As of November 7, 2024, B2Gold had accomplished 25,126 m of drilling over 68 drill holes on the Goose Challenge, together with 14,480 m over 40 drill holes on the Umwelt deposit, 3,899 m over 14 drill holes on the Llama deposit space, 6,610 m over 13 exploration goal drill holes, and 137 m over one metallurgical gap on the Goose Essential deposit. Vital drill gap places from 2024 are proven on the map in Determine 1.

Goose Challenge Drill Outcomes Highlights

- Exploration drilling intersected high-grade mineralization 1,000 m west and down plunge of the Goose Essential deposit on the Goose Challenge’s Nuvuyak deposit

- Drill gap 24GSE-683Z1 returned 6.39 grams per tonne (“g/t”) gold over 28.80 m from 982.20 m, together with a higher-grade interval of 23.49 g/t gold over 6.45 m and 4.66 g/t gold over 20.94 m from 1,037.16 m, together with 8.60 g/t gold over 9.62 m; and

- This outcome demonstrates the continuity of high-grade zones throughout the Nuvuyak deposit by extending high-grade gold mineralization roughly 150 m to the north-northwest.

- Exploration drilling additionally intersected high-grade mineralization on the Mammoth goal 450 m up plunge of the Nuvuyak deposit in direction of the Goose Essential deposit

- Mammoth drill gap 24GSE-687Z1 returned 17.45 g/t gold over 10.96 m from 837.14 m, together with a higher-grade interval of 68.61 g/t gold over 2.51 m;

- Mammoth drilling examined down plunge of the fold between the Nuvuyak deposit and the Hook goal; and

- This outcome demonstrates that the Nuvuyak and Mammoth zones have sturdy potential for future underground mining.

- The Nuvuyak deposit and Mammoth goal should not included within the current Goose Challenge mine plan; these exploration outcomes reveal potential to additional enhance Mineral Assets and lengthen the mine life on the Goose Challenge

- Drill outcomes for infill and mine improvement at the Goose Challenge’s Umwelt deposit verify the continuity of high-grade gold mineralization, with a number of drill holes returning intercepts with larger gold grades and widths than predicted by the prevailing mineral useful resource mannequin

- Drill gap 24GSE-671 returned 27.28 g/t gold over 11.10 m from 457.80 m;

- Drill gap 24GSE-675 returned 19.63 g/t gold over 15.95 m from 389.85 m;

- Drill gap 24GSE-677Z3 returned 9.27 g/t gold over 13.58 m from 664.25 m;

- Drill gap 24GSE-681 returned 11.18 g/t gold over 15.50 m from 779.45 m;

- Drill gap 24GSE-684B returned 29.49 g/t gold over 22.79 m from 332.25 m; and

- Drill gap 24GSE-685 returned 10.51 g/t gold over 21.45 m from 306.00 m.

- Exploration drilling intersected high-grade gold mineralization 530 m down plunge from the estimated open pit boundary on the Goose Challenge’s Llama deposit

- Drill gap 24GSE-663 returned 14.34 g/t gold over 27.95 m from 406.05 m, together with a higher-grade interval of 54.17 g/t gold over 6.00 m and 205.00 g/t gold over 0.80 m, at a vertical depth of 370 m, which examined an space of restricted drilling 530 m down plunge from the Llama open pit; and

- This outcome demonstrates the down plunge continuity of gold grades and widths of those mineralized constructions, and the Llama deposit stays open at depth.

Determine 1. Goose Challenge Drill Gap Areas .

Determine 1 is offered at https://www.globenewswire.com/NewsRoom/AttachmentNg/ed2d9455-caf1-48af-b959-515f573c3805

Goose Challenge Exploration

The Goose Challenge consists of 5 recognized deposits with current mineral assets, Umwelt, Llama, Goose, Echo and Nuvuyak, which happen alongside a strike size of eight kilometers (“km”). The Firm believes that exploration upside exists on all recognized deposits which might be open at depth, in addition to a number of zones of curiosity that stay comparatively untested throughout the footprint of the favorable host banded iron formation (“BIF”) stratigraphy. At Goose, the BIF extends over 10 km in a folded package deal as much as 1.5 km broad hosted inside a northwesterly to westerly putting, steeply-dipping belt of folded, clastic sediments. Ongoing structural and knowledge evaluation has shaped the premise of the 2024 exploration season that has drill examined a number of zones of curiosity.

The Umwelt deposit is the one largest deposit on the Goose Challenge and might be a big contributor to preliminary manufacturing. On the Umwelt deposit, 2024 drilling completed with 14,480 m accomplished over 40 drill holes with gold assays obtained for 34 of the 40 drill holes. Implementation of directional core drilling expertise (Devico) has added accuracy and price effectivity to this system of deep and strategic drilling. Drilling was designed to extend confidence within the geometry and continuity of high-grade mineralization under the deliberate open pits. Drilling has proven the intersection of steeply dipping brittle-ductile excessive pressure zones and fold-thickened BIF is the first management on gold mineralization.

Vital 2024 drill outcomes from the Umwelt deposit on the Goose Challenge embody:

| Gap ID | From (m) | To (m) | Size (m) | Au (g/t) | Au (g/t) Capped 1 |

| 24GSE671 | 457.80 | 468.90 | 11.10 | 27.28 | 21.14 |

| Incl | 464.20 | 468.30 | 4.10 | 50.97 | 34.36 |

| Incl | 465.00 | 466.00 | 1.00 | 112.00 | 50.00 |

| and | 478.85 | 506.95 | 28.10 | 4.45 | 4.28 |

| Incl | 490.35 | 496.10 | 5.75 | 14.33 | 13.50 |

| 24GSE673Z1 | 925.00 | 939.20 | 14.20 | 7.32 | 7.11 |

| Incl | 936.25 | 939.20 | 2.95 | 23.57 | 22.57 |

| 24GSE675 | 389.85 | 405.80 | 15.95 | 19.63 | 16.65 |

| Incl | 390.80 | 396.71 | 5.91 | 32.76 | N/A |

| Incl | 401.34 | 404.84 | 3.50 | 26.25 | 26.25 |

| 24GSE677Z3 | 664.25 | 677.83 | 13.58 | 9.27 | 7.79 |

| Incl | 667.45 | 669.70 | 2.25 | 42.72 | 33.79 |

| 24GSE680Z1 | 889.93 | 911.37 | 21.44 | 7.58 | 6.96 |

| Incl | 893.15 | 897.35 | 4.20 | 22.94 | 19.78 |

| Incl | 905.90 | 910.70 | 4.80 | 9.40 | 9.40 |

| 24GSE681 | 779.45 | 794.95 | 15.50 | 11.18 | 10.62 |

| Incl | 779.45 | 780.15 | 0.70 | 26.10 | 26.10 |

| Incl | 790.05 | 792.80 | 2.75 | 33.36 | 30.22 |

| 24GSE684B | 332.25 | 355.04 | 22.79 | 29.49 | 13.68 |

| Incl | 332.25 | 333.50 | 0.70 | 301.00 | 50.00 |

| Incl | 343.35 | 346.65 | 3.30 | 83.86 | 40.62 |

| Incl | 352.00 | 355.04 | 3.04 | 45.67 | 31.88 |

| 24GSE685 | 306.00 | 327.45 | 21.45 | 10.51 | 6.00 |

| Incl | 319.80 | 325.30 | 5.50 | 34.22 | 16.66 |

| Incl | 323.25 | 325.30 | 0.70 | 188.00 | 50.00 |

| 24GSE685Z1 | 310.90 | 328.05 | 17.15 | 9.49 | 9.49 |

| Incl | 319.95 | 324.70 | 4.75 | 27.24 | 27.24 |

Notes:

1. Capped at 50 g/t gold

2. Drill intercepts are perpendicular to the zones so true widths are very related to reported drill lengths

On the Llama deposit, which outcrops 1,500 m north of the Umwelt deposit, a complete of 1,428 m was drilled over seven drill holes (together with three deserted holes) in areas throughout the Inferred Mineral Useful resource boundary under the open pit. Drill gap 24GSE-668B returned 19.65 g/t gold over 8.20 m from 158.75 m, together with a higher-grade interval of 37.13 g/t gold over 4.00 m.

As well as, a complete of two,471 m over seven drill holes (with two at the moment in progress) are testing areas down plunge from the deliberate Llama open pit. Drill gap 24GSE-663, which examined an space of restricted drilling 530 m down plunge from the deliberate Llama open pit, returned 14.34 g/t gold over 27.95 m from 406.05 m at a vertical depth of 370 m, together with higher-grade intervals of 54.17 g/t gold over 6.00 m and 205.00 g/t gold over 0.80 m. The drill outcome demonstrates the down plunge continuity of gold grades and widths of those mineralized constructions, and the Llama deposit continues to stay open at depth. As well as, two drill holes totaling 1,241 m had been accomplished 1,440 m down dip from Llama within the Llama Extension space, with assays pending. Yet one more drill gap might be accomplished in 2024 on the Llama Extension space.

Vital 2024 drill outcomes from the Llama deposit on the Goose Challenge embody:

| Gap ID | From (m) | To (m) | Size (m) | Au (g/t) | Au (g/t) Capped 1 |

| 24GSE663 | 406.05 | 434.00 | 27.95 | 14.34 | 9.91 |

| Incl | 426.50 | 432.50 | 6.00 | 54.17 | 33.50 |

| Incl | 429.35 | 430.15 | 0.80 | 205.00 | 50.00 |

| 24GSE668B | 158.75 | 166.95 | 8.20 | 19.65 | 13.50 |

| Incl | 160.75 | 164.75 | 4.00 | 37.13 | 24.53 |

| Incl | 163.00 | 163.80 | 0.80 | 113.00 | 50.00 |

Notes:

1. Capped at 50 g/t gold

2. Drill intercepts are perpendicular to the zones so true widths are very related to reported drill lengths

Goose Challenge Exploration Drilling

A complete of 6,610 m over 13 drill holes have been drilled at Goose Challenge exploration targets together with Nuvuyak, Mammoth, Stovepipe, Muskox, Wing, Boomerang, Goose Neck South, Hook and Slingshot. Drilling is ongoing on the Mammoth and Hook targets. Outcomes have been obtained for Nuvuyak, Mammoth and Wing, and are pending for the opposite targets.

Highlights up to now embody encouraging outcomes at Nuvuyak and Mammoth. Nuvuyak drill gap 24GSE-683Z1 returned 6.39 g/t gold over 28.80 m from 982.20 m, together with a higher-grade interval of 23.49 g/t gold over 6.45 m and 4.66 g/t gold over 20.94 m from 1,037.16 m, together with 8.60 g/t gold over 9.62 m. Nuvuyak is situated roughly 500 m west and 1,000 m down plunge of the Goose Essential deposit and demonstrates the continuity of high-grade zones throughout the Nuvuyak deposit by extending high-grade gold mineralization roughly 150 m to the north-northwest. The prevailing Inferred Mineral Useful resource estimate at Nuvuyak is 2.42 million tonnes grading 7.50 g/t gold for a complete of 583,000 ounces of gold.

Mammoth drill gap 24GSE-687Z1 returned 17.45 g/t gold over 10.96 m from 837.14 m, together with a higher-grade interval of 68.61 g/t gold over 2.51 m. This encouraging intercept, situated 450 m up plunge of Nuvuyak in direction of the Goose Essential deposit, exhibits the Nuvuyak and Mammoth zones have sturdy potential for future underground mining.

Vital 2024 drill outcomes from the Goose Challenge exploration drilling embody:

| Gap ID | Space | From (m) | To (m) | Size (m) | Au (g/t) | Au (g/t) Capped 1 |

| 24GSE683Z1 | Nuvuyak | 982.20 | 1,011.00 | 28.80 | 6.39 | 6.17 |

| Incl | Nuvuyak | 1,004.55 | 1,011.00 | 6.45 | 23.49 | 22.49 |

| and | Nuvuyak | 1,037.16 | 1,058.10 | 20.94 | 4.66 | 4.66 |

| Incl | Nuvuyak | 1,037.16 | 1,046.78 | 9.62 | 8.60 | 8.60 |

| 24GSE687Z1 | Mammoth | 820.40 | 823.45 | 3.05 | 8.32 | 8.32 |

| and | Mammoth | 837.14 | 848.10 | 10.96 | 17.45 | 8.57 |

| Incl | Mammoth | 837.65 | 840.16 | 2.51 | 68.61 | 29.83 |

Notes:

1. Capped at 5 0 g/t gold

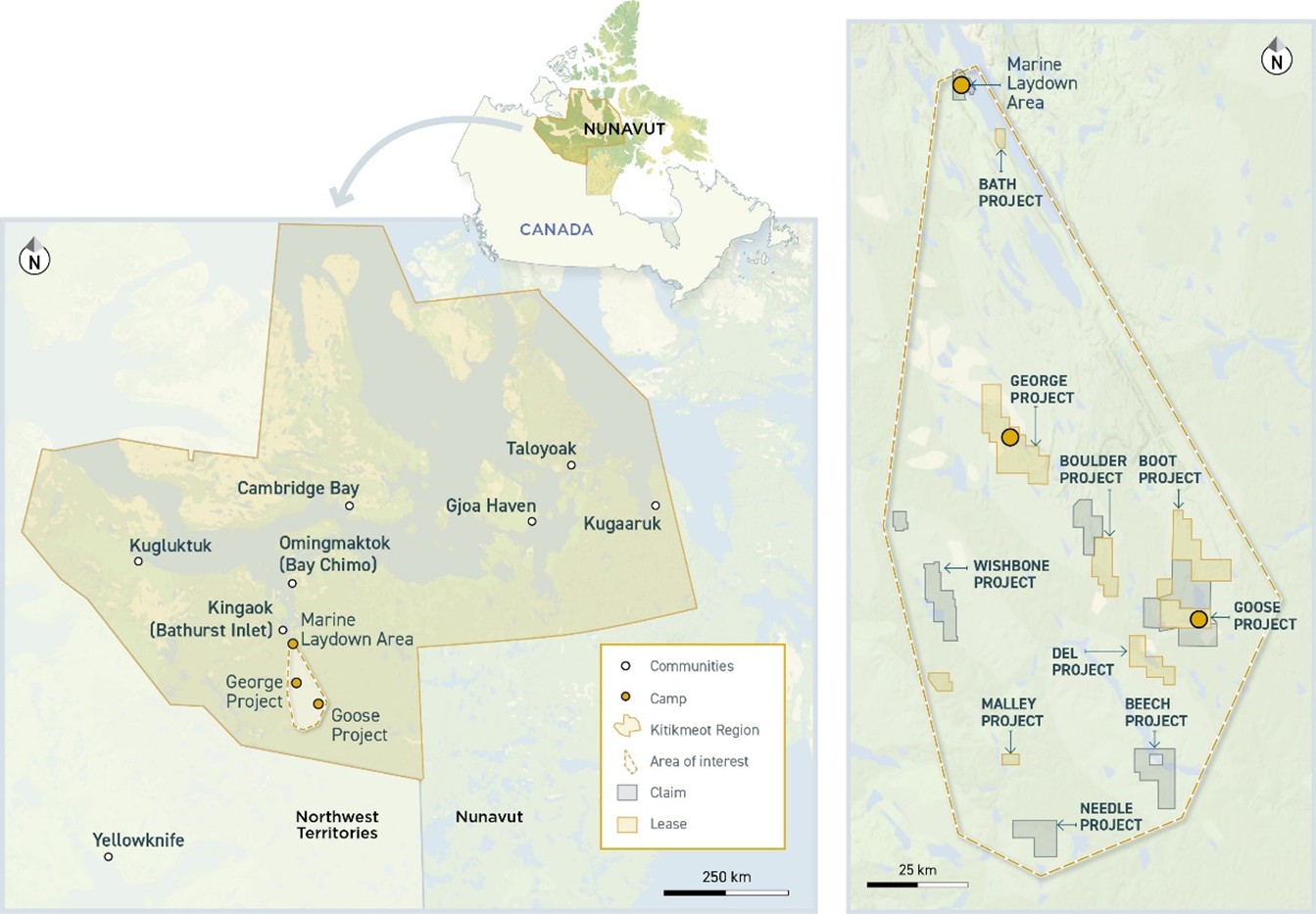

Again River Gold District 2024 Floor Exploration Program

Throughout 2024, regional goal definition was supplemented by way of an built-in floor exploration program comprising of mapping, prospecting, geophysics and the gathering of 1,798 until samples, 35 trenches (216 samples) and 285 rock samples in six properties together with Boot, Boulder, Del, BB13, Needle and Beech. See Determine 2 for an summary of the Again River Gold District properties.

Determine 2. Again River Gold District Properties.

Determine 2 is offered at https://www.globenewswire.com/NewsRoom/AttachmentNg/b05478a1-4c28-4e98-903e-5b71994fc042

Geophysics consisted of floor Induced Polarization (3D-IP) in Boot and Boulder and heli-magnetics in BB13, Needle and Beech in addition to re-processing of outdated geophysical knowledge. As well as, a BHTEM (borehole transient electromagnetics) survey was accomplished over 3,800 m throughout 5 drill holes together with three on the Umwelt deposit and one every at Nuvuyak and Mammoth. Outcomes are being processed.

This work has generated new regional and near-mine targets that might be additional evaluated and drill examined in 2025.

High quality Assurance/High quality Management on Pattern Assortment and Assaying

The first laboratory utilized for the Again River Gold District drilling program in 2024 is ALS laboratory in North Vancouver, Canada. Core samples are ready on the ALS preparation facility in Yellowknife with consultant pulp samples despatched to the ALS North Vancouver laboratory for gold evaluation. Gold is analyzed by a fireplace assay/atomic absorption spectrometry (FA/AAS) end utilizing a 50 gram subsample of the coin pulp. FAs had been completed with AAS, and samples with larger grades that exceeded the utmost detection restrict of AAS obtained a supplemental gravimetric (“GRAV”) end. All samples over 3,000 components per billion are analyzed by FA/GRAV utilizing a 50 gram subsample of the coin pulp. Bureau Veritas Minerals (BV) in Vancouver, Canada, is the umpire laboratory.

High quality assurance and high quality management procedures embody the systematic insertion of blanks and requirements into the core pattern strings. The outcomes of the management samples are evaluated frequently with batches re-analyzed and/or resubmitted as wanted. All outcomes acknowledged on this announcement have handed B2Gold’s high quality assurance and high quality management protocols.

About B2Gold

B2Gold is a low-cost worldwide senior gold producer headquartered in Vancouver, Canada. Based in 2007, immediately, B2Gold has working gold mines in Mali, Namibia and the Philippines, the Goose Challenge below building in northern Canada and quite a few improvement and exploration tasks in numerous international locations together with Mali, Colombia and Finland. B2Gold forecasts complete consolidated gold manufacturing of between 800,000 and 870,000 ounces in 2024.

Certified Individuals

Andrew Brown, P.Geo., Vice President, Exploration, a professional particular person below NI 43-101, has authorized the scientific and technical data associated to exploration and mineral useful resource issues contained on this information launch.

