Silver Tiger Metals Inc. (TSXV:SLVR)(OTCQX:SLVTF) (“Silver Tiger” or the “Company”) is happy to announce a Preliminary Feasibility Examine(” PFS”) for its 100% owned, silver-gold El Tigre Challenge (the “Challenge” or “El Tigre”) situated in Sonora, Mexico. The PFS is concentrated on the traditional open pit mining economics of the Stockwork Mineralization Zone outlined within the up to date Mineral Useful resource Estimate (“MRE”) (Determine 1). The up to date MRE additionally comprises an Out-of-Pit Mineral Useful resource that Silver Tiger plans to check in a Preliminary Financial Evaluation in H1-2025.

Highlights of the PFS are as follows (all figures in US {dollars} until in any other case said):

- After-Tax internet current worth (“NPV”) (utilizing a reduction charge of 5%) of US$222 million with an After-Tax IRR of 40.0% and Payback Interval of two.0 years (Base Case);

- 10-year mine life recovering a complete of 43 million payable silver equal ounces (“AgEq”) or 510 thousand payable gold equal ounces (“AuEq”), consisting of 9 million silver ounces and 408 thousand gold ounces;

- Whole Challenge undiscounted after-tax money move of US$318 million;

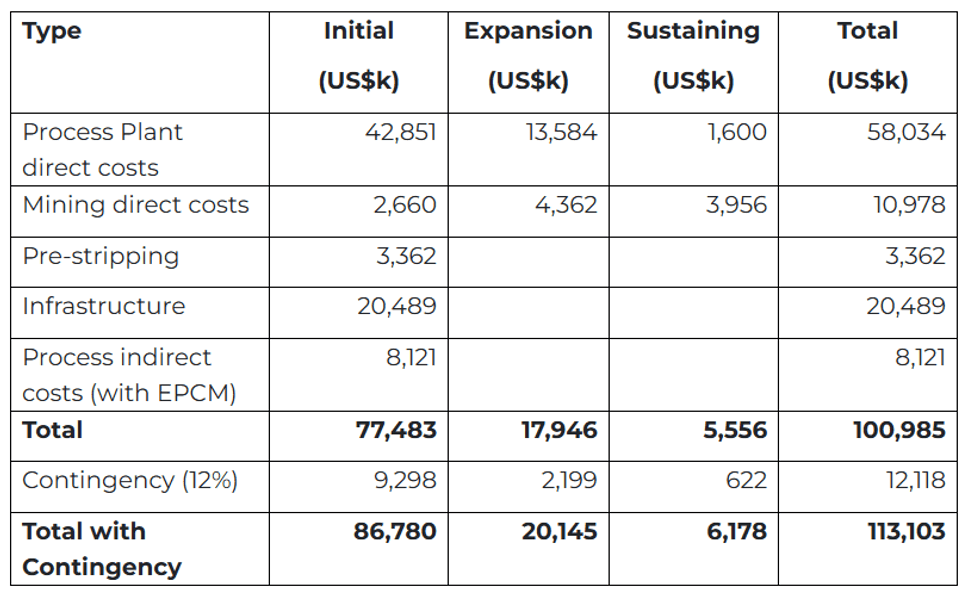

- Preliminary capital prices of $86.8 million, which incorporates $9.3 million of contingency prices, over an anticipated 18-month construct, growth capital of $20.1 million in 12 months 3 and sustaining capital prices of $6.2 million over the lifetime of mine (“LOM”);

- Common LOM working money prices of $973/ouncesAuEq, and all in sustaining prices (“AISC”) of $1,214/ouncesAuEq or Common LOM working money prices of $12/ouncesAgEq, and all in sustaining prices (“AISC”) of $14/ouncesAgEq;

- Common annual manufacturing of roughly 4.8 million AgEq ouncesor 56.7 thousand AuEq oz; and

- Three (3) years of manufacturing within the Confirmed class within the Section 1 Starter Pit.

Glenn Jessome, President & CEO said “We’re more than happy with the work accomplished by our consultants and our technical staff on the PFS for the open pit at El Tigre. The open pit delivers sturdy economics with an NPV of US$222 million, an preliminary capital expenditure of US$87 million, and a payback of two years with 3 years of manufacturing within the Confirmed class within the ‘Starter Pit utilizing steel costs enormously discounted to the spot value.” Mr. Jessome continued “This can be a pivotal level for our Firm as we now have a transparent path ahead to creating a building determination for the open pit. The open pit has good grade (48 g/t AgEq), low strip ratio (1.7:1), and large benches (~150 m) with mineralization at floor. With such optimistic parameters and with our VP of Operations Francisco Albelais, a profession professional within the building of enormous heap leach mines in Mexico, we’re assured we will advance the Challenge in a short time.” Mr. Jessome concluded “The open pit is just one element of El Tigre as we have now additionally right now delivered over 113 Mozs AgEq within the underground Mineral Useful resource Estimate and disclosed an Exploration Goal establishing 10 to 12 million tonnes at 225 to 265 g/t AgEq for 73 to 100 Moz AgEq. This disclosed ‘near-mine’ Mineral Useful resource and potential, when coupled with the truth that solely 30% of this prolific Property has been explored, reveals the worth of the El Tigre Challenge. The Firm can even proceed to work on this substantial underground Mineral Useful resource by beginning underground drilling instantly, and plan to launch an underground PEA in H1-2025.”

