I began my funding profession by studying each investing article I might discover, speaking to others and writing software program to find out the very best property to purchase. I made a decision a C (D?) Class multifamily property was the most suitable choice based mostly on my analysis. Right here’s why:

- The associated fee per door was comparatively low.

- The (paper) money circulate was glorious.

- If one unit had been empty, I’d nonetheless have sufficient lease from the opposite three to cowl my mortgage.

- The property worth was inside my worth vary.

- It was shut sufficient to the place I lived so I might do many of the work.

- The lease for 2 items was city-subsidized, so I assumed the earnings from these could be assured.

So, with a good friend, I purchased my first property.

How Did It Go?

It was a nightmare. I made the error of shopping for a property assuming the tenants would carry out. They didn’t. I quickly discovered:

- The town assured a portion of the lease (about 80%), however the tenant by no means paid their 20%. I talked to an skilled investor, and he informed me this was widespread for many backed tenants. He advised I used to be higher off conserving the nonperforming tenants than evicting them as a result of the alternative tenants would probably behave the identical manner.

- The tenants stay cash-based lives. They had been paid each Friday, cashed their checks, and partied. They usually mentioned they didn’t have the cash to pay lease. From speaking to skilled traders, I discovered that is widespread with cash-based tenants. Evicting them would take time and money, and the following tenants would probably be no higher. So, this was not an possibility.

- I found that the earlier proprietor provided a big low cost if the lease was paid in money. So on Saturday mornings, I went door to door, accumulating the lease and providing the same low cost. The realm was not protected, and I used to be at all times involved about being robbed.

- Nearly each different month, a tenant skipped out. After they left, the situation of those items was unhealthy, and it took vital money and time to make them rentable. The tenants had no considerations about damaging the items as a result of there could be no option to accumulate even when I acquired a judgment towards them.

I discovered that irrespective of how cheap or good a property seems on paper, as a landlord, you rely on the tenant’s efficiency. So, the property sort doesn’t matter; what issues is having dependable tenants: somebody who stays a few years, pays the lease on schedule, and takes excellent care of the property.

What My Analysis Revealed

After I began our investor providers enterprise in 2005, I spent most of my time researching tenant segments for the primary few months. Based mostly on my analysis, I positioned a number of subdivisions the place the common tenant keep was over 5 years. I then decided the widespread traits of those properties.

Nevertheless, as an engineer, I wanted to validate my analysis outcomes, since my future enterprise would depend on tenant efficiency. To verify my findings, I requested a number of property managers this query: “In case your purpose was to have tenants who stayed for a few years, paid lease on time, and took care of the property, what properties would you purchase?”

Most property managers directed me to the identical varieties of properties as my analysis. I used to be assured I had the suitable section.

The tenant defines the property to purchase

Over time, we’ve studied our goal tenant demographic: households with elementary school-aged kids and a gross family earnings (right this moment) between $60,000 and $85,000 per yr.

A normal description of the properties that appeal to this section is:

- Kind: Single-family

- Configuration: Two-plus bedrooms, two-plus baths, two-plus automotive storage, 1,100 to 2,400 SF, one or two tales, lot dimension 3,000 SF to six,000 SF.

- Lease vary: $1,900/month to $2,400/month

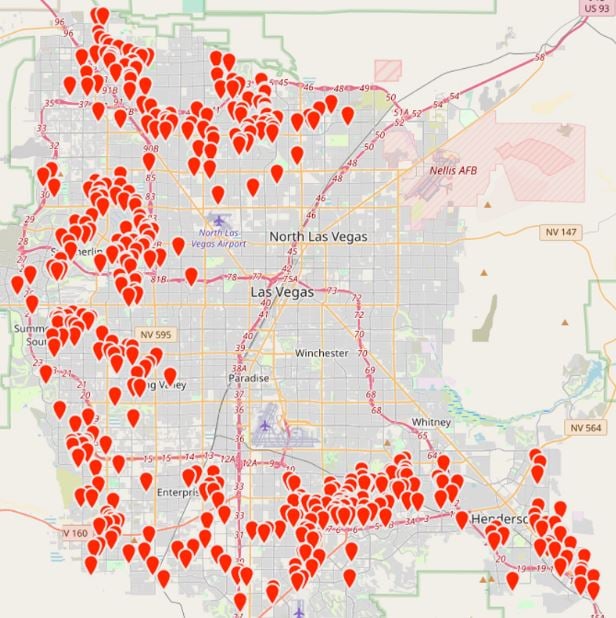

- Location: The map reveals the final areas.

Our shift from a property-focused search to looking for properties that match the housing necessities of our goal tenant section has labored extraordinarily nicely. Our common tenant keep is over 5 years; we’ve had seven evictions in 16-plus years.

Lesson Realized

In case your purpose is monetary independence, the property sort will not be related. What issues is the tenant who occupies the property. So, discover a tenant section with a excessive focus of dependable folks, decide what and the place they lease right this moment, and purchase comparable properties. Neglect about guru dogma.

Discover monetary freedom by means of leases

Should you’re contemplating utilizing rental properties to construct wealth, this ebook is a must-read. With almost 400 pages of in-depth recommendation for constructing wealth by means of rental properties, The Ebook on Rental Property Investing imparts the sensible and thrilling methods that traders use to construct money circulate and wealth.

Observe By BiggerPockets: These are opinions written by the creator and don’t essentially symbolize the opinions of BiggerPockets.

-logo-1200x675.jpg?w=150&resize=150,150&ssl=1)