ON BEHALF OF B2GOLD CORP.

“Clive T. Johnson”

President and Chief Government Officer

Supply: B2Gold Corp.

The Toronto Inventory Change and NYSE American LLC neither approve nor disapprove the data contained on this information launch.

Manufacturing outcomes and manufacturing steering introduced on this information launch replicate complete manufacturing on the mines B2Gold operates on a 100% mission foundation. Please see our Annual Info Type dated March 14, 2024 for a dialogue of our possession curiosity within the mines B2Gold operates.

This information launch contains sure “forward-looking data” and “forward-looking statements” (collectively “forward-looking statements”) throughout the which means of relevant Canadian and United States securities laws, together with: projections; outlook; steering; forecasts; estimates; and different statements relating to future or estimated monetary and operational efficiency, gold manufacturing and gross sales, revenues and money flows, and capital prices (sustaining and non-sustaining) and working prices, together with projected money working prices and AISC, and budgets on a consolidated and mine by mine foundation; future or estimated mine life, steel value assumptions, ore grades or sources, gold restoration charges, stripping ratios, throughput, ore processing; statements relating to anticipated exploration, drilling, improvement, building, allowing and different actions or achievements of B2Gold; and together with, with out limitation: remaining nicely positioned for continued sturdy operational and monetary efficiency in 2024; projected gold manufacturing, money working prices and AISC on a consolidated and mine by mine foundation in 2024; complete consolidated gold manufacturing of between 800,000 and 870,000 ounces (together with 20,000 attributable ounces from Calibre) in 2024, with money working prices of between $835 and $895 per ounce and AISC of between $1,420 and $1,480 per ounce; B2Gold’s continued prioritization of growing the Goose Challenge in a way that acknowledges Indigenous enter and issues and brings long-term socio-economic advantages to the realm; the Goose Challenge producing in extra of 310,000 ounces of gold per yr from 2026 to 2030; and the potential for first gold manufacturing within the second quarter of 2025 from the Goose Challenge. All statements on this information launch that handle occasions or developments that we count on to happen sooner or later are forward-looking statements. Ahead-looking statements are statements that aren’t historic info and are usually, though not at all times, recognized by phrases equivalent to “count on”, “plan”, “anticipate”, “mission”, “goal”, “potential”, “schedule”, “forecast”, “price range”, “estimate”, “intend” or “consider” and related expressions or their unfavourable connotations, or that occasions or situations “will”, “would”, “might”, “might”, “ought to” or “would possibly” happen. All such forward-looking statements are primarily based on the opinions and estimates of administration as of the date such statements are made.

