Nevada Lithium Sources Inc. (CSE: NVLH; OTCQB: NVLHF; FSE: 87K) (“Nevada Lithium” or the “Firm”) is happy to offer an up to date mineral useful resource estimate (“Mineral Useful resource Estimate”) at its 100% owned Bonnie Claire Lithium Mission (the “Mission” or “Bonnie Claire”), situated in Nye County, Nevada. The Mineral Useful resource Estimate was ready by International Useful resource Engineering (“GRE”) in accordance with Canadian Institute of Mining and Metallurgy and Petroleum (“CIM”) definitions, as required below Nationwide Instrument 43-101 – Requirements of Disclosure for Mineral Tasks (“NI 43-101”) and has an efficient date of September 24, 2024. Most notably, the Decrease Zone (as outlined beneath) provides an indicated useful resource of 275.85 million tonnes (“Mt”) at 3,519 components per million (“ppm”) lithium (“Li”) (5.167 Mt lithium carbonate equal (“LCE”)) and 275.85 Mt at 8,404 ppm boron (“B”) (2.318 Mt B), along with an inferred useful resource of 1,561.06 Mt at 3,085ppm lithium (25.634 Mt LCE).

Nevada Lithium’s CEO, Stephen Rentschler, feedback:

“We’re excited to announce the impression of the brand new drilling within the Decrease Zone of mineralized lithium and boron at Bonnie Claire. With the considerably elevated tonnage and better grades, Bonnie Claire is probably unmatched by different sediment hosted lithium initiatives in Nevada and is now amongst the biggest lithium assets on the earth and amongst the highest-grade in Nevada.

In comparison with Bonnie Claire’s earlier useful resource report, the brand new drilling within the Decrease Zone has led to a 68% improve in LCE tonnage, at a mean grade that has tripled from 1,000 ppm to over 3,000 ppm. It consists of intervals the place grades exceed 6,000ppm. These will increase have occurred utilizing a cut-off grade that has greater than doubled to 1,800 ppm. For the primary time, we’re additionally in a position to report a big high-grade boron useful resource that we imagine additional enhances the Mission’s worth.

The Decrease Zone stays open to the NW, NE and SE, for future useful resource enlargement. Moreover, the brand new infill drilling has resulted in an indicated useful resource classification. We’re assured that the continuity of the mineralization will enable us to simply improve extra assets from the inferred classification into indicated assets and add new inferred assets.

The outcomes from this report will feed immediately into ongoing work on an up to date Preliminary Financial Evaluation (“PEA”) that we’re focusing on for completion on the finish of Q1 2025. This PEA will mirror the elevated tonnages and grades reported at present. The PEA may even embody the metallurgical processes at present being developed by Fluor Enterprises Inc., as reported in our information launch dated October 23, 2024.

I wish to provide my congratulations and due to Nevada Lithium’s technical crew for this super success. Their dedication and imaginative and prescient has led to outcomes which might be of world significance and, for my part, will result in future will increase in shareholder worth.”

Highlights:

- Sources for the deposit have been separated into two zones; a Decrease Zone (i.e., mineralization hosted by Decrease Claystone and Decrease Sandstone models) (the “Decrease Zone”) and an Higher Zone (i.e., mineralization hosted by an Higher Claystone unit) (the “Higher Zone”).

- The up to date Mineral Useful resource Estimate consists of assays from eleven (11) extra exploration and infill drill holes accomplished because the 2021 maiden useful resource estimate. 2023 & 2024 drilling intersected the decrease claystone which hosts the excessive grade (as much as 7,160ppm) lithium, and which stays open in three instructions. It’s fairly anticipated that the majority of inferred assets may be upgraded to indicated by means of extra infill drilling.

- The Decrease Zone provides an indicated useful resource of 275.85 Mt at 3,519 ppm lithium (5.167 Mt LCE) and 275.85 Mt at 8,404 ppm Boron (2.318 Mt B), along with an inferred useful resource of 1,561.06 Mt at 3,085ppm lithium (25.634 Mt LCE). This base-case useful resource is predicated on a 1,800ppm lithium cutoff, constrained by hydraulic borehole mining (“HBHM”) parameters, and an assumed 60% restoration of the host strata.

