Shanghai Composite Elliott Wave technical evaluation

-

Operate: Counter Pattern.

-

Mode: Corrective.

-

Construction: Orange wave 2.

-

Place: Navy blue wave 3.

-

Subsequent larger diploma: Orange wave 3.

Particulars

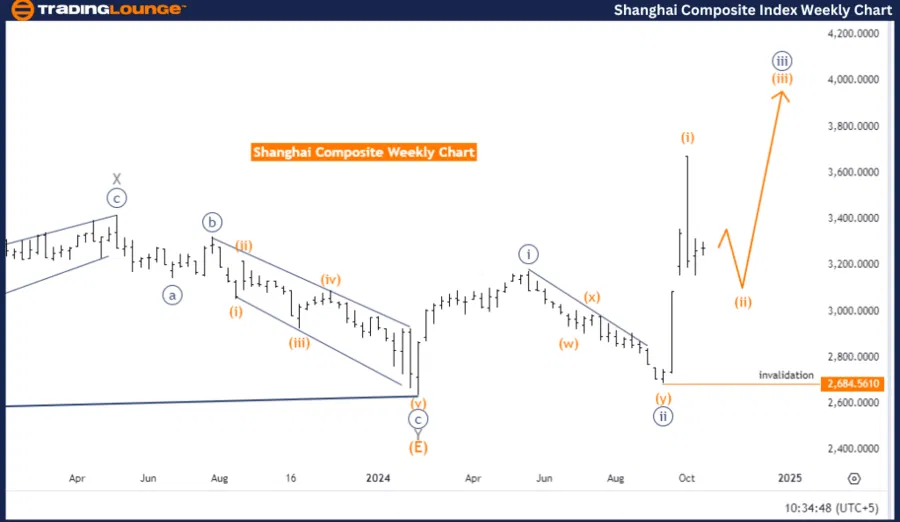

The Elliott Wave evaluation for the Shanghai Composite on the each day chart highlights a counter-trend section in a corrective mode. The present construction is orange wave 2, which follows the completion of orange wave 1. The market is positioned in navy blue wave 3, indicating that the corrective section remains to be unfolding.

With orange wave 1 accomplished, orange wave 2 is now growing as a retracement throughout the broader pattern. As soon as orange wave 2 finishes, the subsequent transfer is anticipated to be orange wave 3, signaling the resumption of the general upward motion.

The upper-degree focus stays on the upcoming orange wave 3, which is anticipated to observe as soon as the corrective section completes. Costs might expertise fluctuations throughout orange wave 2, as this wave represents a short lived pause or reversal earlier than the continuation of the bigger pattern.

- Wave cancellation stage: 2684.5610 – If costs fall under this stage, the present wave rely can be invalidated, and a reassessment of the wave construction can be required.

Abstract

The Shanghai Composite each day chart is at the moment in a corrective section inside orange wave 2, following the completion of orange wave 1. The market is positioned inside navy blue wave 3, with an anticipated upward motion in orange wave 3 as soon as the correction concludes. The important thing stage to look at is 2684.5610, as a breach of this stage would invalidate the present wave rely.

Shanghai Composite Elliott Wave each day chart

Shanghai Composite Elliott Wave technical evaluation

- Operate: Counter Pattern

- Mode: Corrective

- Construction: Orange wave 2

- Place: Navy blue wave 3

- Subsequent Larger Diploma: Orange wave 3

Particulars

The Elliott Wave evaluation for the Shanghai Composite on the weekly chart reveals a counter-trend motion in a corrective mode. The market is at the moment unfolding in orange wave 2, following the completion of orange wave 1. This corrective section signifies a short lived value retracement throughout the broader upward pattern.

The market is positioned in navy blue wave 3, which means that after the completion of orange wave 2, a future upward motion is anticipated, as orange wave 3 begins. This corrective wave permits the market to pause and regulate earlier than the bigger upward pattern continues.

The upper diploma factors towards the forthcoming orange wave 3, anticipated to renew the upward momentum as soon as the present correction in orange wave 2 concludes.

- Wave cancellation stage: 2684.5610 – If the worth drops under this stage, the present wave rely can be invalidated, requiring a reevaluation of the evaluation.

Abstract

The Shanghai Composite weekly chart is at the moment in a corrective section inside orange wave 2, following the completion of orange wave 1. The market is positioned in navy blue wave 3, and an upward motion in orange wave 3 is anticipated as soon as the correction finishes. The important thing stage to look at is 2684.5610, which, if breached, would invalidate the present wave rely.

![Shanghai Composite Index Elliott Wave technical evaluation [Video] Shanghai Composite Index Elliott Wave technical evaluation [Video]](https://i1.wp.com/editorial.fxstreet.com/miscelaneous/Shanghai-638651873717424922.png?w=860&resize=860,0&ssl=1)