Investor Insights

Ramp Metals’ strategic concentrate on valuable and base metals is crucial for varied rising industries within the international market. The corporate is in a compelling place to doubtlessly make a big gold discovery in a top-tier Canadian mining jurisdiction which is at the moment underexplored.

Overview

Ramp Metals (TSXV:RAMP) is a grassroots exploration firm specializing in valuable and base metals, notably gold and nickel-copper-PGE. The corporate has two properties, two located in Northern Saskatchewan, Canada.

The flagship property, Rottenstone SW Claims is located alongside a geological construction that traditionally yielded the highest-grade nickel and platinum group parts (PGE) in Canada. It displays outstanding parallels to the Nova-Bollinger nickel-copper mine in Western Australia, which was found by Sirius Assets and in the end bought to IGO Restricted for AU$1.8 billion. The Nova-Bollinger mine had an estimated useful resource of 13.1 million tons (Mt) grading 2 p.c nickel, 0.8 p.c copper, and 0.07 p.c cobalt.

The putting similarity between Rottenstone and Nova-Bollinger mine is encouraging and the appointment of Dr. Mark Bennett, the discoverer of the Nova-Bollinger deposit, as a strategic advisor, reinforces Ramp’s perception within the potential of the Rottenstone property. Bennett has over three many years of expertise in establishing mines, and performed a key function in a number of discoveries, such because the Wahgnion gold mine, the Thunderbox gold mine, and the Waterloo nickel mine, along with the Nova-Bollinger nickel-copper mine. Together with Bennett, Ramp Metals has additionally appointed main geologists Scott McLean and Richard Murphy, as its strategic advisors to bolster its geology staff.

The venture’s presence in Saskatchewan can be encouraging for buyers given the area’s mining-friendly insurance policies. Saskatchewan was ranked second globally and the highest in Canada by the Fraser Institute as essentially the most enticing jurisdiction for mining funding in 2021.

Saskatchewan has gained prominence for its considerable uranium assets, but its geological range presents vital potential past this. Exploration for different battery metals within the area has been restricted or largely unexplored.

Present Gold Panorama

Based on knowledge from the World Gold Council, whole gold demand gained a report 5 p.c year-over-year to 1,313 tons throughout the third quarter of 2024, leading to a collection of record-high gold costs throughout the identical quarter. The worth of demand rose 35 p.c to greater than US$100 billion for the primary time ever.

A significant driver for gold’s development are international gold ETF inflows, whereas bar and coin investments dipped 9 p.c year-over-year. Gold jewellery consumption declined 12 p.c, regardless of a rise in spending, with the worth of demand leaping to 13 p.c to greater than US$36 billion.

12 months-to-date central financial institution shopping for stays according to 2022, regardless of a notable slowing down in Q3 2024.

Gold software in know-how continues to be pushed by synthetic intelligence, rising 7 p.c year-over-year and the “outlook stays cautious,” the World Gold Council report mentioned.

