This week, Shimano introduced its third-quarter monetary outcomes, wherein it revealed a 12 per cent drop in gross sales of its bicycle parts when in comparison with the identical interval – the primary 9 months – in 2023.

The report, which reveals gross sales right down to 253.8 billion yen (£1.28 billion) and earnings down by 26 per cent to 41.3 billion yen (£207 million), appears to be like to chop a damaging image at first look, however Shimano’s evaluation of the state of affairs is considered one of optimism.

It cited the continuing battle in Ukraine and tensions within the Center East as causes for “downward strain on the financial local weather,” however recommended that world economic system was displaying “indicators of a pickup” because of subsidised excessive inflation. It added that in Europe, the economic system was “beginning to present indicators of restoration,” however that the “tempo of financial growth was average” within the USA.

Analysing the long-term traits, Shimano’s enterprise appears to be like to nonetheless be stabilising following the height it skilled because of the pandemic.

Shimano has two major sectors of its enterprise. The bicycle sector makes up roughly 75% of gross sales, whereas fishing sort out makes up the majority of the remaining 25%.

Analsying the years

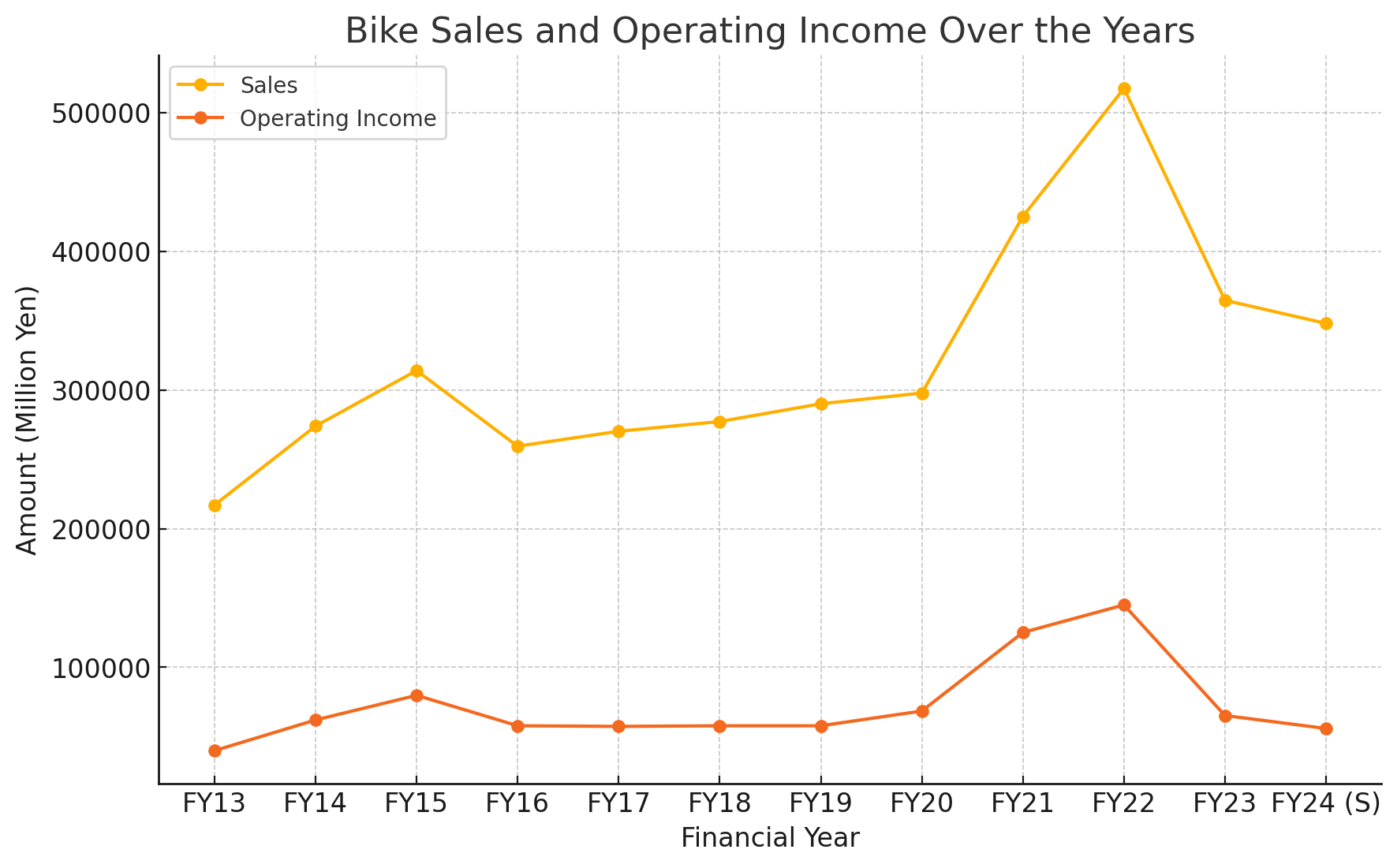

Within the bike business alone, if we normalise for the pandemic-led anomalous years, the corporate’s gross sales have been on a average upward pattern since 2013, because the under graph reveals.

For the FY24 information, Shimano has used the primary 9 months of the 12 months and projected a year-end income forecast. (Picture credit score: Future)

Overlaying the working earnings – basically the model’s revenue – to that very same graph, we will see that it has remained regular.

The most recent race content material, interviews, options, evaluations and skilled shopping for guides, direct to your inbox!

Between FY16 and FY19, revenue sat at 57 billion yen for 4 years, regardless of gross sales rising from 259 billion yen to 290 billion yen in the identical interval.

