US inflation in all probability moved sideways at greatest in October, highlighting the uneven path of easing worth pressures within the house stretch towards the Federal Reserve’s goal.

Article content material

(Bloomberg) — US inflation in all probability moved sideways at greatest in October, highlighting the uneven path of easing worth pressures within the house stretch towards the Federal Reserve’s goal.

The core shopper worth index due on Wednesday, which excludes meals and vitality, probably rose on the identical tempo on each a month-to-month and annual foundation in comparison with September’s readings.

Commercial 2

Article content material

The general CPI in all probability elevated 0.2% for a fourth month, whereas the year-over-year measure is projected to have accelerated for the primary time since March.

“The October CPI report will probably help the notion that the final mile of inflation’s journey again to focus on would be the hardest,” Wells Fargo & Co. economists Sarah Home and Aubrey Woessner wrote in a report. “Excluding the extra risky vitality and meals parts, the unwinding of pandemic-era worth distortions has confirmed to be frustratingly sluggish.”

They added that costs of core items in all probability rose once more in October, due partially to increased demand for vehicles and auto elements after Hurricanes Helene and Milton. Evacuation orders from the storms additionally compelled extra individuals to remain in motels, persevering with what’s been a “glacial slowing” in companies costs.

What Bloomberg Economics Says:

“We anticipate each CPI and PPI to return in scorching, pushing long-end charges even increased — and additional restraining the financial system over the following couple months. We anticipate control-group retail gross sales to sluggish and the unemployment price to proceed to climb, reaching 4.5% by yr finish,”

Commercial 3

Article content material

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou, Chris G. Collins, economists. For full evaluation, click on right here.

Even so, “the story could be very constant, with inflation persevering with to return down on a bumpy path,” and one or two dangerous experiences received’t change that sample, Fed Chair Jerome Powell stated Thursday after the central financial institution reduce rates of interest by 1 / 4 level.

The US authorities may even launch wholesale inflation figures within the coming week, which in all probability picked up after stalling in September. Meantime, earnings progress that continues to outpace inflation probably contributed to a different respectable acquire in retail gross sales, in knowledge due Friday.

- For extra, learn Bloomberg Economics’ full Week Forward for the US

On Tuesday, Fed Governor Christopher Waller is because of converse at a banking convention earlier than the central financial institution releases its newest Senior Mortgage Officer Opinion Survey. Powell is scheduled for an occasion later within the week, whereas New York Fed President John Williams and Dallas Fed President Lorie Logan are additionally on the calendar.

In Canada, in the meantime, house gross sales knowledge for October will reveal whether or not the central financial institution’s price cuts are beginning to jolt the sluggish housing market.

Article content material

Commercial 4

Article content material

A packed week for knowledge elsewhere features a vary of financial numbers from China, wage and progress statistics within the UK, and a number of inflation readings, from India to Argentina. New European Union forecasts may even be revealed.

Click on right here for what occurred prior to now week, and beneath is our wrap of what’s developing within the world financial system.

Asia

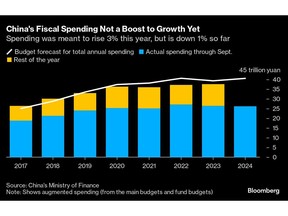

An information blast from China could present the financial system’s efficiency improved marginally in October, with industrial output, mounted asset funding and retail gross sales all seen choosing up a bit because the downturn in property funding moderates.

Even so, the info will underscore the need of the broad stimulus steps undertaken since late September as President Xi Jinping seeks to attain his progress objectives.

China’s slew of figures comes on the finish of the week, on the identical day that Japan is predicted to report that its financial progress slowed to an annualized 0.6% quarter on quarter within the three months via September.

India’s inflation is projected to have picked as much as 5.72% in October, whereas industrial output is seen rebounding in September in figures due on Tuesday.

Commercial 5

Article content material

Australia will get shopper and enterprise confidence surveys on Tuesday earlier than releasing various labor-market statistics later within the week.

The wage worth index for the third quarter comes on Wednesday, and different employment statistics for October can be revealed a day later. Indonesia experiences commerce knowledge on Friday.

Amongst central banks, the Financial institution of Japan releases a abstract of opinions from its October assembly, when it held charges regular, and Reserve Financial institution of Australia Governor Michele Bullock seems on a panel on Thursday, with policymaking colleague Brad Jones doing the identical a day later.

- For extra, learn Bloomberg Economics’ full Week Forward for Asia

Europe, Center East, Africa

The UK can be in focus following Thursday’s Financial institution of England price reduce, which got here with a warning of the inflationary influence of the latest finances. Governor Andrew Bailey is scheduled to make a speech on Thursday.