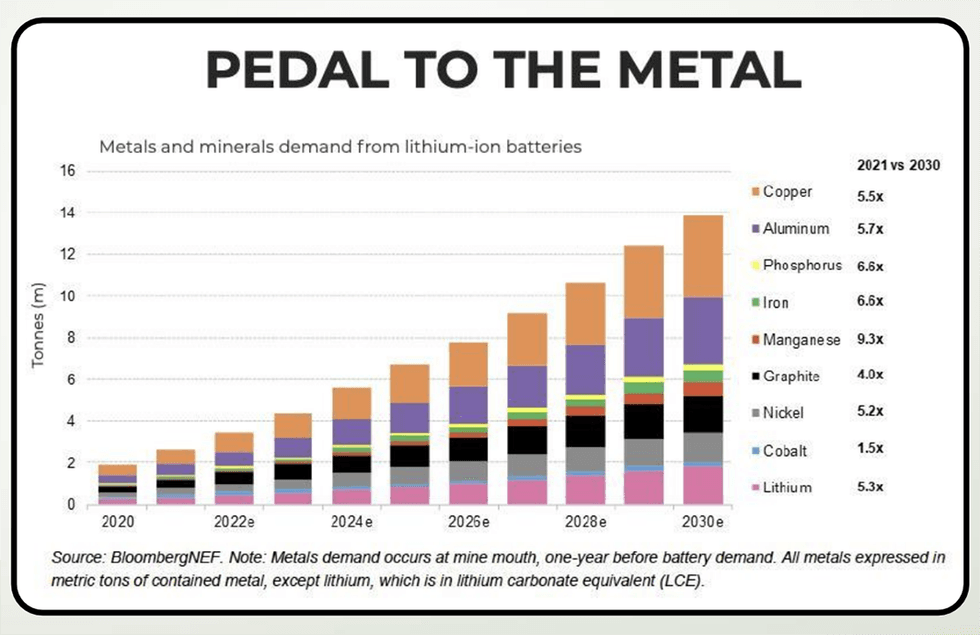

Outlook on Battery Metals

The demand for battery metals will proceed to develop, because of a strengthening EV market. S&P World Mobility’s 2024 international gross sales forecast anticipates battery-electric passenger automobiles will attain roughly 13.3 million models worldwide by the top of 2024, a rise of 40 p.c year-over-year. When it comes to market share, EVs will represent round 16.2 p.c of the entire international passenger automobile gross sales in 2024, in comparison with 12 p.c in 2023.

Additional, the rising pattern towards high-density batteries utilizing nickel and cobalt, and fewer lithium, can be anticipated to spice up demand for these metals. As one of many high important minerals within the US and Canada, nickel initiatives are more likely to see elevated funding over the approaching years.

There’s a robust demand available in the market for brand new, high-quality nickel-copper and lithium alternatives. Rottenstone SW borders Fathom Nickel, which lately secured C$4.6 million in funding and appears to be specializing in the same geological system. The Rottenstone SW eye construction presents a great goal for nickel-copper-PGE exploration.

Firm Highlights

- Ramp Metals is a valuable and base metals exploration firm with a concentrate on exploring high-grade gold and nickel-copper-PGE in Northern Saskatchewan. Ramp intends to uncover a brand new gold district in a area that’s underexplored following its discovery of high-grade gold intercepts, together with 73.55 g/t gold over 7.5m.

- The corporate has two properties overlaying a complete space of 33,886 hectares. Of those, two are positioned in Northern Saskatchewan – Rottenstone SW Claims and Peter Lake Area (PLD).

- The corporate’s flagship venture Rottenstone SW property is located adjoining to a northeast-southwest geological formation related to the famend Rottenstone Mine. This mine yielded 40,000 tons of high-grade nickel-copper-platinum group parts (PGE) and gold ore, with grades averaging 3.28 p.c nickel, 1.83 copper, and 9.63 grams per ton platinum-palladium-gold.

- The geophysical program at Rottenstone highlights putting similarities with the Nova-Bollinger mine in Australia owned by Sirius Assets, which was finally bought for AU$1.8 billion.

- Dr. Mark Bennett, founding father of Sirius Assets who oversaw the event of the Nova-Bollinger mine, is a strategic advisor to Ramp Metals.

