Inventory costs continued consolidating on Tuesday, with the S&P 500 index closing 0.05% decrease after rebounding from an intraday decline. Traders are anticipating extra quarterly earnings experiences, with Tesla’s (TSLA) launch in focus after at present’s session. The S&P 500 index is prone to open 0.3% decrease, extending its short-term consolidation.

Regardless of extra advances of the inventory market, investor sentiment barely worsened final week, as proven by final Wednesday’s AAII Investor Sentiment Survey, which reported that 45.5% of particular person traders are bullish, whereas 25.4% of them are bearish, up from 20.6% final week.

The S&P 500 continues to commerce sideways, remaining near its file excessive, as we will see on the day by day chart.

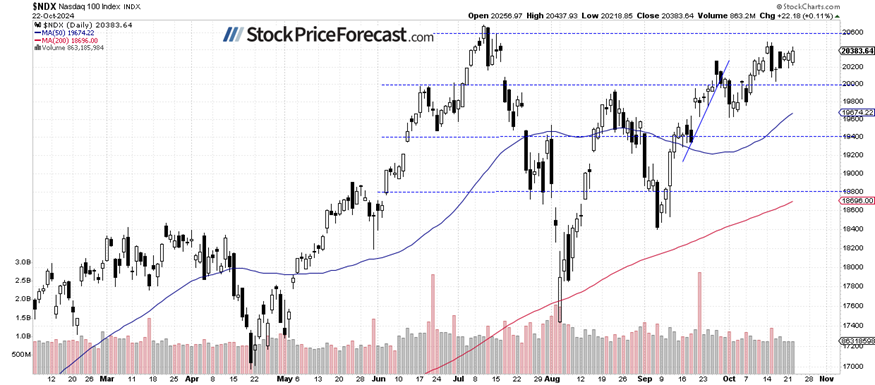

Nasdaq 100: Transferring sideways

The Nasdaq 100 gained 0.11% on Tuesday, persevering with its short-term consolidation above the 20,000 degree, although nonetheless beneath the file excessive of 20,690.97 set on July 10.

Final Tuesday, I wrote that “tech shares could expertise a interval of uncertainty as traders await quarterly earnings and future outlooks.” That also holds true.

VIX stays beneath 20

On September 6, the VIX index, a measure of market concern, reached a neighborhood excessive of 23.76. On September 26, it fell to 14.90 as inventory costs had been advancing towards new file highs. Not too long ago, the VIX has been fluctuating across the 20 degree, and final Friday, it moved in direction of 18, signalling much less concern out there.

Traditionally, a dropping VIX signifies much less concern out there, and rising VIX accompanies inventory market downturns. Nevertheless, the decrease the VIX, the upper the likelihood of the market’s downward reversal. Conversely, the upper the VIX, the upper the likelihood of the market’s upward reversal.

Futures contract: Under 5,900

The S&P 500 futures contract retains shifting sideways, remaining barely beneath the 5,900 degree. The help degree is at 5,850, marked by short-term lows, whereas resistance stays at 5,900-5,925.

Conclusion

Inventory costs are anticipated to open barely decrease this morning. The S&P 500 index continues to fluctuate as traders await vital quarterly earnings releases, together with Tesla’s (TSLA) report later at present.

The important thing query stays: is that this a topping sample or only a consolidation earlier than one other leg up? For now, it seems to be like a consolidation and a flat correction of the record-breaking rally.

For now, my short-term outlook is impartial.

I feel that no positions are justified from the chance/reward standpoint.

Right here’s the breakdown:

-

The S&P 500 is poised to increase short-term fluctuations as traders await earnings releases.

-

Inventory costs could also be forming a neighborhood excessive, nonetheless, no adverse indicators are evident.

-

In my view, the short-term outlook is impartial.

Need free follow-ups to the above article and particulars not accessible to 99%+ traders? Signal as much as our free e-newsletter at present!