Investor Perception

Tartana Minerals is a brand new copper producer producing robust money circulate, with a considerable exploration footprint in a tier 1 mining jurisdiction. Tartana Minerals is creating shareholder worth by means of funding in growing its present copper, zinc and gold assets and accelerating exploration of key tasks inside its extremely potential exploration portfolio. Tartana Minerals presents a compelling funding towards the backdrop of a powerful macroeconomic atmosphere for copper.

Overview

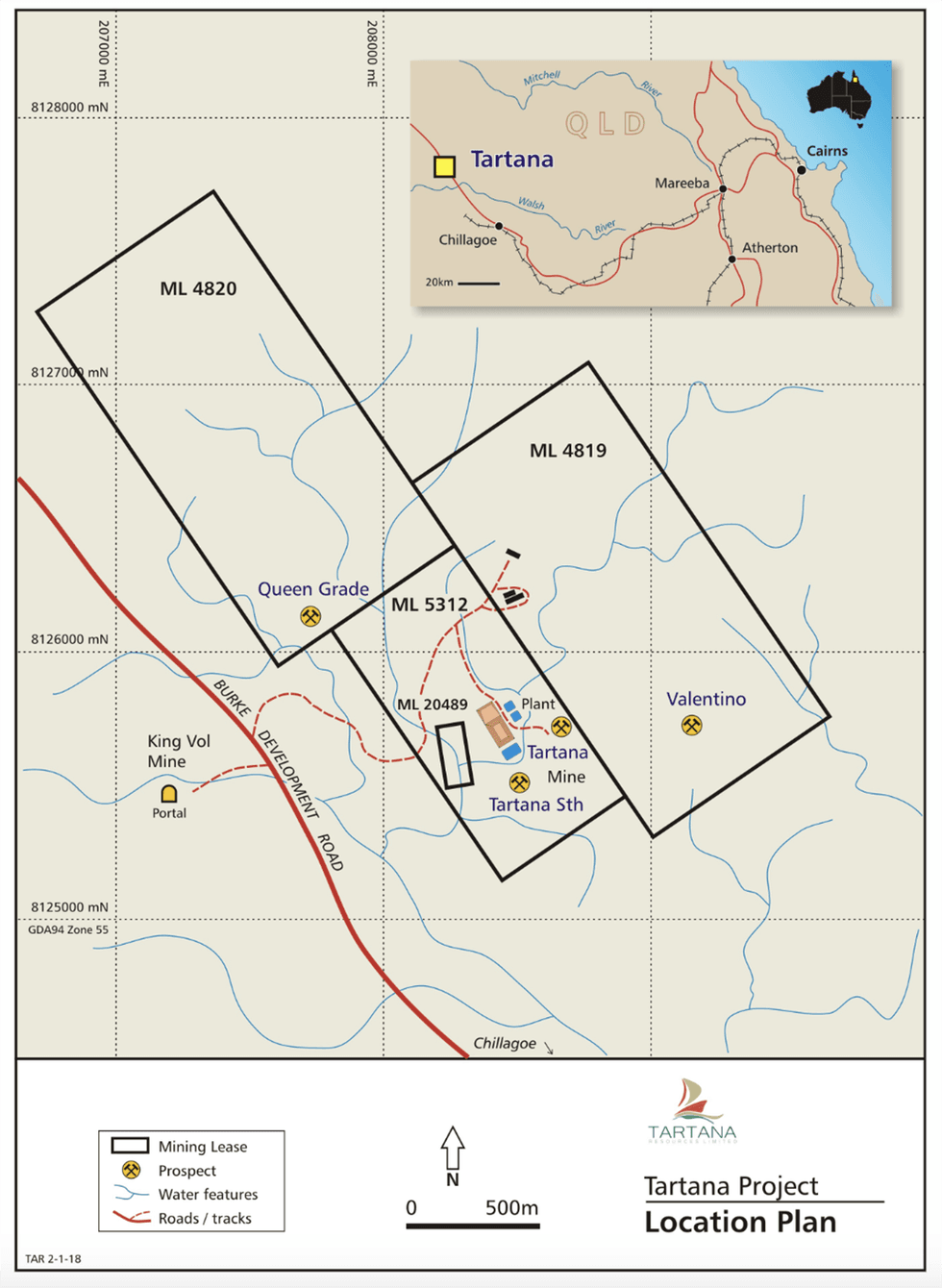

Tartana Minerals (ASX:TAT) is a copper, gold, silver and zinc, producer, explorer and developer in Far North Queensland. Its flagship undertaking is the one hundred pc owned Tartana copper and zinc undertaking which includes 4 mining leases situated north of Chillagoe. The corporate’s enterprise mannequin has concerned refurbishing an present heap leach – solvent extraction – crystallisation plant which is situated on the Tartana mining leases. The refurbishment and commissioning of this plant is now accomplished and the corporate is producing copper sulphate pentahydrate which is offered to offtaker, Kanins Worldwide. Copper sulphate is priced on a premium plus proportion of the LME copper value and gives buyers with leverage to anticipate growing copper costs.

