Investor Perception

With belongings positioned in a historic copper mining district in Chile that boasts high-grade mineralization and low-cost operations, Purple Metallic Assets represents a compelling funding alternative and many potential for growing shareholder worth.

Overview

Purple Metallic Assets (CSE:RMES) is a Canadian-listed junior mining firm specializing in copper exploration, with a specific deal with Chile’s Carrizal Alto mining district within the Atacama Area. The corporate’s exploration targets, primarily the Farellon and Perth tasks, are well-positioned to profit from Chile’s globally important copper sector.

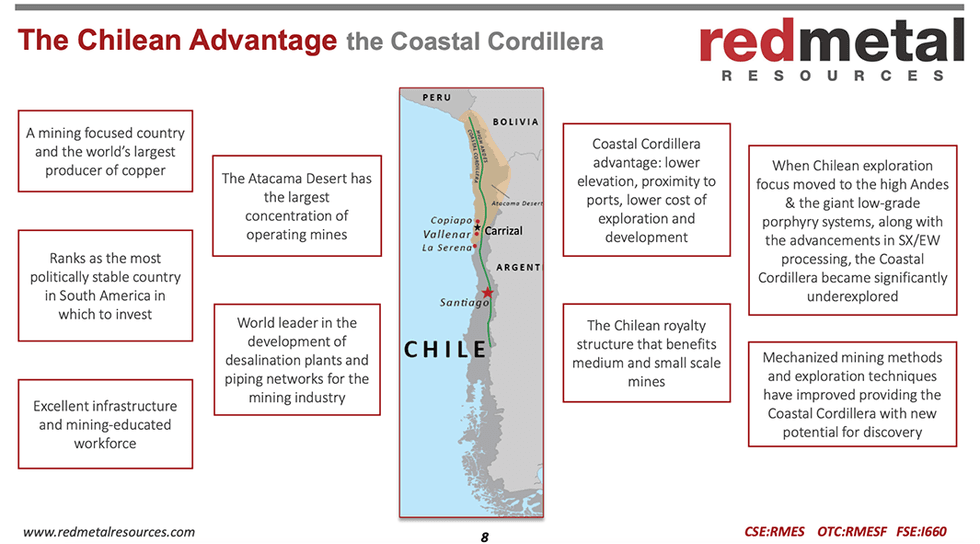

Chile is the biggest producer of copper worldwide, accounting for practically 28 p.c of the worldwide provide. Given the nation’s favorable mining insurance policies, skilled workforce, and well-established infrastructure, Purple Metallic Assets is well-placed to leverage these benefits because it advances its tasks on this prolific area.