Wage numbers on Tuesday could present mildly slowing pay progress, providing restricted reassurance to policymakers. A launch on Friday will in all probability reveal financial progress to have weakened within the third quarter to 0.2% from 0.5% within the prior three months, in keeping with economists.

Commercial 6

Article content material

Different international locations with preliminary GDP numbers for a similar interval embody Poland on Thursday and Switzerland on Friday.

Turning to the euro zone, Tuesday’s German ZEW index will supply a glimpse of investor sentiment at a time when Europe’s largest financial system continues to be struggling to shake off industrial malaise, and now faces the prospect of early elections as effectively.

Euro-zone industrial manufacturing on Wednesday will reveal the state of producing on the finish of the third quarter, and a second estimate of GDP will arrive concurrently. The European Fee in Brussels will launch new financial forecasts for the area on the finish of the week.

The European Central Financial institution on Thursday will publish an account of its October assembly, probably containing hints on officers’ pondering for his or her December resolution. Vice President Luis de Guindos, talking in Madrid the identical day, is amongst a number of officers scheduled to make appearances.

In Sweden, minutes of the Riksbank’s resolution to ramp up easing with a half-point price reduce are due on Wednesday, adopted by its monetary stability report a day later.

Commercial 7

Article content material

In Russia on Wednesday, knowledge will in all probability present the financial system contracted within the third quarter — for the primary time since war-related fiscal stimulus started boosting exercise again in late 2022. Bloomberg Economics forecasts GDP to have fallen 0.3% to 0.5% within the three months via September.

Russia is amongst various international locations releasing inflation knowledge. Right here’s an summary:

- On Sunday, Egyptian financial officers will hope annual worth progress slowed in October after quickening for 2 successive months to 26.4% in September. That’s prone to have delayed the beginning of an easing cycle.

- Norway on Monday could present a notable slowdown in inflation, to 2.4%. However with krone weak spot preoccupying officers, the central financial institution stored borrowing prices unchanged on Thursday, signaling no imminent plans for any discount.

- With Russia’s launch for October due on Wednesday, policymakers will watch to see if a 200 basis-point price enhance final month will assist decelerate worth progress towards its 4% goal. In September it was at 8.6%.

- On Friday, Nigeria’s inflation numbers are anticipated to indicate quickening to 33.4% from 32.7% after gasoline prices spiked due to the scaling again of subsidies, in keeping with Bloomberg Economics.

- The identical day in Israel, knowledge will probably reveal worth progress stayed above 3%, the higher finish of the official goal. It’s been above goal for 3 straight months because the conflicts in Gaza and Lebanon trigger authorities spending on protection to soar and worsen supply-side constraints.

Commercial 8

Article content material

Amongst central banks, financial policymakers in Zambia are anticipated to depart their price unchanged at 13.5% to help the drought-battered financial system. That ordeal has prompted the Worldwide Financial Fund to nearly halve its 2024 progress projections, to 1.2%.

- For extra, learn Bloomberg Economics’ full Week Forward for EMEA

Latin America

Argentina President Javier Milei is prone to get some welcome information with the October shopper costs report. Month-to-month inflation could have slowed to a three-year low of slightly below 3% with the annual studying coming in underneath 200%, down from April’s 289.4% peak.

Analysts anticipate a hawkish tone to the minutes of the Brazilian central financial institution’s Nov. 6 resolution to hike to 11.25%. On the identical time, ahead steering could also be briefly provide on condition that Brazil’s authorities had but to decide to spending cuts, and all of the wild playing cards inherent following the US election.

Economists anticipate a hike of at the least the identical magnitude on the BCB’s December assembly, and plenty of have marked up their terminal price projections to 13% or extra.

Uruguay’s central financial institution has held its key price at 8.5% since April and is prone to hold it there for a fifth straight assembly.

Commercial 9

Article content material

In Peru, Lima labor market figures and September GDP-proxy knowledge are on faucet, each underscoring the financial system’s rebound from final yr’s recession.

Banco de Mexico’s case for a third-straight price reduce on Nov. 14 appeared fairly easy a month in the past, however yet one more bout of quicker inflation makes it a barely harder name.

Nonetheless, the mixture of slower progress and 21 straight months of slowing core inflation will probably see Governor Victoria Rodriguez and colleagues go forward with the discount to 10.25%.

- For extra, learn Bloomberg Economics’ full Week Forward for Latin America

—With help from Brian Fowler, Laura Dhillon Kane, Monique Vanek, Robert Jameson, Paul Wallace and Piotr Skolimowski.

Article content material