Highlights of the up to date Mineral Useful resource

- Elevated confidence in MRE, with improve of 132% in Whole Measured & Indicated Silver Equal (“AgEq”) Ounces from September 2023 MRE, with 59% improve in Measured & Indicated AgEq grade;

- Whole Measured & Indicated Mineral Useful resource of 200 Moz AgEq grading 92 g/t AgEq contained in 68.0 million tonnes (“Mt”);

- Inferred Mineral Useful resource of 84 Moz AgEq grading 180 g/t AgEq contained in 14.5 Mt; and

- Inclusion of Out-of-Pit Mineral Useful resource of 5.3 Mt Measured & Indicated Mineral Useful resource at grade of 255 g/t AgEq and 10.1 Mt Inferred Mineral Useful resource grading 216 g/t AgEq.

Preliminary Feasibility Abstract

The PFS was ready by impartial consultants P&E Mining Consultants Inc. (“P&E”), with metallurgical check work accomplished by McClelland Laboratories, Inc. – Sparks, Nevada, course of plant design and costing by D.E.N.M. Engineering Ltd., and environmental and allowing led by CIMA Mexico. Following are tables and figures displaying key assumptions, outcomes, and sensitivities.

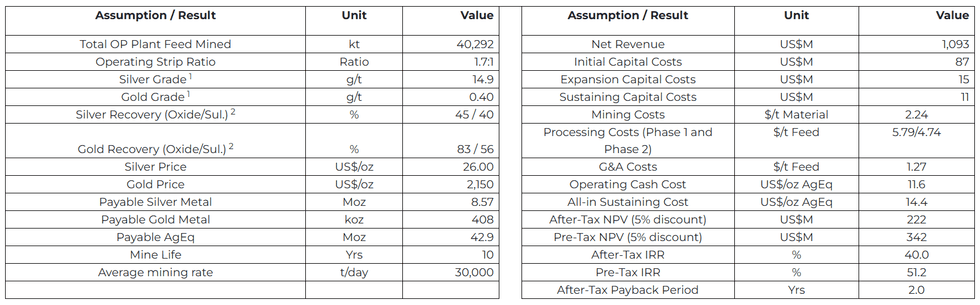

Desk 1: El Tigre PFS Key Financial Assumptions and Outcomes

Desk 1: El Tigre PFS Key Financial Assumptions and Outcomes

- Grades proven are LOM common course of plant feed grades embrace solely OP sources. Mining losses and exterior dilution of three.7% had been integrated within the mining schedule.

- Column testing indicated each variable gold and silver restoration for the oxide materials vs the beforehand reported non-discounted PEA (83% and 64%) at a 3/8-in crush measurement. Within the course of design and monetary mannequin for the PFS course of design and monetary mannequin recoveries have been discounted by 3% for leaching within the subject versus optimum circumstances within the laboratory and proven accordingly. The presence of transition and sulfide zones has affected each the gold and silver recoveries and are proven as separate recoveries. These are cheap and acceptable to be used on this PFS design and financial evaluation.

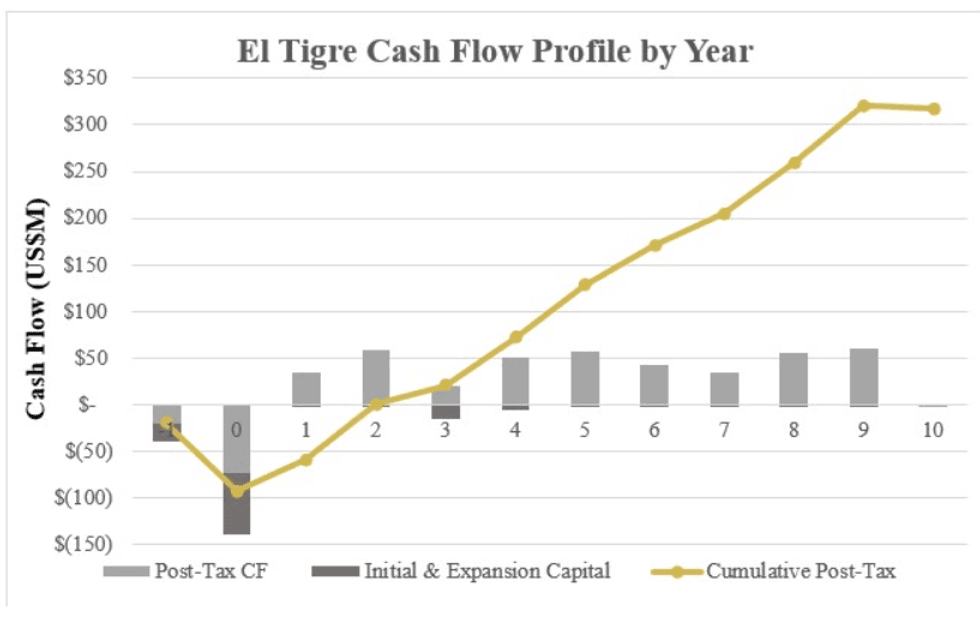

Determine 2: El Tigre Money Circulation Profile by 12 months

Determine 2: El Tigre Money Circulation Profile by 12 months

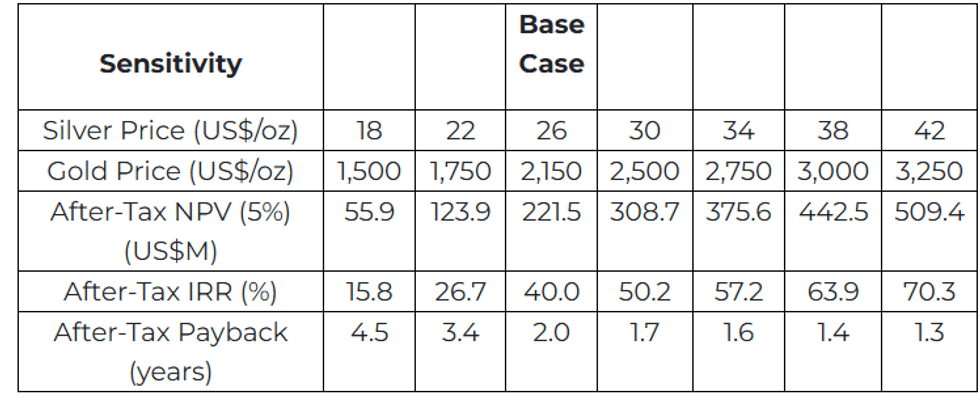

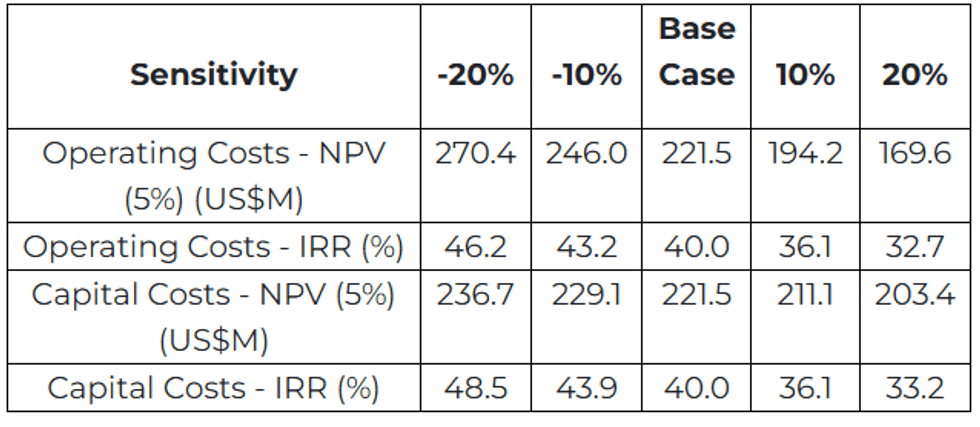

Determine 2 above highlights the post-tax money flows of US$318 million related to the El Tigre Challenge. The economics of the Challenge have been evaluated based mostly on the bottom case state of affairs $26/ouncessilver value and gold value of $2,150/oz. As illustrated within the following sensitivity tables, the Challenge stays sturdy even at decrease commodity costs or with larger prices (Tables 2 and three).

Desk 2 – El Tigre PFS Gold and Silver Worth Sensitivities

Desk 2 – El Tigre PFS Gold and Silver Worth Sensitivities

Desk 3 – El Tigre PFS Working Price and Capital Price Sensitivities

Desk 3 – El Tigre PFS Working Price and Capital Price Sensitivities

Capital and Working Prices

The El Tigre Challenge has been envisioned as an open pit mining operation beginning at a processing charge of seven,500 tonnes per day for years 1-3 after which ramping as much as 15,000 tonnes per day by 12 months 4 after 1 12 months building for ramp up in 12 months 3.

The method plant is comprised of standard three (3) stage crushing to an optimum -3/8 inch (10 mm) crush measurement. The crushed materials might be conveyed and loaded on the lined pad areas. A collection of pumping and piping will enable irrigation of the stacked heap materials and subsequent manufacturing of pregnant answer to move to the respective impoundment pond. The pregnant answer might be pumped to the restoration facility consisting of the Merrill – Crowe course of (zinc precipitation) and refinery to provide the gold and silver dore for advertising. The method barren answer might be recycled (with NaCN addition) and pumped again to the heap for additional leaching. The method plant location might be adjoining to the pad and pond infrastructure space.

Water provide to the method plant is offered by pumping from close by Bavispe River to the method space water distribution system and excessive voltage grid energy might be put in by the native utility to provide course of and infrastructure electrical necessities. Enlargement capital contains the associated fee to extend the method plant capability from 7,500 tonnes per day to fifteen,000 tonnes per day as famous in 12 months 4 of operation.

Desk 4 – LOM Capital Price Estimate

Desk 4 – LOM Capital Price Estimate

Mining

Open pit mining might be contracted and carried out by drill and blast adopted by standard loading and truck haulage to the waste rock storage services and the method plant.

