谷歌 DeepMind 扩大其在英国的人工智能承诺

谷歌深度思维宣布计划在英国建立第一个自动化科学实验室。新设施将专注于先进材料研究。这也将深化公司与英国政府之间的合作。

谷歌人工智能部门由诺贝尔奖获得者英国科学家Sir领导黛米斯·哈萨比斯。周四,该公司确认该实验室将于 2026 年开放。该项目将专注于使用人工智能驱动的工具开发超导体、太阳能电池和半导体的新材料。

DeepMind 还表示,英国研究人员将优先使用其科学人工智能系统。此举旨在加强国内创新并加速发现。

与英国政府在人工智能安全方面的合作

作为总理凯尔·斯塔默为了推动公共和私营部门更广泛地采用人工智能,DeepMind 已与英国政府签署了一份谅解备忘录。

DeepMind 成立于伦敦,于 2014 年被谷歌收购,该公司承诺与英国人工智能安全研究所进行更密切的合作。该研究所负责评估先进人工智能系统的安全性和可靠性。

根据协议,DeepMind 将授予研究所研究人员访问其模型的权限。他们将共同开发监控人工智能“思维链”推理的工具,该推理描述了模型如何逐步解决问题。合作伙伴还将研究人工智能对用户的社会和情感影响,以及更广泛的经济影响。

近年来,英国积极寻求与人工智能公司建立合作伙伴关系以吸引投资。 9月,英国和美国签署技术协议,推动科学研究和人工智能发展。

一些外国公司已经参与其中。型号来自人择被用来帮助公民获得政府服务。加拿大公司连贯性承诺支持英国公共部门和国防工业。同时,开放人工智能两年前在伦敦开设了第一个非美国办事处,该公司表示将探索在英国建设研究基础设施。

英国圣诞节前降息似乎不可避免

美国借贷成本下降增加了英国将在圣诞节前降息的预期。

12月10日,美联储利率下调0.25个百分点至3.5%至3.75%。这是自 2022 年以来的最低水平。

虽然英格兰银行由于美联储要到 12 月 18 日才会召开下一次政策会议,市场已经消化了降息的预期。分析师估计这种可能性在 90% 左右。

许多经济学家预计下降0.25个百分点。这将使基本利率降至 3.75%,为近三年来的最低水平。一些预测表明,0.5 个百分点的大幅削减也是可能的。

全球货币政策发出的信号

这些信号表明英国央行可能会实现期待已久的降息。美联储的决定进一步增强了这一预期。

财富管理公司 Mather and Murray Financial 董事总经理塞缪尔·马瑟-霍尔盖特 (Samuel Mather-Holgate) 表示,英国央行不会自动遵循美国政策。不过,美联储今年第三次降息却发出了强烈信号。这表明放松货币条件是合理的。

增加特殊教育投资

英国政府宣布大幅扩大对有特殊教育需要和残疾儿童的支持。

官员们承诺在英格兰主流学校为 SEND 学生增设 50,000 个学额。未来三年,政府计划投资 30 亿英镑来资助该计划。

部分资金将来自取消几个计划中的免费学校项目。地方议会强调,这笔资金必须由了解当地需求的人来使用。

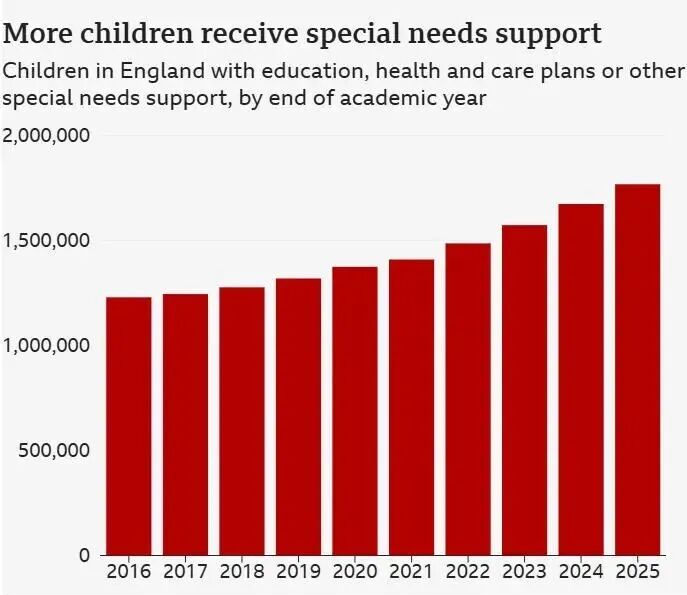

目前,英格兰有近 170 万学生接受特殊教育需求支持。这个数字每年都在持续增加。

教育改革和地方当局资助

教育秘书布里奇特·菲利普森表示这项投资将为即将到来的 SEND 改革奠定基础。预计这些改革将在定于明年初推迟发布的学校白皮书中概述。

经过协商,政府确认计划取消28所新的主流免费学校。另外 16 个地点仍在审查中。菲利普森表示,由于学生人数下降,一些项目已经变得不可行。

地方议会将能够利用这笔资金升级现有建筑物。目的是创建专门的教学空间并减少弱势学生的长途旅行。

英国房价预计 2026 年上涨

房产门户右移预计2026年英国房价将上涨2%。这一上涨预计将受到买家负担能力改善的推动。

目前平均两年期固定抵押贷款利率为 4.33%。这远低于去年 5.08% 的平均水平。工资上涨和贷款标准放宽预计也将支持需求。

经过 2025 年下半年的低迷之后,市场活动预计将出现反弹。

抵押贷款利率和买家信心

Rightmove抵押贷款专家马特·史密斯表示,年底前的降息应该会提振信心。预计贷款机构将通过降低抵押贷款利率来积极竞争。

到 2026 年,买家可能面临比 2025 年初更便宜的借贷成本。许多家庭还将受益于工资上涨,从而提高购买力。

此外,贷款机构一直在放宽负担能力检查。这使得买家可以借到更多金额。 Rightmove 注意到英国预算公布后出现的早期复苏迹象,伦敦高端住宅挂牌量环比增长 24%。

查尔斯国王再次打破皇室传统

国王查理三世记录了有关他的癌症诊断和康复的深刻个人信息。该视频将于周五播出,被认为具有历史意义。

这位 77 岁的君主于 2024 年初被诊断出患有一种未明确的癌症。从那时起,他继续每周接受治疗,同时保持严格的日程安排。仅今年一年,他就完成了五次海外国事访问。

在视频中,国王将强调癌症筛查对于早期诊断的重要性。他还将反思自己的康复历程。该消息于 11 月底在克拉伦斯宫的早间室录制。

君主制的里程碑时刻

今年的“抗击癌症”活动由英国癌症研究中心和频道4。该活动旨在提高人们对早期诊断的认识,资助癌症研究,并支持那些受该疾病影响的人。

对于英国君主制来说,这次广播标志着对传统的重大背离。在位君主很少在电视上公开谈论个人医疗问题。

此前,白金汉宫拒绝透露有关国王癌症或治疗的详细信息。官方仅证实这与前列腺疾病无关。这一决定平衡了医疗隐私与查尔斯国王希望通过公开讨论如何在治疗期间过上有意义的生活来鼓励他人的愿望。