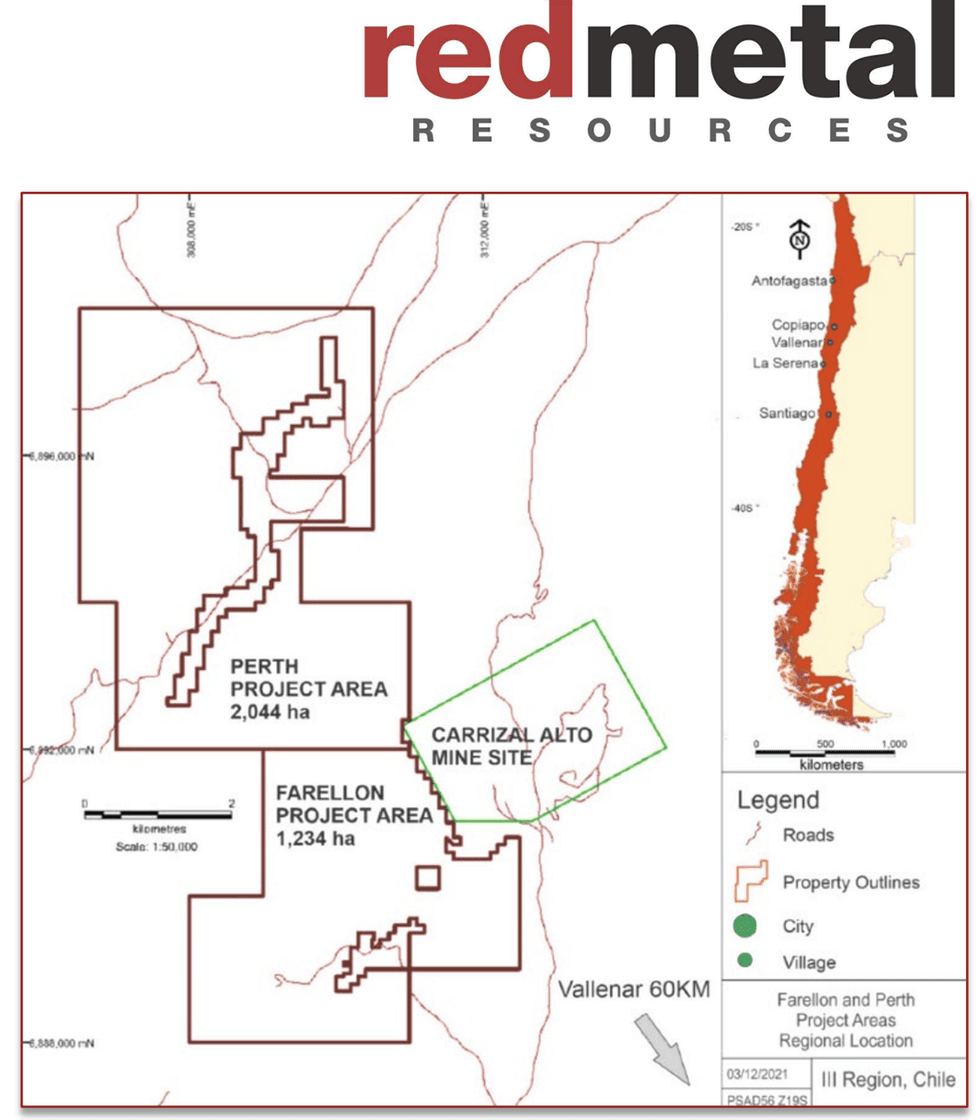

The corporate’s Carrizal property includes two key undertaking areas: the Farellon undertaking within the south and the Perth undertaking within the north. The famend Carrizal Alto mining district has a wealthy historical past of copper and gold manufacturing relationship again to the nineteenth century. Traditionally, the district was one in all Chile’s most efficient copper areas, located inside Chile’s prolific Coastal Cordillera belt, which boasts high-grade copper mineralization and low-elevation, cost-effective operations. Purple Metallic Assets is working to rejuvenate Carrizal’s legacy by bringing fashionable exploration strategies to the area’s underexplored deposits.

Purple Metallic Assets’ administration crew brings collectively a mix of technical and enterprise experience, driving the corporate towards its objective of contributing to the rising international demand for copper and clear power transition. The corporate additionally advantages from a board of administrators and advisors with substantial expertise in capital markets, exploration, and the Chilean mining trade. This mixture of technical experience and enterprise acumen is crucial for Purple Metallic Assets because it seeks to advance its tasks from exploration to potential manufacturing.

Prolific mining district

The Carrizal Alto mining district, positioned in Chile’s Atacama Desert, is thought for its mineral wealth, significantly copper, gold and cobalt. The district’s mining historical past dates again to the early nineteenth century when it turned probably the most essential copper manufacturing areas in Chile.

One of many key benefits of the Carrizal Alto district is its favorable geographic place. The world is positioned at a low elevation of round 500 meters above sea stage, which reduces the logistical challenges usually related to exploration in higher-altitude areas. Moreover, the district is well-connected by infrastructure, together with highways and proximity to main city facilities. The property is located simply 150 kilometers south of Copiapó, 25 kilometers from the coast, and solely 20 kilometers west of the Pan-American Freeway. This shut entry to infrastructure permits for simpler transportation of apparatus and provides, in addition to streamlined entry to labor and different sources.

The Carrizal Alto district affords a mix of historic mining information and fashionable exploration potential. Whereas the area was closely mined within the nineteenth and early twentieth centuries, a lot of the realm stays underexplored utilizing fashionable strategies. At the moment, the district is experiencing a revival, thanks partially to Purple Metallic Assets’ exploration efforts. The corporate’s Carrizal property spans 3,278 hectares, comprising 21 safe mining claims, and includes two tasks: Farellon and Perth.

Firm Highlights

- Purple Metallic Assets holds 3,278 hectares throughout 21 safe mining claims inside the Carrizal Alto mining district within the prolific Coastal Cordillera.

- The corporate’s Carrizal property includes two tasks – Farellon and Perth – positioned in an space with a wealthy historical past of copper and gold manufacturing.

- The Farellon undertaking has over 9,000 metres of drilling, figuring out 1.5 kilometres of mineralized strike size with potential for an extra 3.5 kilometres.

- In 2022, a high-grade floor pattern from Farellon returned 5.77 p.c copper, 1.55 p.c cobalt, and 0.11 g/t gold.

- Administration and insiders management roughly 35 p.c of the corporate’s shares, aligning their pursuits with traders.