Key Initiatives

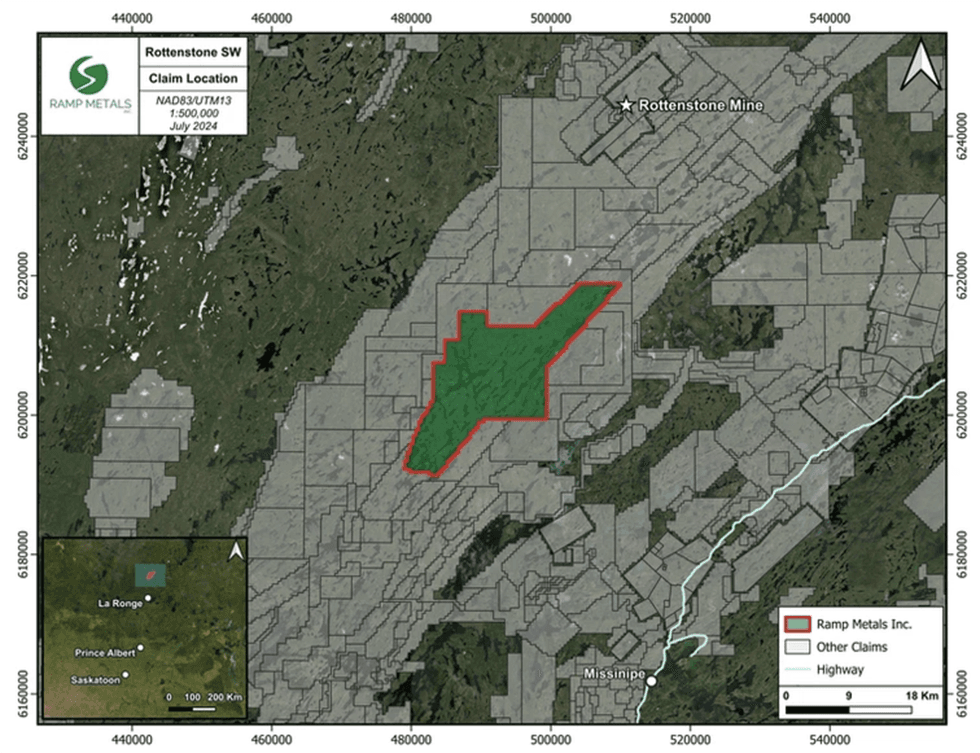

Rottenstone SW Claims

The Rottenstone SW property is roughly 115 kilometers north of La Ronge, Saskatchewan. The property contains 12 claims encompassing 17,285.5 hectares and is located adjoining to a northeast-southwest geological formation related to the famend Rottenstone Mine. This mine yielded 40,000 tons of high-grade nickel-copper-PGE and gold ore, with grades averaging 3.28 p.c nickel, 1.83 copper, and 9.63 grams per ton platinum-palladium-gold.

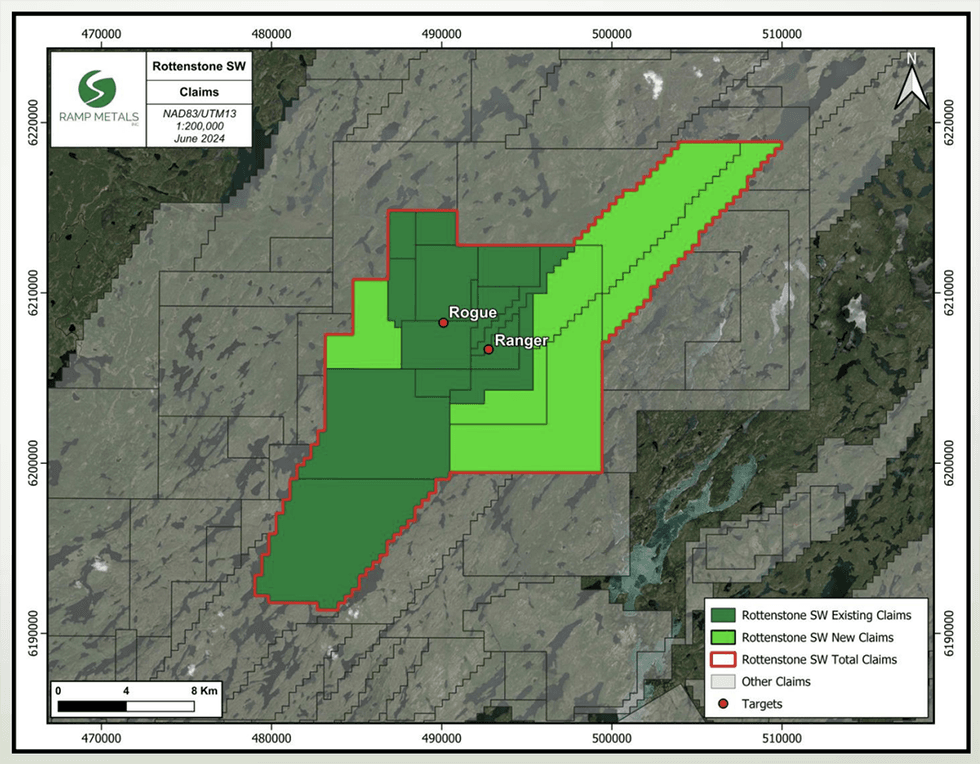

The corporate has accomplished varied geophysical surveys together with time-domain airborne geophysical measurements (TDEM), and soil sampling, all geared toward figuring out potential drill targets. The survey outcomes present putting similarities between Rottenstone SW Claims and the Nova-Bollinger deposit. The Rottenstone SW conductors present a powerful correlation with the conductors recognized on the Nova-Bollinger deposit. Primarily based on the geophysical survey outcomes, the corporate has recognized 4 high-priority targets.

The corporate’s first drill program on the Rottenstone property was accomplished in April 2024 which led to a new high-grade gold discovery of 73.55 g/t gold over 7.5 meters in drill gap Ranger-01.

The corporate has expanded the Rottenstone SW declare block to a complete of 32,715 hectares. Further unexplored EM and magazine targets are located on the unique declare block with related signatures to Ranger and Rogue.

Peter Lake Area Claims

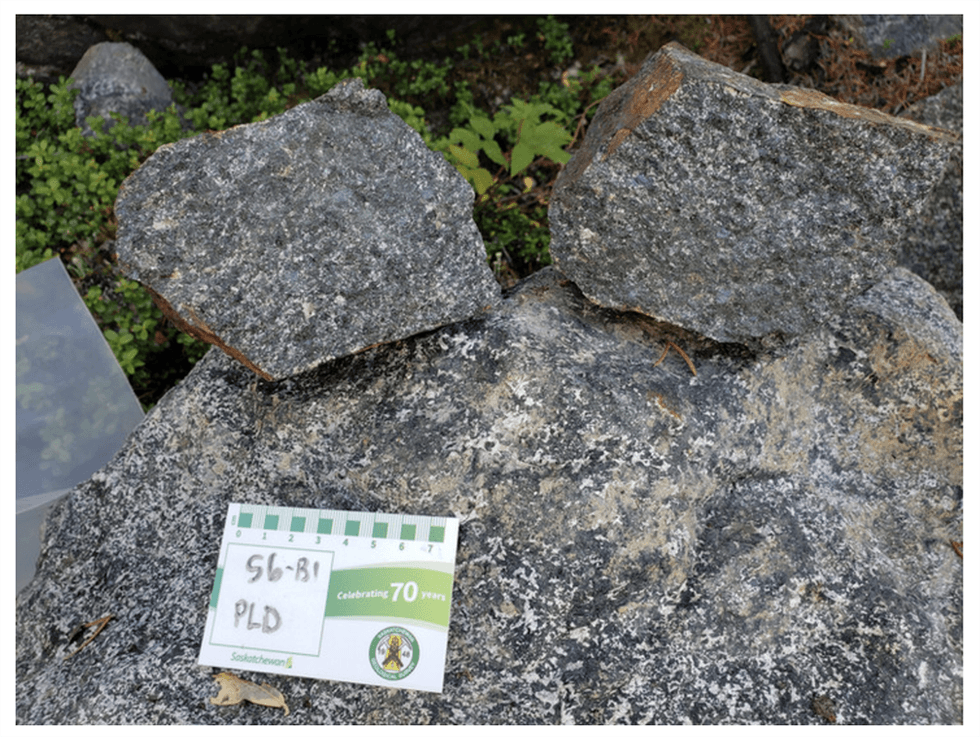

The Peter Lake Area (PLD) property is located inside the Peter Lake Area of the Swan River complicated in Northern Saskatchewan, Canada, round 260 kilometers northeast of La Ronge, Saskatchewan. The property contains two mineral deposit claims spanning roughly 1,171 hectares.

Peter Lake Area has a historical past of exploration accomplished by earlier operators. The earlier exploration work returned floor seize samples of gabbro outcrop with disseminated pyrite and chalcopyrite (SMDI 5545) having values of 1,860 components per million (ppm) copper, 461 ppm nickel, 41 components per billion (ppb) platinum and 49 ppb palladium. A historic VTEM survey performed by Geotech outlined compelling targets. Based on Ramp Metals, the sooner operators drilled the property inaccurately and didn’t correctly take a look at the targets that have been generated.

The venture has the potential to be a serious new discovery. Ramp Metals plans to undertake an airborne TDEM survey to construct upon historic knowledge and determine exploration targets. As soon as the targets are recognized, the corporate will implement a drill program of about 2,000 to 2,500 meters.

Administration Staff

Jordan Black – Chief Government Officer and Director

Jordan Black brings over 12 years of geotechnical engineering expertise for varied infrastructure, renewable vitality and mining initiatives. Black was beforehand the vice-president of enterprise improvement at GoldSpot Discoveries and labored as a senior geotechnical engineer at WSP Canada.

