但在他服刑之前,他就去世了…

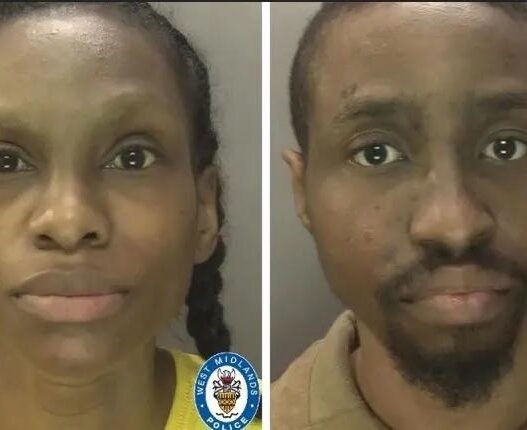

2012年,蘇格蘭鄧迪市發生了一起殘酷的謀殺案。兇手卡勒姆·托爾 (Callum Toll) 是一名 30 歲的吸毒者,也是這起令人毛骨悚然的犯罪事件的中心人物。

(卡勒姆·收費)

托爾和他的女朋友都是癮君子,他們打算去她家待一段時間。然而,他們忘記了鑰匙,不得不在外面等待鎖匠。在等待的過程中,他們遇到了鄰居羅尼·弗雷澤 (Ronnie Fraser),他是一位 44 歲的社區德高望重的男子。托爾看到弗雷澤,百無聊賴,決定向他勒索香菸。

儘管弗雷澤是個善良的人,但他對托爾這樣的癮君子沒有耐心,他堅決拒絕了。爭吵升級,托爾因藥物引起的昏迷昏倒了。當他甦醒後,他將自己的病情歸咎於弗雷澤,導致了一場扭打。

就在這時,鎖匠趕到並打開了托爾女友公寓的門。托爾盛怒之下衝了進去,抓起一把大菜刀,回來刺向弗雷澤的心臟。

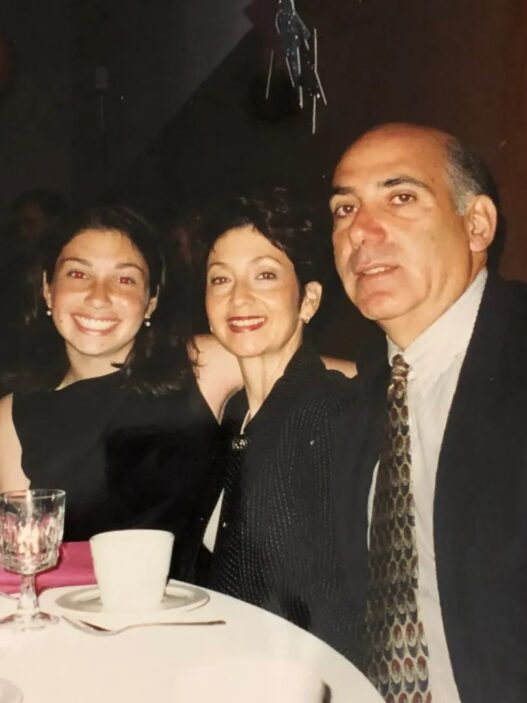

鄰居和弗雷澤的家人目睹了整個痛苦過程,並立即報了警。儘管他們在調度員的幫助下努力營救弗雷澤,但警察到達後他還是被宣布死亡。

有了充足的證據和證人,托爾當場被捕,但他仍然否認有任何不當行為。他聲稱有人在他的午餐中給他下藥,導致他失控。然而,這種辯護在壓倒性的證據面前顯得很無力。陪審團只花了 30 分鐘就判他有罪。

法官指出,這並不是托爾第一次犯罪;他曾因暴力行為被定罪,包括在公共場合攜帶武士刀。 「你隨後的行為是不可原諒的,也是不可原諒的。你選擇用致命武器武裝自己,在一個手無寸鐵的人的家人面前殺死他,而事後你卻沒有表現出任何悔意和關心。法庭無法讓時間倒流,但是,我唯一能做的就是判處你無期徒刑。

聽到判決後,托爾不但沒有表現出悔意,反而嘲笑弗雷澤的家人:「振作起來,今天是個好日子!至少我還活著,18年後我就會出院。我就45歲了。 ” ,還有充足的生命!” (註:數學不準確;托爾實際上是 48 歲,而不是 45 歲,但考慮到他的狀態,他的數學技能可能有所欠缺。)

弗雷澤的家人聽到這個消息後,悲痛欲絕,這是可以理解的。他們在審判結束後接受採訪時表示,「這是一起有預謀的謀殺案,對我們的家庭和生活產生了深遠的影響。這是一個殘忍、野蠻的行為,一個膽小鬼在毒品的影響下實施的,他用暴力手段實施了這起謀殺案。

儘管家人很憤怒,但法律就是法律,他們不得不接受託爾最終會刑滿釋放的事實,而他們將永遠承受失去親人的痛苦。

但命運轉折,蘇格蘭警方發言人於2024年11月26日宣布,托爾被從監獄轉移到艾爾德里蒙克蘭茲大學醫院,並在那裡去世,享年42歲,沒有任何可疑情況。

托爾沒能活著看到自己被釋放,甚至還沒有達到誤算的 45 歲…

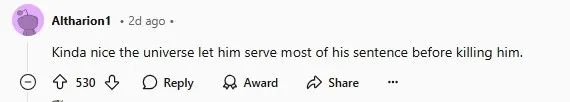

網友們終於從這個結果中找到了一些安慰:

- “命運讓他服完大部分刑期才帶走他,這真是了不起,很好!”

(來自 Reddit 的評論)

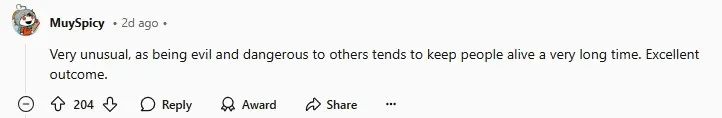

- 「這種情況很少見。他們說犯罪是有代價的,但通常情況下,有罪的人會長壽而沒有罪責。這個結果非常令人滿意。”

(來自 Reddit 的評論)

- “我通常不會說死者的壞話,但這次我要破例。祝你擺脫困境!”

(來自 Reddit 的評論)

- “更正一下:他不會在 45 歲就缺陣。”

- “不,他42歲就出來了,但那是他的屍體……”

(來自 Reddit 的評論)

所以,雖然法律可能會表現出寬大的態度,但命運卻有自己的方式來伸張正義…