KEY

TAKEAWAYS

- A head-and-shoulders high sample has to finish three phases earlier than it may be thought of legitimate.

- Even when semiconductors would full this bearish worth sample, energy in different sectors suggests restricted influence on the broader fairness area.

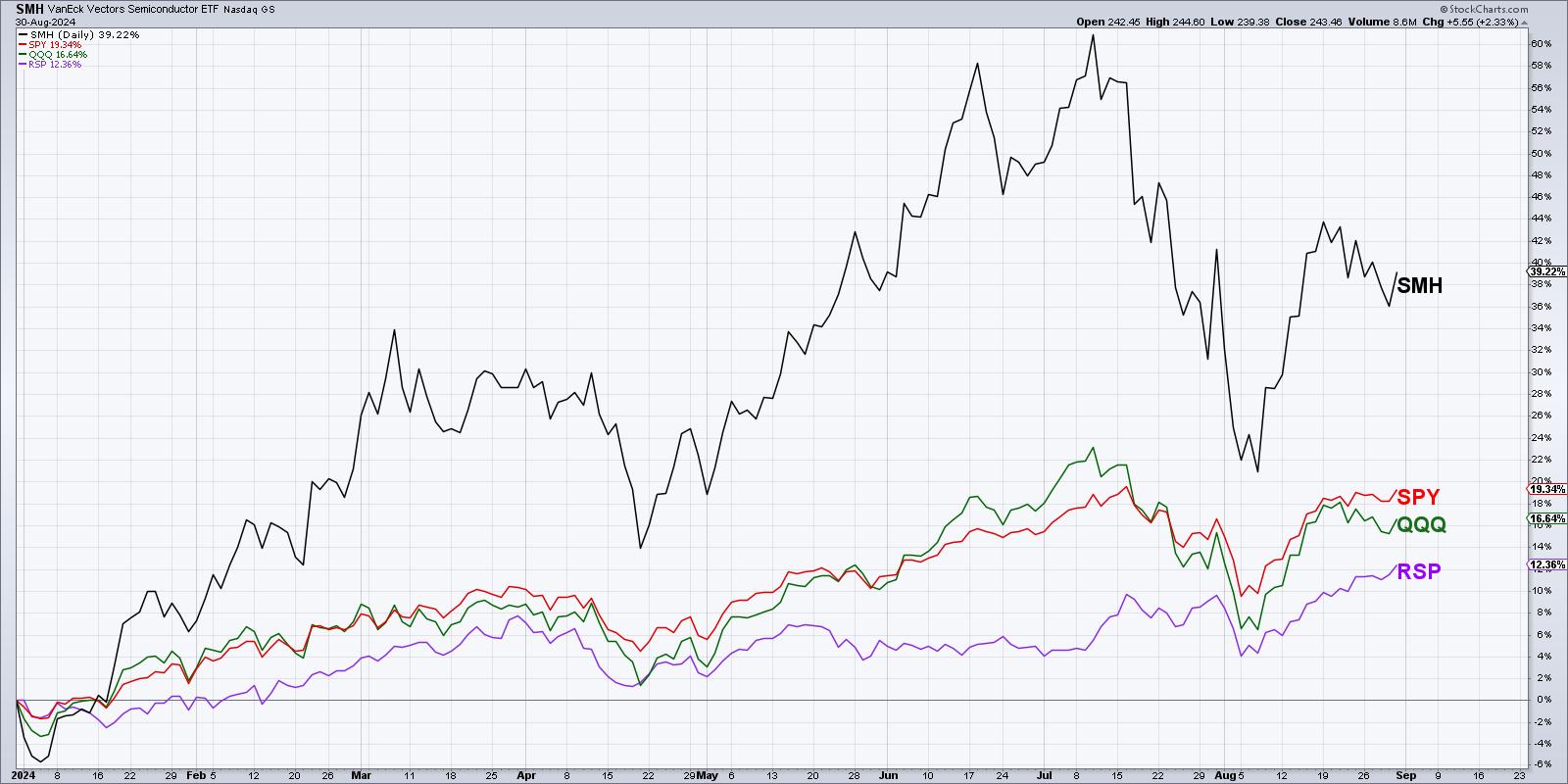

After Nvidia (NVDA) dropped after earnings this week, buyers are as soon as once more reminded of the significance of the semiconductor area. I consider semis as a “bellwether” group, as energy within the VanEck Vectors Semiconductor ETF (SMH) normally means the broader fairness area is doing fairly effectively. In the present day, we’ll take a look at a possible topping sample forming for the SMH, what ranges would verify a high for semiconductors, and what weak point on this key group might suggest for our fairness benchmarks.

Presenting the Dreaded Head-and-Shoulders Prime Sample

Ralph Edwards and John Magee, of their traditional textual content Technical Evaluation of Inventory Traits, laid out the analytical course of for outlining a head-and-shoulders high. I’ve discovered that any worth sample like this consists of three necessary phases.

First, we now have the “Setup” part, the place the value motion begins to tackle the looks of a sure part. That is when your mind tells you, “That is undoubtedly a head and shoulders topping sample.” On this case, we’re on the lookout for a big excessive surrounded by two decrease highs, creating the looks of a head and two shoulders.

