Canadian Pure is already the nation’s largest petroleum producer, pumping out 1.29 million boe per day through the second quarter, and it continues to develop

Article content material

Each time worldwide oil and gasoline firms are heading for the exits or promoting main properties in Canada, one firm at all times appears to be on the doorstep, prepared to maneuver.

On Monday, Canadian Pure Sources Ltd. continued its decades-long observe file of shopping for oilsands and gasoline properties from international gamers, asserting a significant $8.85-billion (US$6.5 billion) cope with Chevron Corp.

Commercial 2

Article content material

The Calgary-based firm agreed to an all-cash transaction to accumulate Chevron’s 20 per cent stake within the Athabasca Oil Sands Mission (AOSP), a improvement already operated and majority owned by Canadian Pure Sources.

It additionally picks up Chevron’s properties within the Duvernay formation in Alberta, with plans to shortly increase manufacturing.

“Each these belongings present important free money circulation for many years,” firm president Scott Stauth informed analysts on Monday.

“We’re going to proceed to do what we do — and that’s give attention to driving worth by means of steady enchancment, have a look at methods to lowering prices, have a look at methods to optimize manufacturing.”

The acquisition is predicted so as to add about 122,500 barrels of oil equal (boe) per day to the corporate’s output subsequent 12 months.

Canadian Pure is already the nation’s largest petroleum producer, pumping out 1.29 million boe per day through the second quarter, and it continues to develop.

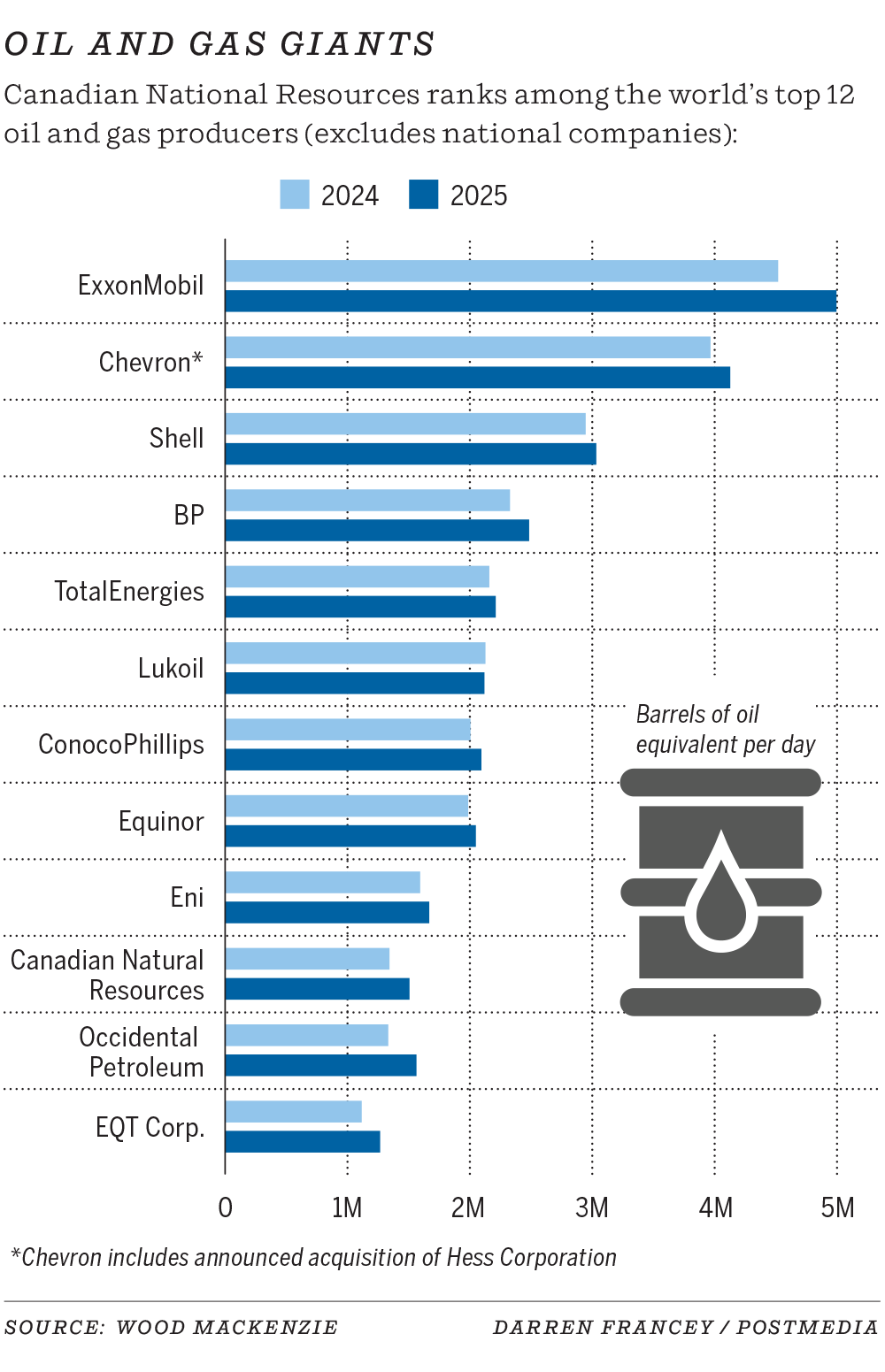

The deal will safe the corporate’s spot within the checklist of prime 12 largest petroleum producers on the earth subsequent 12 months, excluding nationwide oil firms, based on knowledge by consultancy Wooden Mackenzie.

