Aufdeckung einer Säuglingsnahrungsallergie: Die schockierende Wahrheit, die alle Eltern kennen müssen!

Wird die Haut Ihres Babys nach der Säuglingsnahrung rot? Formelallergie vs. normale Verdauungsbeschwerden: Kennen Sie den Unterschied Nicht jeder Fall von Spucken oder Durchfall ist eine…

2024-12-27

Der König der Kugelfische: Der Geschmack und die Herausforderung des Tigerkugelfischs

Was für ein Fisch ist der Tigerkugelfisch? Wer sich für japanische Fugu (Kugelfische) interessiert, hat wahrscheinlich das Sprichwort gehört: „Der Tigerkugelfisch aus dem Westen, der…

2024-12-27

Schockierende Entdeckung: National Geographic enthüllt das erstaunlichste Bild des Jahres 2024 – einen 70 Tage alten Nashornfötus, der durch IVF gezeugt wurde!

Ein Foto eines 70 Tage alten Nashornfötus, des ersten durch In-vitro-Fertilisation (IVF) gezeugten Nashornfötus, wurde als eines der National Geographic-Bilder des Jahres 2024 aufgeführt. Ein…

2024-12-27

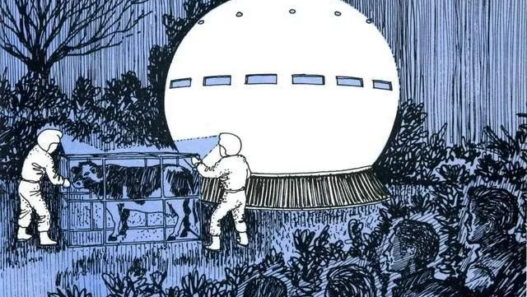

Erste Fotos von Brasiliens isoliertem Stamm! Ihre Zahlen und Bräuche bleiben ein Rätsel, die wahren Pfirsichblüten-Frühlingsmenschen …

Eine Gruppe muskulöser, nackter Männer, jeder mit einem Holzspeer in der Hand, versammelte sich um einen Stapel Werkzeuge und flüsterte in einer Sprache, die niemand verstehen kann ……

2024-12-27

Bleiben Sie über die wichtigsten Neuigkeiten auf dem Laufenden

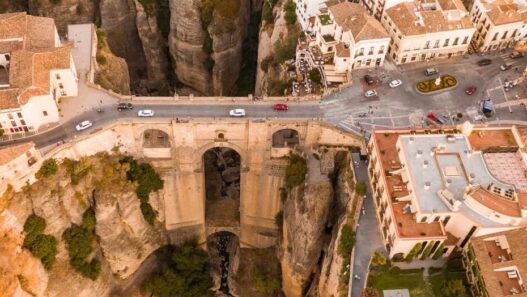

700 Jahre ohne Straßen! Diese Stadt, in die Sie mit dem Boot reisen, ist so schön, dass Sie den Rest Ihres Lebens hier verbringen möchten …

Wer der städtischen Hektik überdrüssig ist, ist immer auf der Suche nach einem ruhigen Ort zum Übernachten. Im Idealfall wäre es sehr ruhig und mit frischer Luft; wenn möglich, gäbe es einen…

2024-12-27