We are able to clearly observe the setup part on the chart of the SMH, with the June and July highs forming a considerably nontraditional, however nonetheless legitimate, head. The decrease peaks in March and August full the image. It is price noting right here that, in every of these peaks, we are able to see a bearish engulfing sample, serving as an exquisite reminder for longer-term place merchants: ignore candle patterns at your individual danger!

What Would Verify This Topping Sample for Semis?

However the setup part solely means there’s a potential sample forming right here. Subsequent we want the “set off” part, the place the value completes the sample by breaking by a key set off degree on the chart. For a head-and-shoulders high, meaning a break under the neckline, shaped by drawing a trendline connecting the swing lows between the top and two shoulders.

Utilizing the bar chart above, that will recommend a neckline round $200, over $40 under Friday’s shut. One other faculty of thought entails closing costs solely, for a cleaner perspective and extra easy measurements.

Utilizing closing costs, we get an upward-sloping neckline which at the moment sits just under the 200-day shifting common round $215. In both case, till we break under neckline help, this isn’t a sound head-and-shoulders topping sample. The third part, which I name the “affirmation” part, entails some type of follow-through past the breakout degree. This might imply one other down shut after the break, or maybe a sure proportion threshold under that help degree. And as soon as all three phases are full, then we now have a sound topping sample.

Gauging Potential Broad Market Impression

So let’s assume that semiconductors do certainly full the topping sample. What would that imply for the broader fairness panorama?