Key Undertaking

Farellon Copper Undertaking

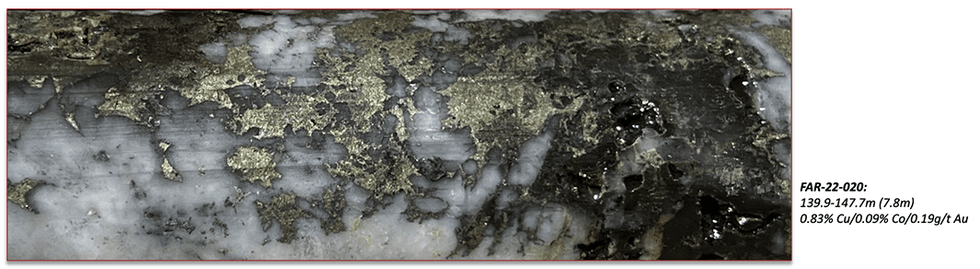

The Farellon undertaking is Purple Metallic Assets’ flagship asset, positioned within the southern portion of the Carrizal Alto mining district. The undertaking is a high-grade iron-oxide-copper-gold vein deposit that has been the main focus of a lot of the corporate’s exploration actions. The mineralization at Farellon is primarily hosted in quartz-calcite veins that include chalcopyrite, bornite and chalcocite sulphide mineralization. These veins vary from 3 to six meters in width, with a halo of lower-grade mineralization extending 15 to twenty meters across the veins.

Farellon is positioned adjoining to the historic Carrizal Alto mine, one in all Chile’s most prolific copper mines in the course of the nineteenth century. The mineralized veins on the Farellon property are believed to be a part of the identical geological construction that hosted the mineralization on the Carrizal Alto mine. Historic mining within the space offers useful insights into the area’s geology, which Purple Metallic Assets is leveraging to information its exploration technique.

To this point, the corporate has accomplished over 9,000 meters of drilling at Farellon, figuring out a mineralized strike size of roughly 1.5 kilometers. The mineralization stays open alongside strike for an extra 3.5 kilometers, and at depth, indicating important exploration upside. In 2022, the corporate accomplished a 2,010-meter diamond drilling program that prolonged the recognized mineralization at depth and recognized a parallel construction, the Gorda Vein, which provides additional exploration potential.

Current floor geochemistry work has additionally highlighted a number of new targets for follow-up sampling and drilling. One high-grade pattern, taken 2 kilometers north of the Farellon drilling, returned values of 5.77 p.c copper, 1.55 p.c cobalt, and 0.11 grams per ton (g/t) gold, additional underscoring the potential for extra high-grade mineralization on the property. These exploration outcomes place Farellon as a extremely potential undertaking with the potential to turn into a major copper-gold-cobalt useful resource.

