My current discussions on the Market Misbehavior podcast have usually included some feedback on the rate of interest setting, significantly the form of the yield curve. We have had an inverted yield curve since late 2022, and so the yield curve taking over a extra regular form may imply an enormous tailwind to sure sectors and teams.

When the Yield Curve is No Longer Inverted

Right here we’re displaying the Ten Yr Treasury Yield together with two methods to point out the form of the yield curve by evaluating totally different durations. The primary panel under the worth compares the 3-month yield to the 10-year yield, and the underside panel exhibits the 2-year yield versus the 10-year yield.

Again in 2022, each of those spreads went under the zero line, indicating that the yield curve was inverted as a result of long-term yields had been now decrease than short-term yields. As a result of Fed elevating short-term rates of interest to attempt to carry inflation in test after the COVID pandemic, together with a basic downtrend in bond costs, this inverted form to the curve raised fears amongst buyers for a recession.

With inflationary pressures pretty subsiding into late 2024, the Fed has now begun reducing short-term charges, which can almost certainly trigger the yield curve to regain a standard form. As we are able to see from the Dynamic Yield Curve instrument on StockCharts, the yield curve shifting again to a standard form can usually result in decrease inventory costs within the short-term. Nonetheless, two ETFs come to thoughts that ought to do higher on this new market part.

Regional Banks Get a Main Tailwind

The monetary sector basically skilled a very weak begin to the yr, with financials underperforming progress sectors into the summer season. However regional banks have begun to mount a reasonably sturdy rally in This fall, maybe reflecting optimism going into 2025.

The SPDR S&P Regional Banking ETF (KRE) has proven a sequence of breakouts in 2024, together with a brand new 52-week excessive in July on sturdy momentum, in addition to a niche increased in early November. KRE now sits above two upward-sloping shifting averages, and the RSI suggests sturdy however not extreme momentum.

Regional banks primarily borrow cash on the brief finish of the curve, then lend these funds out to people on the lengthy finish of the curve to purchase homes and make different massive purchases. A steeper yield curve would indicate a way more hospitable setting for regional banks, which may imply a lot additional upside for KRE.

Small Caps May Thrive Given Sector Weightings

Whereas the S&P 500 and Nasdaq are each closely weighted in progress sectors like expertise and communication providers, the small cap indexes function far more of a balanced publicity to worth and progress shares. As visitor Tom Bowley identified on our podcast, Smaller corporations normally have to borrow cash, so decrease charges may imply a greater setting for small caps as nicely.

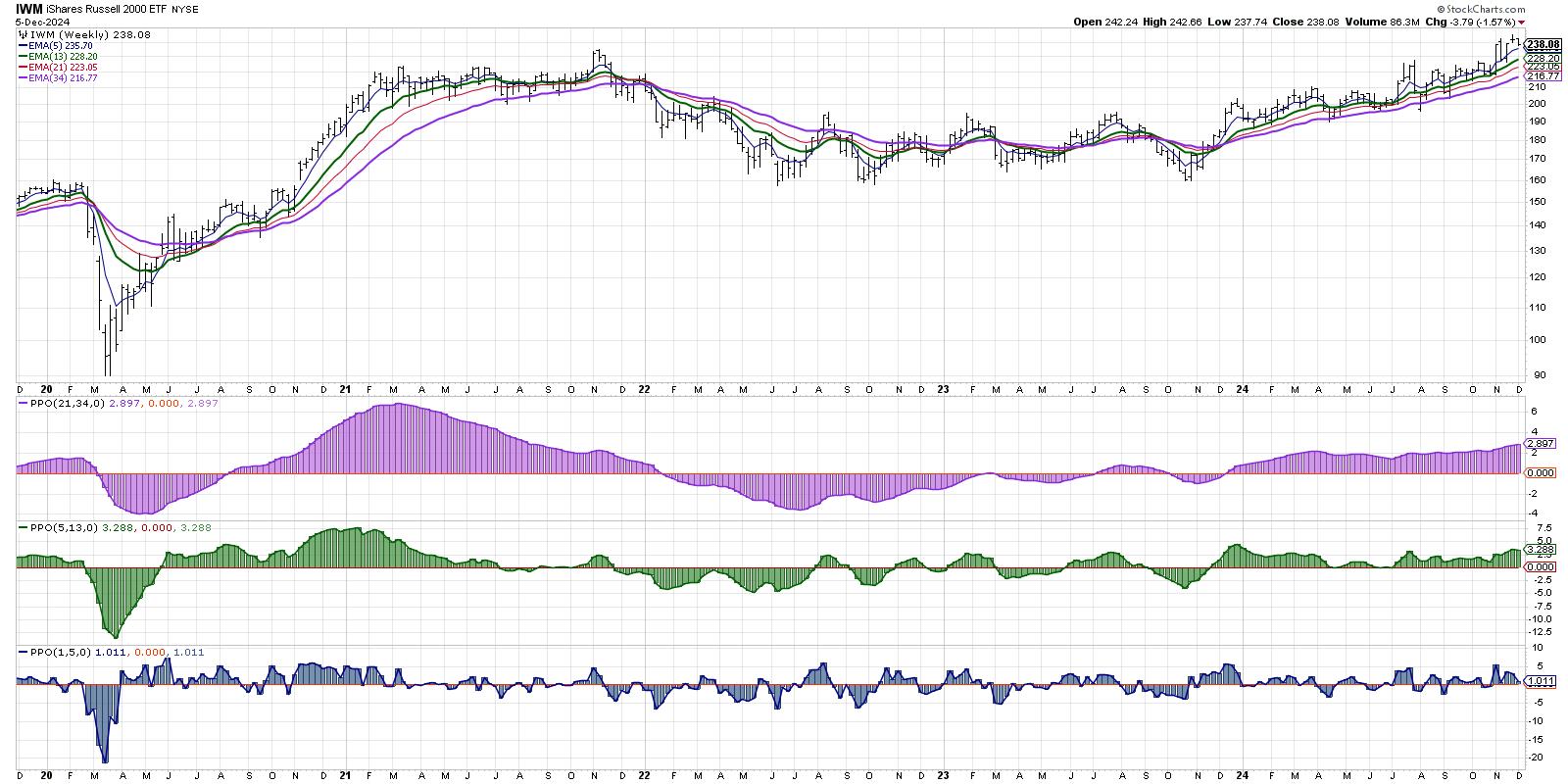

Right here we’re making use of our Market Pattern Mannequin to the iShares Russell 2000 ETF (IWM). Much like our predominant Market Pattern Mannequin utilizing the S&P 500, we are able to see that small caps have proven bullish alerts on the long-term and medium-term fashions for all of 2024. Whereas the short-term mannequin has turned unfavorable quite a few occasions this yr, the mannequin at present signifies short-term power.

The important thing with small caps is the relative power, which measures whether or not the IWM is definitely outperforming the S&P 500. Whereas small caps have been shifting increased within the second half of the yr, they’ve nonetheless been underperforming massive caps. Nonetheless, given this shift in rates of interest, we could possibly be heading into a brand new yr the place small caps signify an honest alternative to outperform the SPX.

RR#6,

Dave

PS- Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Analysis LLC

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any manner signify the views or opinions of some other particular person or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps lively buyers make higher selections utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main consultants on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Be taught Extra