Metallurgy

An in depth metallurgical check program was carried out by McClelland Laboratories, Inc., Sparks, Nevada on six (6) El Tigre starter pit samples. This system included crushing, coarse bottle rolls, and column testing at each 80% passing 3/8 inch and 1/2 inch (10 and 12 mm) crush measurement for 5 (5) of the six samples. One low grade pattern was solely crushed to 80% passing 1-1/2 inch (38 mm) as a sign of low grade leachability. The leach samples comprised of drill core pattern representing the starter pit and throughout the testing course of it grew to become obvious that the presence of transition and sulfide zones are within the starter pit thus affecting the bottom design recoveries. This variable check program (column and coarse bottle roll) estimated oxide common gold and silver respective metallurgical recoveries of 86% Au and 48% Ag on the 3/8 inch (10 mm) crush. The transition and sulfide zones had estimated recoveries of 59% Au and 43% Ag. Additional percolation testing additionally confirmed no requirement for agglomeration of the crushed materials is required previous to loading on the leach pad.

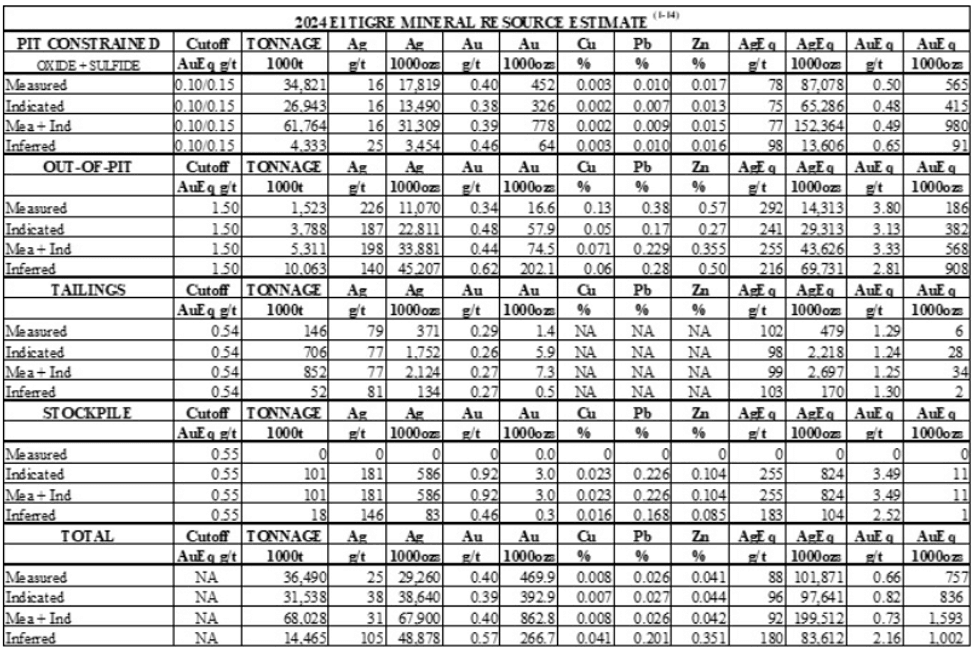

Mineral Useful resource Estimate

The premise for the PFS is the Mineral Useful resource Estimate accomplished by P&E for the El Tigre Challenge situated in Sonora State, Mexico, which has an efficient date of October 22, 2024, with an NI 43-101 Technical Report back to be filed inside 45 days of this information launch. A abstract of the Mineral Useful resource Estimate is offered in Desk 5.

Desk 5 – Up to date Mineral Useful resource Estimate October 2024

Desk 5 – Up to date Mineral Useful resource Estimate October 2024

- Mineral Sources, which aren’t Mineral Reserves, wouldn’t have demonstrated financial viability. The estimate of Mineral Sources could also be materially affected by environmental, allowing, authorized, title, taxation, socio-political, advertising, or different related points.

- The Inferred Mineral Useful resource on this estimate has a decrease stage of confidence than that utilized to an Indicated Mineral Useful resource and should not be transformed to a Mineral Reserve. It’s fairly anticipated that almost all of the Inferred Mineral Useful resource could possibly be upgraded to an Indicated Mineral Useful resource with continued exploration.

- The Mineral Sources had been estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Requirements on Mineral Sources and Reserves, Definitions and Tips ready by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- Traditionally mined areas had been depleted from the Mineral Useful resource mannequin.

- Costs used are US$2,000/ouncesAu, US$25/ouncesAg, US$4.00/lb Cu, US$0.95 lb Pb and US$1.25/lb Zn.

- The pit-constrained AuEq respective oxide and sulfide cut-off grades of 0.10 and 0.15 g/t had been derived from 40% Ag and 83% Au oxide course of restoration, 40% Ag and 56% Au sulfide course of restoration, US$5.25/tonne course of and G&A value. The constraining pit optimization parameters had been $2.00/t mining value and 45-degree pit slopes. Relating to recoveries, the PFS restoration for Ag in oxide materials was elevated to 45% after a extra detailed research was full after the MRE was finalized.

- The out-of-pit AuEq cut-off grade of 1.50 g/t was derived 93% Ag and 89% Au course of restoration, US$28/tonne course of and G&A value, and a $60/tonne mining value. The out-of-pit Mineral Useful resource grade blocks had been quantified above the 1.50 g/t AuEq cut-off, beneath the constraining pit shell and throughout the constraining mineralized wireframes. Out-of-Pit Mineral Sources are restricted to the El Tigre Fundamental Veins, which exhibit historic continuity and cheap potential for extraction by reduce and fill and lengthy gap mining strategies.

- The Low-Grade Stockpile AuEq cut-off grade of 0.54 g/t was derived from 85% Ag and 85% Au restoration US$28/tonne course of and G&A value, and a $2/tonne mining value.

- The Tailings AuEq cut-off grade of 0.55 g/t was derived from 82% Ag and 83% Au course of restoration, US$28.72/tonne course of and G&A value.

- AgEq and AuEq had been calculated at an Ag/Au ratio of 166:1 (oxide) and 122:1 (sulfide) for pit-constrained Mineral Sources.

- AgEq and AuEq had been calculated at an Ag/Au ratio of 77:1 for out-of-pit Mineral Sources.

- AgEq and AuEq had been calculated at an Ag/Au ratio of 80:1 for Low-Grade Stockpile Mineral Sources.

- AgEq and AuEq had been calculated at an Ag/Au ratio of 79:1 for Tailings Mineral Sources

- Totals might not sum attributable to rounding.

Mineral Useful resource Estimate Methodology – El Tigre Challenge

The El Tigre Challenge contains the El Tigre Veins, El Tigre Tailings and the El Tigre Low-Grade Stockpile.

The databases used for this Mineral Useful resource replace include a complete of 20,149 collar information that contribute on to the Mineral Useful resource Estimate and contains collar, survey, assay, lithology and bulk density knowledge. Assay knowledge contains Au g/t, Ag g/t, Cu %, Pb % and Zn % grades. The drilling extends roughly 5 km alongside strike.

P&E Mining Consultants Inc. (“P&E”) collaborated with Silver Tiger personnel to develop the mineralization fashions, grade estimates, and reporting standards for the Mineral Sources at El Tigre. Mineralized domains had been initially developed by Silver Tiger and had been reviewed and modified by P&E. A complete of twenty-seven particular person mineralized domains have been recognized by means of drilling and floor sampling. Interpreted mineralization wireframes had been developed by Silver Tiger geologists for the El Tigre Veins based mostly on logged drill gap lithology, assay grades and historic information. Silver Tiger recognized steady zones of mineralization from assay grades equal to or larger than 0.30 g/t AuEq with noticed continuity alongside strike and down-dip, utilizing a calculated Ag:Au equal issue of 75:1. The chosen intervals embrace decrease grade materials the place needed to take care of wireframe continuity between drill holes.

P&E developed mineralized domains for the El Tigre Low-Grade Stockpile and the El Tigre Tailings based mostly on lithological logging and LiDAR floor topography.

Assay samples had been composited to both 1.00 m or 1.50 m for the vein domains. No compositing was used for the Low-Grade Stockpiles and Tailings fashions. Composites had been capped previous to grade estimation based mostly on the evaluation of particular person composite log-probability distributions.

A complete of 5,542 bulk density values had been taken by Silver Tiger from drill gap core. Mineralized bulk density values had been assigned for every of the El Tigre Fundamental Veins based mostly on the median vein measurement. For the El Tigre North Veins, a bulk density of two.65 t/m 3 was assigned for the veins and a worth of two.42 t/m 3 was assigned for the Protectora Halo. For the Low-Grade Stockpile a worth of 1.60 t/m 3 was assigned, and for the Tailings a worth of 1.39 t/m 3 was used based mostly on 37 nuclear density measurements.

Vein block grades for gold and silver had been estimated by Inverse Distance Cubed (“ID3”) interpolation of capped composites utilizing a minimal of 4 and a most of twelve composites. Vein block grades for copper, lead and zinc had been estimated by Inverse Distance Squared (“ID2”) interpolation of capped composites utilizing a minimal of 4 and a most of twelve composites.

Nearest-Neighbour grade interpolation was used for the Low-Grade Stockpiles, and for the Tailings, block grades had been estimated by ID2 estimation of capped assays utilizing a minimal of 4 and a most of twelve samples.

For the El Tigre Fundamental Veins, blocks inside 30 m of three or extra drill holes/channels had been categorised as Measured Mineral Sources, and blocks inside 60 m of three or extra drill holes/channels had been categorised as Indicated Mineral Sources. All further estimated blocks had been categorised as Inferred Mineral Sources.

For the North Veins, blocks interpolated by a minimum of two drill holes inside 50 m had been categorised as Indicated Mineral Sources. Blocks interpolated by a minimum of one drill gap inside a most distance of 200 m had been categorised as Inferred Mineral Sources.

For the Low-Grade Stockpiles, blocks inside 15 m of two or extra drill holes had been categorised as Indicated Mineral Sources. All further estimated blocks had been categorised as Inferred Mineral Sources.