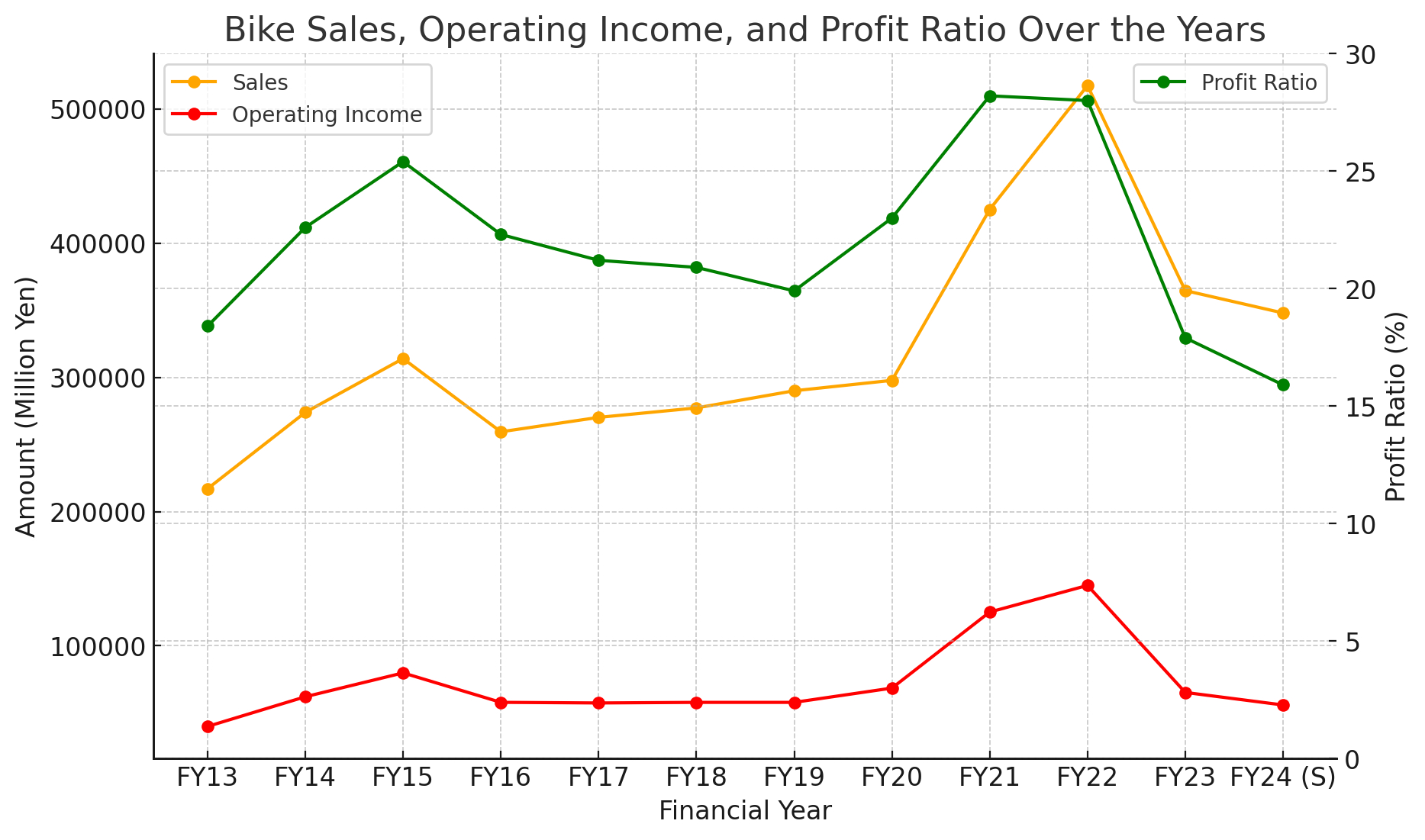

Subsequent, we have overlaid the revenue margin, as proven under.

With forecast gross sales of 348 billion yen and a forecast working earnings of 55.5 billion yen. Shimano’s predicted revenue margin for FY24 is its lowest in a decade. The corporate’s working earnings from the bike sector is in keeping with the expansion it was seeing earlier than the pandemic, and the revenue margin appears to be like to observe the pre-pandemic trajectory too.

Given the outsized impression of the pandemic, it is arduous to know whether or not the info from 2023 and 2024 are dependable indicators of future efficiency, or whether or not the business – and in flip Shimano – will proceed to peak and trough within the coming years.

It is also essential to keep in mind that in September 2023, Shimano introduced the recall of over 1,000,000 Ultegra and Dura-Ace cranksets, a recollect it later claimed was costing $18 million to foot the invoice.

We’re but to see that information listed within the FY24 accounts although. In year-end outcomes for FY22 and FY23, ‘Voluntary Remembers’ is listed as a line underneath Non-Working Bills, and is quoted at 1 million yen ($6,500) for FY22 and 1.4 billion yen (9,000,000 USD) for FY23.

Nonetheless, Voluntary Recall does not function on this Q3 report. There’s 1.9 billion yen merely listed underneath ‘Different’, however presumably we’ll have to attend for the year-end outcomes to see the newest price of that.

In Could, Shimano launched a 12-speed model of its GRX gravel groupset, and elsewhere within the report, Shimano makes a degree of highlighting this. It says the Group “acquired a good reception for its merchandise,” the place it additionally referred to as out the 2023 launch of the road-going 105 groupset.

Why is that this essential?

Given the dimensions of Shimano and its prevalence on bikes all the best way from the grass-roots to the high-end, the Japanese model is seen as one thing of a bellwether for the well being of the broader bicycle business. Its efficiency in several geographical markets additionally gives a worldwide image of the business’s world state.

For instance, the report reveals that forecasted whole gross sales in Europe will match pre-pandemic ranges in FY24, whereas the market in China will exceed even the pandemic peak, and is ready to complete greater than double the 2019 whole.

Additionally fascinating is that gross sales to North America solely make up roughly 6% of the overall gross sales quantity, whereas Europe dominates with over 40% of the overall gross sales.