提到可乐,人们通常会想到可口可乐或百事可乐。但在印度可乐史上,有个特立独行的碳酸叛逆者——Thums Up。这款标志性饮料以更强烈的气泡、更高的咖啡因含量和大胆的风味著称,它的诞生不仅是商业产物,更是政治博弈、民族自豪感和辛辣调味的混合结晶。

可口可乐退出印度:传奇的起点

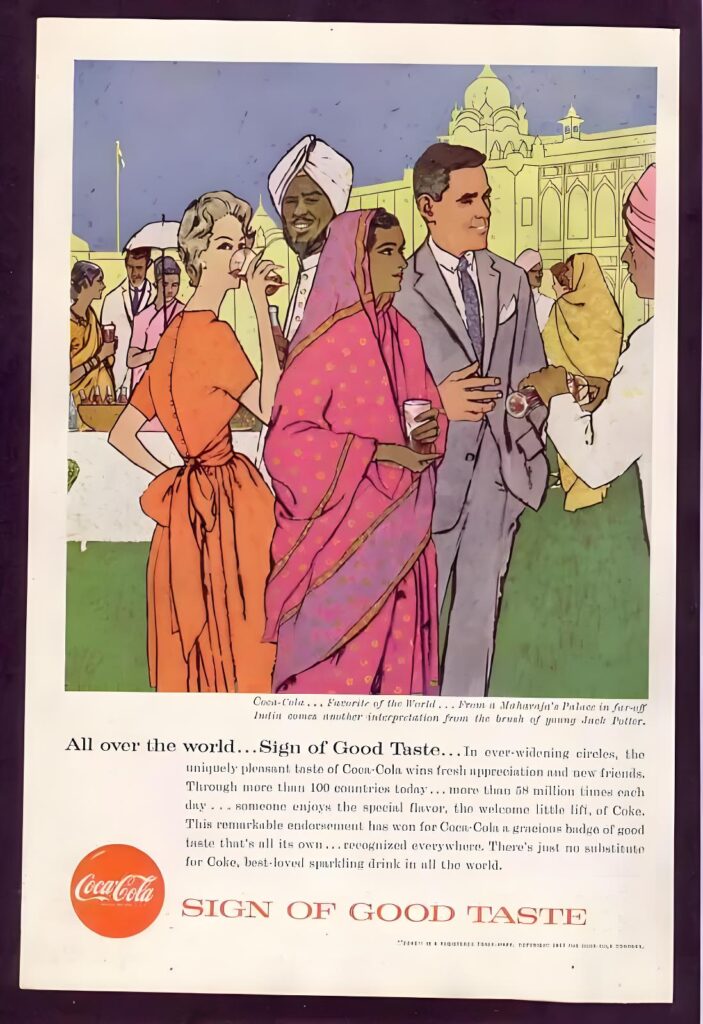

早在1950年代,可口可乐就进入了印度市场,主要面向上层阶级。此后数十年间,软饮市场始终平淡无奇,只有可口可乐和本土巨头Parle旗下的Gold Spot(橙味汽水)、Limca(柠檬青柠汽水)等少数产品。

但1977年风云突变。印度颁布《外汇管制法》(FERA),规定外资持股不得超过40%,并要求向印度合作伙伴转让技术。可口可乐拒绝公开”神秘配方”,经过数年僵持后彻底退出印度市场。

Thums Up登场:印度的可乐革命

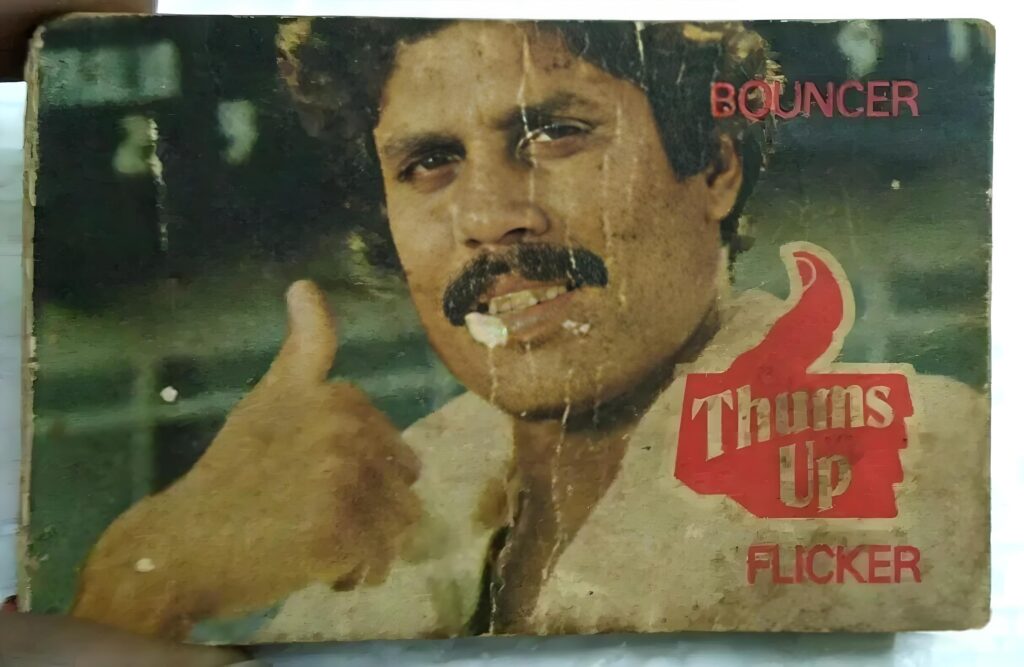

Parle迅速抓住机遇。可乐配方并非高深科技——主要是香草、肉桂和磷酸。但Parle决定大胆创新:增强气泡感、提高咖啡因含量(13mg/100ml,可口可乐为9mg)、采用蔗糖提升甜度层次,并加入肉豆蔻、小豆蔻等印度香料。有人戏称甚至尝出了咖喱味!

于是,专为印度灵魂打造的可乐Thums Up横空出世——更浓烈、更辛辣、充满本土特色。

冷知识:品牌名写作”Thums Up”而非”Thumbs Up”,因为字母”b”在发音中不发声,创始人索性将其省略——既实用又极具印度特色。

百事的土豆战略

1988年,百事试图进军印度市场。但在FERA政策限制下,他们另辟蹊径:以农业公司身份进入,通过建立土豆农场支持乐事薯片业务。这条路线虽不盈利,却创造了就业机会并完善了基础设施——堪称长远布局。

可口可乐回归:惊天逆转

1991年印度经济濒临崩溃。随着老盟友苏联解体,印度启动经济自由化改革,废除FERA政策,重新向外资敞开大门。

1993年可口可乐高调回归,直接收购Parle旗下的Thums Up、Gold Spot和Limca。苦心经营多年的百事措手不及,犹如追求心上人数年,却目睹其与衣锦还乡的富豪前任闪婚。

余波未平:气泡依旧升腾

可口可乐曾试图用自家产品取代Thums Up,却低估了印度消费者的忠诚度。许多人至今不知品牌已易主。如今,Thums Up仍是印度最畅销可乐之一。

辛辣、浓烈、深植印度基因——Thums Up证明大胆创新终有回报。即便在全球可乐大战中,这位碳酸叛逆者依然续写着属于自己的传奇。

最终思考

Thums Up不仅是饮料,更是印度历史的碳酸注脚。从政策剧变到爱国风味革命,它的故事证明:本土情怀、大胆风味与一抹辛辣,足以铸就真正的传奇。