For the Tailings, blocks inside 30 m of three or extra auger or core drill holes had been categorised as Measured Mineral Sources. Blocks inside 60 m of two or extra auger/drill holes/pits or trenches had been categorised as Indicated Mineral Sources. All further estimated blocks had been categorised as Inferred Mineral Sources.

P&E considers that the block mannequin Mineral Useful resource Estimates and Mineral Useful resource classification signify an affordable estimation of the worldwide mineral sources for the El Tigre Challenge with regard to compliance with typically accepted trade requirements and pointers, the methodology used for estimation, the classification standards used and the precise implementation of the methodology when it comes to Mineral Useful resource estimation and reporting. The Mineral Sources have been estimated in conformity with the necessities of the CIM “Estimation of Mineral Useful resource and Mineral Reserves Finest Practices” pointers as required by the Canadian Securities Directors’ Nationwide Instrument 43-101. Mineral Sources aren’t Mineral Reserves and wouldn’t have demonstrated financial viability.

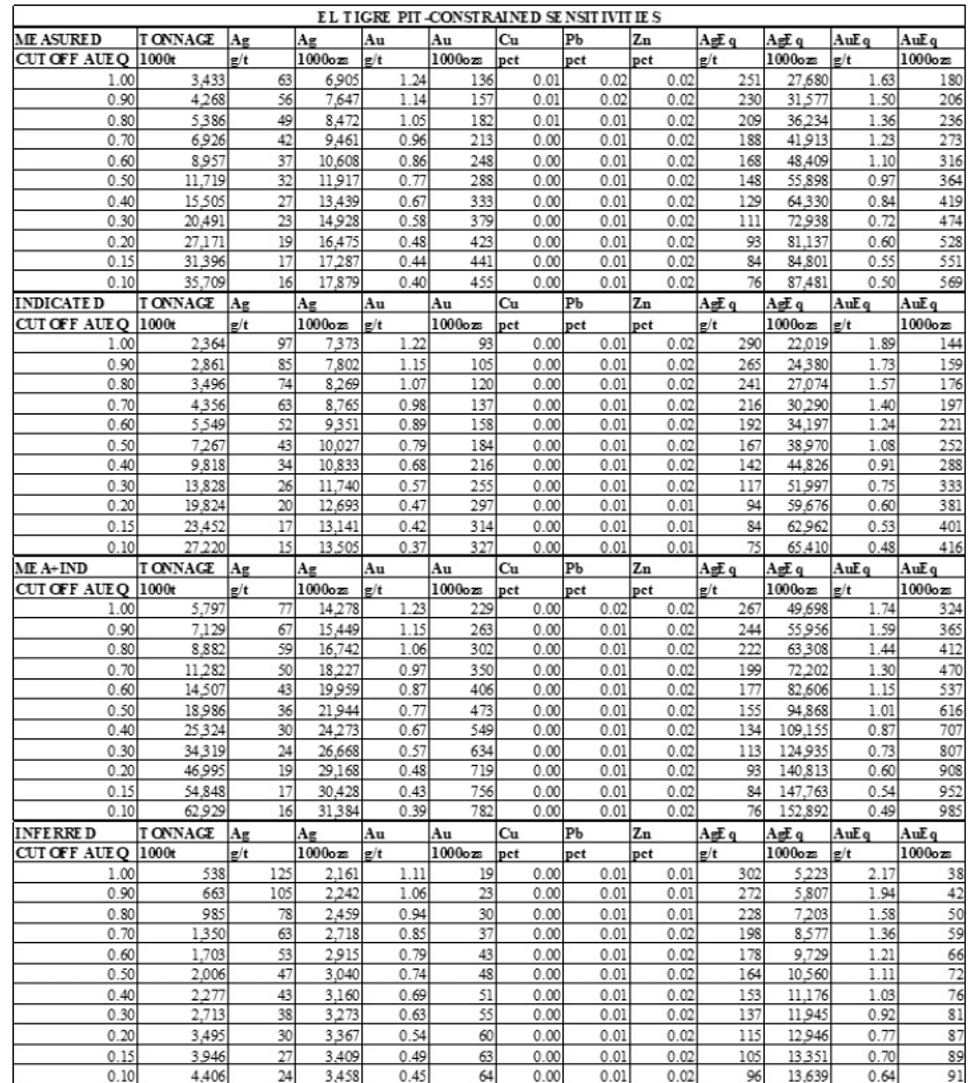

Desk 6: AuEq Reduce-off Sensitivities – ET Pit-Constrained Mineral Useful resource

Desk 6: AuEq Reduce-off Sensitivities – ET Pit-Constrained Mineral Useful resource

