Investor Perception

Tartana Minerals is a brand new copper producer producing robust money circulation, with a considerable exploration footprint in a tier 1 mining jurisdiction. Tartana Minerals is creating shareholder worth by funding in rising its present copper, zinc and gold assets and accelerating exploration of key tasks inside its extremely potential exploration portfolio. Tartana Minerals presents a compelling funding in opposition to the backdrop of a robust macroeconomic surroundings for copper.

Overview

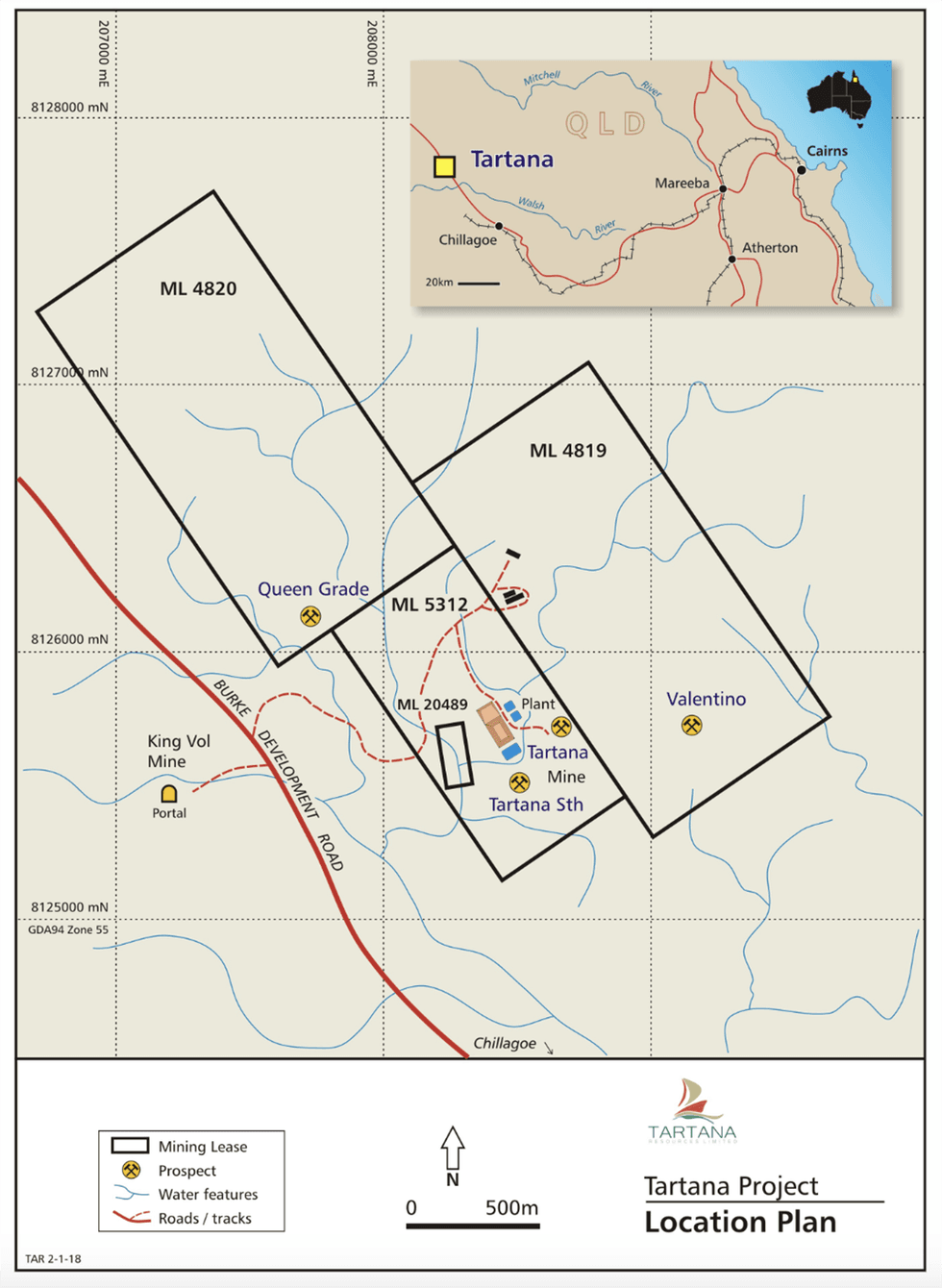

Tartana Minerals (ASX:TAT) is a copper, gold, silver and zinc, producer, explorer and developer in Far North Queensland. Its flagship undertaking is the 100% owned Tartana copper and zinc undertaking which includes 4 mining leases positioned north of Chillagoe. The corporate’s enterprise mannequin has concerned refurbishing an present heap leach – solvent extraction – crystallisation plant which is positioned on the Tartana mining leases. The refurbishment and commissioning of this plant is now accomplished and the corporate is producing copper sulphate pentahydrate which is bought to offtaker, Kanins Worldwide. Copper sulphate is priced on a premium plus proportion of the LME copper value and offers traders with leverage to anticipate rising copper costs.

