Prior to now month, the S&P 500 and Nasdaq have loved strong beneficial properties, with international markets largely on track to finish September within the inexperienced.

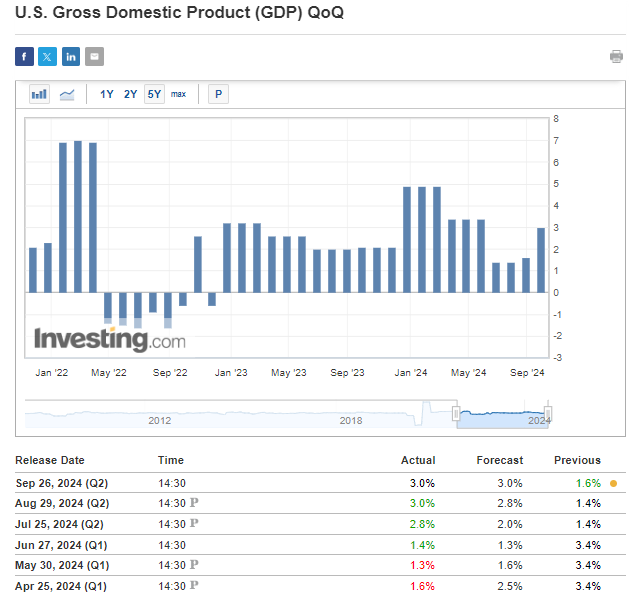

The long-term uptrend, which has been constructing for practically two years, lately picked up momentum because of the Federal Reserve.

With a daring 50 foundation level price reduce, the Fed kicked off what many anticipate to be a continued cycle of financial easing.

Markets are already anticipating one other price reduce on the subsequent assembly.

Importantly, current financial information exhibits no indicators of a looming recession, suggesting these price cuts aren’t a rescue try however somewhat a calculated transfer to stimulate development.

The Folks’s Financial institution of China additionally contributed to the constructive sentiment by reducing rates of interest, unlocking over $140 billion in lending capability to assist obtain its 5% development goal for the yr.

As markets look to finish the week on a excessive, let’s check out how the technical image is shaping for key indexes.

S&P 500: Pullback within the Offing?

The S&P 500 has been a beacon of energy, lately pushing previous its earlier all-time highs.

This breakout indicators strong market demand, pushed largely by expectations of additional price cuts and favorable financial situations.

From a technical perspective, this transfer has firmly established 5,720 factors as a essential assist stage.

If the present pullback extends, this zone might act as the primary line of protection for the bulls, providing a possibility for merchants to re-enter the market.

Past 5,720 factors, a deeper correction might goal the 5,660 stage, the place the upward trendline intersects.

This convergence of assist ranges means that any draw back will probably be restricted, permitting the broader uptrend to stay intact.

On the upside, the spherical variety of 5,900 factors represents the subsequent vital resistance stage.

If bullish momentum continues, the market might make a swift transfer towards this psychological barrier, setting the stage for additional beneficial properties.

The bulls have clear targets forward, with each technical indicators and sentiment favoring continued upside.

Nasdaq Eyes New Peaks

The Nasdaq, whereas barely trailing the S&P 500, has exhibited indicators of energy. The index lately broke via a key resistance stage of round 18,000 factors, a sign that momentum is constructing.

This breakout above a serious psychological stage marks a pivotal second for the index, because it opens the trail towards a retest of the all-time excessive close to 18,600 factors.

From a technical perspective, the NASDAQ’s subsequent goal is obvious—attacking this earlier peak.

If a pullback happens earlier than the Nasdaq hits 18,600, merchants ought to look ahead to assist on the 18,000 stage, which beforehand acted as resistance.

This zone now serves as a key inflection level for each short-term merchants and long-term traders.

Ought to the the index breakthrough 18,600, the subsequent logical goal for the bulls can be 19,000 factors.

A sustained rally towards 19,000 would additional reinforce the uptrend, with technical indicators corresponding to RSI and transferring averages signaling continued bullish momentum.

DAX Surges with Practically Vertical Good points

The German DAX leads the pack this month with a 3.34% return, reflecting near-vertical beneficial properties after breaking above 19,000 factors.

Within the occasion of a shallow correction, assist is anticipated across the earlier highs of 18,900 to 19,000 factors, maintaining the bullish momentum intact.

***

Disclaimer: This text is written for informational functions solely. It isn’t meant to encourage the acquisition of property in any approach, nor does it represent a solicitation, supply, advice or suggestion to take a position. I wish to remind you that every one property are evaluated from a number of views and are extremely dangerous, so any funding choice and the related threat is on the investor’s personal threat. We additionally don’t present any funding advisory companies. We’ll by no means contact you to supply funding or advisory companies.

Associated Articles

US Inventory Market Reveals Resilience Amid Blended Indicators from E-Mini Indexes

Chinaâs Tech Shares Surge: What High Buyers Know That You Donât