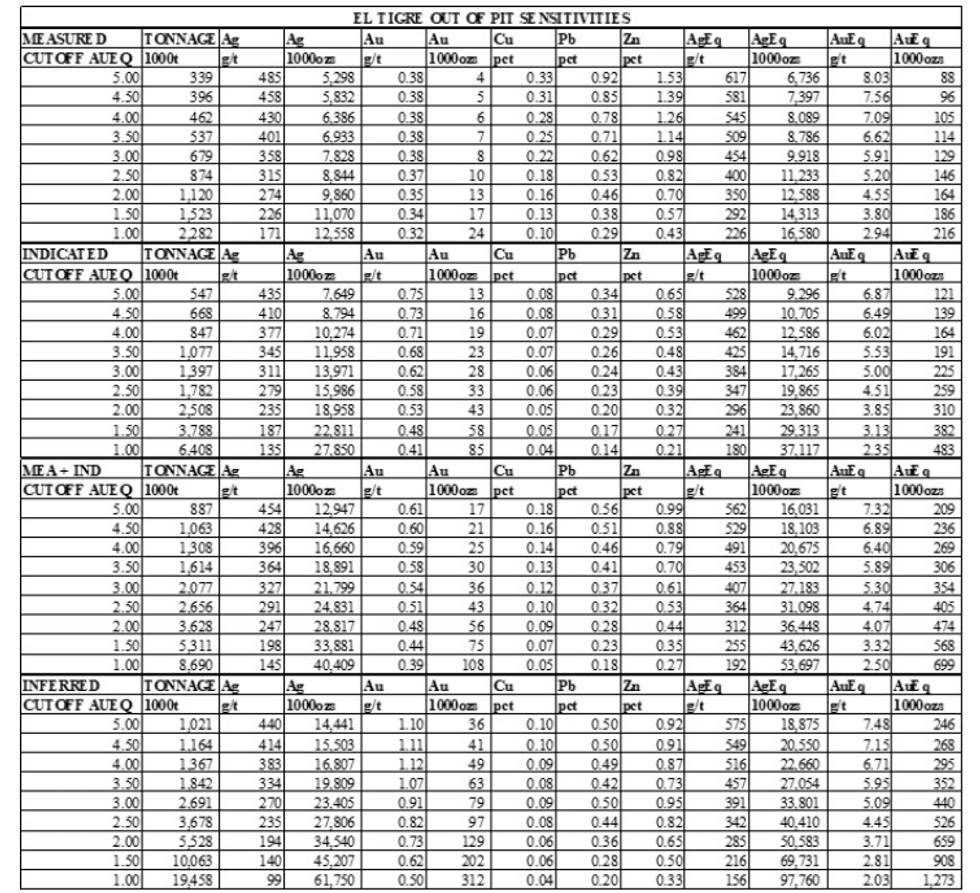

Desk 7: AuEq Reduce-off Sensitivities – ET Out-of-Pit Mineral Useful resource

Desk 7: AuEq Reduce-off Sensitivities – ET Out-of-Pit Mineral Useful resource

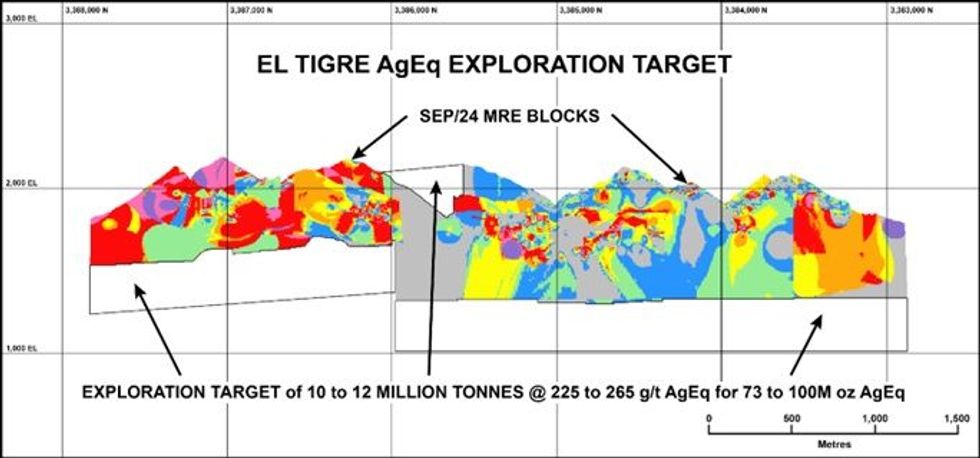

Exploration Potential

Exploration potential on the El Tigre Challenge is substantial with potential areas for exploration each down dip and alongside strike with the disclosed Exploration Goal establishing 10 to 12 million tonnes at 225 to 265 g/t AgEq for 73 to 100 Moz AgEq.

Determine 3-Exploration Potential launched October 2024

Determine 3-Exploration Potential launched October 2024

Floor Rights Settlement

The Firm owns royalty-free, 100% of the 6,238 hectares land-package encompassing the footprint of proposed mining operation with no Ejido presence. As well as, the Firm controls 28,414 hectares of Concessions to conduct exploration alongside a 25 km strike size of the Sierra Madres.

Underground Preliminary Financial Evaluation

The Firm can even proceed to work on this substantial, permitted underground Mineral Useful resource Estimate and advance this in direction of a Preliminary Financial Evaluation by H1-2025. The Measured and Indicated Out-of-Pit Mineral Useful resource at El Tigre is 44 Moz AgEq grading 255 g/t AgEq contained in 5.3 Mt and the Inferred Mineral Useful resource is 70 Moz AgEq grading 216 g/t AgEq contained in 10.1 Mt.