Perth Undertaking

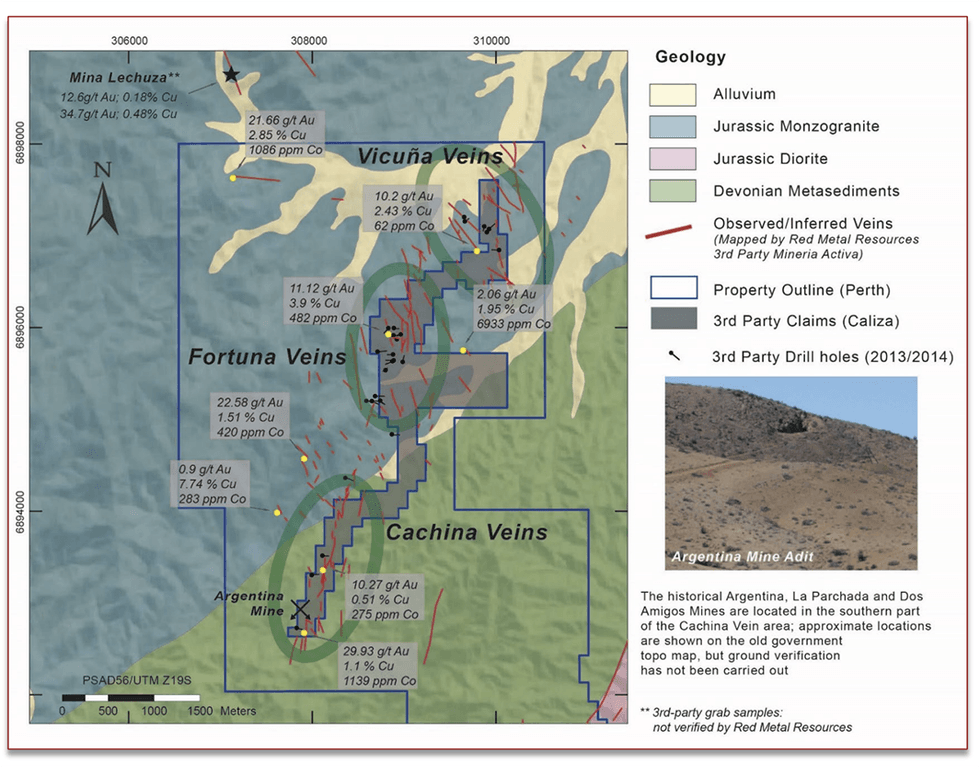

The Perth undertaking, positioned within the northern portion of the Carrizal Alto district, is Purple Metallic Assets’ second main exploration asset. The undertaking holds appreciable potential for copper-gold-cobalt mineralization. Perth is characterised by fault-related quartz veins which were mapped and sampled throughout the property. Historic prospecting and mapping packages have recognized 12 veins, with a median thickness of two meters and a few zones reaching as much as 6 meters in width.

Exploration at Perth has yielded promising outcomes, with 48 floor samples returning gold values better than 1 g/t, 46 samples returning copper grades exceeding 1 p.c, and 19 samples exhibiting cobalt values above 0.05 p.c. These early-stage exploration outcomes are encouraging and recommend that the Perth undertaking has the potential to host important copper-gold-cobalt mineralization.

Purple Metallic Assets plans to conduct extra exploration at Perth to raised perceive the extent of the mineralization and to prioritize drill targets for future campaigns. Whereas the undertaking is at an earlier stage in comparison with Farellon, it affords an essential alternative for the corporate to develop its useful resource base inside the Carrizal Alto District.

Administration Crew

Caitlin Jeffs – President and CEO

Caitlin Jeffs is a founding associate of Fladgate Exploration Consulting in Thunder Bay, Ontario, the biggest, full service, mineral exploration consulting agency in Northwestern Ontario. She has over 20 years of mineral exploration expertise in gold and base metallic exploration with junior and main useful resource firms, together with Placer Dome and Goldcorp. Jeffs can also be a director of Kesselrun Assets and TomaGold.

John Da Costa – CFO

John Da Costa has 30 years of accounting expertise managing and reporting for Canadian public firms, and 10 years with US public firms. He labored with a Canadian public firm working in Chile within the late Nineties and has expertise with Chilean subsidiaries. He’s the founder and president of Da Costa Administration, offering administration and accounting providers to each private and non-private firms within the US and Canada since 2003.

Brian Gusko – VP Finance

Brian Gusko has an MBA from the College of Calgary and attended the European Summer season College of Superior Administration. Gusko has over 15 years’ expertise in capital markets and has helped increase over $75 million for varied enterprises. He has served on the board and as chief monetary officer of assorted non-public and public firms. Gusko has assisted with the interlisting of greater than 10 firms on the Frankfurt Inventory Trade and has helped quite a few firms entry German capital markets. He has labored as chief monetary officer at a number of non-public and public firms. The final firm he helped take public on the CSE had a market capitalization of over $200 million on the time of itemizing.

Michael Thompson – VP Exploration and Director

Michael Thompson obtained his Honours B.Sc. in Geology from the College of Toronto in 1997, and has since labored for a number of junior and main firms in each gold and base metallic exploration, together with Teck Cominco, Tri Origin Exploration, Placer Dome CLA, and Goldcorp. He makes a speciality of structural interpretation of gold deposits in addition to administration of enormous exploration packages. He’s a founding associate and 33 p.c proprietor of Fladgate Exploration Consulting in Thunder Bay, Ontario.

Marian Myers – Undertaking Supervisor and Director

Marian Myers has an M.Sc (Geology) from the College of the Witwatersrand, South Africa, and has 35 years’ expertise working for a wide selection of main and junior mining firms together with Gold Fields, Anglo American, AngloGold, Balmoral Assets and Cardero Useful resource. Myer’s breadth of worldwide expertise has taken her from her residence city close to Johannesburg, South Africa to work on tasks in Ghana, Zimbabwe, Australia, Alaska, Peru, Chile and now, Canada, the place she resides in Vancouver. She specializes within the GIS integration of geochemical, geophysical and geological info, together with historic information units with experience in QA/QC procedures, area information assortment supervision, and evaluation and technical report growth.

Cody McFarlane – Director

Primarily based in Santiago, Chile, Cody McFarlane is managing associate of Axiom Authorized, a global and multidisciplinary regulation agency specializing in cross border transactions between Australia, Canada and Latin America. McFarlane brings intensive expertise within the mining and regulatory atmosphere in Chile.