Ahead-looking statements essentially contain assumptions, dangers and uncertainties, sure of that are past B2Gold’s management, together with dangers related to or associated to: the volatility of steel costs and B2Gold’s frequent shares; adjustments in tax legal guidelines; the hazards inherent in exploration, improvement and mining actions; the uncertainty of reserve and useful resource estimates; not attaining manufacturing, value or different estimates; precise manufacturing, improvement plans and prices differing materially from the estimates in B2Gold’s feasibility and different research; the power to acquire and keep any crucial permits, consents or authorizations required for mining actions; environmental rules or hazards and compliance with complicated rules related to mining actions; local weather change and local weather change rules; the power to switch mineral reserves and establish acquisition alternatives; the unknown liabilities of corporations acquired by B2Gold; the power to efficiently combine new acquisitions; fluctuations in alternate charges; the provision of financing; financing and debt actions, together with potential restrictions imposed on B2Gold’s operations in consequence thereof and the power to generate adequate money flows; operations in international and growing international locations and the compliance with international legal guidelines, together with these related to operations in Mali, Namibia, the Philippines and Colombia and together with dangers associated to adjustments in international legal guidelines and altering insurance policies associated to mining and native possession necessities or useful resource nationalization usually; distant operations and the provision of satisfactory infrastructure; fluctuations in value and availability of power and different inputs crucial for mining operations; shortages or value will increase in crucial gear, provides and labour; regulatory, political and nation dangers, together with native instability or acts of terrorism and the consequences thereof; the reliance upon contractors, third events and three way partnership companions; the dearth of sole decision-making authority associated to Filminera Assets Company, which owns the Masbate Challenge; challenges to title or floor rights; the dependence on key personnel and the power to draw and retain expert personnel; the danger of an uninsurable or uninsured loss; antagonistic local weather and climate situations; litigation threat; competitors with different mining corporations; neighborhood help for B2Gold’s operations, together with dangers associated to strikes and the halting of such operations every so often; conflicts with small scale miners; failures of data programs or data safety threats; the power to keep up satisfactory inner controls over monetary reporting as required by legislation, together with Part 404 of the Sarbanes-Oxley Act; compliance with anti-corruption legal guidelines, and sanctions or different related measures; social media and B2Gold’s status; dangers affecting Calibre having an affect on the worth of the Firm’s funding in Calibre, and potential dilution of our fairness curiosity in Calibre; in addition to different components recognized and as described in additional element below the heading “Danger Elements” in B2Gold’s most up-to-date Annual Info Type, B2Gold’s present Type 40-F Annual Report and B2Gold’s different filings with Canadian securities regulators and the U.S. Securities and Change Fee (the “SEC”), which can be seen at www.sedar.com and www.sec.gov, respectively (the “Web sites”). The listing is just not exhaustive of the components which will have an effect on B2Gold’s forward-looking statements.

B2Gold’s forward-looking statements are primarily based on the relevant assumptions and components administration considers cheap as of the date hereof, primarily based on the data out there to administration at such time. These assumptions and components embody, however should not restricted to, assumptions and components associated to B2Gold’s capacity to hold on present and future operations, together with: improvement and exploration actions; the timing, extent, length and financial viability of such operations, together with any mineral assets or reserves recognized thereby; the accuracy and reliability of estimates, projections, forecasts, research and assessments; B2Gold’s capacity to satisfy or obtain estimates, projections and forecasts; the provision and price of inputs; the value and marketplace for outputs, together with gold; international alternate charges; taxation ranges; the well timed receipt of crucial approvals or permits; the power to satisfy present and future obligations; the power to acquire well timed financing on cheap phrases when required; the present and future social, financial and political situations; and different assumptions and components usually related to the mining business.

B2Gold’s forward-looking statements are primarily based on the opinions and estimates of administration and replicate their present expectations relating to future occasions and working efficiency and communicate solely as of the date hereof. B2Gold doesn’t assume any obligation to replace forward-looking statements if circumstances or administration’s beliefs, expectations or opinions ought to change apart from as required by relevant legislation. There could be no assurance that forward-looking statements will show to be correct, and precise outcomes, efficiency or achievements might differ materially from these expressed in, or implied by, these forward-looking statements. Accordingly, no assurance could be on condition that any occasions anticipated by the forward-looking statements will transpire or happen, or if any of them do, what advantages or liabilities B2Gold will derive therefrom. For the explanations set forth above, undue reliance shouldn’t be positioned on forward-looking statements.

Cautionary Assertion Concerning Mineral Reserve and Useful resource Estimates

The disclosure on this information launch was ready in accordance with Canadian Nationwide Instrument 43-101, which differs considerably from the necessities of america Securities and Change Fee (“SEC”), and useful resource and reserve data contained or referenced on this information launch is probably not akin to related data disclosed by public corporations topic to the technical disclosure necessities of the SEC. Historic outcomes or feasibility fashions introduced herein should not ensures or expectations of future efficiency.

For extra data on B2Gold please go to the Firm web site at www.b2gold.com or contact: Michael McDonald VP, Investor Relations & Company Improvement +1 604-681-8371 investor@b2gold.com Cherry DeGeer Director, Company Communications +1 604-681-8371 investor@b2gold.com