Certified Individuals

Mineral Useful resource Estimate: Dave Duncan P. Geo. VP Exploration of Silver Tiger, Charles Spath P.Geo., VP of Technical Companies of Silver Tiger, and Fred Brown, P.Geo RM-SME Senior Affiliate Geologist of P&E Mining Consultants, and Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants are the Certified Individuals as outlined beneath Nationwide Instrument 43-101. All Certified Individuals have reviewed and accredited the scientific and technical data on this press launch.

Preliminary Feasibility Examine: Andrew Bradfield P. Eng of P&E Mining Consultants, Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants and David J. Salari, P. Eng. of D.E.N.M. Engineering Ltd are the Certified Individuals as outlined beneath Nationwide Instrument 43-101. All Certified Individuals have reviewed and accredited the scientific and technical data on this press launch.

A Technical Report is being ready on the Preliminary Feasibility Examine in accordance with Nationwide Instrument 43-101 (“NI-43-101”), and might be obtainable on the Firm’s web site and SEDAR inside 45 days of the date of this information launch. The efficient date of this Preliminary Feasibility Examine is October 22, 2024.

VRIFY Slide Deck and 3D Presentation – Silver Tiger’s El Tigre Challenge

VRIFY is a platform being utilized by corporations to speak with traders utilizing 360° digital excursions of distant mining belongings, 3D fashions and interactive displays. VRIFY could be accessed by web site and with the VRIFY iOS and Android apps.

Entry the Silver Tiger Metals Inc. Firm Profile on VRIFY at: https://vrify.com

The VRIFY Slide Deck and 3D Presentation for Silver Tiger Metals Inc. could be considered at: https://vrify.com/discover/decks/492 and on the Company’s web site at: www.silvertigermetals.com.

About Silver Tiger and the El Tigre Historic Mine District

Silver Tiger Metals Inc. is a Canadian firm whose administration has greater than 25 years’ expertise discovering, financing and constructing giant epithermal silver initiatives in Mexico. Silver Tiger’s 100% owned 28,414 hectare Historic El Tigre Mining District is situated in Sonora, Mexico. Principled environmental, social and governance practices are core priorities at Silver Tiger.

The El Tigre historic mine district is situated in Sonora, Mexico and lies on the northern finish of the Sierra Madre silver and gold belt which hosts many epithermal silver and gold deposits, together with Dolores, Santa Elena and Las Chispas on the northern finish. In 1896, gold was first found on the property within the Gold Hill space and mining began with the Brown Shaft in 1903. The main target quickly modified to mining high-grade silver veins within the space with manufacturing coming from 3 parallel veins the El Tigre Vein, the Seitz Kelley Vein and the Sooy Vein. Underground mining on the center El Tigre Vein prolonged 1,450 metres alongside strike and was mined on 14 ranges to a depth of roughly 450 metres. The Seitz Kelley Vein was mined alongside strike for 1 kilometre to a depth of roughly 200 metres. The Sooy Vein was solely mined alongside strike for 250 metres to a depth of roughly 150 metres. Mining abruptly stopped on all 3 of those veins when the value of silver collapsed to lower than 20¢ per ounce with the onset of the Nice Melancholy. By the point the mine closed in 1930, it’s reported to have produced a complete of 353,000 ounces of gold and 67.4 million ounces of silver from 1.87 million tons (Craig, 2012). The typical grade mined throughout this era was over 2 kilograms silver equal per ton.

For additional data, please contact:

Glenn Jessome

President and CEO

902 492 0298

jessome@silvertigermetals.com

CAUTIONARY STATEMENT:

Neither TSX Enterprise Change nor its Regulation Companies Supplier (as that time period is outlined within the insurance policies of the TSX Enterprise Change) accepts accountability for the adequacy or accuracy of this information launch.

This Information Launch contains sure “forward-looking statements”. All statements aside from statements of historic truth included on this launch, together with, with out limitation, statements relating to potential mineralization, Mineral Sources and Reserves, the flexibility to transform Inferred Mineral Sources to Indicated Mineral Sources, the flexibility to finish future drilling packages and infill sampling, the flexibility to increase Mineral Useful resource blocks, the similarity of mineralization at El Tigre to Delores, Santa Elena and Chispas, exploration outcomes, and future plans and targets of Silver Tiger, are forward-looking statements that contain numerous dangers and uncertainties. Ahead-looking statements are ceaselessly characterised by phrases resembling “might”, “is predicted to”, “anticipates”, “estimates”, “intends”, “plans”, “projection”, “may”, “imaginative and prescient”, “targets”, “goal” and “outlook” and different related phrases. Though Silver Tiger believes the expectations expressed in such forward-looking statements are based mostly on cheap assumptions, there could be no assurance that such statements will show to be correct and precise outcomes and future occasions may differ materially from these anticipated in such statements. Necessary elements that might trigger precise outcomes to vary materially from Silver Tiger’s expectations embrace dangers and uncertainties associated to exploration, improvement, operations, commodity costs and international monetary volatility, danger and uncertainties of working in a overseas jurisdiction in addition to further dangers described on occasion within the filings made by Silver Tiger with securities regulators.