- The Higher Zone provides an indicated useful resource of 188.08 Mt at 1,074 ppm lithium (1.075 Mt LCE) and 152.11 Mt at 1,519 ppm boron (0.231 Mt B), along with an inferred useful resource of 451.10 Mt at 1,106 ppm lithium (2.655 Mt LCE) and 270.53 Mt at 1,505 ppm boron (0.407 Mt B). This useful resource is calculated at a 900 ppm lithium cut-off, inside a constraining pit shell, and can be mined by typical open-pit strategies

- The 60% HBHM restoration is predicated purely on a cylindrical cavity and doesn’t account for any improved recoveries from the anticipated plastic deformation of the deep zone materials.

- The up to date Mineral Useful resource Estimate shall be included into ongoing work on an up to date PEA anticipated for completion on the finish of Q1 2025.

to study extra in regards to the Firm’s findings and ask questions throughout the interactive Q&A.

Date and time: Tuesday, November nineteenth at 1 pm ET / 10 am PT

Outcomes and Interpretation

Bonnie Claire consists of a sedimentary package deal of volcaniclastic origin, laid down in a NW-SE basin hanging basin. Lithium and boron mineralization are situated inside an Higher Zone, hosted inside an higher claystone unit encountered by drilling from floor to about 425 ft (130m), and a Decrease Zone, hosted inside decrease claystone and decrease sandstone models intersected from 1,500-2,850ft (457-853m). Lithium mineralization seems to be hosted inside non-swelling clay phases comparable to illite, or as lithium carbonate or salt throughout the sedimentary matrix. Boron mineralization seems to be related to searlesite, a sodium borosilicate mineral.

Whereas the Higher Zone and Decrease Zones exhibit lithium and boron mineralization, they’re separated spatially, and exhibit variations in metallurgical behaviour, main the Firm to deal with them as two distinct deposits with totally different mining strategies.

Decrease Zone

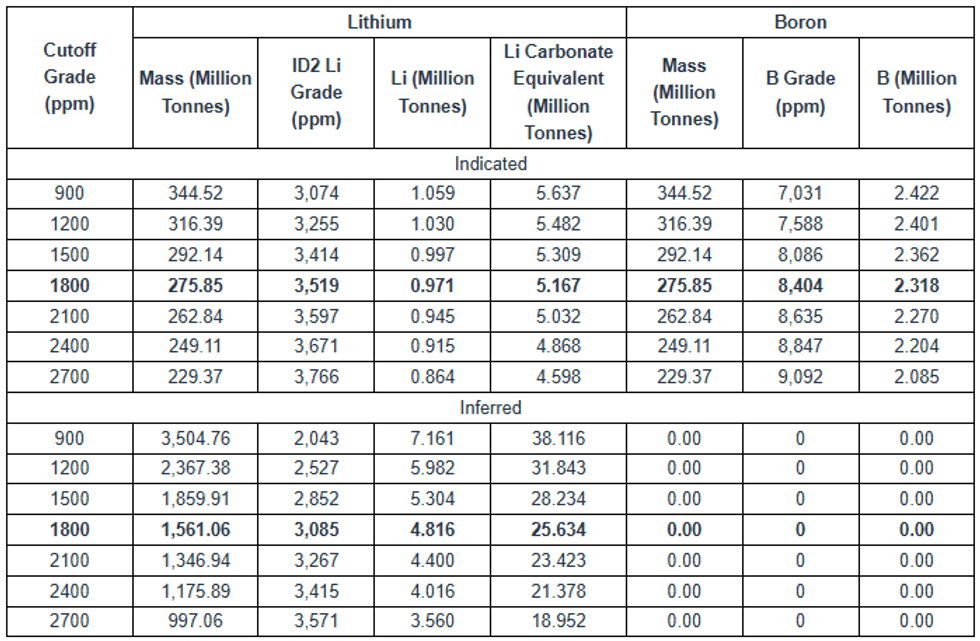

Whereas early exploration focused on mineralization within the Higher Zone, the Firm has shifted its focus to mineralization within the Decrease Zone, hosted within the decrease claystone and sandstone models and containing the majority of lithium and boron. This Decrease Zone stays open to the NW, NE and SE. The present plan is to make use of an underground HBHM methodology, with a better 1,800ppm cut-off. The Mineral Useful resource Estimate for the Decrease Zone is offered in Desk 1-1 and the sensitivity of the Decrease Zone to cutoff grade is offered in Desk 1-2.

