Inventory splits do not change the worth of an organization, however they do usually point out that administration expects the enterprise will proceed to carry out properly. And that strong operational efficiency can result in wealth-building features for shareholders.

If in case you have $1,000 or extra to speculate that you do not want for on a regular basis residing bills or to pay down debt, you will have come to the suitable place. Learn on to study two high-quality companies which have not too long ago cut up their inventory. Each are set to ship good-looking rewards to their traders.

Inventory-split inventory to purchase No. 1: Walmart

Inflation may be moderating, however the sharp rise within the worth of meals, shelter, and different necessities lately has many individuals looking for reductions wherever they will. In an more and more high-cost world, Walmart (NYSE: WMT), with its costs, has develop into an oasis for these bargain-hunting customers.

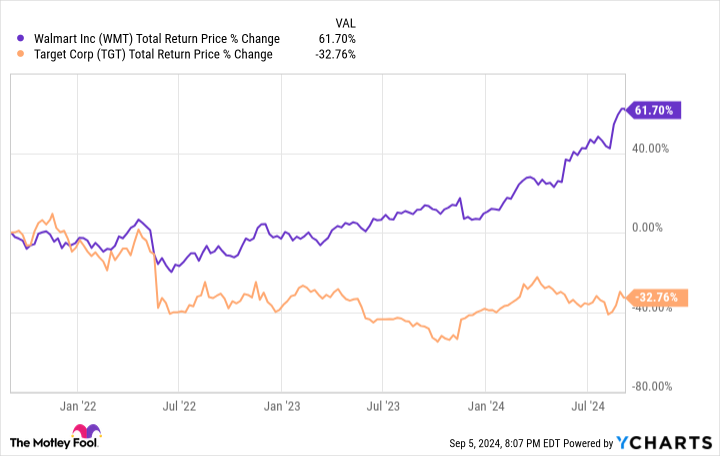

An enormous choice of low-cost groceries and different family requirements is enabling Walmart’s shops to generate sturdy gross sales whilst consumers pull again on nonessentials. That is one cause it has outperformed Goal and different opponents that rely extra on discretionary gross sales.

The retailer’s on-line gross sales are additionally rising briskly. Booming demand for curbside pickup and supply providers fueled a 21% surge in Walmart’s e-commerce income in its most up-to-date quarter.

An increasing military of third-party retailers additional lifted gross sales on the corporate’s on-line marketplaces. These sellers are additionally driving the growth of Walmart’s profitable promoting enterprise, which noticed gross sales rise by 26%.

Higher nonetheless, its investments in automation and synthetic intelligence (AI) are boosting income. The corporate’s working earnings climbed by greater than 8% to $8 billion on a 5% improve in income to $169 billion.

Walmart, in flip, selected to reward its shareholders with a 3-for-1 inventory cut up in February. With its value-focused technique clearly resonating with customers, traders can anticipate the retail chief to proceed to ship sturdy returns.

Inventory-split inventory to purchase No. 2: Nvidia

Whereas Walmart is saving folks cash, Nvidia (NASDAQ: NVDA) helps its prospects create game-changing improvements. The semiconductor chief’s chip designs lie on the coronary heart of the AI revolution.

Cloud computing giants like Microsoft and Alphabet are ramping up their spending on AI infrastructure. Nvidia’s chips are the very best in the marketplace, so it is an enormous beneficiary of this highly effective pattern. The chipmaker’s income leaped by 122% yr over yr to $30 billion in its most up-to-date quarter. Internet income rose by an much more spectacular 168% to $16.6 billion.

But the get together is simply getting began. Nvidia CEO Jensen Huang estimates that $1 trillion value of knowledge middle tools will must be upgraded to new accelerated computing infrastructure to fulfill the torrid demand for AI. Because the main supplier of AI chip designs, his firm stands to revenue from this large spending greater than some other firm.

With its enterprise firing on all cylinders, Nvidia dazzled traders with a 10-for-1 inventory cut up in June. Wall Road analysts see loads of upside remaining. For one, Rosenblatt Securities analyst Hans Mosesmann believes the inventory is headed to $200 per share, fueled by sturdy gross sales of its forthcoming Blackwell chips. That may symbolize features of greater than 85% for traders who purchase shares at the moment.

Furthermore, in the event you put money into Nvidia’s inventory now, you may seemingly be shopping for alongside its administration. The board of administrators boosted its share repurchase program by $50 billion on Aug. 26.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $630,099!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 3, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Joe Tenebruso has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Microsoft, Nvidia, Goal, and Walmart. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

The Greatest Inventory-Cut up Shares to Make investments $1,000 in Proper Now was initially printed by The Motley Idiot