The corporate, previously often called R3D Sources, modified its identify to Tartana Minerals in April 2024. Tartana Minerals is predicated in Sydney, Australia.

Tartana Minerals has reported the next assets:

- 45,000 contained copper at 0.45 % copper in mixed inferred and indicated assets within the Tartana open pit and northern oxide zone

- 39,000 tonnes of contained zinc at 5.29 % zinc in inferred assets within the Queen Grade undertaking, additionally situated on the Tartana mining leases, and

- 415 koz contained gold at 0.34 g/t in inferred assets at Mountain Maid – topic to a mining lease software.

These copper, zinc and gold assets stay open at depth and alongside strike and the corporate has designed drilling applications to develop these assets. Specifically, the copper mineralisation and probably the gold mineralisation have scope to be upgraded by means of ore sorting.

Nevertheless, the refurbished heap leach – solvent extraction – crystallisation plant utilises present copper within the ponds and the heaps and these copper sources might be replenished after we start mining from the open pit.

The primary and second shipments of copper sulphate have been offered in the course of the June 2024 quarter with additional shipments are at present being ready. The copper sulphate accommodates 25 % copper metallic and fee is predicated on the LME copper value for the previous month plus a premium. It is without doubt one of the few types of saleable copper the place the copper content material receives the complete LME value.

Sprinklers working on the decrease heap. Notice the presence of copper (blue).

Sprinklers working on the decrease heap. Notice the presence of copper (blue).

Exploration

Chillagoe area of Far North Queensland is very potential with the invention and improvement of plenty of key tasks over the previous few a long time together with Purple Dome (2.5 Moz gold), Mungana (1.2 Moz gold), and King Vol (250 kt zinc). These deposits happen alongside the Palmerville Fault in the same location to the Tartana Mining leases.

The mining leases at Tartana include copper, zinc and gold mineralisation however the firm additionally has important tasks that are each east and west of the Palmerville Fault. Within the west it has the Cardross and Mountain Maid copper-gold tasks and additional north it has the Beefwood undertaking. Mountain Maid has gold assets talked about above and that are open to the south and at depth whereas the corporate is finalising a maiden copper useful resource for the Cardross undertaking. The Beefwood undertaking includes a buried geophysical goal and floor sampling has recovered samples grading as much as 180 g/t Au with no obvious supply. Drilling is deliberate to check this goal within the present dry season.

Within the east of the Palmerville Fault, the corporate has the Bellevue/Dry River undertaking, the OK South undertaking and the Dimbulah Porphyry undertaking, all copper tasks with historic copper mines and prospects. Like many elements of Far North Queensland, historic exploration has not been systematic and thorough regardless of many promising expressions of floor mineralisation.

On the Nightflower undertaking, Tartana has upgraded its exploration goal after reviewing its earlier estimation, in mild of the current will increase within the antimony value. Nightflower is a high-grade silver-lead deposit with beforehand missed important antimony credit. Nightflower exploration goal consists of 2.75 Mt @ 364 g/t silver equal for 32 Moz silver equal to five.36 Mt @ 270 g/t silver equal for 47 Moz silver equal (the exploration goal is conceptual in nature solely and there’s no assure that additional exploration will outline a useful resource). Drilling is now being deliberate to check the goal and improve beforehand recognized mineralisation to JORC 2012 reporting requirements.

Tartana’s exploration group includes of skilled exploration geologists with supporting money circulate from their copper manufacturing, they anticipate to find a way drill essentially the most promising targets within the brief time period.

Sturdy Macroeconomic Atmosphere for Copper

General, the macroeconomic atmosphere for copper stays robust. The LME three-month copper value hit US$5.24/lb on Might 17, the best since March 7, 2022, pushed by a weaker US greenback, Chinese language property stimulus measures, and a brief squeeze on the Chicago Mercantile Alternate futures market.