Desk 1-1: Bonnie Claire Decrease Zone Mineral Useful resource Estimate With 60% Hydraulic Borehole Mining Restoration

- The efficient date of the Mineral Useful resource Estimate is September 24, 2024.

- The Certified Particular person (as such time period is outlined in NI 43-101) for the estimate is Terre Lane of GRE.

- Mineral assets are usually not mineral reserves and wouldn’t have demonstrated financial viability.

- Mineral assets are reported at an 1,800 ppm Li cutoff, an assumed lithium carbonate (Li2CO3) value of $20,000/tonne, 5.323 tonnes of Li2CO3 per tonne Li.

- Numbers within the desk have been rounded to mirror the accuracy of the estimate and will not sum because of rounding.

Desk 1-2: Bonnie Claire Decrease Zone Useful resource Estimate Sensitivity to Cutoff Grade With 60% Hydraulic Borehole Mining Restoration

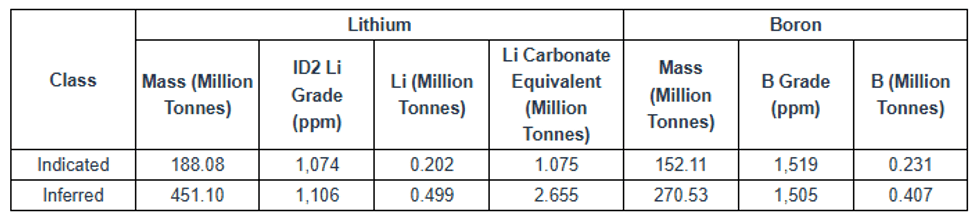

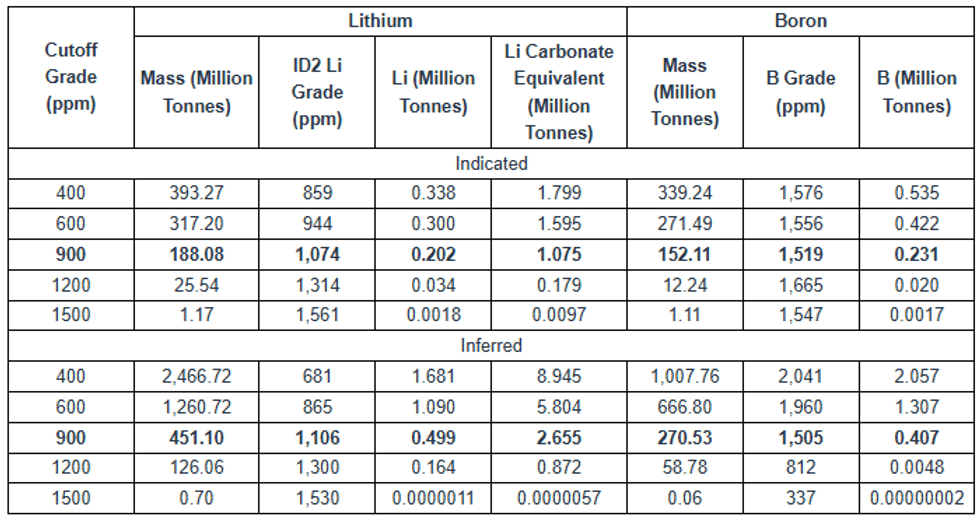

Higher Zone

The Higher Zone extends from floor to about 425ft (130m) depth and can be mined by typical open-pit strategies, mirrored in a decrease 900 ppm cutoff. The Mineral Useful resource Estimate for the Higher Zone is offered in Desk 1-3, and the Higher Zone sensitivity to cutoff grade is offered in Desk 1.4

Desk 1-3: Bonnie Claire Higher Zone Mineral Useful resource Estimate Inside a Constraining Pit Shell

- The efficient date of the Mineral Useful resource Estimate is September 24, 2024.

- The Certified Particular person for the estimate is Terre Lane of GRE.

- Mineral assets are usually not mineral reserves and wouldn’t have demonstrated financial viability.

- Mineral Sources are reported at a 900 ppm Li cutoff, an assumed lithium carbonate (Li2CO3) value of $20,000/tonne, 5.323 tonnes of Li2CO3 per tonne Li, 75% restoration, a slope angle of 18 levels, no royalty, processing and normal and administrative price of $26.52/tonne, mining price of $3.52/tonne, and promoting prices of $100/tonne Li2CO3.

- Numbers within the desk have been rounded to mirror the accuracy of the estimate and will not sum because of rounding.