The corporate, previously often known as R3D Assets, modified its title to Tartana Minerals in April 2024. Tartana Minerals relies in Sydney, Australia.

Tartana Minerals has reported the next assets:

- 45,000 contained copper at 0.45 % copper in mixed inferred and indicated assets within the Tartana open pit and northern oxide zone

- 39,000 tonnes of contained zinc at 5.29 % zinc in inferred assets within the Queen Grade undertaking, additionally positioned on the Tartana mining leases, and

- 415 koz contained gold at 0.34 g/t in inferred assets at Mountain Maid – topic to a mining lease utility.

These copper, zinc and gold assets stay open at depth and alongside strike and the corporate has designed drilling applications to develop these assets. Particularly, the copper mineralisation and doubtlessly the gold mineralisation have scope to be upgraded by ore sorting.

Nonetheless, the refurbished heap leach – solvent extraction – crystallisation plant utilises present copper within the ponds and the heaps and these copper sources can be replenished after we start mining from the open pit.

The primary and second shipments of copper sulphate had been bought in the course of the June 2024 quarter with additional shipments are at present being ready. The copper sulphate comprises 25 % copper metallic and cost relies on the LME copper value for the previous month plus a premium. It is without doubt one of the few types of saleable copper the place the copper content material receives the complete LME value.

Sprinklers working on the decrease heap. Notice the presence of copper (blue).

Sprinklers working on the decrease heap. Notice the presence of copper (blue).

Exploration

Chillagoe area of Far North Queensland is extremely potential with the invention and improvement of a lot of key tasks over the previous couple of a long time together with Crimson Dome (2.5 Moz gold), Mungana (1.2 Moz gold), and King Vol (250 kt zinc). These deposits happen alongside the Palmerville Fault in the same location to the Tartana Mining leases.

The mining leases at Tartana comprise copper, zinc and gold mineralisation however the firm additionally has important tasks that are each east and west of the Palmerville Fault. Within the west it has the Cardross and Mountain Maid copper-gold tasks and additional north it has the Beefwood undertaking. Mountain Maid has gold assets talked about above and that are open to the south and at depth whereas the corporate is finalising a maiden copper useful resource for the Cardross undertaking. The Beefwood undertaking includes a buried geophysical goal and floor sampling has recovered samples grading as much as 180 g/t Au with no obvious supply. Drilling is deliberate to check this goal within the present dry season.

Within the east of the Palmerville Fault, the corporate has the Bellevue/Dry River undertaking, the OK South undertaking and the Dimbulah Porphyry undertaking, all copper tasks with historic copper mines and prospects. Like many elements of Far North Queensland, historic exploration has not been systematic and thorough regardless of many promising expressions of floor mineralisation.

On the Nightflower undertaking, Tartana has upgraded its exploration goal after reviewing its earlier estimation, in mild of the current will increase within the antimony value. Nightflower is a high-grade silver-lead deposit with beforehand ignored important antimony credit. Nightflower exploration goal consists of 2.75 Mt @ 364 g/t silver equal for 32 Moz silver equal to five.36 Mt @ 270 g/t silver equal for 47 Moz silver equal (the exploration goal is conceptual in nature solely and there’s no assure that additional exploration will outline a useful resource). Drilling is now being deliberate to check the goal and improve beforehand recognized mineralisation to JORC 2012 reporting requirements.

Tartana’s exploration crew includes of skilled exploration geologists with supporting money circulation from their copper manufacturing, they anticipate to find a way drill probably the most promising targets within the brief time period.

Robust Macroeconomic Atmosphere for Copper

Total, the macroeconomic surroundings for copper stays robust. The LME three-month copper value hit US$5.24/lb on Might 17, the best since March 7, 2022, pushed by a weaker US greenback, Chinese language property stimulus measures, and a brief squeeze on the Chicago Mercantile Trade futures market.

