper, lead and zinc.

Prospect Ridge advantages from a workforce of execs boasting in depth experience in geology and mining. The corporate is led by Micheal Iverson, CEO, who has greater than three a long time of expertise in mining exploration. The administration workforce has a confirmed monitor report of executing a number of profitable exploration and growth initiatives, together with Fortuna Silver Mines and NioGold Mining’s Marban undertaking.

Firm Highlights

- Prospect Ridge is a Canada-based exploration and growth firm with two extremely potential land packages in British Columbia.

- The corporate’s two key property are the Knauss Creek property and the Holy Grail property, positioned close to the famend Golden Triangle area in northwestern British Columbia. The Golden Triangle has traditionally been recognized for considerable treasured and base steel discoveries, with quite a few energetic mining initiatives and ongoing useful resource exploration.

- The flagship Knauss Creek property has revealed high-grade floor samples as much as 78.9 g/t gold, 4,740 g/t silver, 29.4 p.c copper, 33.33 p.c lead and 4.10 p.c zinc. The Copper Ridge zone is especially fascinating, the place a 1.5-km strike zone containing high-grade gold-silver-copper traits have been found.

- The corporate has accomplished an inaugural drilling program to check the drill-ready goal Copper Ridge zone.

- Prospecting outcomes from the Holy Grail property are exceptionally promising. They reveal noteworthy discoveries of gold, silver, copper, lead and zinc.

- Prospect Ridge is led by a confirmed workforce of executives with greater than 100 years of mixed expertise main a number of profitable exploration and growth initiatives, together with Fortuna Silver Mines and NioGold Mining’s Marban undertaking (offered to Oban Mining, now Osisko Mining).

Key Initiatives

Knauss Creek Property

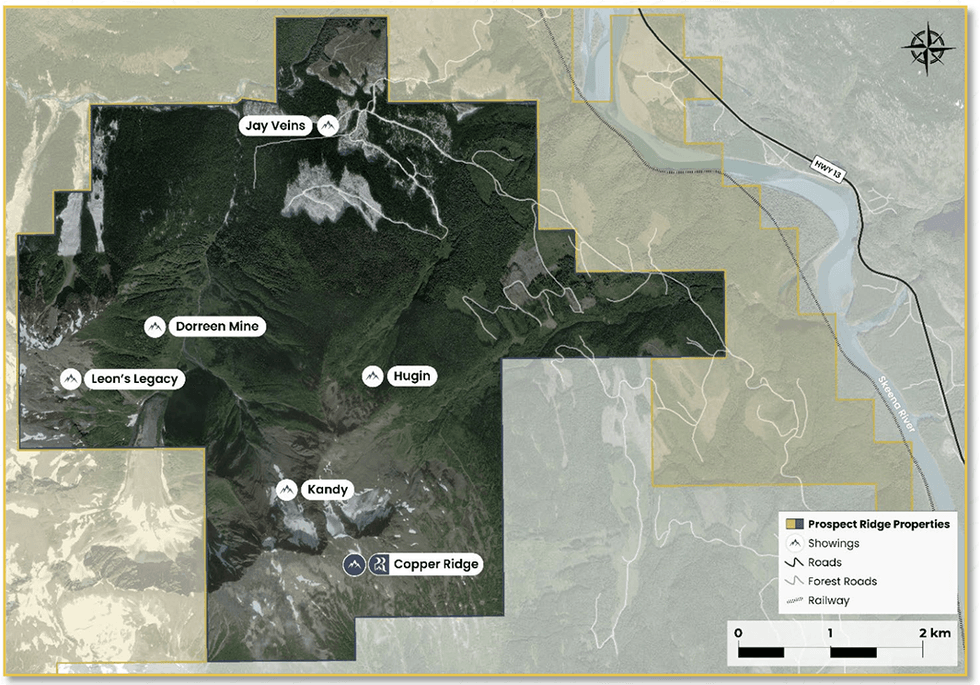

The Knauss Creek property, located 35 kms north of Terrace, BC, spans 2,944. It has wonderful infrastructure entry, proximity to Freeway 16, quite a few logging roads traversing it, and the Canadian Nationwide Railway passing by way of.

The property is residence to the historic Dorreen mine. Numerous showings on the property, together with the Jay Veins, Hugin, Kandy and Copper Ridge, include gold, silver, copper, lead and zinc mineralization. The present focus is on the Copper Ridge zone, a high-grade polymetallic mineralization zone spanning 1,500 meters.