Desk 1.4: Bonnie Claire Higher Zone Useful resource Estimate Sensitivity to Cutoff Grade Inside a Constraining Pit Shell

Cautionary Statements Concerning Mineral Useful resource Estimates:

Mineral assets are usually not mineral reserves and wouldn’t have demonstrated financial viability. There is no such thing as a certainty that each one or any a part of the mineral assets shall be transformed into mineral reserves. Inferred mineral assets are that a part of a mineral useful resource for which amount and grade or high quality are estimated on the premise of restricted geological proof and sampling. Geological proof is ample to indicate however not confirm geological and grade or high quality continuity. It’s fairly anticipated that almost all of inferred mineral assets may very well be upgraded to indicated mineral assets with continued exploration.

Useful resource Estimation Parameters

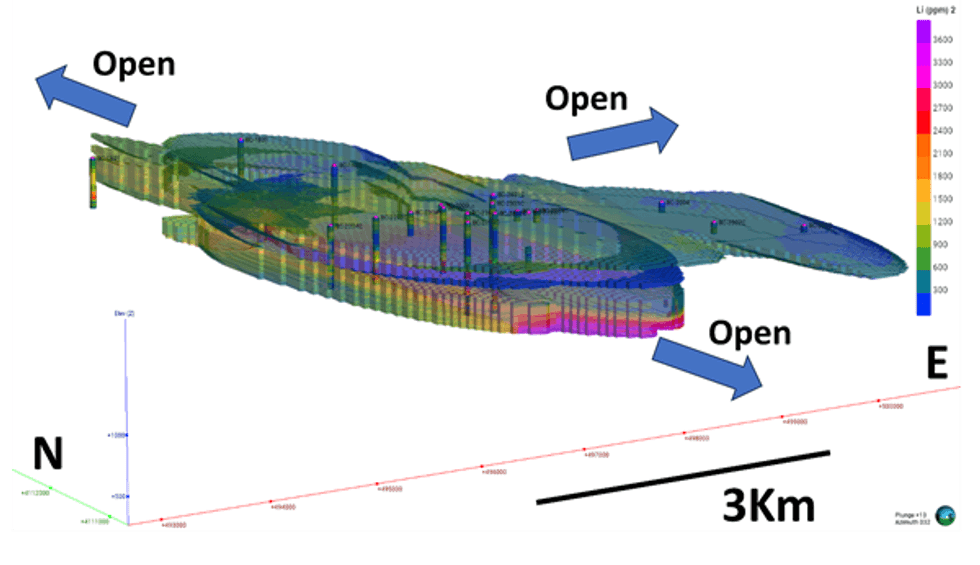

The up to date Mineral Useful resource Estimate for Bonnie Claire was carried out utilizing Leapfrog® Geo and Leapfrog® Edge software program. Leapfrog® Geo was used to replace the geologic mannequin, and Leapfrog® Edge was used for geostatistical evaluation and grade modeling within the block mannequin. An indirect view of the block mannequin at Bonnie Claire is illustrated by Determine 1.1

Determine 1.1: Indirect view from southwest of block mannequin for Bonnie Claire generated by Leapfrog® Edge software program. Lithium ppm legend to proper.

The drill gap database used for the estimation included:

- 21 exploration drill holes, together with 8 reverse circulation holes and 11 vertical diamond core holes

- 9,159.54 meters of drilling in exploration drill holes

- 1,898 assay intervals in exploration drill holes

- Minimal grade of 18 ppm Li in exploration drill holes

- Most grade of seven,160 ppm Li in exploration drill holes

Cumulative chance plots of lithium and boron assay values didn’t exhibit grade breaks that might point out the presence of outlier knowledge, so the info weren’t capped or clipped. A selected gravity of 1.7 grams per cubic centimeter (g/cm3) for all lithological models, similar to different comparable lithium deposits. Drill gap assay values have been composited to intervals of equal size to make sure that the samples utilized in statistical evaluation and estimations have been equally weighted. Nearly all of samples have been collected at 6.096-meter (20-foot) intervals, with some samples collected at different intervals as much as a most of 12.192 meters (40 toes). Down-the-hole composites have been created from the Li and B assays inside higher claystone, decrease claystone, and decrease sandstone mineralized domains, with the next specs: 6.096-meter (20-foot) intervals, with something lower than 3.048 meters (10 toes) added to the earlier interval. This resulted in 1,313 Li composite intervals with Li grades from 40.37 ppm to five,764.48 ppm and 857 B composite intervals with B grades from 10 ppm to 14,658.8 ppm.

Certified Particular person Terre Lane estimated Li and B grades into the block mannequin utilizing inverse distance to the second energy (“ID2”) and for every methodology, a single move was carried out on the ellipsoid ranges (1,600 meters x 900 meters x 150 meters). All blocks with modeled grade have been coded as inferred assets. The search was restricted to a minimal of 4 samples and a most of 12 samples per block and a most of three samples per drill gap, thereby requiring knowledge from a minimal of two drill holes to populate a block. For statistical comparability, nearest neighbor (“NN”) and odd kriging (“OK”) fashions have been run to function comparisons with the estimated outcomes from the ID2 methodology. The estimate means for the worldwide inhabitants in addition to the means for the estimation domains are comparable, suggesting the ID2 estimate is just not biased or overestimating the grades. The discount in imply, coefficient of variation, and most from composites to the ID2 estimate exhibits an acceptable quantity of smoothing. Swath plots and visible comparability of composites versus block mannequin values by part and plan present good correlation.

Mining Strategies

Hydraulic Borehole Mining of Decrease Zone

As disclosed of their April 16, 2024, information launch, Nevada Lithium contracted Kinley Exploration LLC (“Kinley”) to offer a preliminary analysis of HBHM for Bonnie Claire.

Kinley was requested to ascertain an affordable and financial mining technique using HBHM throughout the Bonnie Claire Lithium useful resource deposit to extract lithium in a steady, environment friendly, price efficient and secure method within the focused greater grade zone from 1,500-2,800ft (457-853m) deep.

Kinley’s evaluation took into consideration that the mineralization is very plastic and with the help of jetting and pumping would probably movement. With this data, coupled with the numerous price of backfilling after which the consideration of subsidence, Kinley evaluated HBHM with out backfilling and utilizing directional drilling from a steady place.

The Kinley mannequin assumed the extremely cellular mineralization throughout the goal part would behave plastically and movement in a fluid state or caving situation to the mining system consumption. This depends on movement of the mobilized mineralization, accelerated by excessive strain jetting to a centralized properly, then pumped again to floor. GRE assumes a extra conservative restoration of 60% due to potential mass movement points that should be evaluated throughout check mining.

Open Pit Mining of Higher Zone

Open pit mining of the Higher Zone at Bonnie Claire would probably use typical mining gear of hydraulic shovels and mining haul vehicles however might presumably use scrapers. The soil is extraordinarily gentle and usually saturated. In consequence, pit wall slopes would should be comparatively shallow; for the Lerchs-Grossman pit train in Part 14, the GRE Certified Particular person used 18° aspect wall slopes. Further geotechnical testing would should be accomplished to find out steady aspect wall slope angles, bench heights, and catch bench widths. Dewatering parts of the pit, freezing, or different types of stabilizing pit slopes and backside could also be required.

Mineral Processing and Metallurgical Testing

The mineral assemblage modifications with depth. The Higher Zone typically exhibits decrease grade lithium and boron and better calcite content material, whereas the Decrease Zone tends to be considerably higher-grade lithium and boron and decrease calcite content material. The ultimate mine design has not been accomplished, and the challenge might have a number of choices: mine the higher portion, mine the decrease portion, or mine the whole deposit. In consequence, two distinct therapy choices have been evaluated.

For the Higher Zone, a thermal therapy was developed that concerned a sulfate calcination adopted by a scorching water leach. This course of had the benefit of not solubilizing as many impurities, notably iron. Excessive lithium extractions (as much as 80%) have been achieved.

New drill samples from the Decrease Zone have been examined, and the calcination course of was not efficient as a result of low melting level of the boron minerals (searlesite). Subsequently, sulfuric acid leaching was evaluated to deal with the deeper deposit materials. The acid therapy demonstrated that the lithium host is instantly soluble in a robust sulfuric acid answer, reaching extractions of roughly 85%. The standard downstream purification of the acid liquor had challenges for the higher sections of the deposit because of excessive iron solubilization.

Boron concentrations within the Decrease Zone warrant a separate boron restoration circuit. Boron is recovered from the leach liquor after main impurity removing through ion alternate to provide a boric acid product.

High quality Assurance / High quality Management

A top quality assurance / high quality management protocol following business greatest observe was integrated into the drill program by Nevada Lithium. Drilling was carried out by Main Drilling Group Worldwide Inc. (“Main Drilling”). Core was transported by Main Drilling from the collar location and acquired by Nevada Lithium workers on the Firm storage facility in Beatty, Nevada. The ability is simply accessible to Nevada Lithium workers and stays in any other case locked. Obtained core was logged and minimize on the facility by Nevada Lithium workers. Logging and sampling included the systematic insertion of blanks, duplicates and authorized reference materials (“CRM”) MEG Li.10.12 and OREAS 750 into pattern batches at an insertion fee of roughly 10%. All core samples collected have been transported by Firm workers to ALS USA Inc.’s laboratory in Reno, Nevada. for pattern preparation. Pattern preparation contains preliminary weighing (Code WEI-21), crushing high quality management check (CRU-QC), pulverizing high quality management check (PUL-QC), wonderful crushing at 70%

Information verification by GRE workers included: an on-site inspection of the Mission website and core, reverse circulation and chip tray storage services, examine sampling, geologic maps and studies, and handbook auditing of the Mission drill gap database. GRE’s Certified Individuals have been concerned with the challenge since 2018. They visited the positioning in 2018 after drilling, throughout drilling in 2020 and 2022. The outcomes from the positioning inspection, visible pattern inspection and examine sampling for every drilling marketing campaign are given beneath. Primarily based on the outcomes of GRE’s Certified Individuals examine of the sampling practices, verification of drill gap collars within the subject, outcomes of the examine assay evaluation, visible examination of chosen core intervals, and the outcomes of each handbook and mechanical database audit efforts, GRE considers the collar, lithology, and assay knowledge contained within the challenge database to be fairly correct and appropriate to be used in estimating mineral assets.

The info verification of the drilling campaigns exhibits that knowledge from the rotary mud drilling was suspect and never used within the useful resource estimate. Open pit mining and processing strategies, prices and infrastructure wants have been verified by Ms. Lane compared to different comparable sized open pit mines working within the western USA. Borehole mining prices have been developed by Kinley with coordination with GRE. Different price knowledge used within the report was sourced from the latest infomine price knowledge report. All prices used to find out cheap prospects for financial extraction have been verified and reviewed by GRE and have been assessed to be present and acceptable to be used.

Metallurgical testing was accomplished for Bonnie Claire by a widely known business metallurgical laboratory. GRE reviewed all accessible metallurgical studies. GRE confirmed that the mineralization discovered on the Mission is just like one other challenge the place GRE has carried out different consulting work and finds that the check work for Bonnie Claire exhibits that the fabric behaves in an analogous method, particularly in lithium extraction and restoration and reagent consumption. Given the similarities of the Bonnie Claire materials to different comparable initiatives, this offers a great foundation for benchmarking the metallurgical check. The work seems to be professionally accomplished and is properly documented and is appropriate for estimation of lithium extraction and restoration calculations within the Mineral Useful resource Estimate.

About Nevada Lithium Sources Inc.

Nevada Lithium Sources Inc. is a mineral exploration and growth firm centered on shareholder worth creation by means of its core asset, the Bonnie Claire Lithium Mission, situated in Nye County, Nevada, the place it holds a 100% curiosity.

For additional data on Nevada Lithium and to subscribe for updates about Nevada Lithium, please go to its web site at: https://nevadalithium.com/

Certified Particular person Disclosure

The technical data within the above disclosure has been reviewed and permitted by the designated Certified Particular person below NI 43-101, Dr. Jeff Wilson, PhD, P.Geo, Vice President of Exploration for Nevada Lithium. Dr. Wilson is just not unbiased of Nevada Lithium, as he’s Vice President of Exploration for Nevada Lithium.

The technical data within the above disclosure has additionally been reviewed and permitted by Terre Lane, a ‘Certified Particular person’ as outlined below NI 43-101. Ms. Lane is Principal Mining Engineer with GRE and regarded to be “unbiased” of the Firm below Part 1.5 of NI 43-101.

On behalf of the Board of Administrators of Nevada Lithium Sources Inc.

“Stephen Rentschler”

Stephen Rentschler, CEO

For additional data, please contact:

Nevada Lithium Sources Inc.

Stephen Rentschler

CEO and Director

Cellphone: (647) 254-9795

E-mail: sr@nevadalithium.com

Media Inquiries

E-mail: information@nevadalithium.com

Discover Nevada Lithium on Twitter and LinkedIn

The Canadian Securities Change doesn’t settle for accountability for the adequacy or accuracy of this information launch. The Canadian Securities Change has not permitted or disapproved of the contents of this information launch.

Cautionary Observe Concerning Ahead-Wanting Statements

This information launch comprises forward-looking statements and forward-looking data (collectively, “forward-looking statements”) throughout the that means of relevant Canadian securities laws. These statements relate to issues that establish future occasions or future efficiency. Usually, however not all the time, ahead wanting data may be recognized by phrases comparable to “might”, “professional forma”, “plans”, “expects”, “might”, “will”, “ought to”, “price range”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “potential” or variations of such phrases together with destructive variations thereof, and phrases that confer with sure actions, occasions or outcomes which will, might, would, may or will happen or be taken or achieved.

The forward-looking statements contained herein embody, however are usually not restricted to, statements relating to: the efficiency of the Mission; outcomes of the 2023 Exploration and Growth Plan (together with, with out limitation, its mineral assets, present claims and its skill to make the most of international lithium wants); any plans following the Mineral Useful resource Estimate; the preparation of an up to date PEA in 2025; and the efficiency of lithium as a commodity, together with the sustained lithium demand and costs.

In making the ahead wanting statements on this information launch, Nevada Lithium has utilized a number of materials assumptions, together with with out limitation: market fundamentals that lead to sustained lithium demand and costs; the receipt of any mandatory permits, licenses and regulatory approvals in reference to the long run growth of Bonnie Claire in a well timed method; the supply of financing on appropriate phrases for the event; building and continued operation of Bonnie Claire; the Mission containing mineral assets; and Nevada Lithium’s skill to adjust to all relevant rules and legal guidelines, together with environmental, well being and security legal guidelines.

Traders are cautioned that forward-looking statements are usually not based mostly on historic information however as an alternative mirror Nevada Lithium’s administration’s expectations, estimates or projections regarding future outcomes or occasions based mostly on the opinions, assumptions and estimates of managements thought of cheap on the date the statements are made. Though Nevada Lithium believes that the expectations mirrored in such forward- wanting statements are cheap, such data entails dangers and uncertainties, and below reliance shouldn’t be positioned on such data, as unknown or unpredictable components might have materials opposed results on future outcomes, efficiency or achievements expressed or implied by Nevada Lithium. Among the many key threat components that might trigger precise outcomes to vary materially from these projected within the forward- wanting statements are the next: working and technical difficulties in reference to mineral exploration and growth and mine growth actions on the Mission; estimation or realization of mineral reserves and mineral assets, necessities for extra capital; future costs of valuable metals and lithium; modifications generally financial, enterprise and political circumstances, together with modifications within the monetary markets and within the demand and market value for commodities; attainable variations in ore grade or restoration charges; attainable failures of crops, gear or processes to function as anticipated; accidents, labour disputes and different dangers of the mining business; delays or the shortcoming of Nevada Lithium to acquire any mandatory approvals, permits, consents or authorizations, financing or different deliberate actions; modifications in legal guidelines, rules and insurance policies affecting mining operations; forex fluctuations, title disputes or claims limitations on insurance coverage protection and the timing and attainable consequence of pending litigation, environmental points and liabilities; dangers regarding epidemics or pandemics comparable to COVID-19, together with the impression of COVID-19 on Nevada Lithium’s enterprise; in addition to these components mentioned below the heading “Threat Elements” in Nevada Lithium’s newest Administration Dialogue and Evaluation and different filings of Nevada Lithium filed with the Canadian securities authorities, copies of which may be discovered below Nevada Lithium’s profile on the SEDAR+ at www.sedarplus.ca.

Ought to a number of of those dangers or uncertainties materialized, or ought to assumptions underlying the forward-looking statements show incorrect, precise outcomes might fluctuate materially from these described herein as meant, deliberate, anticipated, believed, estimated or anticipated. Though Nevada Lithium has tried to establish necessary dangers, uncertainties and components which might trigger precise outcomes to vary materially, there could also be others that trigger outcomes to not be as anticipated, estimated or meant. Nevada Lithium doesn’t intend, and doesn’t assume any obligation, to replace this forward-looking data besides as in any other case required by relevant regulation.