RUSSELL 2000 Elliott Wave Evaluation – Buying and selling Lounge Day Chart.

RUSSELL 2000 Elliott Wave technical evaluation

Perform: Development.

Mode: Impulsive.

Construction: Grey wave 3.

Place: Orange wave 3.

Course subsequent increased levels: Grey wave 3 (in progress).

Particulars: Grey wave 2 seems to be accomplished, and now grey wave 3 is lively.

Wave cancel invalid stage: 203.76.

The Russell 2000 Elliott Wave evaluation on the each day chart exhibits the market at the moment in an impulsive development mode, indicating sturdy directional motion. The wave construction being analyzed is grey wave 3, which suggests the market is within the third and usually most dynamic section of the Elliott Wave cycle. This section normally follows a corrective wave and is characterised by sturdy worth momentum.

In keeping with the evaluation, grey wave 2 has accomplished, and grey wave 3 is now in progress. The positioning of orange wave 3 inside the general wave construction reinforces that the market is at the moment in an impulsive development. This alignment of wave 3 at each the grey and orange ranges alerts that the upward motion is anticipated to proceed with important power.

The following increased diploma wave route can be grey wave 3, additional supporting the general bullish development available in the market. When a number of wave levels are aligned in the identical route, it usually will increase confidence within the continuation of the development. Grey wave 3 is usually thought-about one of many strongest waves within the Elliott Wave sequence, indicating that the market might see additional upward motion.

The evaluation highlights a wave cancellation invalidation stage at 203.76. This threshold is essential; if the market falls under this stage, it will invalidate the present wave rely, suggesting the anticipated impulsive transfer could not happen as projected.

In abstract, the Russell 2000 is in an impulsive development on the each day chart, with grey wave 3 in progress following the completion of grey wave 2. The market is anticipated to proceed transferring upward until the invalidation stage of 203.76 is breached.

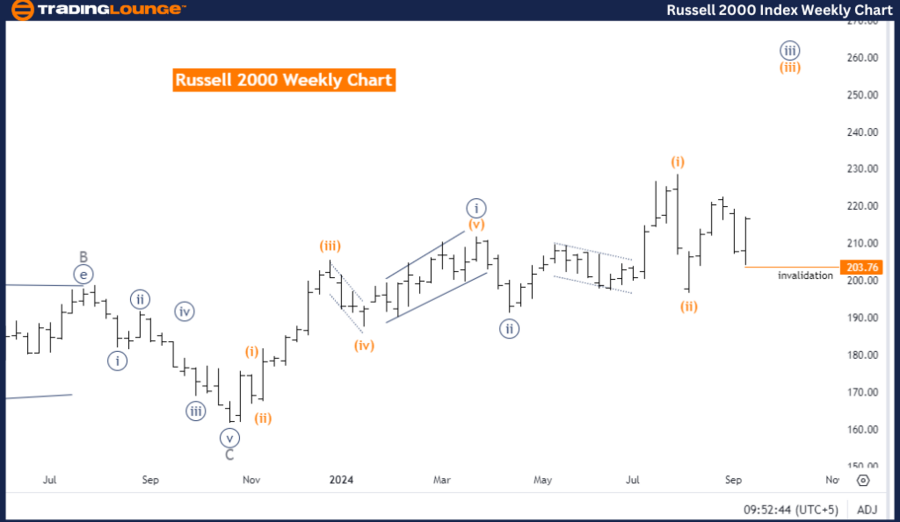

RUSSELL 2000 Elliott Wave technical evaluation

Perform: Development.

Mode: Impulsive.

Construction: Orange wave 3.

Place: Navy Blue Wave 3.

Course subsequent increased levels: Orange wave 3 (in progress).

Particulars: Orange wave 2 seems to be accomplished, and now orange wave 3 is lively.

Wave cancel invalid stage: 203.76.

The Russell 2000 Elliott Wave evaluation on the weekly chart suggests the market is at the moment in an impulsive development, indicating sturdy directional motion. The present wave construction being analyzed is orange wave 3, which is usually a robust and prolonged section within the Elliott Wave cycle, usually reflecting the continuation of the general development. This construction follows the completion of orange wave 2, which was a corrective section.

The evaluation exhibits that orange wave 3 has already began, that means the market is more likely to expertise upward momentum according to the impulsive nature of this wave. The place inside this broader wave construction is navy blue wave 3, which is a subwave inside orange wave 3. This confirms that the upward development is robust and in progress.

The following increased diploma wave route can be orange wave 3, indicating a continuation of the impulsive motion at a number of ranges. This alignment of wave counts throughout totally different levels reinforces the likelihood of additional market beneficial properties and a sustained bullish development. When wave counts are aligned in the identical route throughout totally different levels, it normally alerts a strong and dependable development.

The evaluation specifies a wave cancel invalidation stage at 203.76. This stage is essential as a result of if the market falls under this level, the present Elliott Wave rely can be invalidated, probably signaling a reversal or shift available in the market’s anticipated route.

In abstract, the Russell 2000 weekly chart exhibits an impulsive development with orange wave 3 in progress following the completion of orange wave 2. The upward momentum is anticipated to proceed until the market breaches the invalidation stage of 203.76.

Technical analyst: Malik Awais.

RUSSELL 2000 Elliott Wave technical evaluation [Video]

![RUSSELL 2000 index Elliott Wave technical evaluation [Video] RUSSELL 2000 index Elliott Wave technical evaluation [Video]](https://i0.wp.com/editorial.fxstreet.com/miscelaneous/p-638620745214339213.png?w=860&resize=860,0&ssl=1)