Within the near-to-mid time period China’s demand for refined copper is predicted to develop, because of better-than-expected performances from key shopper segments, together with the facility grid, photo voltaic installations and electrical automobile and air con equipment gross sales. On the provision aspect the copper focus market is predicted to stay in a big deficit as a result of estimated delay within the Cobre Panama mine restart however can be partially offset by the upper projected manufacturing from smelters in China. Consequently, we see additional demand progress and provide tightening for the copper market as constructive for base metallic equities who keep important leverage to rising costs.

Firm Highlights

- Tartana Minerals is producing copper sulphate pentahydrate from its heap leach – solvent extraction – crystallisation plant in Chillagoe with a 100% offtake settlement with Kanins Worldwide.

- Copper sulphate is priced at a premium plus proportion of the LME copper value, offering publicity to the booming copper market

- With copper, zinc and gold assets in separate tasks and all inside granted or quickly to be granted mining leases, the corporate is investigating processing choices which might doubtlessly utilise out there infrastructure.

- Close to-term catalysts embody targetted drilling applications to extend the JORC useful resource and develop on metallurgical check work, rising the useful resource grade and estimate

- With the copper sulphate plant totally commissioned and in manufacturing, the corporate is now accelerating its exploration actions. The corporate has a variety of prospects from superior brownfields tasks close to present historic mines to many prospects containing ‘ore grade’ floor mineralisation which haven’t been examined at depth.

- The corporate’s exploration portfolio consists of the Beefwood/Bulimba, Bellevue, Dimbulah, Cardross and Maid tasks. The exploration crew is concentrated on course era, significantly with the addition of crucial minerals inside its present tenure and elsewhere.

Administration Staff

Jihad Malaeb – Non-executive Chairman

Jihad Malaeb is an skilled entrepreneur throughout a lot of industries, together with hospitality and building, in addition to having important expertise in mineral exploration and mining operations – each as an lively investor and firm director. He at present owns and operates a portfolio of hospitality companies and actual property throughout Australia, which have been established over the previous 30 years. Malaeb was beforehand a non-executive director of Vital Assets (ASX:CRR), the place he helped steer CRR by the previous few years as considered one of its largest shareholders and as a board member.

Dr Stephen Bartrop – Managing Director

Steve Bartrop’s skilled expertise spans greater than 30 years protecting durations in each the mining business and monetary sector. With a geology background, Bartrop has labored in exploration, feasibility and analysis research and mining in a variety of commodities and in numerous elements of the world. Within the monetary sector, he has been concerned in analysis, company transactions and IPOs spanning greater than 20 years, together with senior roles at JPMorgan, Bankers Belief and Macquarie Equities.

Bartrop can also be a director of Southwest Pacific Bauxite (HK), an organization creating a bauxite undertaking within the Solomon Islands and chairman of Breakaway Analysis.

Bruce Hills – Govt Director

Bruce Hills is an accountant and is at present an government director of Breakaway Funding Group, which operates the Breakaway Non-public Fairness Rising Assets Fund. Hills is a director of a lot of unlisted firms within the mining and monetary providers sectors together with The Danger Board and Stibium Australia. Hills has 35 years’ expertise within the monetary sector together with 20 years within the banking business primarily within the areas of technique, finance and threat.

Dr Alistair Lewis – Non-executive Director

Dr Alistair Lewis is a profitable entrepreneur and extremely skilled medical physician with over 40 years’ expertise. For the previous 10 years Lewis has been concerned within the administration of mining and exploration firms. In 2017, Lewis established Oosen Lewis Mining in North Queensland. He financed the aggregation of a considerable portfolio of gold, tin, tungsten and antimony belongings and instigated subsequent intensive exploration applications. These belongings now kind a part of the QSM portfolio.

Michael Thirnbeck – Impartial Non-executive Director

Michael Thirnbeck is an skilled geologist with over 25 years in managing quite a few mineral improvement tasks in Papua New Guinea, Indonesia and Australia. He has been a member of the Australasian Institute of Mining and Metallurgy since 1989 and holds B.Sc (Hons.) diploma from College of Queensland.

Shuyi (Kiara) Wang

Shuyi (Kiara) Wang was appointed a director of Tartana Minerals on July 17, 2024. Wang is an completed, rising chief with a robust educational {and professional} background. She holds a Bachelor of Arts majoring in Philosophy from The College of Melbourne and is at present pursuing a Juris Physician on the prestigious Melbourne Legislation College.