Within the near-to-mid time period China’s demand for refined copper is anticipated to develop, on account of better-than-expected performances from key client segments, together with the ability grid, photo voltaic installations and electrical car and air con equipment gross sales. On the provision aspect the copper focus market is anticipated to stay in a major deficit as a result of estimated delay within the Cobre Panama mine restart however might be partially offset by the upper projected manufacturing from smelters in China. In consequence, we see additional demand development and provide tightening for the copper market as optimistic for base metallic equities who keep important leverage to growing costs.

Firm Highlights

- Tartana Minerals is producing copper sulphate pentahydrate from its heap leach – solvent extraction – crystallisation plant in Chillagoe with a one hundred pc offtake settlement with Kanins Worldwide.

- Copper sulphate is priced at a premium plus proportion of the LME copper value, offering publicity to the booming copper market

- With copper, zinc and gold assets in separate tasks and all inside granted or quickly to be granted mining leases, the corporate is investigating processing choices which might probably utilise obtainable infrastructure.

- Close to-term catalysts embody targetted drilling applications to extend the JORC useful resource and develop on metallurgical take a look at work, growing the useful resource grade and estimate

- With the copper sulphate plant absolutely commissioned and in manufacturing, the corporate is now accelerating its exploration actions. The corporate has a spread of prospects from superior brownfields tasks close to present historic mines to many prospects containing ‘ore grade’ floor mineralisation which haven’t been examined at depth.

- The corporate’s exploration portfolio consists of the Beefwood/Bulimba, Bellevue, Dimbulah, Cardross and Maid tasks. The exploration group is concentrated heading in the right direction technology, notably with the addition of important minerals inside its present tenure and elsewhere.

Administration Workforce

Jihad Malaeb – Non-executive Chairman

Jihad Malaeb is an skilled entrepreneur throughout plenty of industries, together with hospitality and building, in addition to having important expertise in mineral exploration and mining operations – each as an energetic investor and firm director. He at present owns and operates a portfolio of hospitality companies and actual property throughout Australia, which have been established over the previous 30 years. Malaeb was beforehand a non-executive director of Important Sources (ASX:CRR), the place he helped steer CRR by means of the previous few years as considered one of its largest shareholders and as a board member.

Dr Stephen Bartrop – Managing Director

Steve Bartrop’s skilled expertise spans greater than 30 years masking intervals in each the mining trade and monetary sector. With a geology background, Bartrop has labored in exploration, feasibility and analysis research and mining in a spread of commodities and in several elements of the world. Within the monetary sector, he has been concerned in analysis, company transactions and IPOs spanning greater than 20 years, together with senior roles at JPMorgan, Bankers Belief and Macquarie Equities.

Bartrop can be a director of Southwest Pacific Bauxite (HK), an organization creating a bauxite undertaking within the Solomon Islands and chairman of Breakaway Analysis.

Bruce Hills – Govt Director

Bruce Hills is an accountant and is at present an govt director of Breakaway Funding Group, which operates the Breakaway Non-public Fairness Rising Sources Fund. Hills is a director of plenty of unlisted corporations within the mining and monetary companies sectors together with The Threat Board and Stibium Australia. Hills has 35 years’ expertise within the monetary sector together with 20 years within the banking trade primarily within the areas of technique, finance and danger.

Dr Alistair Lewis – Non-executive Director

Dr Alistair Lewis is a profitable entrepreneur and extremely skilled medical physician with over 40 years’ expertise. For the previous 10 years Lewis has been concerned within the administration of mining and exploration corporations. In 2017, Lewis established Oosen Lewis Mining in North Queensland. He financed the aggregation of a considerable portfolio of gold, tin, tungsten and antimony property and instigated subsequent intensive exploration applications. These property now kind a part of the QSM portfolio.

Michael Thirnbeck – Impartial Non-executive Director

Michael Thirnbeck is an skilled geologist with over 25 years in managing quite a few mineral improvement tasks in Papua New Guinea, Indonesia and Australia. He has been a member of the Australasian Institute of Mining and Metallurgy since 1989 and holds B.Sc (Hons.) diploma from College of Queensland.

Shuyi (Kiara) Wang

Shuyi (Kiara) Wang was appointed a director of Tartana Minerals on July 17, 2024. Wang is an achieved, rising chief with a powerful tutorial {and professional} background. She holds a Bachelor of Arts majoring in Philosophy from The College of Melbourne and is at present pursuing a Juris Physician on the prestigious Melbourne Legislation Faculty.