KEY

TAKEAWAYS

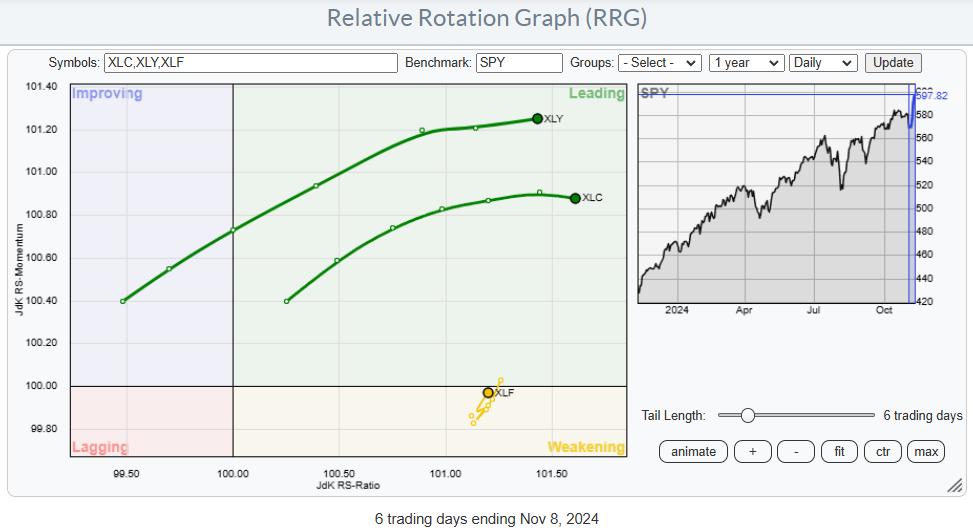

- Market got here out of protection after the election

- Previous resistance at 585 is now help for SPY

- XLC, XLY, and XLF exhibiting power

Initially, for these of you on the lookout for a brand new video this week, I’ve deliberately skipped it as a result of I did not wish to make a video proper earlier than such an necessary occasion with a lot uncertainty.

After the elections, which have been clearly eventful, I wished to see what the market’s response could be and let the mud cool down earlier than diving into any evaluation, which could have been too preoccupied and presumptuous too early.

Nonetheless, it is now Friday, the top of the week, and we’ve got a bit of extra coloration on how markets have responded to the election outcomes.

It is time to see what the sector rotation is telling us and the way the chart of the S&P 500 has modified—as a result of it has positively modified!

The S&P 500’s Publish-Election Reversal

If you happen to have a look at that chart proper now with the annotations, which have been the cornerstone of my view, I’ve to say that it was a bit of conservative going into the elections. This has now just about rotated.

On the chart, a really clear island reversal is now seen.

We’ve the hole down on the thirty first of October, adopted by three kind of sideways days, which took SPY to a low of simply round 567.

On November fifth, election day, the market closed on the excessive, adopted by a large hole up the day after.

It was not solely a niche up but additionally a transfer above the S&P 500’s all-time highs.

So we’ve got a large hole up. We’ve an island reversal, which accomplished simply above fairly necessary help round 565, and we now have already got two days of fine follow-through.

That could be a sturdy signal. This market needs to go larger, not less than within the close to time period.

If we change to the weekly chart for SPY, these gentle divergences between the RSI and value and the MACD and value are nonetheless seen, however the value motion itself is so sturdy that it can’t and shouldn’t be negated.

So, not less than within the close to time period, this market needs to go larger. For now, corrections holding above help round 585 (the previous peak) ought to be considered shopping for alternatives.

