理想のカップル:衝撃の真実

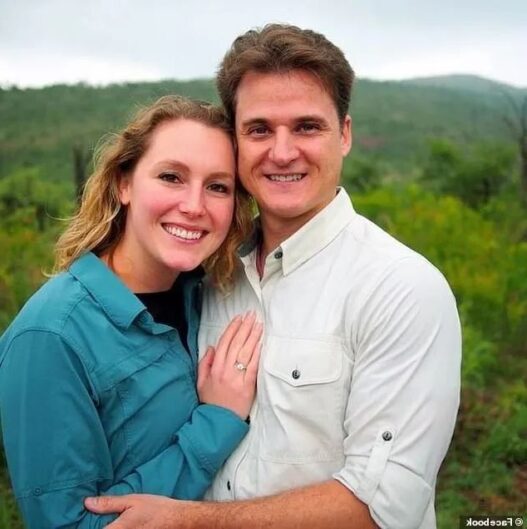

ゲルハルト・ケーニヒと妻アリエルは完璧な夫婦と見なされていた。2018年に結婚し、2020年にハワイの風光明媚な島マウイに移住した。著名な麻酔科医であるゲルハルトは輝かしい経歴を持ち、2022年にマウイ麻酔グループのパートナーになる前に、ピッツバーグ大学で麻酔学と生体医工学の助教授を務めていた。一方、アリエルは核燃料産業でリモートワークをしており、夫と2人の子供と過ごす十分な時間があった。

近所の人や同僚の目には、彼らは穏やかで友好的な夫婦の象徴のように映っていた。トラブルを起こすこともなく、プライベートな生活を守りながら、家族との時間や親しい友人とのウィスキーを楽しむ夜を過ごしていた。安定した幸せな生活を送っており、多くの人々が彼らの完璧な家庭を羨ましく思っていた。

アリエルの36歳の誕生日の恐怖

しかし、アリエルの36歳の誕生日に全てが一変した。祝うため、家族はハワイのホノルル行きの飛行機に乗り、子供たちをベビーシッターに預けた後、ゲルハルトとアリエルはパリ展望台へのハイキングに出かけた。この展望台は息をのむような景色で知られる人気観光スポットだが、同時に危険も伴う場所だ。展望台はコオラウ山脈沿いの崖の上に位置し、その下には90メートルの深い谷が広がっている。落下を防ぐ唯一の保護策は腰の高さまでの柵だけである。

午前10時38分頃、カップルは展望台に到着した。アリエルによると、最初ゲルハルトは崖の端で彼女と自撮りをしたがっていた。彼女は危険すぎると感じ、崖の近くに立つことを拒否した。彼女が戻り始めた時、ゲルハルトは突然激怒し、戻ってくるよう叫んだ。再び拒否されると、ゲルハルトは石を拾い、彼女の後頭部を殴った。その後、彼女を近くの茂みに引きずり込もうとした。

襲撃と英雄的な救出

医師によると、ゲルハルトはアリエルに岩で少なくとも10回殴打し、髪を掴んで顔を地面に繰り返し叩きつけた。アリエルは、彼が未知の物質が入った注射器を2本取り出し、自分に注射しようとしていたことも思い出した。

激しい痛みと恐怖の中、アリエルは助けを求めて叫んだ。幸運にも、2人の女性ハイカーが彼女の叫び声を聞き、駆けつけた。ゲルハルトが一瞬躊躇した隙に、アリエルは逃げ出し、女性たちの方へ這っていった。計画が阻まれたと悟ったゲルハルトは一言も発さず、山頂の方へ歩き去った。

ハイカーたちはすぐに警察に通報し、警察は迅速に現場に到着した。アリエルの傷は重篤だが安定していた。彼女の顔と頭には複数の大きな裂傷があり、警察は彼女を病院に搬送した。一方、ゲルハルトはその日の午後6時頃、幹線道路近くで逮捕された。

壊滅的な余波

現在、アリエルはまだ入院中で、64歳の母親が付き添っています。ゲルハルトは拘留され、保釈金は500万ドルに設定されましたが、支払われる可能性は低いようです。彼は殺人未遂の罪に問われており、来週月曜日に予備審問が行われます。

6ヶ月以上この家族と共に働いていたベビーシッターは、メディアのインタビューで衝撃を語りました。彼女はアリエルについて、これまで出会った中で最も優しく、愛情深く、寛大な人物だと述べました。ベビーシッターはこの襲撃事件に驚いたと言います。ゲルハルトは常に礼儀正しく穏やかで、夫婦としてのコミュニケーションも模範的と思われていたからです。しかし、彼がこのような恐ろしい行為をするとは夢にも思わなかったと語りました。

より暗い説が浮上

一部のネットユーザーはさらに推測を進め、ゲルハルトがアリエルを意図的に崖の端に誘い、突き落とすつもりだったのではないかと示唆しています。あるコメントでは、犯罪ドラマから学んだ教訓だとユーモラスに指摘されています。夫やボーイフレンド、あるいは保険金受取人と一緒に崖の近くに立ってはいけない、というものです。

注射器や生命保険契約についての説も浮上しています。調査で注射器の内容物や生命保険の詳細が明らかになれば、真の動機が明らかになるだろうと推測するコメントもありました。アリエルは何かおかしいと感じていたに違いない、崖の近くに立つのを拒み、立ち去ったのは正しかったと確信している人もいます。

恐ろしい事件

この悲劇的な事件は、多くの人々に、なぜあんなに穏やかで落ち着いた人がこのような攻撃を犯すことができたのか疑問を抱かせました。アリエルが以前このような行動を疑っていたかどうかは不明ですが、この経験によるトラウマは間違いなく長い間彼女を苦しめるでしょう。