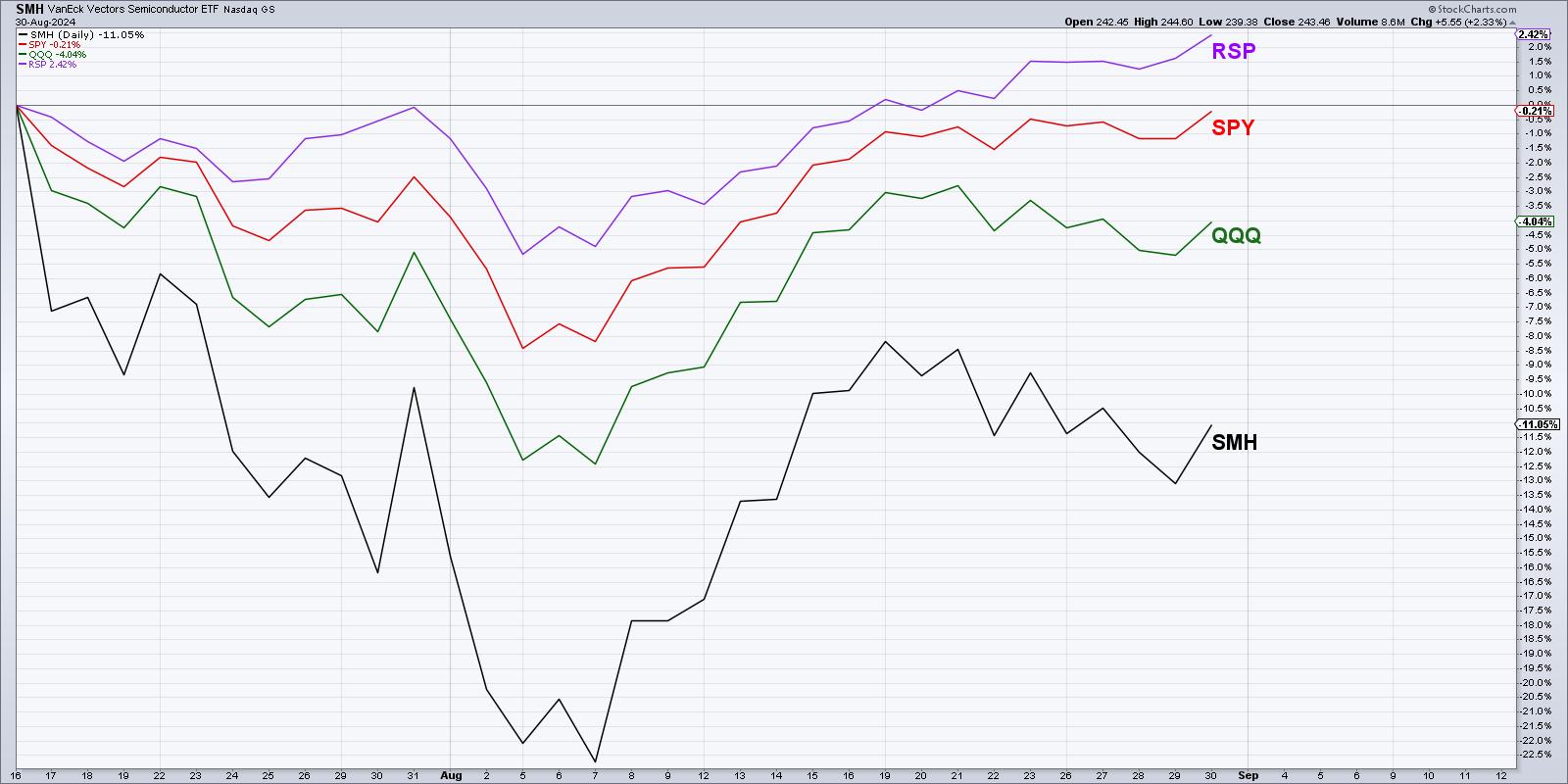

As of Friday’s shut, the SMH is up about 38.2% year-to-date. That compares to the S&P 500 (SPY) at +18.9%, the Nasdaq 100 (QQQ) with +16.2%, and the equal-weighted S&P 500 (RSP) at +12.1%. So semiconductors have actually been a stronger management group in 2024. However what about because the July market peak?

Now we are able to see that, whereas the S&P 500 is sort of again to its July peak, the Nasdaq remains to be 4% under that day’s shut and semis are a full 11% under the market peak in July. And the equal-weighted S&P 500 is definitely above its July peak already, chatting with the energy that we have noticed in non-growth sectors off the early August low.

There is no such thing as a doubt that semiconductors are wanting a bit susceptible after Nvidia’s earnings this week. However given the energy that we’re seeing exterior of the semiconductor area during the last two months, weak point within the SMH doesn’t essentially imply weak point for shares. Keep in mind that it is all the time an excellent time to personal good charts!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any means signify the views or opinions of every other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers reduce behavioral biases by technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness strategies to investor determination making in his weblog, The Conscious Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing danger by market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to establish funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra