Investor Perception

As FPX Nickel strengthens its place within the crucial metals area, buyers in search of publicity to the inexperienced power transition might discover FPX Nickel an intriguing prospect, given its potential to grow to be a low-cost, environmentally accountable nickel producer in a steady jurisdiction.

Overview

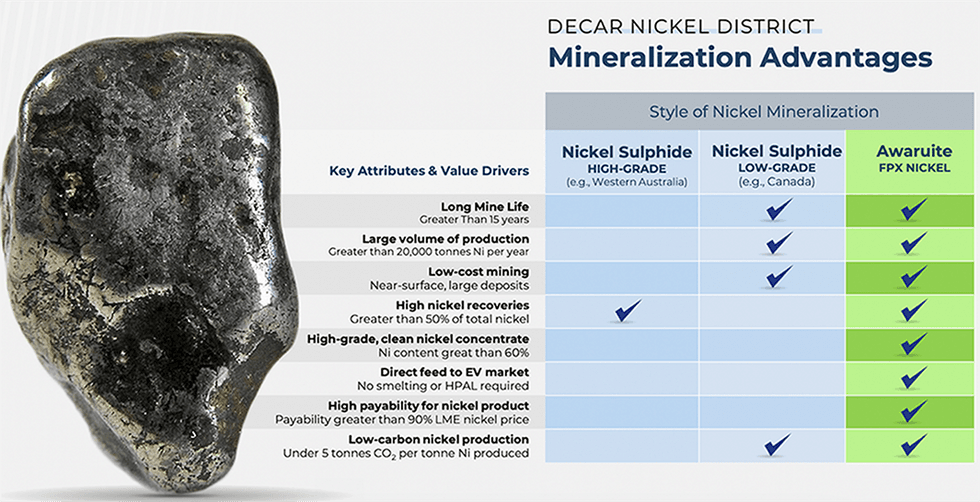

FPX Nickel (TSXV:FPX,OTXQB:FPOCF) is an exploration and improvement firm centered on its advanced-development-stage Tier 1 Baptiste venture within the Decar Nickel District in central British Columbia. The venture has the potential to provide high-concentration nickel and cobalt sulfates appropriate for the rising electrical car battery business, in addition to extra conventional markets for nickel, resembling chrome steel.

Nickel performs an important position in electrical car (EV) and battery manufacturing, a sector that sees speedy growth 12 months after 12 months. Market analysis tasks a rising nickel demand for EVs to achieve 1.3 million metric tonnes each year by 2030, as nickel content material in electrical automobiles will increase to over 40 kilograms per automotive battery.

Regardless of its vital position in powering a world shift to greener energies, analysts additionally venture an undersupply of nickel for the subsequent a number of years on account of lowering manufacturing and an absence of recent lively mines. Mining firms advancing high-margin nickel tasks provide buyers publicity to a market with nice financial progress and success potential.

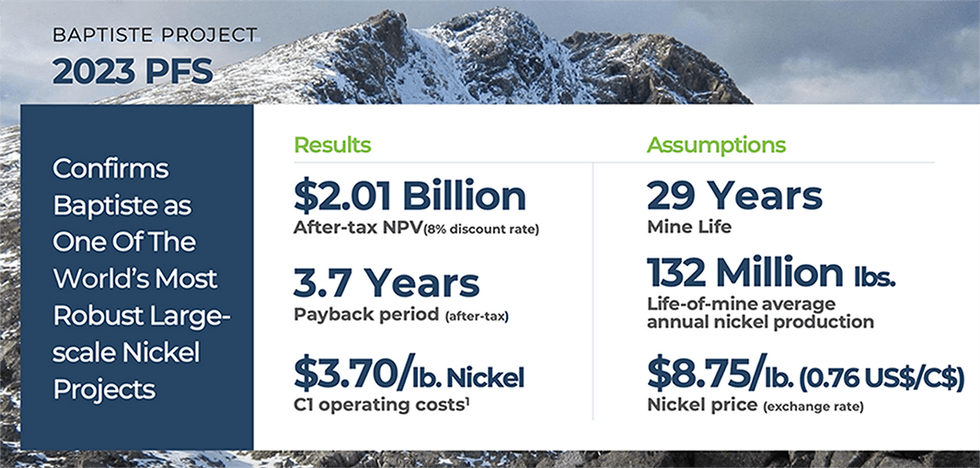

FPX Nickel’s Baptiste venture leverages a 2023 preliminary feasibility research( PFS) and an up to date mineral useful resource estimate that features complete nickel and potential by-product components, cobalt and iron.

The PFS for Baptiste indicated an after-tax NPV of $2.01 billion and an IRR of 18.6 % at $8.75-pound nickel for a 29-year mine life producing a mean of 59,100 tonnes of nickel per 12 months.

The optimistic geological interpretation of the Van goal on the Decar Nickel District provides additional blue-sky potential for the Baptiste venture, doubtlessly mimicking the successes of its geographic neighbors in central British Columbia, resembling Artemis Gold’s C$1.8 billion Blackwater Gold open-pit venture.

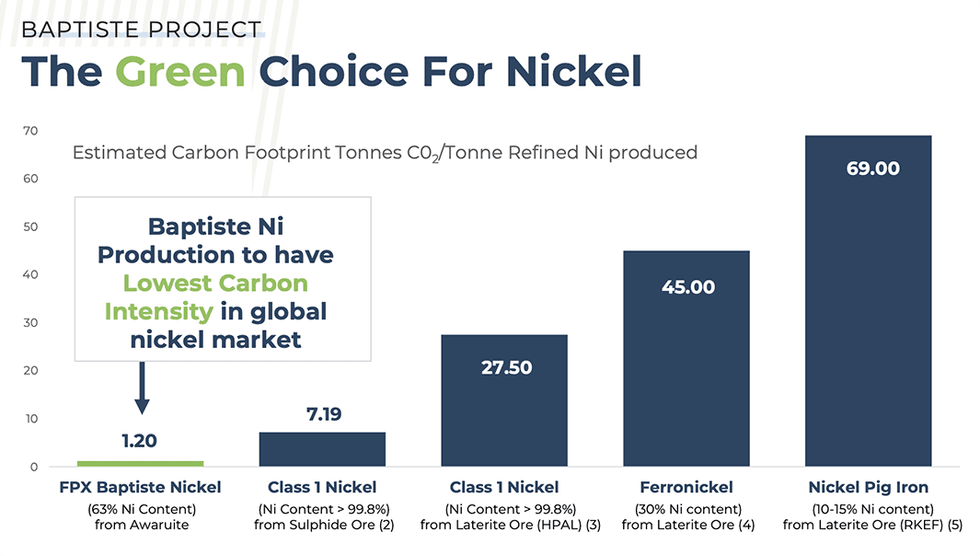

The Baptiste venture presents FPX Nickel with the potential to produce nickel at a considerably decrease carbon footprint than different sources of manufacturing within the international nickel business. Current leach testing of awaruite nickel concentrates produced from Baptiste achieved nickel recoveries of 98.8 % to 99.5 % in producing a high-purity chemical answer containing 69.4 to 70.1 g/L nickel.

In line with FPX Nickel’s goal to construct a carbon-neutral mining operation on the Baptiste venture, the corporate co-founded a multi-university analysis program to review carbon seize and storage at mining websites. This system is in collaboration with Anglo-American majority-owned (LSE:AAL,OTCQX:AAUKF) DeBeers, and the Authorities of Canada.

Metallurgical testing carried out by FPX Nickel for the manufacturing of high-grade (> 65 % nickel) awaruite focus has included three campaigns with profitable pilot-scale check work. This massive-scale pilot check work validates the processing technique for Baptiste, leveraging awaruite’s ferromagnetism, excessive density, lively floor properties, and really excessive nickel content material.