Assays from outcrop samples gathered in the course of the 2023 prospecting season have revealed quite a few high-grade gold, silver and copper findings. Highlights from rock outcrop sampling, embody:

- Pattern W489444 incorporates 6.70 grams per ton (g/t) gold, 4,610 g/t silver, 2.23 p.c copper

- Pattern W489424 incorporates 15.9 g/t gold, 987 g/t silver, 0.29 p.c copper, 17.55 p.c lead, 6.99 p.c zinc

- Pattern W501837 incorporates 0.49 g/t gold, 134 g/t silver and 29.4 p.c copper

- Pattern W501812 incorporates 2.14 g/t gold, 264 g/t silver and 10.35 p.c copper

Consequently, the Copper Ridge zone has been prolonged, now measuring an east-west size of 1,550 meters, a north-south strike size of 850 meters, and a vertical distinction of 470 meters. Discipline knowledge suggests the veins observe a north-south orientation and dip in the direction of the east.

The interpretation suggests the zone includes a community of mineralized veins organized like a ladder hosted inside a granodioritic intrusion.

The corporate has accomplished an inaugural drilling program to judge drill-ready targets just like the Copper Ridge zone, which confirmed the orientation of the veins and prolonged them extra at depth.

Holy Grail Property

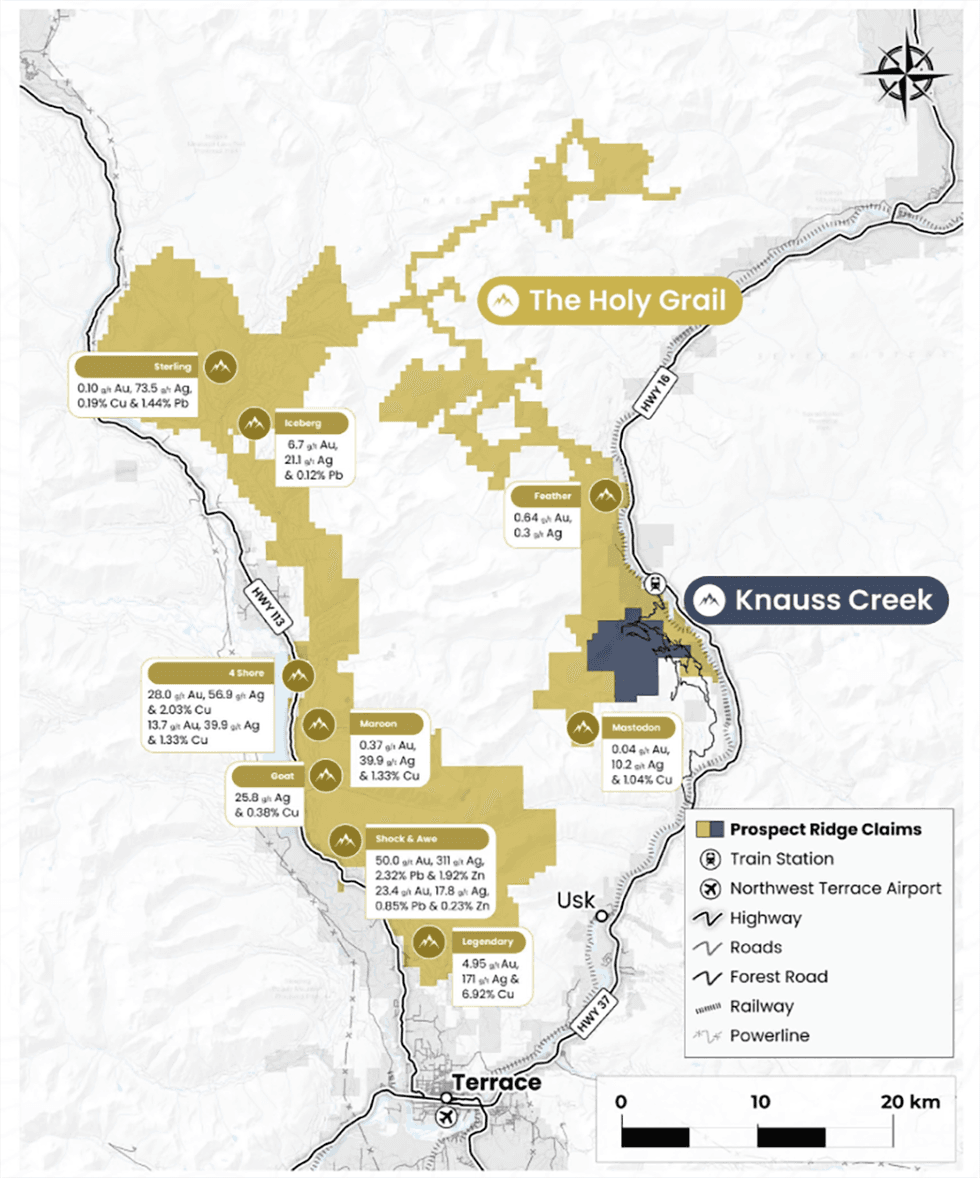

The Holy Grail property is positioned 10 km north of Terrace, BC, and varieties a horseshoe that encloses the absolutely owned Knauss Creek property in its southeastern half. It presently spans 70,109 hectares. The property is well accessible by way of a freeway, a number of serviced roads, logging roads, and ATV trails that cross reduce it.

Prospecting outcomes from the Holy Grail property displayed outstanding potential by way of substantial findings of gold, silver, copper, lead and zinc. Key highlights of the outcomes embody:

- Seize pattern C362354 returned 28.0 g/t gold, 56.9 g/t silver and a pair of.03 p.c copper on the 4 Shore displaying

- Seize pattern C362357 returned 13.7 g/t gold, 39.9 g/t silver and 1.33 p.c copper on the 4 Shore displaying

- Seize pattern C363353 returned 0.37 g/t gold, 58.7 g/t silver and three.43 p.c copper on the Maroon Creek displaying

- Seize pattern C363092 returned 6.7 g/t gold, 21.1 g/t silver, and 0.12 p.c lead on the Iceberg displaying.

Administration Crew

Michael Iverson – CEO and Director

Michael Iverson has over three a long time of expertise in private and non-private capital markets. He additionally has vital expertise within the mining trade, having based Niogold Mining and Fortuna Silver Mines. At Niogold, he spearheaded the acquisition and exploration of an expansive land parcel in Val D’Or, resulting in the corporate’s acquisition by Oban Mining, presently often known as Osisko Mining , at a considerable premium to its market capitalization. At Fortuna, he performed an important position within the firm’s affluent evolution right into a silver producer with operational mines in Peru and Mexico. Iverson, over his total profession spanning three a long time, has achieved, in combination, market capitalizations over $1 billion.

Yan Ducharme – President and Director

Yan Ducharme is an expert geologist with over 25 years of expertise in greenfield and brownfield exploration initiatives in Quebec, Ontario, Africa and South America. He was on the exploration workforce at SEMAFO and Cambior/Iamgold and was an exploration supervisor at NioGold (then vice-president exploration), Canadian Malartic, SOQUEM, and Wesdome Gold Mine. He labored in underground mines and open pits. Ducharme obtained a masters in earth sciences from the College of Quebec in Montreal.

Jasmine Lau – CFO

Jasmine Lau is a seasoned finance and accounting professional with a wealth of expertise as a CFO within the mineral exploration and useful resource sector, having labored on initiatives throughout the globe. She was employed in inner audit at Teck Assets and Deloitte, the place she targeted on audits of public mining and useful resource firms. Lau is a CPA, CA, and holds a Bachelor of Commerce diploma from the College of British Columbia.

Simon Ridgway – Chairman and Director

Simon Ridgway is the CEO of Rackla Metals, a Vancouver-based junior gold exploration firm listed on the TSX Enterprise Change since September 2011. He’s additionally the CEO, president and director of Volcanic Gold Mines, a Vancouver-based firm engaged in gold and silver property acquisition and exploration.

Michael Michaud – Director

Michael Michaud is an expert geologist with over 30 years of expertise. He’s an professional in creating and executing regional and mine-site exploration methods throughout numerous deposit varieties in North and South America, Africa, Asia and Europe. Michaud is the vice-president of exploration at Wesdome Gold Mines. He additionally held roles at a number of corporations, together with Iamgold, St Andrew Goldfields, SRK Consulting and North American Palladium. Michaud holds an honors B.Sc. from the College of Waterloo and an M.Sc. from Lakehead College.

Toby Lim – Director

Toby Lim has been a working towards solicitor since 1997, specializing in company and securities regulation. He obtained a Bachelor of Commerce diploma with honours from the College of British Columbia in 1992, adopted by a Bachelor of Legal guidelines diploma from Osgoode Corridor Regulation Faculty in Ontario in 1996.

Jacques Brunelle – Director

Jacques Brunelle has over three a long time of involvement within the North American mining sector. He has held government positions as president and director in publicly traded firms, together with Niogold Mining, the place he served in 2003, culminating in a profitable acquisition by Osisko Mining in 2016. All through his profession, Brunelle has raised substantial funds for exploration and fairness financing initiatives in each private and non-private enterprises.

Bradley Scharfe – Director

Bradley Scharfe has over 25 years of expertise in North America’s capital markets. Scharfe has led financing endeavors all through his profession and assembled strong firms throughout numerous sectors, together with sources and commodities. He makes a speciality of elevating, deploying and managing enterprise capital for firms of their early development levels. Beforehand, Scharfe served as a enterprise capital stockbroker with Canaccord Capital, a number one Canadian funding agency. Scharfe holds a Bachelor of Arts diploma from the College of Toronto, the place he majored in commerce and economics.