Ankh Capital Inc is a capital pool firm.

Investor Perception

With a copper-focused exploration technique and North American belongings, Quetzal Copper is in a superb place to capitalize on the widening copper provide and demand hole and play a key function within the vital minerals race.

Overview

Quetzal Copper (TSXV:Q) is a copper exploration firm targeted on three drill-ready copper initiatives in British Columbia, Canada: Princeton, Huge Kidd and DOT. All three initiatives are located within the copper-rich jurisdiction of British Columbia and close by producing mines reminiscent of Teck’s Highland Valley copper mine, Hudbay’s Copper Mountain mine, and the Craigmont mine.

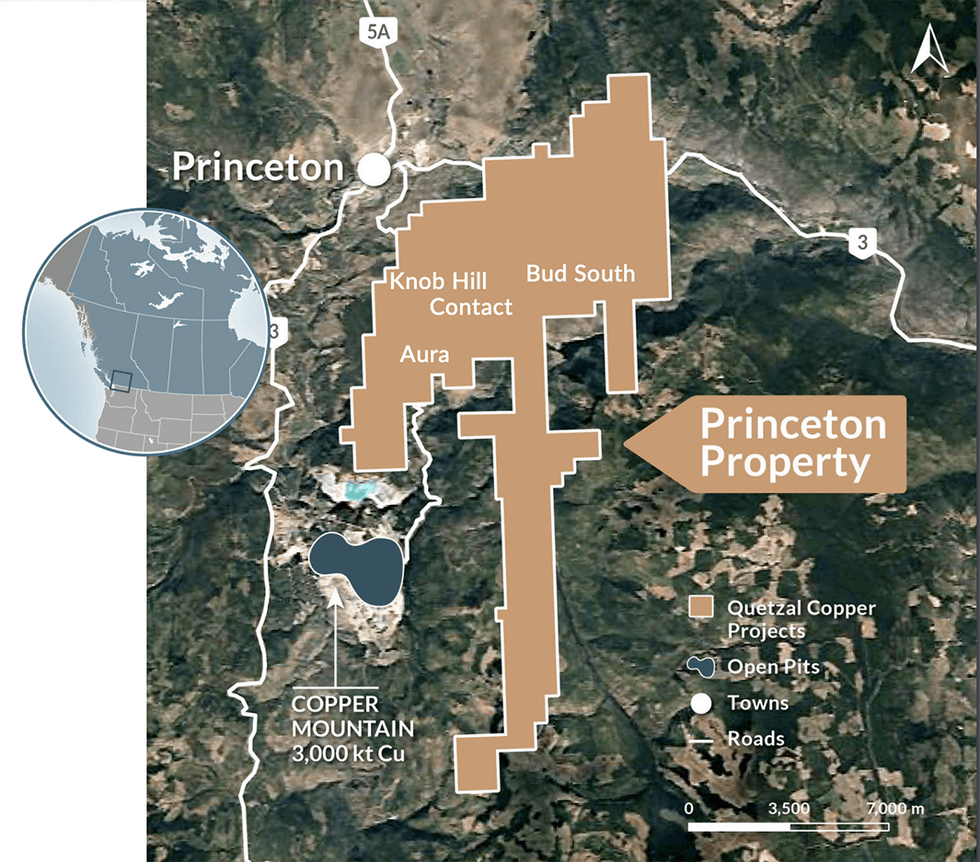

The corporate’s flagship is the Princeton copper challenge, which is instantly to the north of the Copper Mountain mine. The challenge has seen restricted historic drilling, and research have recognized targets characterised by copper mineralization and geochemical anomalies. Quetzal plans to start drilling on the Princeton and Huge Kidd initiatives in 2024.

The current acquisition of the Cristinas copper challenge in Mexico is encouraging. The Cristinas challenge is an thrilling exploration goal boasting all the important thing options required for achievement, reminiscent of proximity to infrastructure, street entry, distinctive geology with excessive grades, and a historical past of profitable exploration. Historic drilling at Cristinas yielded spectacular outcomes, intersecting 4.7 meters @3.2 % copper and three.7 meters @3 % copper. The Cristinas challenge presents shareholders a compelling threat/reward profile for an exploration enterprise, with plans to start drilling in 2024.

