KEY

TAKEAWAYS

- SPY and QQQ are nonetheless in long-term uptrends, however the pink flags are rising.

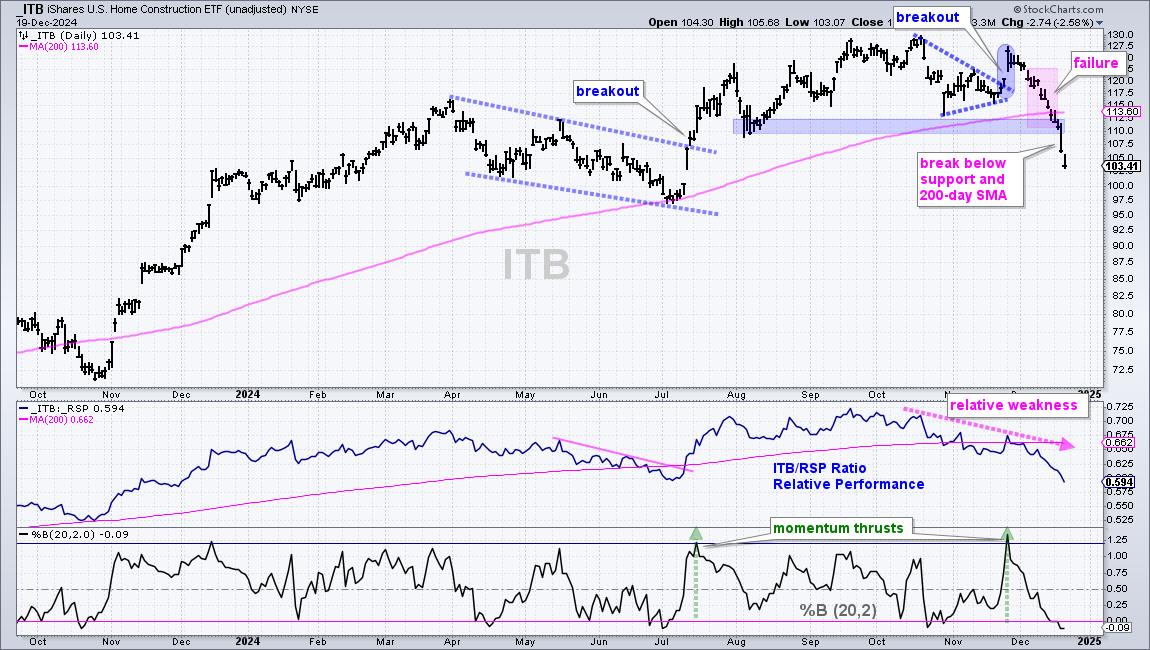

- Housing and semis, two key cyclical teams, are in downtrends.

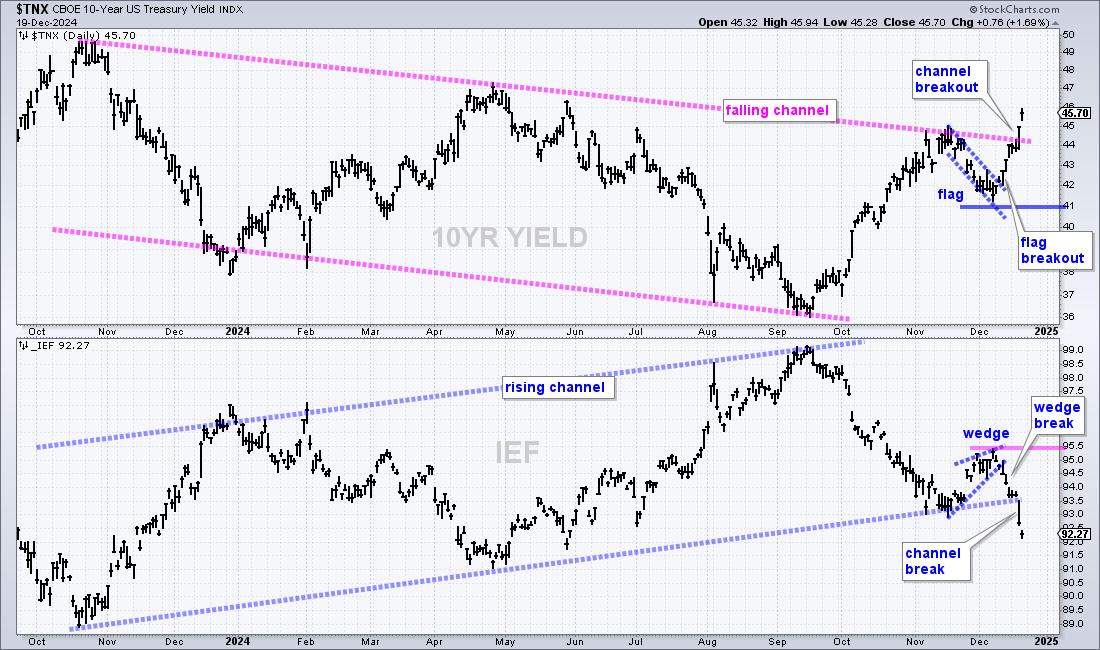

- Rates of interest are rising because the 10-yr Yield reversed a 13 month downtrend.

SPY and QQQ stay in long-term uptrends, however three huge negatives are presently hanging over the inventory market. Two negatives are tied to essential cyclical teams and the third is paying homage to summer season 2022. The semiconductor enterprise is cyclical and the Semiconductor ETF (SOXX) is without doubt one of the weakest trade group ETFs. Housing is a vital a part of the home financial system and the Residence Building ETF (ITB) broke down. On prime of this, the 10-yr Treasury Yield is breaking out and seems headed again to five%, simply because it did in summer season 2022. The charts beneath inform the story.

The Semiconductor ETF (SOXX) stays in a long-term downtrend. The chart beneath reveals SOXX breaking down in July, forming a rising wedge into October and breaking wedge help on the finish of October. Discover how this wedge retraced round 61.8% of the July decline and met resistance close to the July help break. This advance was a counter-trend bounce and the wedge break alerts a continuation decrease. That is damaging for semis, and by extension, the Expertise sector and QQQ.

We not too long ago lined weakening breadth and oversold circumstances in two breadth indicators. These indicators might stay oversold. As such, we’re setting bullish thresholds to differentiate between a sturdy bounce and a useless cat bounce. Click on right here to take a trial to Chart Dealer and get two bonus studies!

The Residence Building ETF (ITB) failed to carry its late November breakout and reversed its long-term uptrend this month. ITB surged in November with a momentum thrust, just like the July breakout. The July breakout held and ITB hit new highs in mid October. The November breakout, in distinction, failed because the ETF broke help and the 200-day SMA in December. ITB is in a long-term downtrend, which is damaging for housing, and by extension, the Shopper Discretionary sector and the broader market.

The ten-yr Treasury Yield is on the rise because it broke out of a 13 month falling channel, which was in place since November 2023. This breakout targets a transfer towards the October 2023 excessive round 5%. The chart beneath reveals the falling channel extending from October 2023 to December 2024. TNX hit the higher line in late November and fell relatively sharply into early December. The yield firmed within the 41-42 space (4.1%-4.2%) as a falling flag took form. TNX broke out of the flag on December eleventh and adopted by means of with a channel breakout this week. This transfer reverses the long-term downtrend and argues for a better 10-yr Treasury Yield. Very like summer season 2022, this might weigh on shares.

Despite the fact that SPY and QQQ are nonetheless in long-term uptrends, this damaging trifecta will probably weigh in the marketplace. Small-caps and mid-caps have been slammed this week and breadth has been deteriorating for a couple of weeks. Our breadth fashions at TrendInvestorPro have but to sign a bear market, however we’ll watch them intently within the coming days and weeks.

Click on right here to take a trial to Chart Dealer and get two bonus studies!

//////////////////////////////////////////////

Select a Technique, Develop a Plan and Observe a Course of

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Writer, Outline the Pattern and Commerce the Pattern

Need to keep updated with Arthur’s newest market insights?

– Observe @ArthurHill on Twitter

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out development, discovering alerts inside the development, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise Faculty at Metropolis College in London.

Study Extra