Analog Gadgets (NASDAQ: ADI) is not as well-known within the semiconductor trade as main gamers like Nvidia or Taiwan Semiconductor, that are driving the fast-growing adoption of synthetic intelligence (AI) and reporting eye-popping progress. That explains why shares of the chipmaker are up simply 12% 12 months thus far, lagging the gorgeous good points recorded by a few of its friends and the semiconductor sector general.

Nonetheless, a more in-depth take a look at the corporate’s newest quarterly outcomes and administration’s commentary signifies the chipmaker is on the verge of a turnaround. With its choices utilized in numerous finish markets, together with the economic, automotive, shopper, and aerospace and protection industries, amongst others, shopping for this semiconductor inventory proper now could possibly be a sensible factor to do from a long-term perspective.

Analog Gadgets is struggling, however there are indicators of a revival

Analog Gadgets launched its fiscal 2024 third-quarter outcomes (for the three months ended Aug. 3) final month. The corporate’s income fell 25% 12 months over 12 months to $2.31 billion, whereas non-GAAP earnings have been down 37% from the identical quarter final 12 months to $1.58 per share.

The chipmaker’s poor year-over-year comparisons could be attributed to weak demand throughout nearly all of its finish markets. The commercial enterprise, for instance, is Analog’s largest section and accounts for 46% of its prime line. It witnessed a 37% 12 months over 12 months contraction in income. That is not stunning as this section continues to be reeling from the impression of the oversupply attributable to poor demand final 12 months.

Extra particularly, the worldwide semiconductor trade’s income was down 11% in 2024 as demand remained weak for smartphones, private computer systems, and knowledge facilities. Though AI has emerged as a savior for the semiconductor trade prior to now 12 months, Analog Gadgets hasn’t been capable of journey this development because it does not make graphics processing models (GPUs) like Nvidia and AMD.

Nonetheless, administration factors out that its efficiency within the earlier quarter was higher than anticipated, and the top markets it serves may quickly begin recovering.

For steering, Analog Gadgets is projecting $2.30 billion to $2.50 billion in income within the present quarter with adjusted earnings of $1.53 to $1.73 per share. The corporate’s income stood at $2.72 billion in the identical quarter final 12 months, so Analog’s year-over-year income decline is ready to gradual to 11% within the present quarter. The tempo of decline on its backside line ought to gradual as properly.

These are indications the stock correction in Analog Gadgets’ finish markets could possibly be nearing an finish. CEO Vincent Roche remarked on the most recent earnings name that “improved buyer stock ranges and order momentum throughout most of our markets elevated my confidence that our second quarter marks the cyclical backside for ADI.”

A possible restoration may result in extra inventory upside

Consensus estimates point out Analog Gadgets’ income will decline 24% in fiscal 2024 to $9.38 billion, whereas its earnings are on monitor to drop to $6.33 per share from $10.09 per share within the earlier fiscal 12 months. Nonetheless, fiscal 2025 ought to see a rebound with income up 10% to $10.35 billion, whereas its backside line may improve by nearly 20% to $7.57 per share.

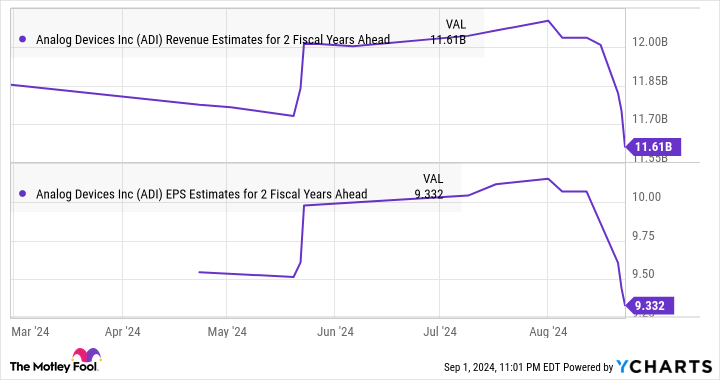

Although analysts have tempered their expectations for fiscal 2026, they’re nonetheless forecasting an acceleration in Analog’s top- and bottom-line progress, as we will see within the chart under:

These estimates can nonetheless transfer greater if Analog Gadgets’ monetary efficiency improves on the again of a restoration in its finish markets. That is why there is a good likelihood this chipmaker may step on the fuel and ship extra good points over the subsequent couple of years.

Must you make investments $1,000 in Analog Gadgets proper now?

Before you purchase inventory in Analog Gadgets, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Analog Gadgets wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $630,099!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 3, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.

Up 12% in 2024, You Could Need to Purchase This Semiconductor Inventory Earlier than It Goes on a Bull Run was initially printed by The Motley Idiot