Reversals In Sector Rotation

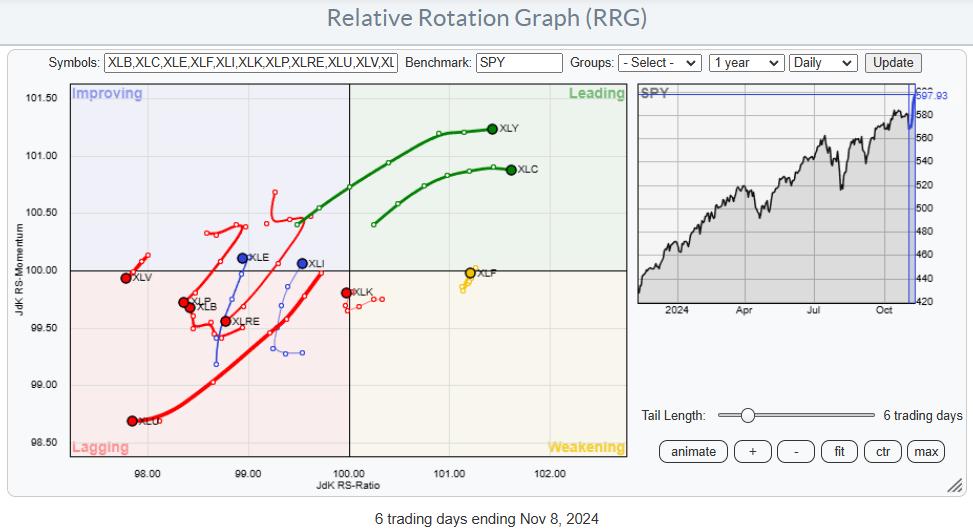

On the relative rotation graph for the 11 S&P sectors above, I’ve deliberately set the tail size at six buying and selling days. That signifies that every tail has seven nodes, and the 4th node, so the center one, is the fifth November.

This permits us to see the three days main as much as election day after which the three days after election day.

As you possibly can see, many of the tails have continued to journey within the route they have been already heading.

Essentially the most distinguished ones are shopper discretionary and communication companies, which entered and moved additional into the main quadrant.

On the opposite aspect is the utility sector, which accelerated additional into the lagging quadrant.

Sectors with Notable Adjustments

I wish to spotlight just a few sectors that basically modified route, the place we noticed a change intimately earlier than and after election day.

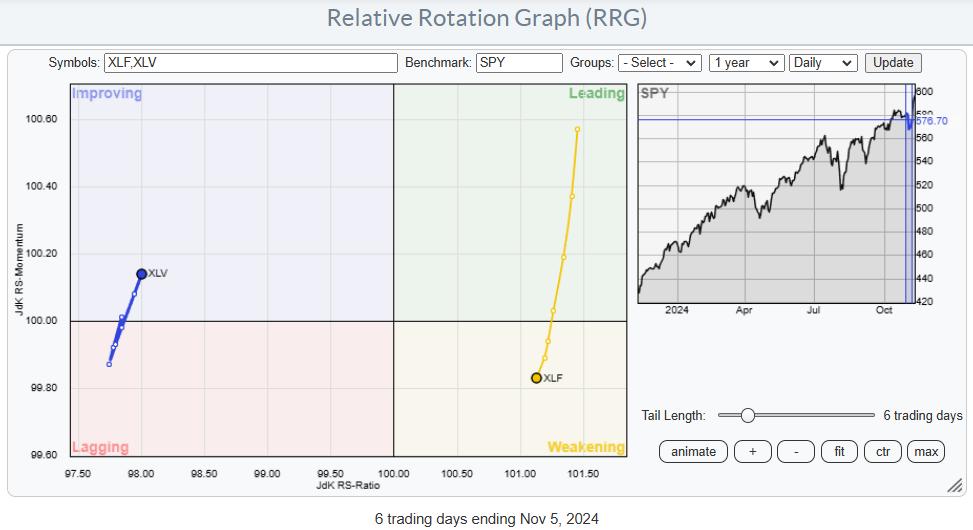

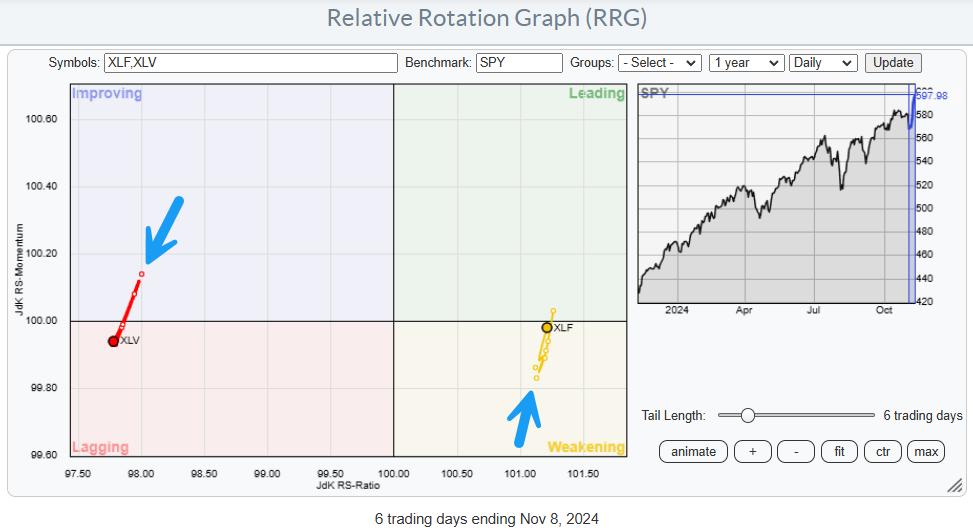

The 2 sectors with probably the most distinguished modifications are financials and well being care.