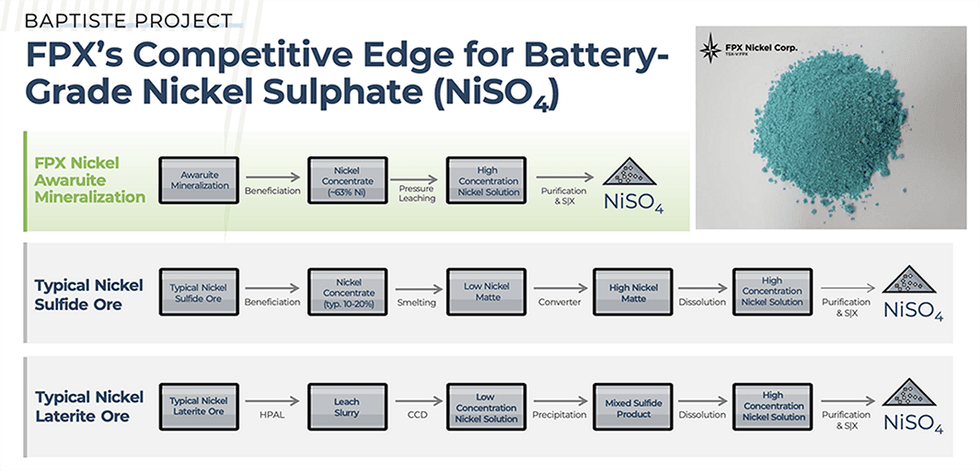

Baptiste’s awaruite mineralization promotes a easy three-stage course of for the manufacturing of nickel sulphate from focus. It has the potential to be extra environment friendly than the standard five-stage course of required to transform sulphide and laterite ores into nickel sulphate. Fast nickel extraction of greater than 98 % in 60 minutes is achieved beneath delicate stress leaching situations with considerably decrease gear dimension/threat, energy consumption, stress and temperature necessities than typical high-pressure acid leach (HPAL) operations.

In January 2024, FPX Nickel closed a C$14.4 million strategic fairness funding from Sumitomo Metallic Mining. Internet proceeds of the personal placement will likely be used to fund exploration and improvement actions at its Baptiste nickel venture, and proceed ongoing environmental baseline actions, feasibility research readiness actions, and basic company and administrative functions.

FPX Nickel’s partially-owned subsidiary CO2 Lock, specializing in carbon seize and storage (CCS) through everlasting mineralization, has accomplished a complete subject program at its SAM website in central British Columbia together with the first-ever profitable injection of CO2 right into a brucite-rich ultramafic mineral venture. This achievement marks a major milestone within the improvement of CO2 Lock’s modern in-situ CO2 mineralization expertise.

FPX Nickel’s administration staff consists of extremely skilled capital markets and mining professionals, together with Canadian Mining Corridor of Fame member Dr. Peter Bradshaw, and veteran geologist Rob Pease.

The Decar Nickel District covers over 410 sq. kilometers and is 80 kilometers west of the Mt. Milligan mine, central British Columbia. The property hosts the extremely potential Baptiste nickel venture, which is without doubt one of the world’s largest development-stage nickel tasks. The asset is accessible through logging and paved roads, with railway and hydropower close by.

Baptiste hosts nickel-iron alloy mineralization, with NI 43-101 compliant indicated assets at a mean grade of 0.123 % DTR nickel for two.3 million tons and 391 million tonnes of inferred assets with a mean grade of 0.115 % DTR nickel.

In September 2022, the corporate accomplished a 2,504-meter step-out drilling program at its Van goal, situated 6 km north of Baptiste within the Decar Nickel District. The finished holes stepped out aggressively from the preliminary discovery space, testing the potential for nickel mineralization as much as 1 kilometer west of the holes drilled in 2021.

