The most important winners within the inventory market over the past two years have all been nice corporations fueling the most important improvements in synthetic intelligence (AI).

Nvidia is the poster baby of huge AI inventory winners. Its GPUs are important gear for coaching and working giant language fashions. It has seen its inventory climb 865% over the past 24 months, resulting in a 10-for-1 inventory cut up in June.

Nvidia was removed from the one AI-fueled inventory to separate shares this 12 months. It was joined by Broadcom, Tremendous Micro Pc, and Lam Analysis, which all executed splits.

A inventory cut up is not essentially a catalyst for a inventory to zoom greater. The elemental worth of an organization would not change when administration decides to separate its shares. And in at this time’s age of fractional shares, it solely has a minor influence on making the inventory extra accessible to small traders.

However a inventory cut up is an indication of confidence from administration that shares will proceed to climb, and few individuals have extra insights into the way forward for an organization and its inventory than administration.

So, traders are rightly excited about what may very well be the subsequent inventory to endure a cut up. One firm important to the provision of AI semiconductors seems to be like an amazing candidate: ASML Holding (NASDAQ: ASML). And at at this time’s share value, traders must be trying to purchase the inventory earlier than it publicizes a cut up.

A necessary a part of the provision chain

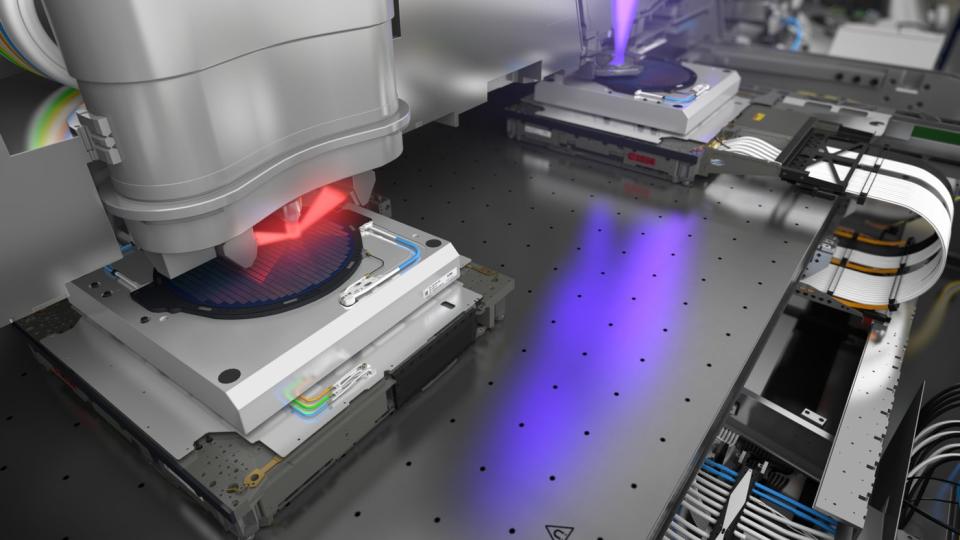

ASML builds and providers photolithography machines, which semiconductor manufacturing corporations use to provide the chips designed by corporations like Nvidia. Mainly, with out ASML’s machines, there aren’t any AI chips.

It is the one provider of maximum ultraviolet lithography (EUV) equipment, a essential know-how for printing essentially the most superior chips, resembling these utilized in AI knowledge facilities for coaching and working giant language fashions. If a producer is printing a high-end semiconductor, it is utilizing ASML’s machines.

Prospects embrace Taiwan Semiconductor Manufacturing, Intel, and Samsung. All three revamped their foundries a few decade in the past to accommodate ASML’s equipment.

However the firm is not reliant on promoting extra machines yearly to gasoline income progress. It receives ongoing income from servicing machines already in use and promoting alternative components. The recurring income from servicing ought to develop as extra machines are put in in chipmakers’ foundries.

ASML’s income from its put in base has grown considerably quicker than its system gross sales over the past 15 years as foundries add extra of its gear to their operations whereas sustaining and updating previous gear. And given the lengthy lifespans of ASML’s machines (25 to 30 years), that is a gradual and rising supply of high-margin income.

Newer machines utilizing the newest EUV know-how will go into service subsequent 12 months. And the elevated complexity of the high-end machines might lead to even higher income from service and alternative components relative to older machines.

The long run seems to be brilliant

ASML referred to 2024 as a transition 12 months. It would not anticipate any income progress, and it forecasts gross margin contraction this 12 months because it gears as much as promote its newest EUV machines.

That stands in stark distinction to an organization like Nvidia, which has seen income and income proceed to soar in 2024. So it is no surprise traders have not been almost as enthusiastic about ASML as they’re about big-name chipmakers.

However that may very well be a possibility for affected person long-term traders. ASML expects 2025 to be an enormous 12 months. Administration’s outlook requires between 30 billion and 40 billion euros ($33.17 billion to $44.2 billion) in income subsequent 12 months as foundry openings utilizing its latest machines go into service. At its midpoint, that represents a 27% enhance from 2023.

At its investor day in 2022, administration supplied an outlook for gross sales in 2030 of between $48.65 billion and $66.34 billion. Contemplating that was earlier than the AI increase actually took off, it is a good wager that income will are available on the excessive finish. Administration would possibly replace that outlook to a better or narrower vary at its subsequent investor day in November.

Together with gross sales progress, administration expects sturdy margin enlargement. It sees gross margins between 54% and 56% in 2025 and 56% and 60% by 2030. And whereas it hasn’t explicitly forecast working margin enlargement, it ought to see good working leverage from its research-and-development and promoting, basic, and administrative bills as its income scales up towards the $66 billion mark.

All of that ought to translate into very sturdy revenue progress. And contemplating the know-how lead and relationships ASML already has with the most important foundries on the earth, there should not be a lot standing in the best way of attaining these numbers.

Will this be the subsequent massive inventory cut up?

ASML at the moment trades round $835 per share. Whereas that is properly off its all-time excessive of round $1,100, it is nonetheless fairly a lofty value. Shares have cut up with far decrease costs.

The corporate final executed ahead splits within the late Nineteen Nineties and the 12 months 2000 amid the dot-com increase. With a powerful outlook primarily based on the continuing spending to construct the subsequent era of AI chips, ASML may very well be motivated to separate its shares within the close to future because it sees important progress forward.

Even with no inventory cut up, it is best to take into account including shares to your portfolio. The inventory at the moment trades round 26 occasions ahead earnings expectations. Given the potential for sturdy and predictable income will increase and margin enlargement for years to return, the corporate ought to be capable of produce earnings progress that greater than justifies that slight premium to the general S&P 500. And while you examine ASML’s value to different AI shares, it is an absolute cut price.

Do you have to make investments $1,000 in ASML proper now?

Before you purchase inventory in ASML, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and ASML wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $765,523!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 30, 2024

Adam Levy has positions in Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends ASML, Lam Analysis, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom and Intel and recommends the next choices: brief November 2024 $24 calls on Intel. The Motley Idiot has a disclosure coverage.

This May Be the Subsequent Large Synthetic Intelligence (AI) Inventory Cut up. Here is Why You Ought to Purchase It Earlier than It Occurs. was initially printed by The Motley Idiot