This primary RRG reveals the tails for each sectors ending on the fifth of November.

Financials Sector (XLF)

If we zoom in on the tail for XLF, you possibly can see that it ended November fifth simply contained in the weakening quadrant. It simply crossed over from resulting in weakening.

After which, within the 3 days after November fifth, it utterly reversed course and is now virtually again into the main quadrant.

Well being Care Sector (XLV)

The identical form of transfer is seen on the opposite aspect of the chart for the healthcare sector, XLV.

On November fifth, XLV had simply crossed into the enhancing quadrant and was on a optimistic heading.

Within the 3 days after, the sector utterly reversed course and is now again into the lagging quadrant at a unfavorable heading.

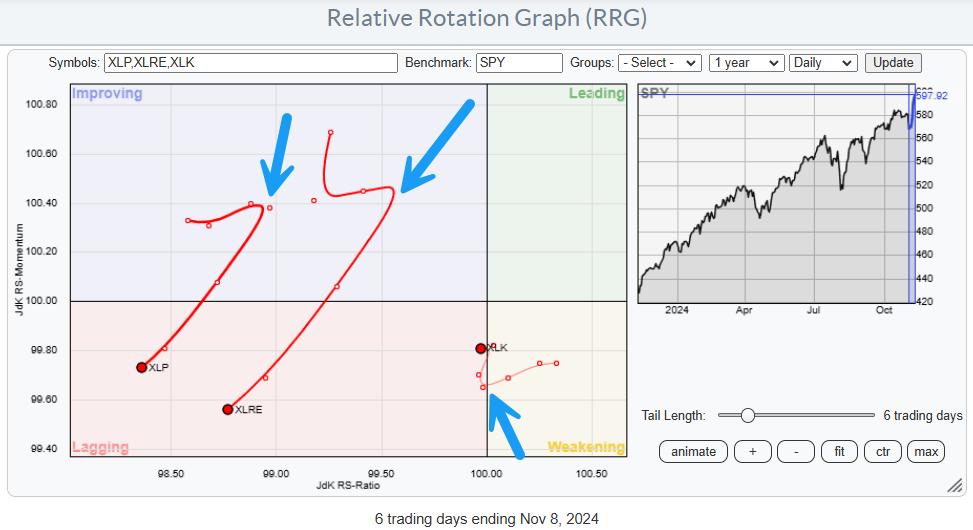

XLP and XLRE rolling over

Different sectors the place we see a change in the middle of the tail are shopper staples, which was contained in the enhancing quadrant however hooked again down, rolled over, and is now again into the lagging quadrant, and actual property, which was additionally contained in the enhancing quadrant however rolled over and is now accelerating into the lagging quadrant.

The know-how sector modified course a bit, however not as clearly as the opposite sectors.

It’s nonetheless proper across the 100 stage on the RS ratio scale and really near the benchmark with out a very clear route.

The Large Winners Publish-Election

I believe the largest winners from these election outcomes with good potential going ahead are shopper discretionary, XLY, and Communication Companies, XLC.

XLY is clearly led by TSLA, which is distorting the efficiency of the patron discretionary sector with an virtually 27% achieve in 3 days. However shopper discretionary shares have picked up roughly between 3% and seven% throughout the board, which nonetheless signifies power.

The communication companies sector is barely extra evenly unfold out and has an excellent base and an excellent basis to maneuver larger and push additional into the main quadrant.

Conclusion

All in all, the market as a complete appears to have reversed its course. After solely a really gentle corrective transfer, it has now began a brand new up leg within the current uptrend.

The sectors which have come out on prime are shopper discretionary and communication companies, adopted by financials.

All 3 are on the right-hand aspect of the RRG, both already contained in the main quadrant or virtually there, and touring at a optimistic RRG heading.

On the other aspect, the sectors with a much less favorable outlook are well being care, shopper staples, and utilities.

General, the sector rotation has now shifted from protection again to offense.

#StayAlert, and have an incredible weekend. –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels below the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to answer every message, however I’ll actually learn them and, the place moderately attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.