The corporate’s give attention to copper may be very enticing given present provide and demand dynamics. The provision of copper is much extra concentrated than oil. Whereas three international locations account for 40 % of the oil provide, solely two international locations – Chile and Peru, contribute 38 % of the copper provide. Given the historical past of political instability in these international locations, a provide supply from North America, with its secure coverage surroundings, makes it very enticing. Authorities-supported tailwinds additionally encourage home copper provide, with Canada and the US selling copper manufacturing via tax breaks and incentives.

The demand situation for copper appears enticing given expectations of fast progress. In line with Nornickel, world copper demand is estimated to rise by 20 % to 30 million metric tons (MT) per 12 months by 2035, from round 24.8 million MT per 12 months in 2022. This progress within the demand will likely be led by functions reminiscent of electrical transport, energy transmission grids and renewable electrical energy technology.

Quetzal Copper is more likely to be a beneficiary of Western international locations attempting to realign their provide chain of vital minerals by sourcing them domestically or from pleasant international locations. Quetzal, with its portfolio of copper initiatives in tier 1 mining jurisdictions, is effectively positioned to supply domestically sourced copper to fill any provide hole.

Firm Highlights

- Quetzal Copper is a copper exploration firm targeted on three drill-ready copper initiatives in British Columbia: Princeton, Huge Kidd, and DOT. Moreover, the corporate just lately acquired the Cristinas copper challenge in Mexico.

- The flagship Princeton copper challenge is situated northeast of Copper Mountain mine in British Columbia. The corporate is planning a major drill program for the challenge in 2024.

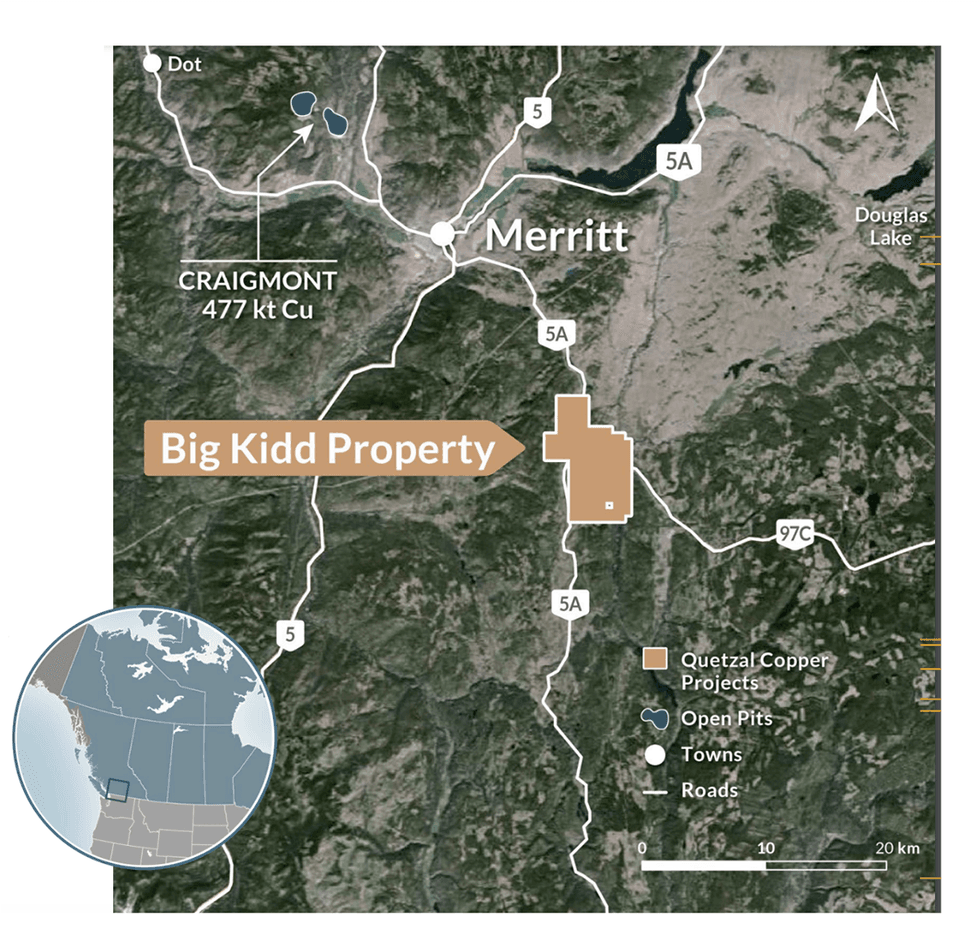

- The Huge Kidd copper challenge is situated in southern British Columbia, halfway between the Copper Mountain and New Afton mines. The corporate has an possibility to amass one hundred pc curiosity on this challenge.