Article content material

Commercial 3

Article content material

It’s barely forward of Occidental Petroleum for tenth spot this 12 months — the checklist is led by supermajors ExxonMobil and Chevron — and Canadian Pure is at present projected to dip barely behind the Houston-based producer subsequent 12 months.

“It’s rising considerably with this acquisition,” mentioned Jonah Resnick, senior analysis analyst with Wooden Mackenzie.

“CNRL is actually neck-and-neck with Oxy. They’re within the prime three by impartial operators in North America and the world, for that matter, as a result of the remainder of these firms are all majors, built-in majors.”

The deal provides about 63,000 barrels per day of artificial crude oil output to CNRL, together with varied pursuits in non-producing oilsands properties. The Duvernay properties in Alberta are focused to supply about 60,000 boe per day subsequent 12 months.

The Canadian firm has an extended historical past of shopping for belongings from worldwide gamers, similar to a $1-billion transaction to purchase oil properties from BP Amoco in 1999, together with some oilsands leases that turned its Horizon Oil Sands improvement.

In 2017, it secured a $12.7-billion settlement to purchase oilsands belongings from Royal Dutch Shell and Houston-based Marathon Oil, giving it a 70 per cent curiosity in AOSP and the Scotford upgrader.

Commercial 4

Article content material

That transaction, together with Cenovus Vitality spending $17.7 billion to purchase oilsands properties and gasoline belongings from ConocoPhillips in 2017, led to the numerous elevated “Canadianization” of the oilsands as worldwide producers left the nation.

Two years later, Canadian Pure purchased Oklahoma-based Devon Vitality’s oilsands and heavy oil properties in Alberta for $3.8 billion.

Canadian Pure Sources, led by chair Murray Edwards, has advanced from a small junior producer within the Nineteen Eighties to one of many world’s largest impartial oil firms by means of each natural progress and important mergers and acquisitions.

Wooden Mackenzie says the corporate can have spent an eye-popping US$33 billion in 23 offers over the previous twenty years.

Its market capitalization exceeds $105 billion on the Toronto Inventory Trade, as its shares closed up 3.3 per cent Monday to $49.81.

“It’s one other stable deal by a crew who’ve been anointed and given a cross to make such inventive offers that don’t impression return of capital,” mentioned Eric Nuttal, a senior portfolio supervisor with Ninepoint Companions, which is a Canadian Pure shareholder.

Commercial 5

Article content material

“Given Murray’s observe file, if Murray’s shopping for, I definitely don’t wish to be promoting.”

With the deal, CNRL will now personal 90 per cent of the Athabasca Oil Sands Mission.

The all-cash deal is predicted to shut within the fourth quarter of this 12 months.

For Chevron, which has operated in Canada since 1938, this marks a significant disposition because it sells belongings following final October’s mammoth deal to accumulate Hess Corp. for US$53 billion.

In January, Chevron introduced its intention to search for potential patrons for its 70 per cent working curiosity within the Duvernay.

Chevron Canada, which has about 275 workers within the nation, will nonetheless personal non-operated pursuits off the East Coast, and retain pursuits in some British Columbia and northern Canada — however no remaining pursuits in Alberta, officers mentioned.

Maybe one of many greatest take-aways is Canada’s largest oil producer is making yet one more long-term guess on the oilsands.

Amid questions concerning the pace of the power transition, the push to decarbonize and develop a carbon seize community within the oilsands, and ongoing unsure oil and gasoline insurance policies, Canadian operators similar to CNRL, Cenovus and Suncor Vitality proceed to increase.

Commercial 6

Article content material

In early 2017, Canadian-led petroleum firms managed about 52 per cent of complete oilsands manufacturing.

Right this moment, Canadian-owned firms personal about 82 per cent of oilsands output, mentioned Wooden Mackenzie.

“We’re in a world the place we’ve acquired two competing narratives. One is that oil and pure gasoline have a restricted remaining length, and one the place the transition goes to take for much longer and we’re going to have significantly longer paths for oil and gasoline,” mentioned Michael Tims, vice-chair of Matco Investments Ltd., which owns some inventory in CNRL.

“It seems to be to me like a really astute transfer on Canadian Pure’s half. And all people knew Chevron was a keen vendor in Canada.”

Chris Varcoe is a Calgary Herald columnist.

Article content material