Garrett Smith – VP Exploration

Garrett Smith graduated with a BSc in geology from the College of Regina. All through his profession, he has been concerned in initiatives throughout Western Canada, specializing in varied commodities. His in depth experience ranges from greenfield mapping and exploration to on-site drill administration. Pushed by a real ardour for exploration, Smith has devoted the previous few years to assembling a set of base metallic initiatives in northern Saskatchewan.

Brett Williams – VP Operations and Senior Geologist

Brett Williams is a seasoned geologist with a various background, having labored as a mine geologist in each open pit and underground mining, in addition to an exploration geologist within the diamond, base metals, gold and uranium sectors for Rio Tinto and SSR Mining. He earned his B.Sc. in geology and a diploma in enterprise administration from the College of Regina. Williams is a registered member of the Skilled Engineers and Geoscientists of Saskatchewan.

Prit Singh – Director

Prit Singh is a seasoned capital markets skilled and presently serves because the CEO of Thesis Capital, an advisory agency providing help to high-growth corporations in fundraising, Canadian market preliminary public choices and investor relations. All through his profession, Singh has collaborated with greater than 50 issuers, facilitating fundraising and offering counsel, ensuing within the procurement of over $100 million in capital throughout varied rising sectors. Earlier than establishing Thesis Capital, he gained expertise in funding banking and wealth administration, fostering enduring relationships inside Canada’s buy-side and sell-side communities. Singh holds a BBA with a specialization in finance from Brock College.

David Parker – Director

David Parker has greater than 15 years of expertise in enterprise financing, consulting and recapitalizing public/non-public corporations within the mining, know-how, and media sectors. He additionally has expertise in retail, workplace, and industrial actual property gross sales and improvement. He has led initiatives from preliminary market evaluation to acquisition, design, approval, website servicing, development and disposition. He understands the monetary implications of technical points and planning coverage modifications, making him an efficient director.

Peter Schloo – Director

Peter Schloo has a decade of expertise and experience in capital markets, operations and assurance, and holds CPA, CA and CFA designations. Moreover, he’s a licensed prospector within the province of Ontario, Canada. His monitor report contains facilitating over C$85 million in related capital elevating alternatives for each private and non-private enterprises. At present, he’s the CEO, president, and director of Heritage Mining, and a director of Pacific Empire Minerals. His earlier roles included CFO of Spirit Banner Capital and VP company improvement and interim CFO for Ion Power.

Michael Romanik – Director

Michael Romanik has over 14 years of useful resource exploration and public market expertise with an emphasis on administration, promotion and company finance. He has constructed a powerful community of useful resource and funding trade contacts through the years, and demonstrated a confirmed skill to make the most of these relationships to advance his enterprise goals. Romanik has served because the president and CEO of GoldON Assets (TSXV:GLD) since 2009 and is a founding shareholder and the CEO of Silver Greenback Assets (CSE:SLVDF).

Advisory Staff

Dr. Mark Bennett, Ph.D.

A PhD-qualified geologist with over 30 years of expertise in capital elevating, mineral exploration and establishing mines; Instrumental in a number of discoveries, together with the Wahgnion gold mine, the Thunderbox gold mine and Waterloo nickel mine, and the Nova-Bollinger nickel-copper mine in Australia for Sirius Assets (acquired for AUD$1.8 billion in 2015); Concerned in elevating over $1 billion in debt and fairness financing for funding exploration and improvement initiatives and overseen mergers, demergers, acquisitions, investments and divestments.

Scott McLean, P.Geo., FGC.

An expert geologist with over 35 years of senior administration, govt and board expertise within the metals and mining trade. Between 1985 and 2007, he labored for Falconbridge Restricted and its successor Xstrata Nickel in varied capacities all through Canada with a concentrate on gold and base metallic exploration; Based HTX Minerals Corp in 2007, Transition Metals Corp in 2010, SPC Nickel Corp in 2013 and Canadian Gold Miner in 2016; At present leads Transition Metals and is the Government Chairman of SPC Nickel.

Richard Murphy, P.Geo.

A seasoned exploration entrepreneur with 27+ years of expertise within the mineral exploration enterprise. Introduced two public corporations by means of founding, acquisition, exploration and gross sales processes, most notably, Manitou Gold Inc. (acquired by Alamos Gold in Q2 2023). Experience in constructing and advancing junior mining corporations by means of discovery, useful resource definition and pre-feasibility phases to determine fully-valued mine reserves.