Baptiste Challenge 2023 PFS

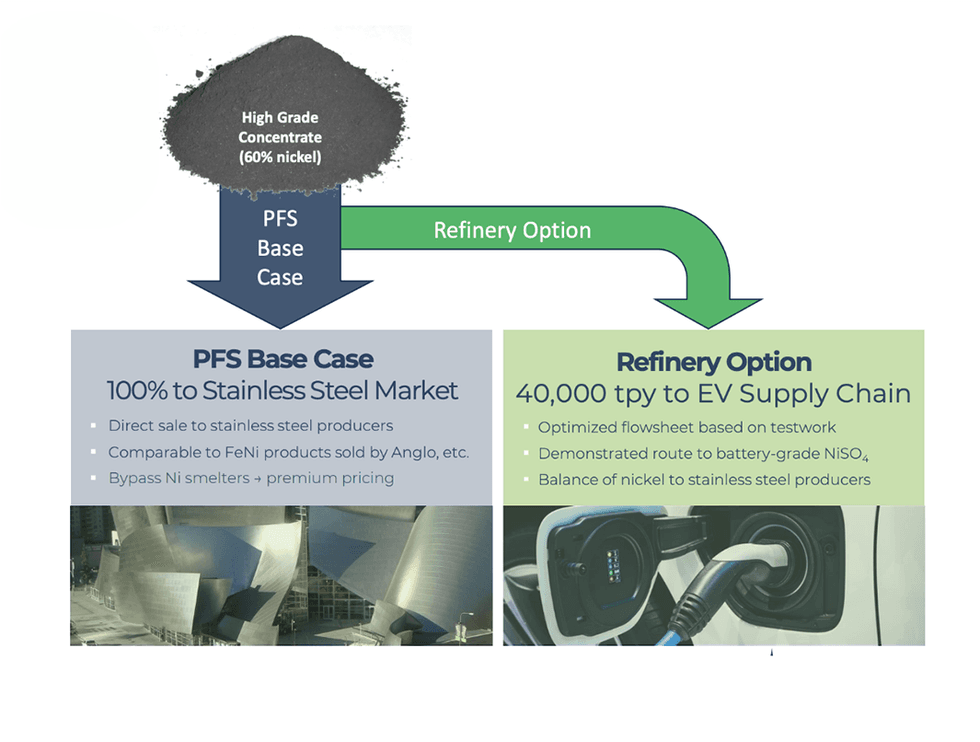

In 2023, the corporate launched the preliminary feasibility research outcomes for the Baptiste nickel venture indicating a mean manufacturing of 59,100 tons of nickel per 12 months in focus over a 29-year mine life. The venture will likely be developed in a phased method, with an preliminary mill throughput charge of 108,000 tons per day (Part 1), adopted by an growth to 162,000 tons per day (Part 2).

In keeping with the venture’s strong economics, FPX Nickel has commenced the event of a standalone nickel sulphate refinery research which will likely be accomplished within the first quarter of 2025.

In 2023, FPX Nickel signed a non-binding memorandum of understanding with Japan Group for Metals and Vitality Safety (JOGMEC) and the Prime Planet Vitality & Options (PPES) three way partnership between Toyota Motor Firm and Panasonic, setting out a framework for FPX and PPES to discover collaborative alternatives for the vertical integration of nickel manufacturing on the Baptiste venture and the manufacturing of nickel sulphate and cathode lively supplies for the PPES provide chain.

In 2024, FPX Nickel accomplished pilot-scale hydrometallurgy refinery testwork and produced battery-grade nickel sulphate. This milestone marks the completion of the marketing campaign funded partly by a grant from Pure Assets Canada (NRCan) beneath the Authorities of Canada’s Important Minerals Analysis, Growth and Demonstration (CMRDD) program.

Administration Workforce

Martin Turenne – President, CEO and Director

Martin Turenne is a senior government with over 15 years of expertise within the commodities business, together with over 5 years within the mining business. He has intensive management expertise in strategic administration, fundraising, financial evaluation, monetary reporting, regulatory compliance and company tax. Turenne previously served as CFO of First Level Minerals Corp. from 2012 to 2015 and in positions at KPMG LLP and Methanex Company. He’s a member of the Canadian Institute of Chartered Accountants.

Andrew Osterloh – Vice-president, Initiatives

With greater than 20 years within the business, Andrew Osterloh is skilled in course of engineering, plant metallurgy and venture administration. He was previously the venture director and head of research for Fluor Canada, main feasibility research work for big base steel property. He was previously venture director and supervisor of research for Fluor Canada, the place he led feasibility research for a number of giant base steel property within the Americas for Glencore, Freeport-McMoRan, Teck and Newmont. Osterloh is a member of the Affiliation of Skilled Engineers of British Columbia and holds a Bachelor of Utilized Science in mineral course of engineering from the College of British Columbia.