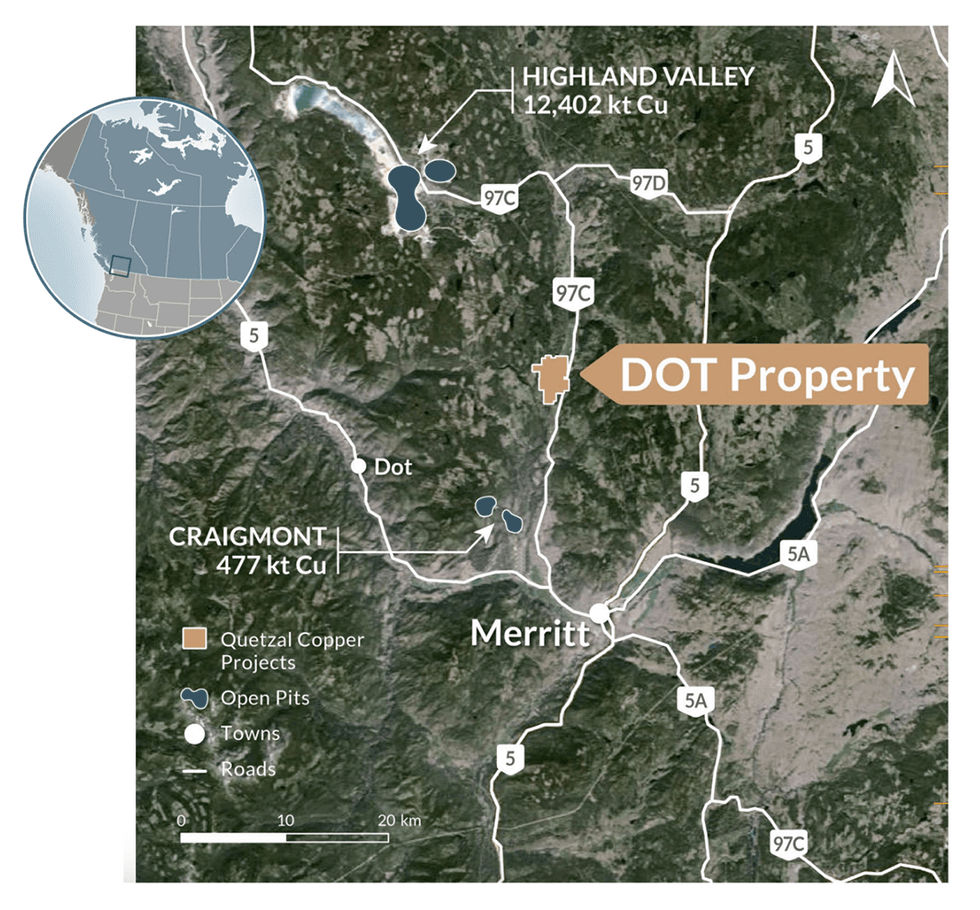

- The DOT copper challenge is situated south of the Highland Valley mine in southern British Columbia. The corporate has an possibility to amass one hundred pc curiosity on this challenge.

- Historic drilling at Cristinas yielded spectacular outcomes intersecting 4.7 meters @3.2 % copper and three.7 meters @3 % copper. The Cristinas challenge presents shareholders a compelling threat/reward profile for an exploration enterprise.

- Provided that round 38 % of the world’s copper is equipped by two international locations (Chile and Peru), a North American provide supply makes the corporate’s initiatives very enticing.

- The corporate’s senior management crew is well-experienced in each geoscience and capital markets, which can assist the corporate unlock the potential of its initiatives.

