据唐纳德·特朗普总统宣布,美国高级别代表团正前往莫斯科,就乌克兰潜在停火协议进行谈判。这一外交行动紧随乌克兰与美方官员在沙特阿拉伯达成30天休战协议之后。

国务卿马可·卢比奥强调下一步取决于俄罗斯,指出和平谈判是结束冲突的唯一可行方案。克里姆林宫已确认收到提案,正在审议条款内容。

特朗普与普京或将通话?

克里姆林宫发言人德米特里·佩斯科夫表示,俄罗斯正在研究停火计划,未来数日将通过”多种渠道”更新进展。特朗普与俄罗斯总统普京的通话事宜也在考虑中。

特朗普在椭圆形办公室表示收到停火”积极信号”,但警告单凭乐观不够。”这是一个非常严峻的局势,”他补充道。

莫斯科谈判由谁主导?

尽管特朗普未透露赴俄官员名单,白宫新闻秘书卡罗琳·莱维特确认国家安全部长 迈克·华尔兹已与俄方对应官员展开磋商。

英国广播公司 消息源透露,中东特使史蒂夫·维特科夫在吉达谈判结束后也将加入赴莫斯科代表团。

“我们敦促俄罗斯接受该计划,”莱维特表示,”这是战争爆发以来最接近和平的时刻。”

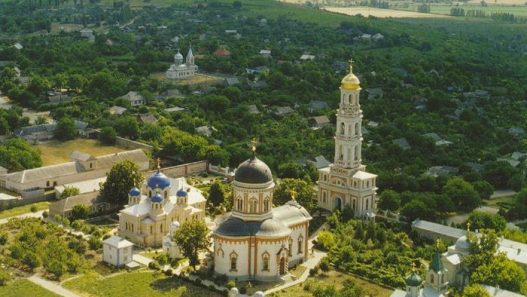

普京视察库尔斯克:武力展示?

尽管外交努力持续,乌克兰战事未歇。俄军无人机和导弹袭击了包括克里维里赫、敖德萨、第聂伯罗彼得罗夫斯克及 哈尔科夫在内的多个城市。

与此同时,俄军在 库尔斯克地区加强攻势,佩斯科夫宣称正”成功推进并收复失地”。

周三,克里姆林宫发布普京视察库尔斯克军事指挥所的视频,总参谋长瓦列里·格拉西莫夫陪同在侧。两人身着作战服,彰显俄方持续军事行动的决心。

这是自乌克兰去年八月发动跨境行动以来,普京首次视察该地区。俄官方媒体报道称,普京已下令对该地区实施全面”解放”。

乌克兰战略撤退

乌克兰武装部队总司令亚历山大·瑟尔斯基承认库尔斯克地区部队调动,暗示战略撤退。他在电报频道写道:

“在最艰难时刻,我的首要任务仍是保全乌克兰士兵的生命。”

特朗普对俄施压手段

特朗普暗示若俄拒绝停火,将动用金融手段施压。”我能采取对俄极其不利的经济措施,”他警告道,但强调更倾向外交途径:”我不愿如此,因为我渴望和平。”

他同时透露谈判涉及领土调整,但未明确乌克兰是否需向俄割让土地作为协议内容。

后续发展

随着美俄谈判临近而普京毫无退意,关键问题仍悬而未决:

- 俄罗斯会接受美国支持的停火协议吗?

- 乌克兰能否获得长期安全保障?

- 特朗普会实施金融制裁施压莫斯科吗?

世界正密切关注外交斡旋与军事行动的动态发展,乌克兰的命运仍悬于一线。