Felicia de la Paz – Chief Monetary Officer and Company Secretary

Felicia de la Paz began her skilled profession with KPMG LLP’s audit observe in Vancouver, culminating along with her position as a senior supervisor main giant groups within the execution of audit engagements for quite a lot of giant and complicated organizations throughout a number of industries. After becoming a member of Equinox Gold as the company controller in 2017, she was a part of a core monetary management staff overseeing company accounting, monetary reporting and system improvement, managing the profitable integration of a number of new acquisitions throughout a number of jurisdictions, together with each working mines and large-scale improvement tasks. She acted because the vice-president of finance for Vida Carbon, a carbon royalty and streaming firm, and has extra not too long ago been offering monetary and methods advisory providers to public firms within the mining sector. She is a chartered skilled accountant and holds a Bachelor of Commerce (Honours) from the College of British Columbia.

Dr. Peter M. D. Bradshaw – Chairman

Dr. Peter Bradshaw is a geologist with greater than 45 years of worldwide mineral exploration expertise in over 30 nations with Barringer Analysis, Placer Dome, and Orvana Minerals. He’s a member of the Canadian Mining Corridor of Fame. Bradshaw’s key discoveries and venture involvement embody Porgera Gold Mine, Papua New Guinea; Kidston Gold Mine, Queensland, Australia; Misima Gold Mine, Papua New Guinea; Massive Bell Gold Mine, Western Australia; Omai Gold Mine, Guyana; Decar Nickel Challenge, British Columbia, Canada; director of Aquila Assets; co-founder and first chairman of the Mineral Deposit Analysis Unit, College of British Columbia.

Nigel Fisher – Director, Surroundings

Nigel Fisher brings 20 years’ expertise main environmental assessments, allowing and administration methods, growing and executing on regulatory technique and advancing governance and funding agreements with Indigenous governments throughout British Columbia. He has held progressively senior roles with New Gold, Teck Assets, Woodfibre LNG, and most not too long ago, Skeena Assets as director of surroundings and regulatory affairs. In his prior roles, he efficiently obtained a number of regulatory approvals for large-scale useful resource tasks whereas sustaining compliance with current and altering laws.

Jarett Lalonde – Director, Authorities and Public Affairs

Jarett Lalonde is a extremely regarded public affairs chief with over 20 years’ expertise within the pure assets, expertise and controlled merchandise sectors. In his most up-to-date position as international head of product coverage at Shopify, Lalonde was instrumental in crafting compelling public affairs narratives for the corporate’s numerous product choices, and spearheading engagement with coverage makers throughout North America and Europe. Earlier than becoming a member of Shopify, he labored with International Public Affairs, a number one authorities relations and strategic communications agency, the place he carried out advisory work for quite a few firms advancing large-scale pure useful resource tasks in British Columbia and throughout Canada. Lalonde beforehand served as chief of workers to the Lawyer Normal & Minister of Justice for the province of British Columbia, and as coverage advisor to the Minister of Pure Assets Canada.

Rob Pease – Director

Rob Pease is a geologist with greater than 30 years of expertise in exploration, mine improvement and building. He’s the previous CEO of Terrane Metals, acquired by Thompson Creek for C$650 million. Pease was additionally the previous director of Richfield Ventures, acquired by New Gold for C$500 million. He’s a director of Pure Gold Mining Inc. and Liberty Gold.

William H. Myckatyn – Director

William Myckatyn is a mining engineer with greater than 34 years of expertise within the mining business. Myckatyn is the founder and CEO of Quadra Mining Ltd. He served as chairman and subsequently co-chairman of Quadra FNX Mining till its takeover in 2012. Previous to this, Myckatyn was chairman, president and CEO of Dayton Mining., the place he led the restructuring and merger with Pacific Rim Mining. He was the previous president and CEO of Princeton Mining and Gibraltar Mines. For over 17 years, he labored for varied operations managed by Placer Dome and its related predecessor firms, together with 4 separate mines in Australia and the Philippines. He’s a director of San Marco Assets and OceanaGold.

Peter Marshall – Director

Peter Marshall is a mining engineer with 30 years of expertise in mine improvement and building. Marshall was previously VP of venture improvement at New Gold and SVP venture improvement at Terrane Metals. He has intensive mine improvement expertise in central British Columbia, together with finishing the Blackwater gold venture feasibility research and improvement, and early building of Mt. Milligan copper-gold mine, acquired by Thompson Creek for C$650 million in 2010.

James S. Gilbert, – Director

James Gilbert has greater than 30 years of funding and transaction execution expertise, with greater than 20 years centered on the worldwide mining and metals business. Gilbert held senior administration positions with Rothschild, Gerald Metals Inc. and Minera S.A., a non-public mining funding firm. His expertise covers mergers and acquisitions, debt and fairness financing, off-take and specialty refining agreements, three way partnership negotiations and strategic advertising and marketing. He was previously director of AQM Copper Inc., acquired by Teck Assets in 2016.

Anne Currie – Director

Anne Currie is a acknowledged chief within the allowing of main Canadian mining tasks, with over 30 years of expertise within the personal and public sector, together with as a former senior associate with main international consultancy Environmental Assets Administration. She was British Columbia’s chief gold commissioner, the chief regulatory authority for the Mineral Tenure Act., and has an distinctive observe report in steering the environmental evaluation and allowing processes for main mining tasks in British Columbia, together with for the KSM, Brucejack, Kemess Underground and Blackwater tasks.

Kim Baird – Director

Kim Baird is an achieved chief and strategic advisor working with indigenous communities, governments, companies and different organizations. In her prior position because the elected chief of the Tsawwassen First Nation, she negotiated and carried out British Columbia’s first trendy city treaty, establishing for the Tsawwassen Folks possession and governance over their land and assets.

Dan Apai – Engineering Supervisor

Dan Apai has over twenty years of mining business expertise in civil engineering and engineering administration over a various vary of tasks. In his earlier position as a principal civil engineer for Fluor Canada, he led the research and detailed engineering works for quite a few large-scale mining tasks for purchasers together with Teck, Newmont, BHP, First Quantum, Glencore, Josemaria Assets and Newcrest. Apai’s technical experience contains website format, earthworks, water administration, linear services (i.e., roads, powerlines, pipelines), and water provide methods – all components that strongly affect the capital depth, permitability, and operability of mining tasks. Apai is a member of the Affiliation of Skilled Engineers of British Columbia and holds a Bachelor of Engineering from the College of Western Australia.

Tim Bekhuys – SVP, Sustainability and Exterior Relations

Tim Bekhuys is a senior mining government with over 40 years’ expertise in group engagement, environmental evaluation and allowing. He was previously VP surroundings, well being, security and sustainability for SSR Mining, the place he led all facets of sustainability reporting, environmental evaluation and allowing actions. He additionally beforehand acted as director of surroundings and sustainability for New Gold, the place he efficiently led the federal government, allowing, Indigenous and group relations applications for the Blackwater venture in central B.C. Bekhuys was a former member of the boards of administrators of the Affiliation for Mineral Exploration British Columbia, the Mining Affiliation of British Columbia, and the Mining Affiliation of Canada.

Keith Patterson – Vice-president, Generative Exploration

Keith Patterson is a senior geologist with over 25 years’ expertise in greenfield exploration all through North America, South America, Europe and Asia. He was previously director of venture technology and greenfield technique with Eldorado Gold the place he managed international exploration and venture technology. Patterson acted as vice-president of exploration for Jinshan Gold Mines the place he was answerable for the execution of exploration applications and venture evaluations in China. He’s a registered skilled geoscientist with the Engineers and Geoscientists of British Columbia and holds a Grasp of Geological Sciences and a Bachelor of Geological Engineering, each from the College of British Columbia.