Key Initiatives

Princeton Challenge

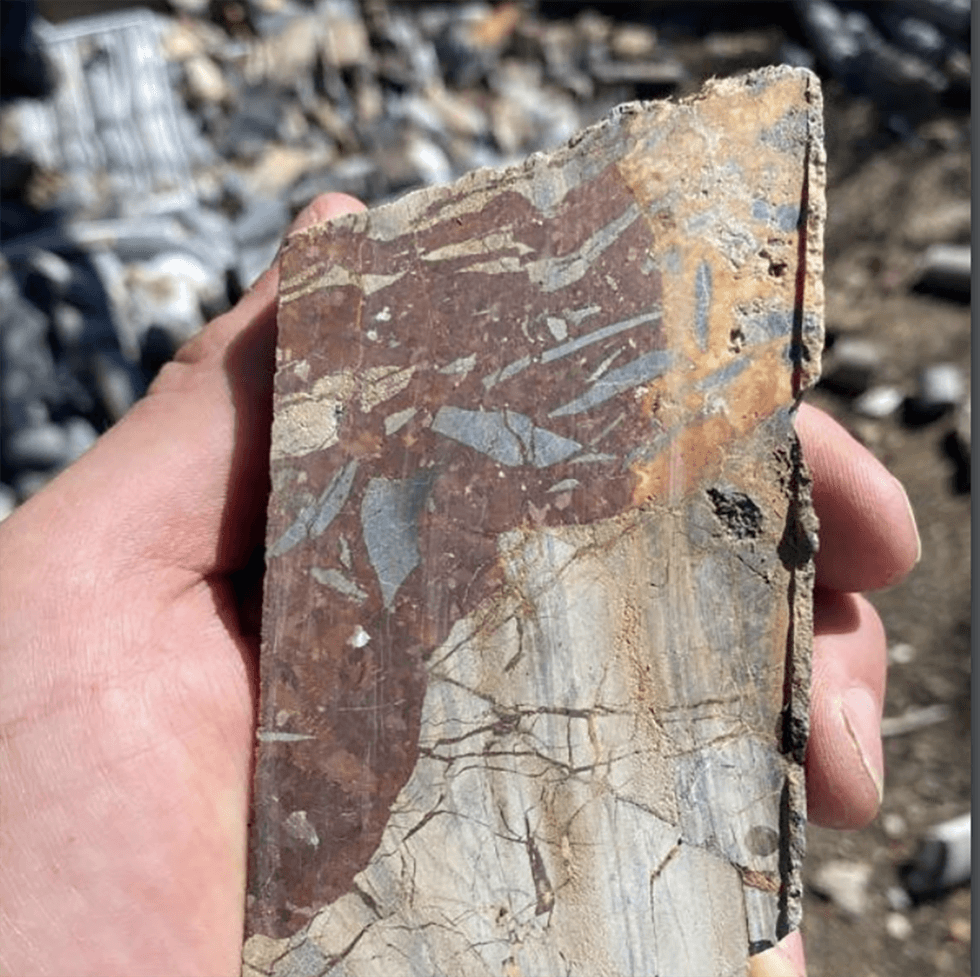

The Princeton copper challenge spans an space of 11,500 hectares and is roughly 5 kilometers from Princeton city in British Columbia. The challenge is situated to the north of Copper Mountain mine. The challenge represents a perfect location and favorable geology for copper exploration, situated between the Copper Mountain mine and the Miner Mountain properties. A number of operators have carried out varied property surveys over the previous 60 years. The geophysical and geochemistry surveys carried out in 2020 and 2021 have recognized a number of drill targets. The challenge has three key targets: Bud South, Knob Hill and Aura.

- Bud South: Traditionally drilled in 1987, this will likely be a main drill goal in 2024. One of many drills encountered copper and gold over 10.5 meters. The part yielded 0.184 % copper, 0.33 grams per ton (g/t) gold, and eight.7 g/t silver over 10.7 meters. Furthermore, a decrease part graded 0.149 % copper, 0.121 g/t gold, and three.2 g/t silver over 4.6 meters.

- Knob Hill: The goal is situated 2 kilometers south of August Lake and is characterised by granodiorite outcropping over an space of 1,000 meters x 600 meters. Traditionally, two samples have reported 0.99 g/t and 0.51 g/t gold, 33.6 g/t and 49.0 g/t silver, and 0.60 % and 1.22 % copper.

- Aura: This goal is analogous to porphyry copper deposits, having a mineralized zone on the periphery.

Huge Kidd Challenge

The corporate has an possibility to amass one hundred pc curiosity on this challenge. The Huge Kidd copper challenge spans an space of 4,055 hectares in southern British Columbia. It’s situated simply 20 kilometers from town of Merritt, and advantages from glorious infrastructure when it comes to accessibility by a community of roads. The area hosts a number of copper and gold deposits, such because the Copper Mountain mine and the Craigmont mine.

The historic exploration dates again to the Nineties. In 1916, 10 tons of ore was extracted with 1,000 lbs of copper. Furthermore, in 1918, a mine produced 44 tons of ore with 12 % copper, 68 g/t silver, and 0.57 g/t gold. In 2019, Jiulian Assets accomplished a drill program on the challenge. A 2004 useful resource estimate has recognized a non-compliant useful resource of 122.4 Mt at 0.33 g/t gold and 0.15 % copper. Extra drilling has expanded the footprint of the mineralization past the 2004 estimate.

The challenge has three vital targets for 2024. 1) Goal 1 – a slender goal spanning 100 m x 400 m; 2) Goal 2 – that spans an space of 200 m x 350 m; 3) Goal 3 – this chance is within the Dago zone.

DOT Challenge

The corporate has an possibility to amass one hundred pc curiosity on this challenge. The DOT copper challenge spans 846 hectares and is situated within the southern portion of the Guichon Creek batholith. The challenge is situated simply 25 kilometers away from Merritt, and enjoys glorious accessibility by roads. DOT is situated in a area with a historical past of copper exploration for greater than 130 years. Furthermore, the challenge is adjoining to Highland Valley mine (20 km) and Craigmont mine (12 km). In 2008, Aurora Geosciences estimated a non-compliant indicated useful resource of 5.3 Mt at 0.49 % copper equal and a couple of.9 Mt of non-compliant indicated useful resource 0.45 % copper equal.

Furthermore, in 2010, a useful resource report recognized the next grades: 30.2 meters @ 1.32 % copper, 27.4 meters @ 2.58 % copper, and 76.2 meters @ 0.91 % copper. These grades and thicknesses point out a sturdy copper system on the property.

The challenge covers 5 zones of copper-gold-silver-molybdenum mineralization: southeast, northwest, west, east and copper zones. All 5 zones stay open. The corporate is planning an exploration program at DOT, which can embody a complete IP survey throughout the property, drilling on the east zone and northwest zone, trench and drilling on the southeast zone, and metallurgical testing.

Cristinas Copper Challenge

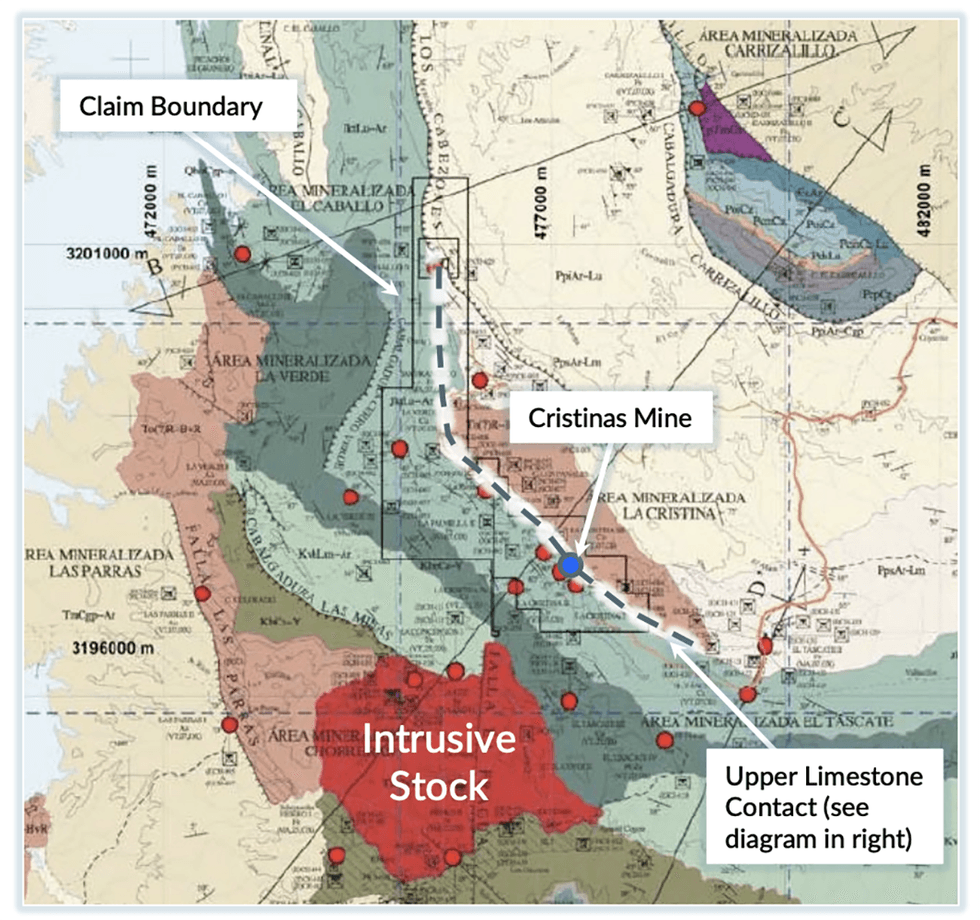

The Cristinas copper challenge spans 685 hectares and is situated within the northeastern Chihuahua state in Mexico. The challenge encompasses a historic copper mine that was operational within the Nineteen Fifties, specializing in shallow copper oxide mineralization.

The challenge boasts a copper mineralization zone exceeding 1,250 meters in size, recognized via floor rock chip samples and 12 historic drill holes from 2014. This mineralization stays open alongside strike and at depth, with important enlargement potential indicated by restricted geophysical surveys. Historic drilling at Cristinas yielded spectacular outcomes intersecting 4.7 meters @3.2 % copper and three.7 meters @3 % copper.

The current floor sampling program returned encouraging outcomes, starting from

The Cristinas Challenge presents shareholders a compelling threat/reward profile for an exploration enterprise, with plans to start drilling in 2024. The corporate intends to conduct an preliminary drill program spanning 1,500 to three,000 meters, incorporating downhole electromagnetic surveying to boost the accuracy of geophysical targets.

Administration Group

Matthew Badiali – CEO and Director

Matthew Badiali holds an M.Sc. diploma in geology from Florida Atlantic College. He’s a geologist and has over 18 years of expertise as a monetary analyst masking the pure sources sector with Stansberry Analysis. He’s additionally a founding father of Mangrove Investor Media, a publishing firm.

Chris Lloyd – VP Exploration

Chris Lloyd is a geologist with over 35 years of expertise, working in Canada and Mexico. He’s a co-founder of Soltoro, which found the El Rayo silver deposit and was acquired by Agnico Eagle. He was additionally related to the Panuco Challenge of Vizsla Silver.

Charles Funk – Technical Advisor

Charles Funk is a geologist with expertise in gold, silver and copper initiatives, and is related to a number of deposit discoveries in Australia and Mexico. He has greater than 14 years of expertise with a number of mining corporations, together with Evrim Assets and Newcrest. He’s additionally the CEO of Heliostar Metals.

Dr. Roy Greig – Technical Advisor

Dr. Roy Grieg is a geologist extremely skilled in advancing copper initiatives. He served for over two years as vice-president of exploration for Amarc Assets, the place he superior their district-scale porphyry copper-gold-molybdenum initiatives in British Columbia in collaboration with main companions Freeport McMoRan and Boliden. Greig holds a Ph.D. from the College of Arizona.

Lisa Thompson – Director

Lisa Thompson brings over 20 years of expertise as a company/securities paralegal, working with massive and small public corporations listed for buying and selling on US and Canadian inventory exchanges. Thompson supplied company secretarial consulting providers for US and Canadian corporations for over 5 years. She is a co-founder of Meraki Company Companies in Vancouver, BC.