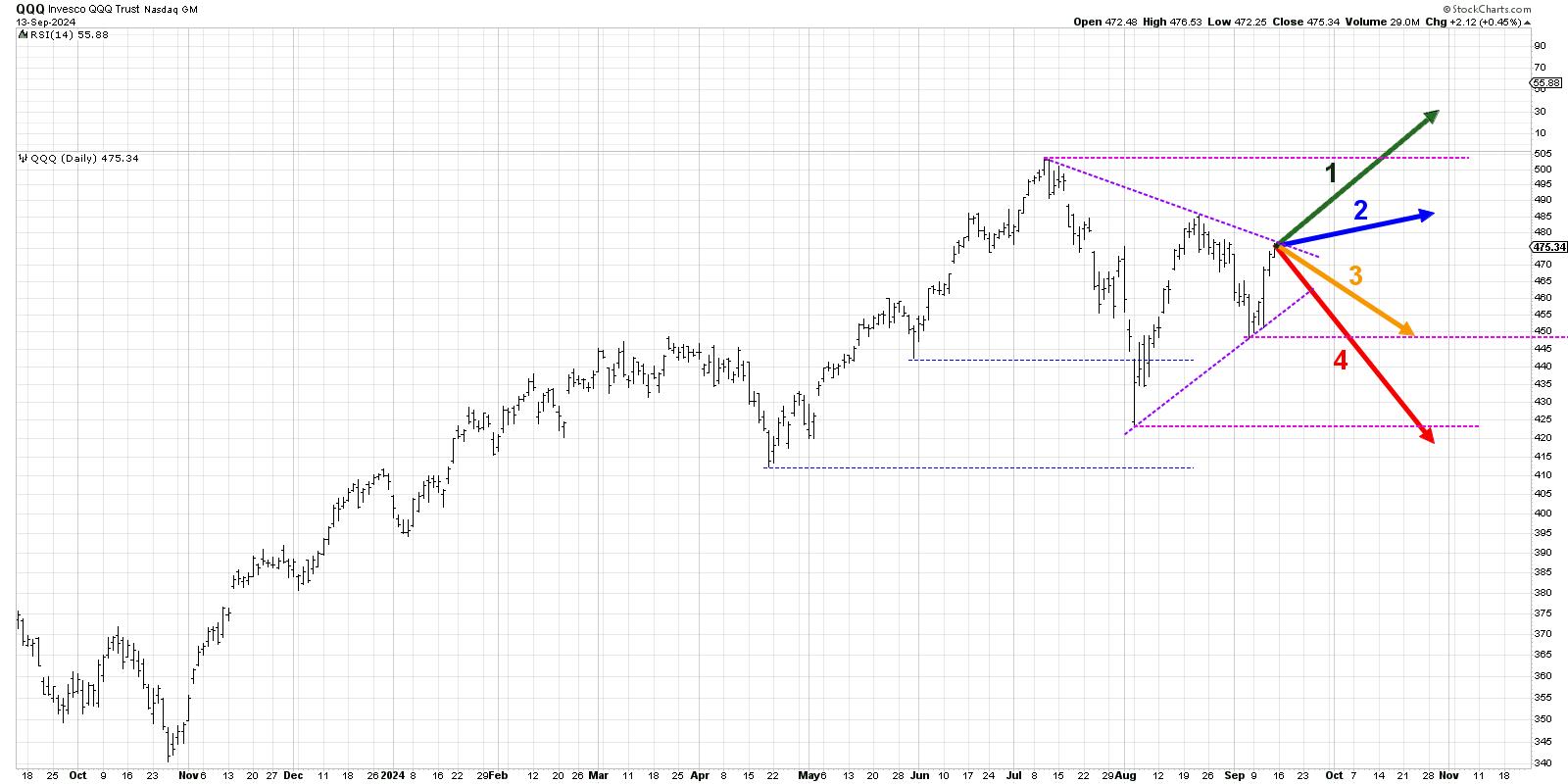

Whereas the S&P 500 completed the week as soon as once more testing new all-time highs round 5650, the Nasdaq 100 stays rangebound in a symmetrical triangle or “coil” sample. Whereas this sample doesn’t essentially counsel a possible subsequent transfer for the QQQ, it did lead me to consider 4 totally different situations that would play out over the subsequent six to eight weeks.

The chart of the QQQ appears to be like lots just like the chart of Nvidia (NVDA), with a transparent consolidation sample of decrease highs and better lows. Different main progress names like Meta Platforms (META) have did not sign an upside breakout to present an “all clear” sign for the bulls. And defensive sectors proceed to thrive, though the S&P 500 completed within the inexperienced each day this week.

Right now, we’ll lay out 4 potential outcomes for the Nasdaq 100. As I share every of those 4 future paths, I am going to describe the market situations that may possible be concerned, and I am going to additionally share my estimated likelihood for every situation.

By the best way, we performed the same train for the Nasdaq 100 again in June, and you will not imagine which situation really performed out!

And bear in mind, the purpose of this train is threefold:

- Take into account all 4 potential future paths for the index, take into consideration what would trigger every situation to unfold when it comes to the macro drivers, and evaluate what indicators/patterns/indicators would verify the situation.

- Resolve which situation you are feeling is almost definitely, and why you suppose that is the case. Do not forget to drop me a touch upon my channels and let me know your vote!

- Take into consideration how every of the 4 situations would impression your present portfolio. How would you handle threat in every case? How and when would you are taking motion to adapt to this new actuality?

Let’s begin with probably the most optimistic situation, with the QQQ attaining a brand new all-time excessive over the subsequent six to eight weeks.

Choice 1: The Very Bullish Situation

What if NVDA breaks out to the upside, META lastly pops above $550, and the remainder of the Magnificent 7 shares go proper again to a management function? That will surely drive the Nasdaq and the S&P 500 to their very own new highs within the subsequent month or so. If Powell’s press convention subsequent week renews investor optimism and the market costs in an ideal mushy touchdown for the economic system, we might maybe see this play out.

Dave’s Vote: 10%

Choice 2: The Mildly Bullish Situation

If the Mag7 names proceed to battle and fail to breakout, however different sectors like financials and industrials surge greater, we might get a extra mildly bullish rally right here. That will imply the QQQ stays beneath its 2024 excessive, however stockpickers rejoice as loads of alternatives seem outdoors of the expansion sectors.

Dave’s vote: 30%

Choice 3: The Mildly Bearish Situation

What if the Fed assembly doesn’t go as properly subsequent week, and buyers begin pondering recession once more? Defensive sectors have actually been displaying energy in latest months, and it seems like it might not take a lot to reverse the indicators of optimism I’ve noticed during the last week. Bonds outperform shares as buyers get defensive, and out of the blue we’re all hoping for an October rally to beat the bearish sentiment.

Dave’s vote: 45%

Choice 4: The Tremendous Bearish Situation

You all the time want a doomsday situation, and this final choice would contain a giant time “threat off” transfer for shares. Development shares rotate decrease, and risk-off performs like gold shine brightest because the QQQ retests the August low round $425. Maybe Powell fails to spice up buyers’ confidence and the “goldilocks situation” for the economic system looks like a distant reminiscence.

Dave’s vote: 15%

What possibilities would you assign to every of those 4 situations? Take a look at the video beneath, after which drop a remark with which situation you choose and why!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any means symbolize the views or opinions of another individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers decrease behavioral biases via technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor determination making in his weblog, The Aware Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing threat via market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to establish funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra